Ethereum is recovering its dominance over stablecoins

One of the easiest ways for investors to deleverage their positions is to look to stablecoins. Centralized stablecoins, unlike their algorithmic counterparts, are volatility resistant and maintain their pegs even in the most turbulent market conditions.

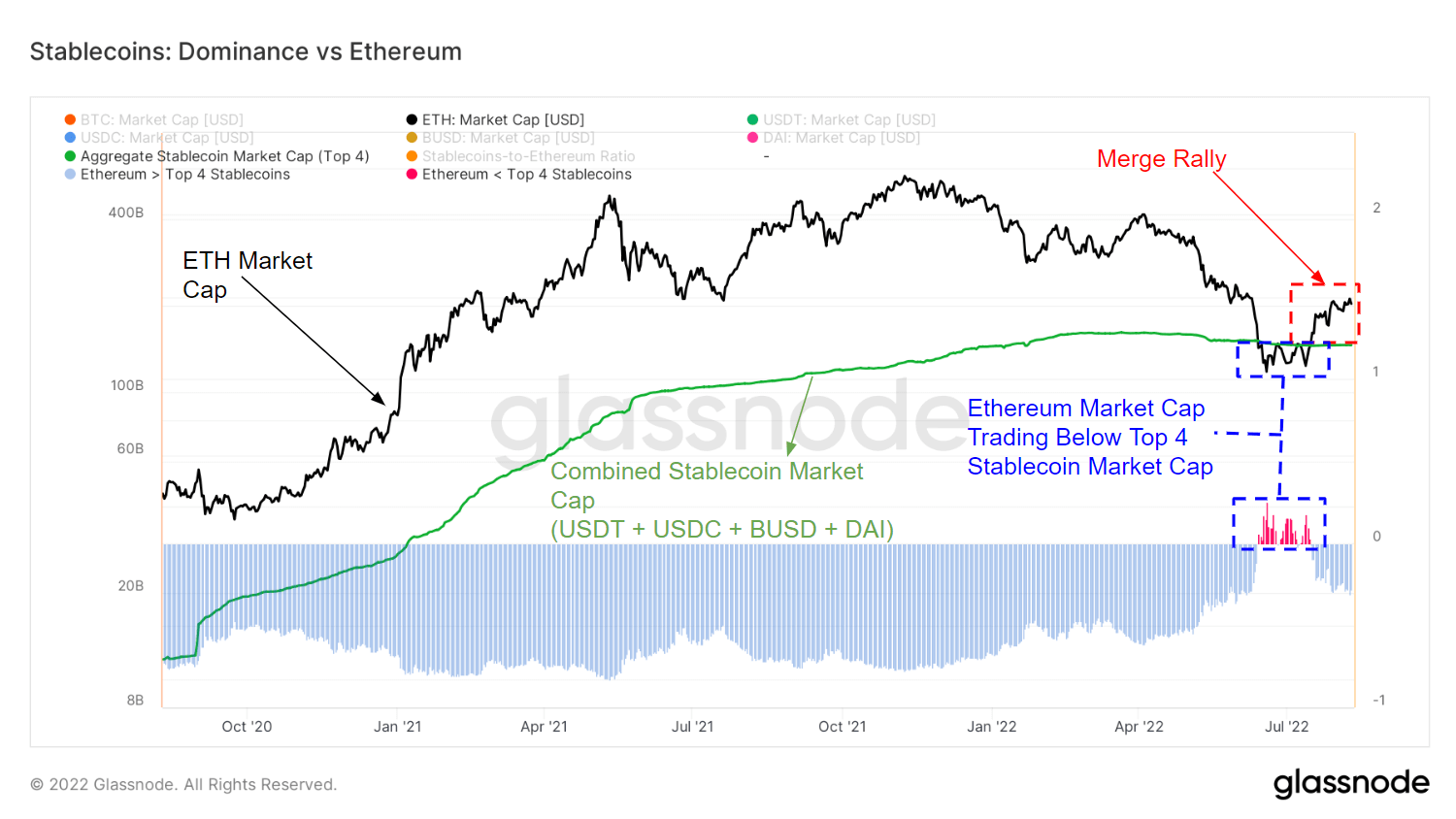

Over the past two years, the market has seen significant growth in stablecoins, making them one of the most important parts of the crypto ecosystem. At its peak, the market capitalization of stablecoins reached $160 billion.

The importance of stablecoins solidified further in 2022, when the industry saw an unprecedented amount of value flow from volatile crypto assets.Terra (LUNA) implosion and ensuing liquidity crisis All the value of leaving volatile assets migrated to stablecoins caused by

Due to the amount of value entering the stablecoin market, the four largest stablecoins surpassed Ethereum (ETH) in terms of market capitalization.

In early June, the market cap of USDT, USDC, DAI, and BUSD surpassed Ethereum’s market cap for the first time. The fact that this is the first time that a group of ‘stable’ assets has outperformed volatile assets shows the severity of the deleveraging seen in June.

However, increased speculation over an upcoming Ethereum merge in September has pushed the price of Ethereum higher, bucking the prevailing bear market trend. has recovered and its market capitalization is now just over $243 billion.

One of the biggest factors that led to the drop in Ethereum’s price and market cap was the significant decrease in Total Value Locked (TVL) in the DeFi protocol. Terra (LUNA) blowback caused massive deleveraging in his DeFi, with investors pulling tokens out of lending protocols en masse.

The deleveraging of 2022 was the exact opposite of the DeFi boom the market saw in 2020 and 2021 with the introduction of yield farming. With new lending protocols emerging almost daily, Ethereum’s Total Locked Value (TVL) will peak at $253 billion in 2021. Deleveraging this year has slashed TVL by more than 70% to just $72 billion.

According to data from glass node, Ethereum’s TVL may have bottomed out in June. TVL temporarily held him at $72 billion, recovered slightly in mid-June, and continued to climb as we entered August.