Do Kwon wants conference with law enforcement; pressure on miners to rise after excepted upcoming difficulty spike

Bitcoin’s Nasdaq Outperformance After Fed Hikes, Do Kwon Calls All Law Enforcement Agencies Worldwide To Join Online Conference In The Biggest News Of The Cryptoverse On Nov. 4 and DOGE’s 9% drop during Twitter’s class action lawsuit.

CryptoSlate Top Stories

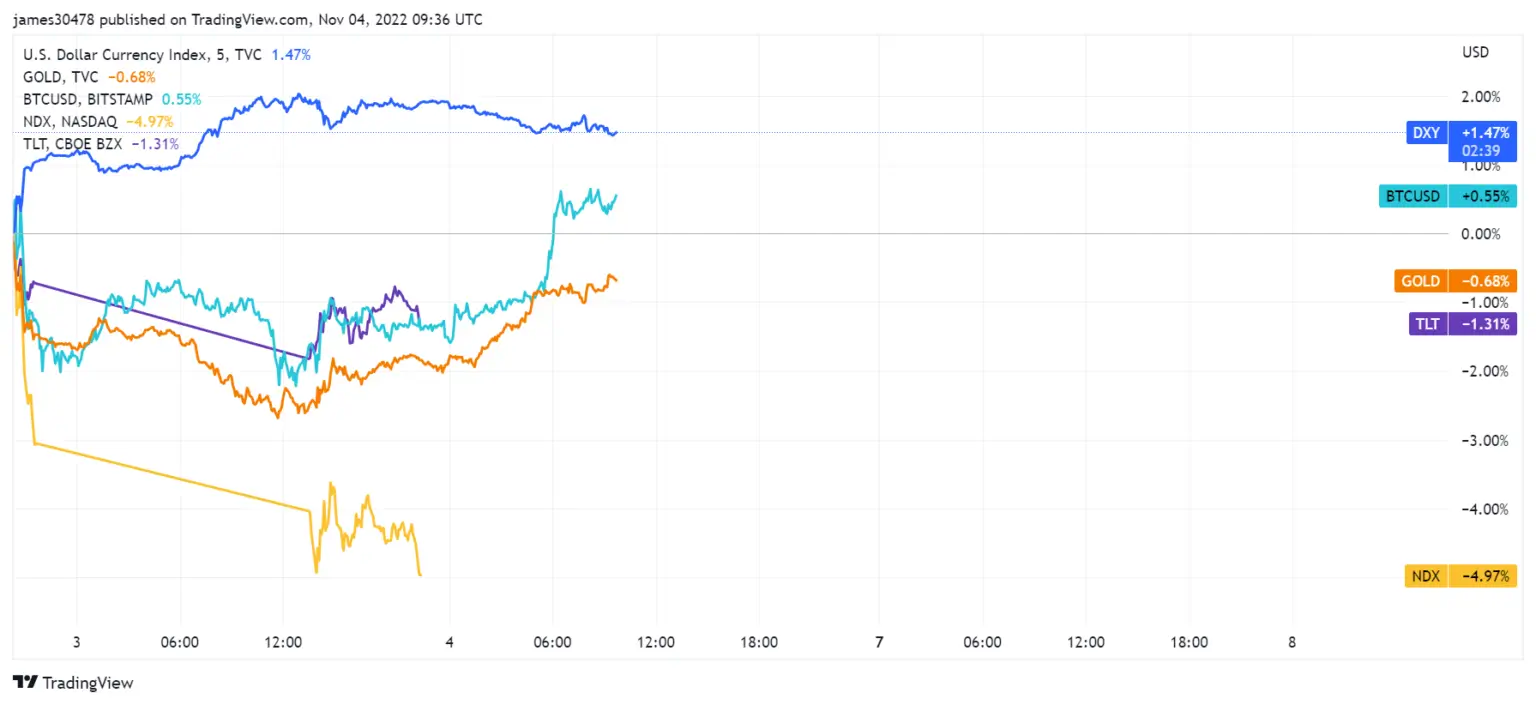

Bitcoin Outperforms NASDAQ After Fed Raises Rates By 0.75%

While the NASDAQ and gold prices fell in response to the Fed’s recent rate hike of 0.75%, Bitcoin (BTC) outperformed both and recorded a surge.

The Nasdaq and gold fell 4.79% and 0.68% respectively. During that time, Bitcoin gained 0.55%.

Teradokwon wants to invite the police to the meeting

On Nov. 3, South Korean prosecutors claimed to have obtained private conversations between Do Kwon and one of his employees, proving that Kwon deliberately manipulated the price of Terra (LUNA). Prosecutors also said the conversation proved Kwon was an illegal immigrant in Europe.

On November 4, Kwon tweeted that he would be holding a virtual meeting to end all talk of him being in hiding.

ok, let’s have a meetup/meeting soon, hide the BS and get over this

Welcoming the participation of police officers from all over the world

— Do Kwon 🌕 (@stablekwon) November 3, 2022

Kwon did not reveal the date of the virtual meeting, but called on all law enforcement agencies around the world to participate.

Twitter Faces Lawsuit Over Staff Layoffs, Dogecoin Drops 9%

After Elon Musk took over Twitter, he announced that he planned to cut 50% of his workforce. This means laying off 3,700 people. Twitter is now facing a class action lawsuit over this, after his employer filed a lawsuit on November 4th.

Musk’s favorite Dogecoin (DOGE) has fallen 9% over the past 24 hours in response to the news.

Bitcoin mining difficulty expected to spike on November 6, increasing pressure on miners

Bitcoin mining difficulty will adjust on Sunday, November 6th, and is expected to increase to three consecutive all-time highs.

Analysts at CryptoSlate looked at mining difficulty and hash rate data and found that Bitcoin’s difficulty dropped slightly on November 4 while hash rate continues to climb.

This indicates that the pressure on miners has not eased and mining difficulty is likely to increase this Sunday.

More Entities Are Backing Ripple As SEC Seeks Extension

Ripple (XRP) and the Securities and Exchange Commission (SEC) have been suing since 2019.

Since then, a total of 12 companies have submitted Amicus briefs to support Ripple’s position. Ripple General Counsel Stuart Alderoti said:

“Twelve independent voices, including companies, developers, exchanges, public interest and trade associations, and retail owners, all filed with SEC v Ripple to explain how the SEC is dangerously wrong. What about the response? We need more time to blindly push forward instead of listening and engaging.”

Canada Begins Talks on Cryptocurrencies, Stablecoins and CBDC

The Canadian government has announced that it will launch a consultation service on all crypto-related topics, including stablecoins and Central Bank Digital Currencies (CBDC).

The consultation will address illegal cryptocurrency activities and conduct a legislative review on the digitization of money.

Mempool Studio launches presale for web3 yearbook, almanac

Mempol Studio collects milestone events from the web3 space in a 300-page limited edition hardcover almanac. The yearbook is called “Web3 Yearbook 2022” and will be released next year.

research highlights

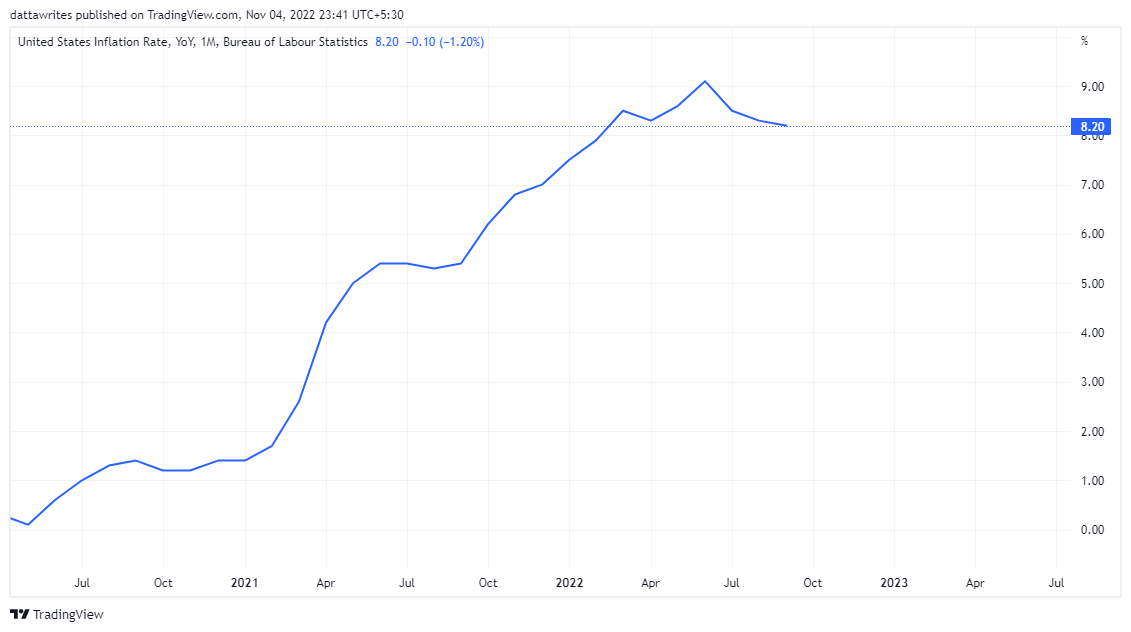

Survey: US Inflation to Break Barriers in 2020s. Started earlier than the trends of the 70’s and 80’s

Inflation has risen alarmingly in developed countries such as Europe and the United States, mainly due to higher prices for energy, fuel oil and gasoline.

In the US, inflation was 7.5% in early 2022 and reached 9% in June. This is well above the 5.4% recorded in June 2021 and the 0.6% recorded in June 2020.

Bitcoin, on the other hand, is up 184.28% since early 2020. Over the same time frame, gold has only risen 5.38%. This shows that Bitcoin is a good hedge against inflation over the past two years.

Crypto Slate Exclusive

Is Now a Good Time to Move Dollar Cost Average (DCA) to Cryptocurrencies?

Tokenist Chief Editor Shane Neagle wrote an exclusive for CryptoSlate discussing whether this is the right time for Dollar Cost Averaging (DCA) for cryptocurrencies.

DCA is a trading strategy that buys and sells the same asset for the same amount at regular intervals. It is based on the premise that it ignores short-term price movements and acts as a hedge against high market volatility. As such, it is often preferred by crypto investors.

However, Neagle draws attention to the fact that Bitcoin’s price is highly dependent on overall macroeconomic conditions. Therefore, investors advise him to think twice before committing to DCA.

Nagle wrote:

“In an environment where the price of Bitcoin is highly exposed to overall macroeconomic conditions, investors should seriously consider tackling dollar-cost averaging as a means of investing in digital assets – a strong conviction if it is widespread.

News around Cryptoverse

What if Michael Thaler bought Ethereum?

blockchaincenter.net shows what would happen if MicroStategy founder Michael Saylor bought Ethereum (ETH) instead of Bitcoin.

According to data at the time of writing, Thaler would gain $1.76 billion if he bought Ethereum instead of losing $1.27 billion.

US billionaire arrested for facilitating drug exchanges via crypto

A US billionaire has been detained in Canada for using crypto to distribute drugs. Montreal GazetteAt the time of his arrest, he had approximately 200,000 bitcoins, $2 million in offshore bank accounts, and $4 million in Canadian dollars.

crypto market

Over the past 24 hours, Bitcoin (BTC) rose +4.05% to reach $21,064 while Ethereum (ETH) also rose +6.61% to trade at $1,643.