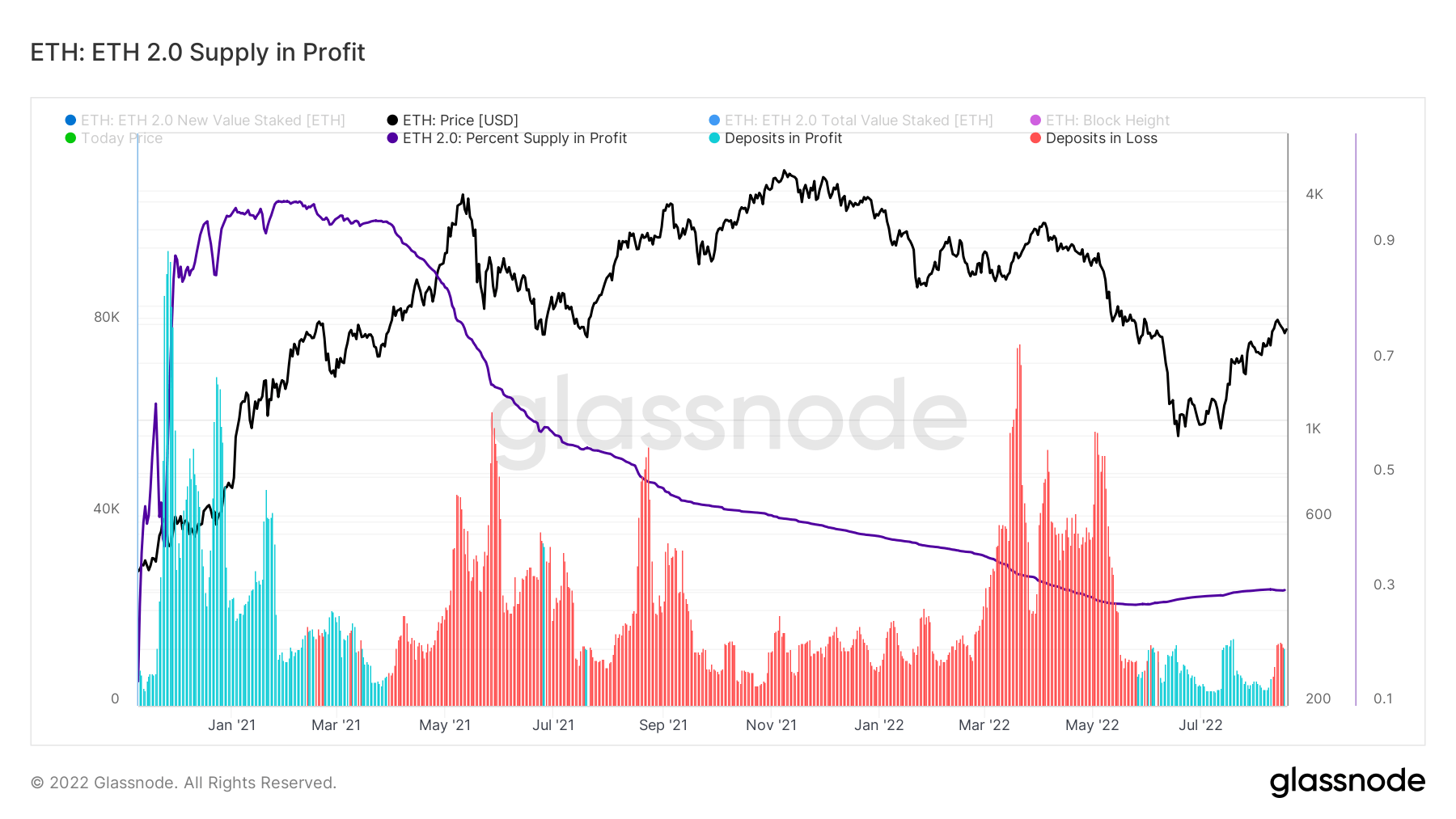

Ethereum staking deposits decline with over 70% stakers in loss

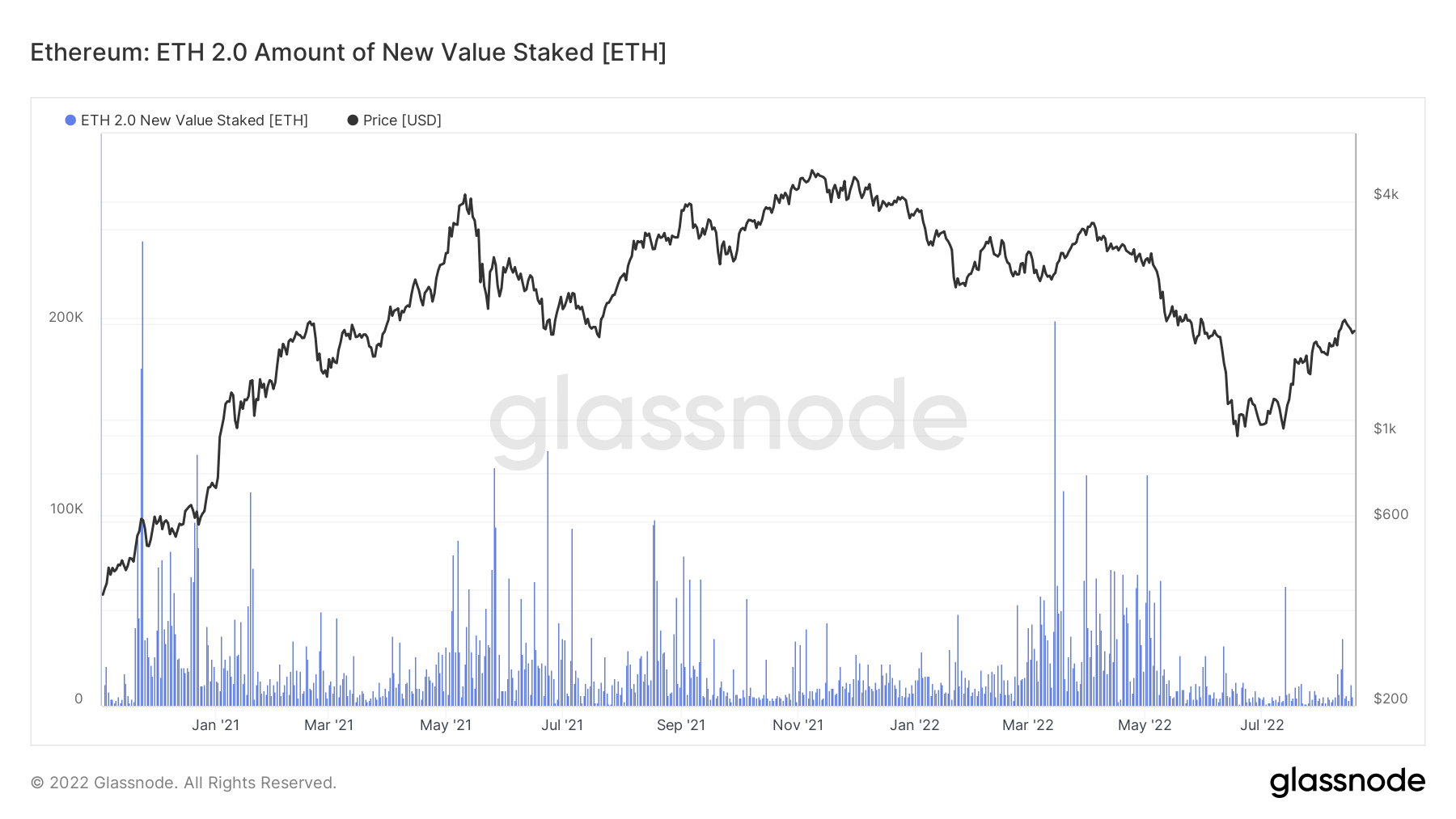

With the merge almost confirmed to take place before September 20th, the amount of new value Ethereum (ETH) staked on the Beacon Chain is at its lowest level, with around 230 ETH deposited daily.

Ethereum’s daily stake volume dropped significantly in July and has yet to recover, according to Glassnode data.

This decline was in line with ETH’s price recovering from the record market crash in Q2 following the Terra LUNA collapse.

The ETH 2.0 staking slowdown was even more pronounced in August, with weekly deposits now at 162 ETH, the lowest ever.

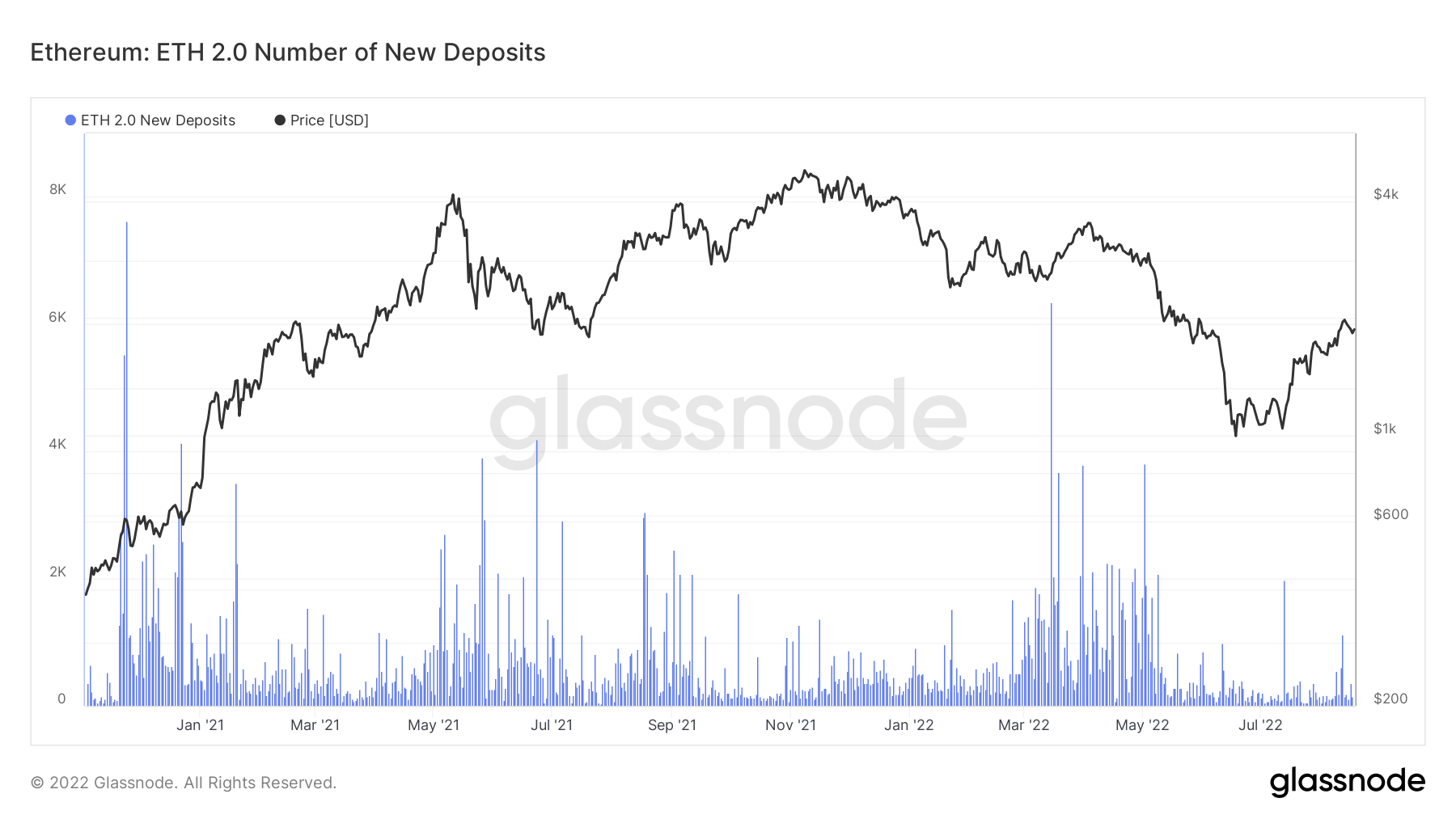

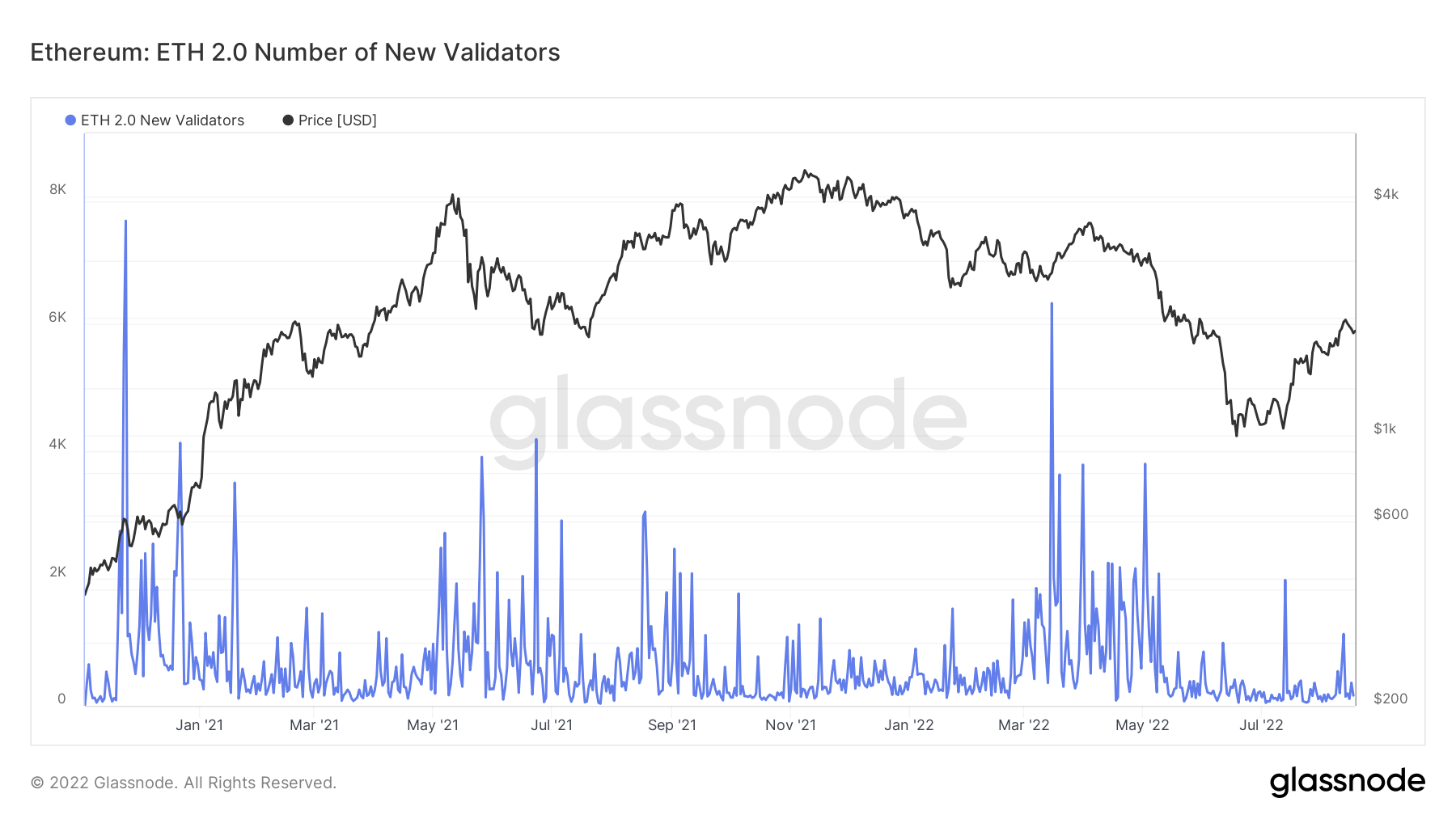

Glassnode’s data also showed that the number of new unique addresses depositing into ETH 2.0 is relatively low and suppressed.

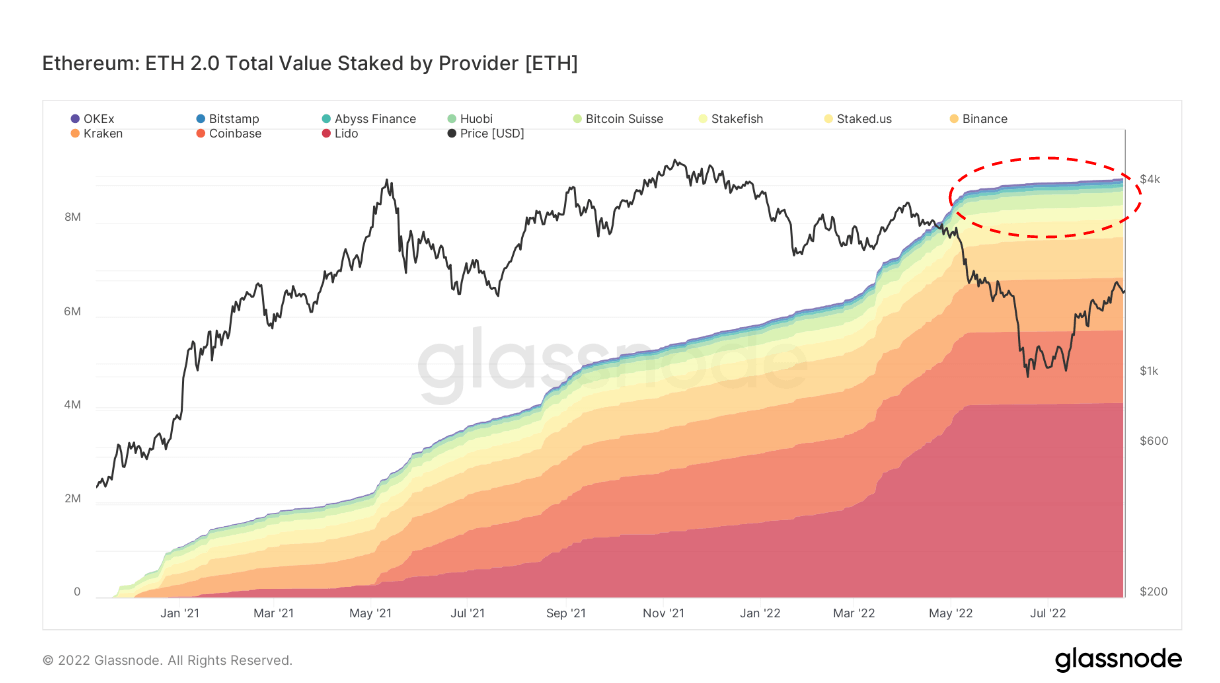

The amount of ETH transferred to ETH 2 deposit contracts via staking pools has been flat since May, suggesting that no new investors have entered the market.

Market analysts have linked the drop to Ethereum fork speculation and merger concerns.

According to @hildobby, the bear market “has a lot to do with this”, “since over 10% of ETH has already been staked, others who want to stake will probably be merged in case it doesn’t work out. I will wait for you later.”

Good point, the bear market probably has a lot to do with this as well.

And 10% of ETH is already staked. Others who want to stake will probably be waiting after the merge in case it fails (unlikely, but still a notable risk).

— Hildby >|< (@hildobby_) August 22, 2022

On the other hand, due to the sharp drop in ETH value due to the bear market, profitable ETH deposits were deposits made when the digital asset traded below $1000 in January 2021, which was wagered. Equivalent to about 30% of total ETH.

Around 83% of stakes on Ethereum suffered losses during the peak of the bear market, the report reveals. However, more deposits are starting to turn a profit as the price of the asset has started to rise from his June lows.

However, despite low interest in Ethereum staking, some stakeholders remain bullish on the merge.

Nexo CEO Antoni Trenchev I believe That the price of Ethereum will skyrocket after the merge as the asset will have lower inflation and more use cases. BitMEX founder Arthur Hayes shares the same view, predicting that Merge could push his ETH to $5000.