Energy is the master resource but it could be Bitcoin that reigns supreme

Nothing highlights the importance of energy more than the rapidly approaching winter. As temperatures drop, energy deficits become apparent and global efforts to sustain them begin.

This year, the battle for energy has never been more intense.

Fiscal and monetary policies implemented during the COVID-19 pandemic have caused dangerous inflation in nearly every country in the world. Quantitative easing launched to contain the impact of the pandemic has resulted in a historically unprecedented increase in the M2 money supply. The decision diluted purchasing power, led to higher energy prices, and sparked a crisis that culminated this winter.

crypto slate Analysis showed that the EU is most likely to be hit hardest by the energy crisis.

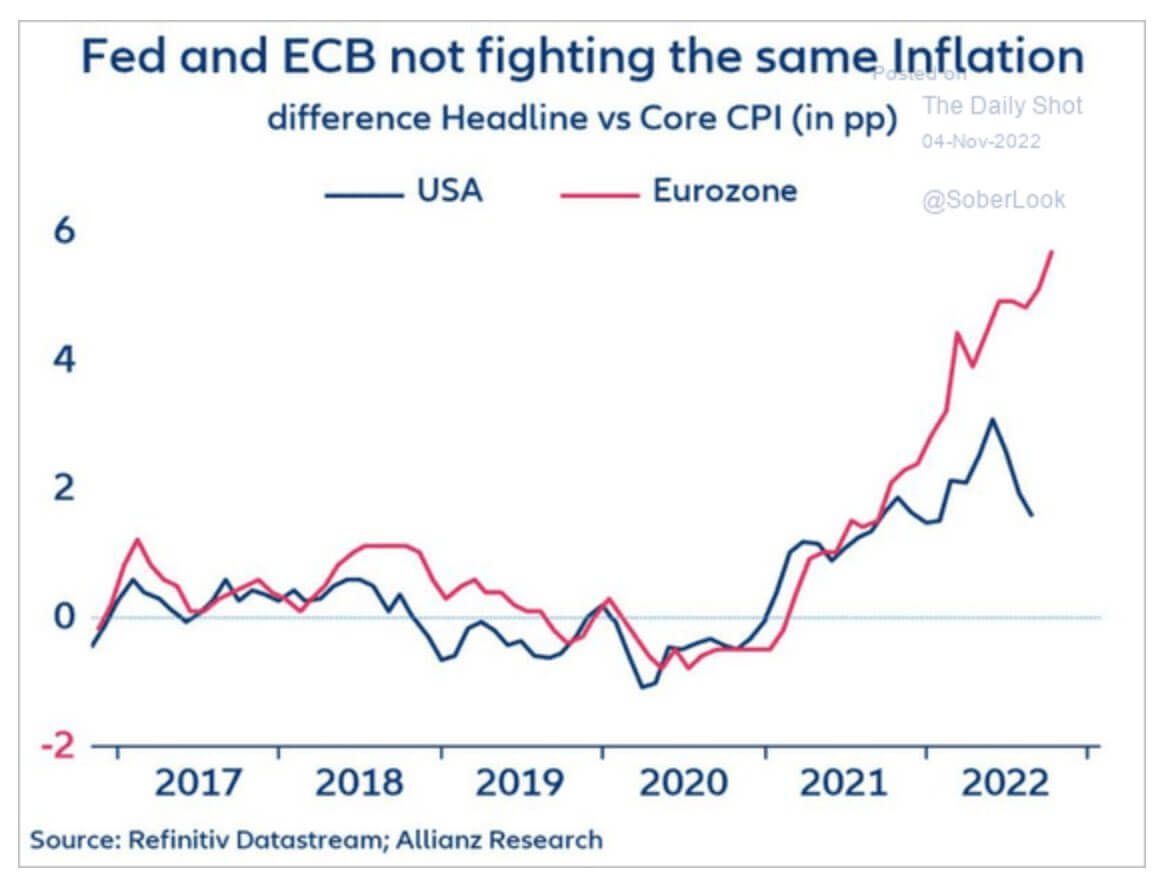

The European Central Bank (ECB) has struggled to contain core inflation this year. The Core Consumer Price Index (CPI) has started to rise significantly in 2021 due to the pandemic in both the US and EU.

In the U.S., core CPI fell sharply after peaking in February, with better-than-expected results last month. However, Eurozone core CPI has continued to rise throughout his year and shows no sign of stopping.

Similar increases in core CPI are seen in Japan and the UK. One factor that may have contributed to currency instability is the lack of investment and support for commodities such as oil and gas. Widespread efforts to switch to renewable energy sources have reduced oil and gas purchases in the EU and UK.

In contrast, the United States and Russia have invested heavily in oil and gas, encouraging innovation in this area.

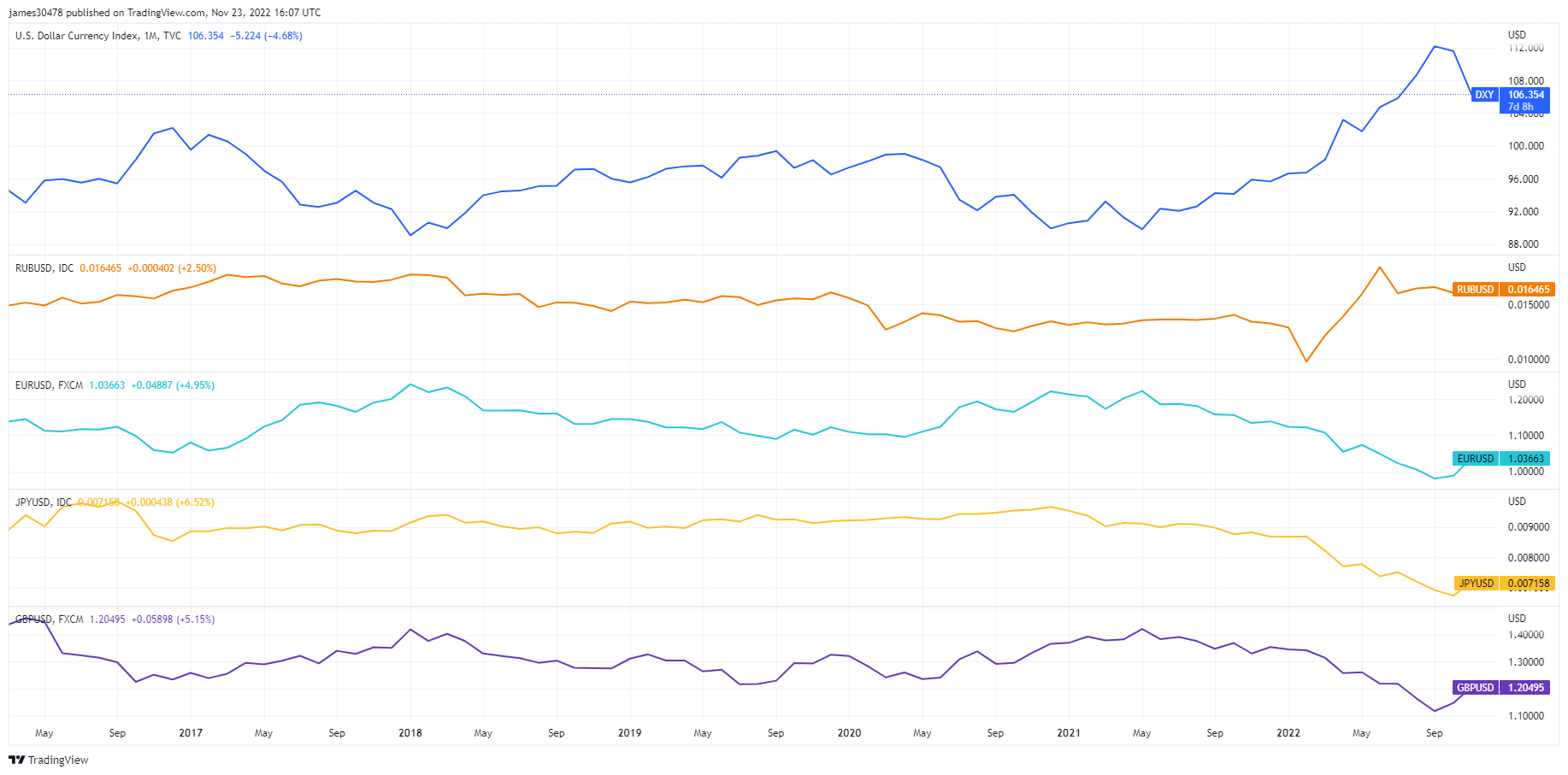

This impact is further confirmed when looking at fiat currency values against the US dollar.

Over the past two years, the Russian Ruble and DXY have appreciated in value, while the Euro, British Pound and Japanese Yen have all fallen in value against the dollar.

Higher inflation and a much weaker currency will make the EU struggle to compete for oil and gas in the global market.natural gas producer warned Until 2026, when a new wave of natural gas supplies is expected, the EU will have to compete with Asia for limited supplies. Swallow high gas prices.

All of this uncertainty could have a positive impact on Bitcoin. The broader cryptocurrency market has struggled to survive the impact of FTX, but Bitcoin has established itself as a pillar of stability in a market plagued by bad actors. When fiat currencies fall in value, retail investors may turn away from safe haven assets such as gold and commodities and toward assets such as Bitcoin.