Emerging markets dominate Chainalysis 2022 Geography of Cryptocurrency Report

The 2022 Global Crypto Adoption Index has released its third report which gives market direction for 2023.

Key highlights of the report:

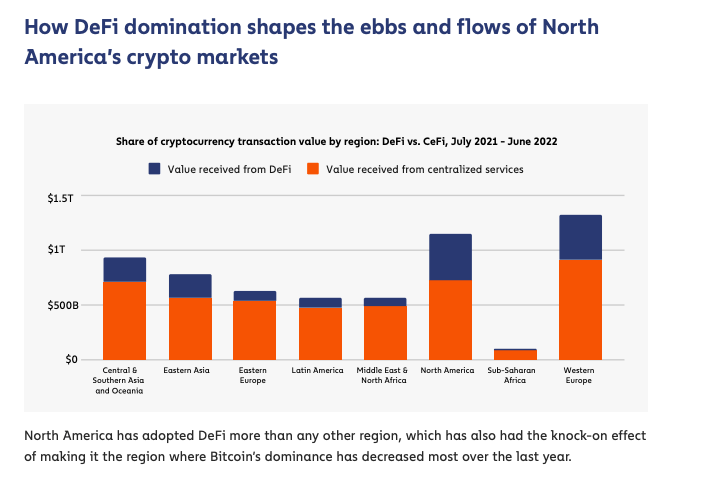

“North America’s DeFi-driven cryptocurrency market had a strong but volatile last year.”

-

- Key Findings: North America ranks second in cryptocurrency activity, receiving $1.15 trillion worth of cryptocurrency between July 2021 and June 2022, accounting for 19% of global cryptocurrency activity. DeFi has been a major contributor to North America’s cryptocurrency surge, accounting for 37% of cryptocurrency transactions in the region, surpassing her DeFi share in Western Europe at 31%. Other regions, such as Sub-Saharan Africa, have much lower DeFi activity at 13%.

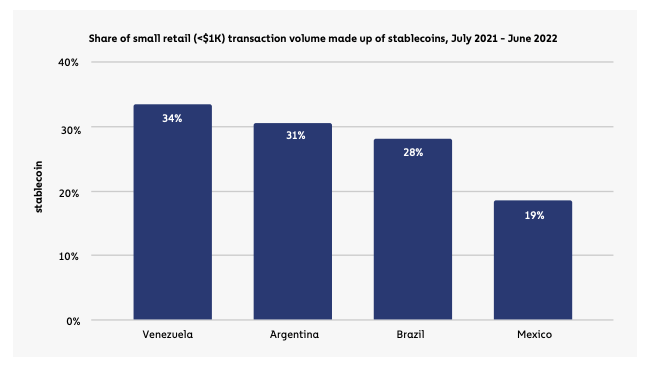

“Latin America’s Key Crypto Adoption Drivers: Storing Value, Sending Remittances, and Pursuing Alpha.”

-

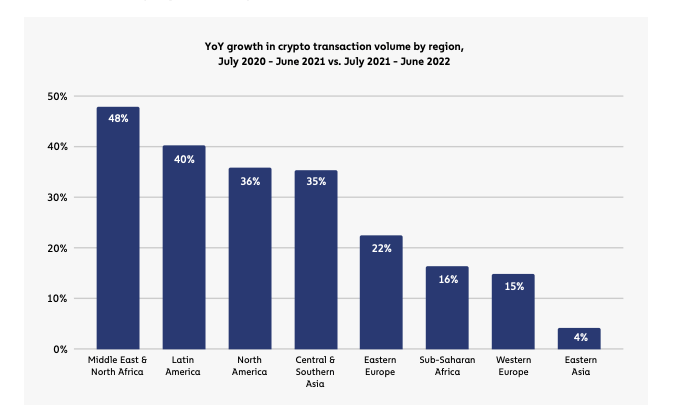

- Key Findings: Latin America ranks 7th in the cryptocurrency market this year, with $562 billion in cryptocurrencies received by citizens from July 2021 to June 2022, a 40% increase from last year.

- In August 2022, combined inflation across Latin America’s top five economies (Brazil, Chile, Colombia, Mexico and Peru) hit a 25-year high of 12.1%, according to the International Monetary Fund. Bitcoin didn’t exist when inflation last reached such highs, but stablecoins designed to be pegged to fiat currencies like the US dollar are the most inflationary in the region. It is becoming increasingly popular in the countries hit. Research Over a third of Latin American consumers indicate they are already using stablecoins for their everyday purchases.

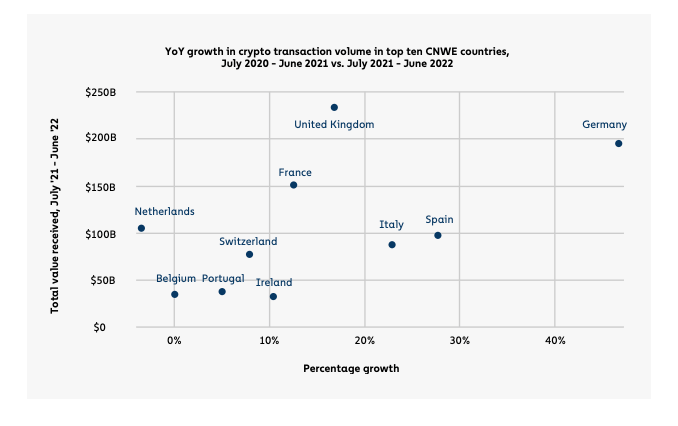

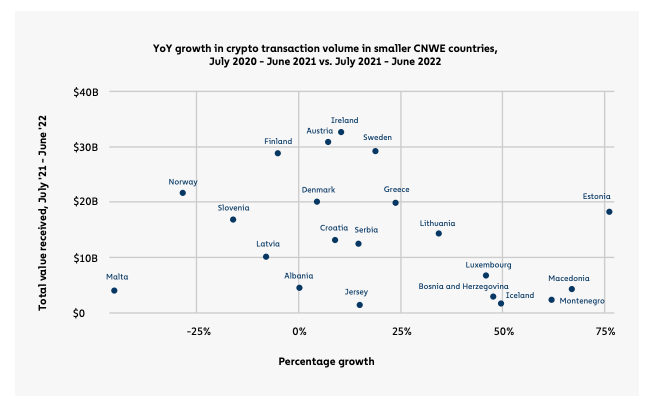

“Central, Northern and Western Europe continue to be the world’s largest crypto economies thanks to DeFi, NFTs and regulatory clarity.”

-

- Key Findings: The CNWE is the world’s largest cryptocurrency economy, with users and institutions in the region receiving $1.3 trillion worth of cryptocurrency from July 2021 to June 2022. Western Europe has 6 of the top 40 cryptocurrency adopters. DeFi has been a major contributor, boosted by EU regulations such as the Crypto Travel Regulation and the MiCA licensing scheme. The UK is her largest DeFi hub in Europe, ranked #1 on the CNWE and #6 globally, and received $233 billion in cryptocurrency from July 2021 to June 2022.

“Crypto markets in Eastern Europe are active, having surged last year due to the war between Russia and Ukraine.”

-

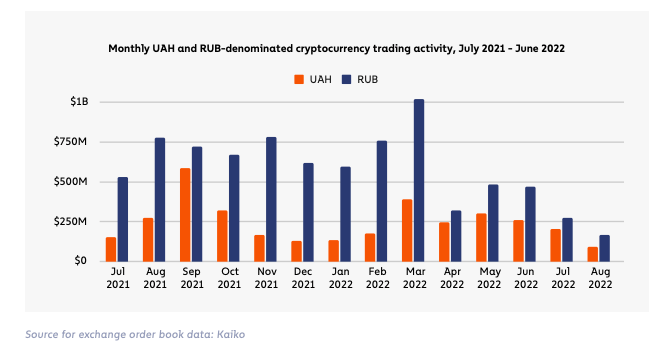

- Key Findings: Eastern Europe is the fifth largest cryptocurrency market, receiving $630.9 billion in cryptocurrency between July 2021 and June 2022, accounting for 10% of global cryptocurrency activity. In March 2022 during the war, trade in Ukrainian hryvnia increased by 121% to $307 million and in Russian rubles increased by 35% to $805 million. From March onwards, however, trade volumes between the two countries declined, fluctuating through August but never reaching their March peak.

“Cryptocurrency adoption is growing steadily in South Asia and skyrocketing in the Southeast.”

-

- Key Findings: The CSAO is the third largest crypto market, with citizens of CSAO member countries receiving $932 billion worth of crypto from July 2021 to June 2022. Play-to-earn games and NFTs go hand in hand. Most blockchain games now have his NFT as an in-game item, which can be sold on various NFT marketplaces. In countries with high NFT marketplace web traffic, such as Thailand, Vietnam, and the Philippines, a significant portion of that traffic may come from blockchain game players for games such as Axie Infinity.

“East Asian cryptocurrency market growth stagnated and Chinese market depressed, following government ban.”

-

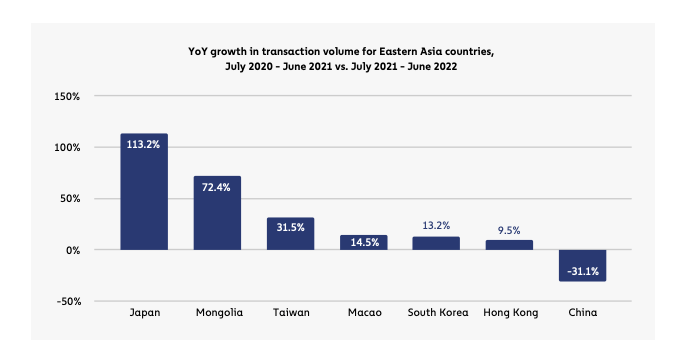

- Key Findings: In East Asia, the cryptocurrency market is the fourth largest in our analysis, with $777.5 billion worth of cryptocurrency traded between July 2021 and June 2022, accounting for nearly 13% of global trade during that time. occupies The region has slipped from its third-place ranking in previous cryptocurrency geographic reports, with transaction volume growing only 4% year-on-year, the lowest of the regions analyzed. Despite being the largest crypto market in the region, China saw a 31% year-over-year decline in cryptocurrency trading, while Japan saw an increase of more than 100%.

“The Middle East and North Africa cryptocurrency market will grow faster than any other region in 2022.”

-

- Key Findings: The Middle East and North Africa (MENA) region may have a minor presence in the 2022 Global Crypto Adoption Index, but it is the fastest growing crypto market. From July 2021 to June 2022, MENA users received $566 billion in cryptocurrency. This is a 48% increase over the previous year. In Turkey and Egypt, fiat currency volatility has made cryptocurrencies an attractive option for maintaining savings. Last year, the Turkish lira experienced inflation of her 80.5%, while the Egyptian pound fell by her 13.5%. In addition, Egypt’s remittance market, which accounts for 8% of GDP, is significant. The country’s central bank has launched a project to create a cryptocurrency-based remittance corridor between Egypt and her UAE, where many Egyptians work.

“Cryptocurrencies are meeting the economic needs of sub-Saharan Africans.”

-

- Key Findings: Sub-Saharan Africa has the lowest cryptocurrency transaction volume among the regions analyzed, with $100.6 billion in on-chain volume received from July 2021 to June 2022, making it the largest share of global activity. 2%, up 16% from the previous year.

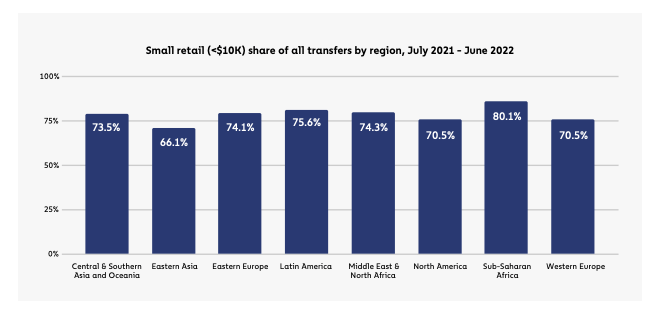

- Small Retail Trade Drives Cryptocurrencies in Sub-Saharan Africa The retail market and high usage of P2P platforms in Sub-Saharan Africa sets it apart from other regions. Retail remittances below US$10,000 accounted for his 6.4% of transaction volume, the highest of any region. The importance of retail becomes even more apparent when looking at individual travel numbers. Retail remittances accounted for 95% of all remittances, 80% of which were his small retail remittances under $1,000, also the highest in any region.

Post Emerging Markets Dominate