Ethereum token issuance continues inflationary, deflationary swing

After years of creation, the merge was completed on September 15th, switching Ethereum from Proof of Work (PoW) to Proof of Stake (PoS).

This rollout has delivered several benefits, including a reported 99% reduction in chain energy consumption and laying the groundwork for sharding for better scaling on future hard forks.

merge too EIP1559which will be rolled out at the London Hard Fork in August 2021.

Under the post-merger PoS mechanism, the burning of base fees was sold as a deflationary mechanism that would significantly reduce token issuance. 88%.

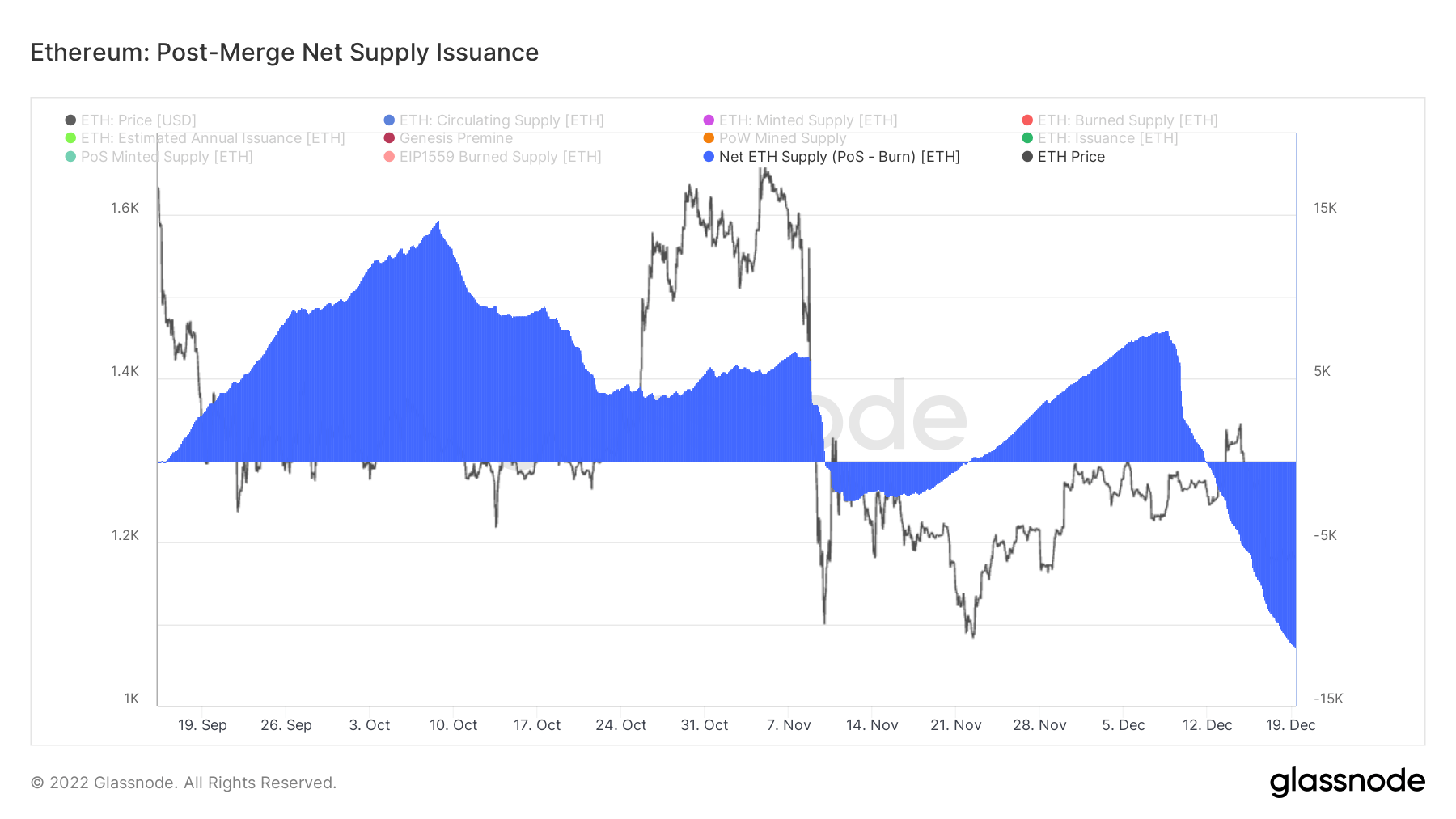

crypto slate We analyzed the Glassnode data to assess whether the claims hold. In his three months post-merger, net supply issuance has consistently been non-deflationary.

Ethereum deflation fluctuates

according to ethereum, in the previous PoW system, miners were issued around 13,000 ETH per day as block mining rewards. This equates to an 87% reduction in issuance.

However, with the advent of base rate burns, a range of daily net reductions in supply come into effect. The basic charge burning depends on network usage. The more congested the network is on a given day, the more basic charges will be consumed.

The minimum activity figure for a burn-based fee to exceed 1,700 ETH and thus lead to a net reduction in supply is around 16 Gway per day.

The chart below shows that net supply issuance trended inflation right after the merger until November 9, hitting a high of 15,000 tokens in early October.

After about two weeks of deflation from November 10, net supply issuance turned into inflation again, and from December 12 onwards, net supply issuance returned to negative net supply, and on December 19 – It has sunk to a new low of 11,000 tokens.

To date, periods of supply inflation have outpaced supply deflation.

net inflation

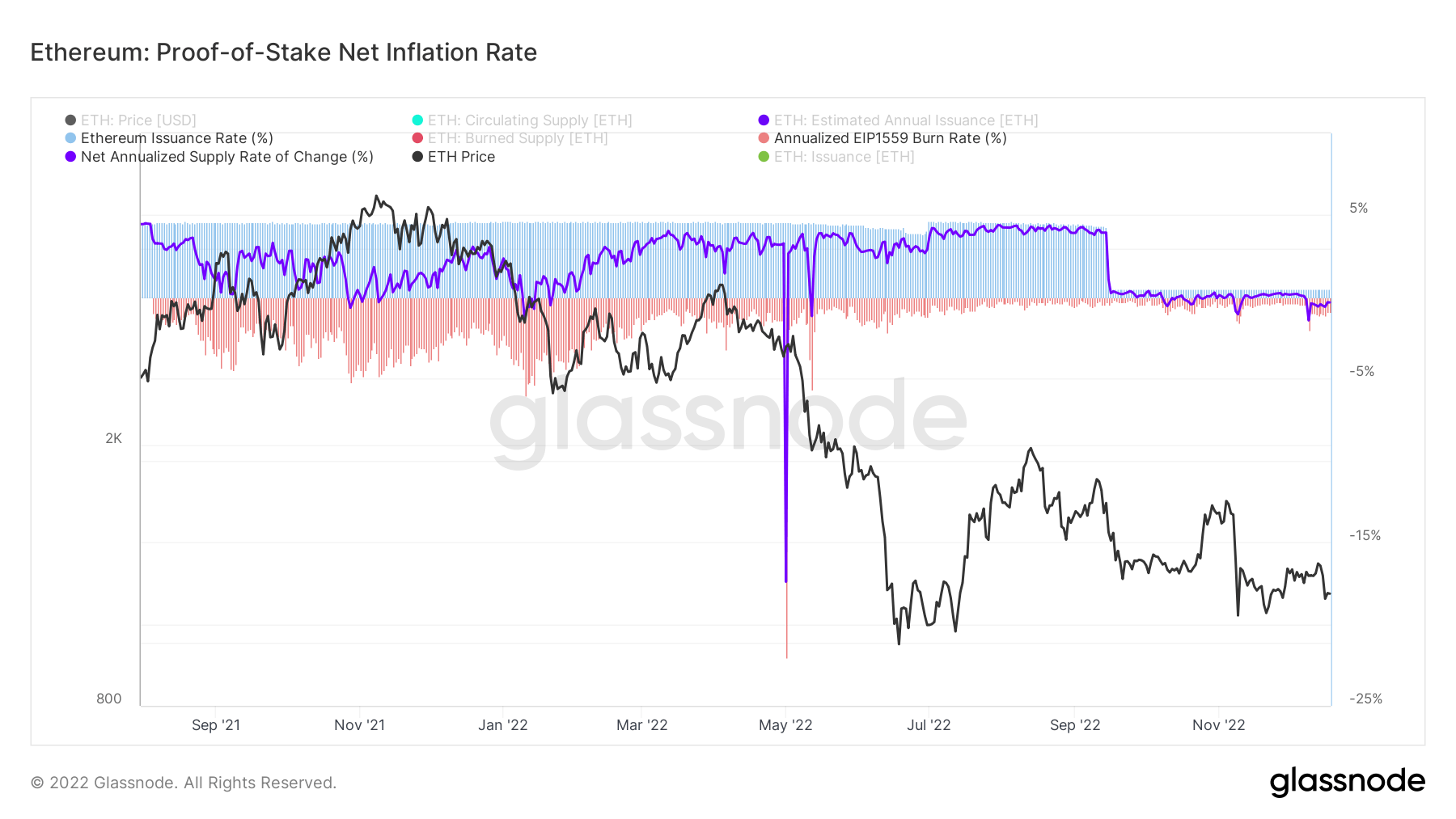

The chart below shows issuance rate and burn rate dropping after the merger, with the former metric dropping significantly since September 15th.

Previously, the issuance rate was relatively stable, holding around 4.1% since October 2021. At the same time, the burn rate during this period was much more volatile by comparison, peaking at around -5% before a rate of 0.35% from August onwards.

From the current issuance rate of 0.5% and burn rate of -0.9%, the net supply change is -0.4%.

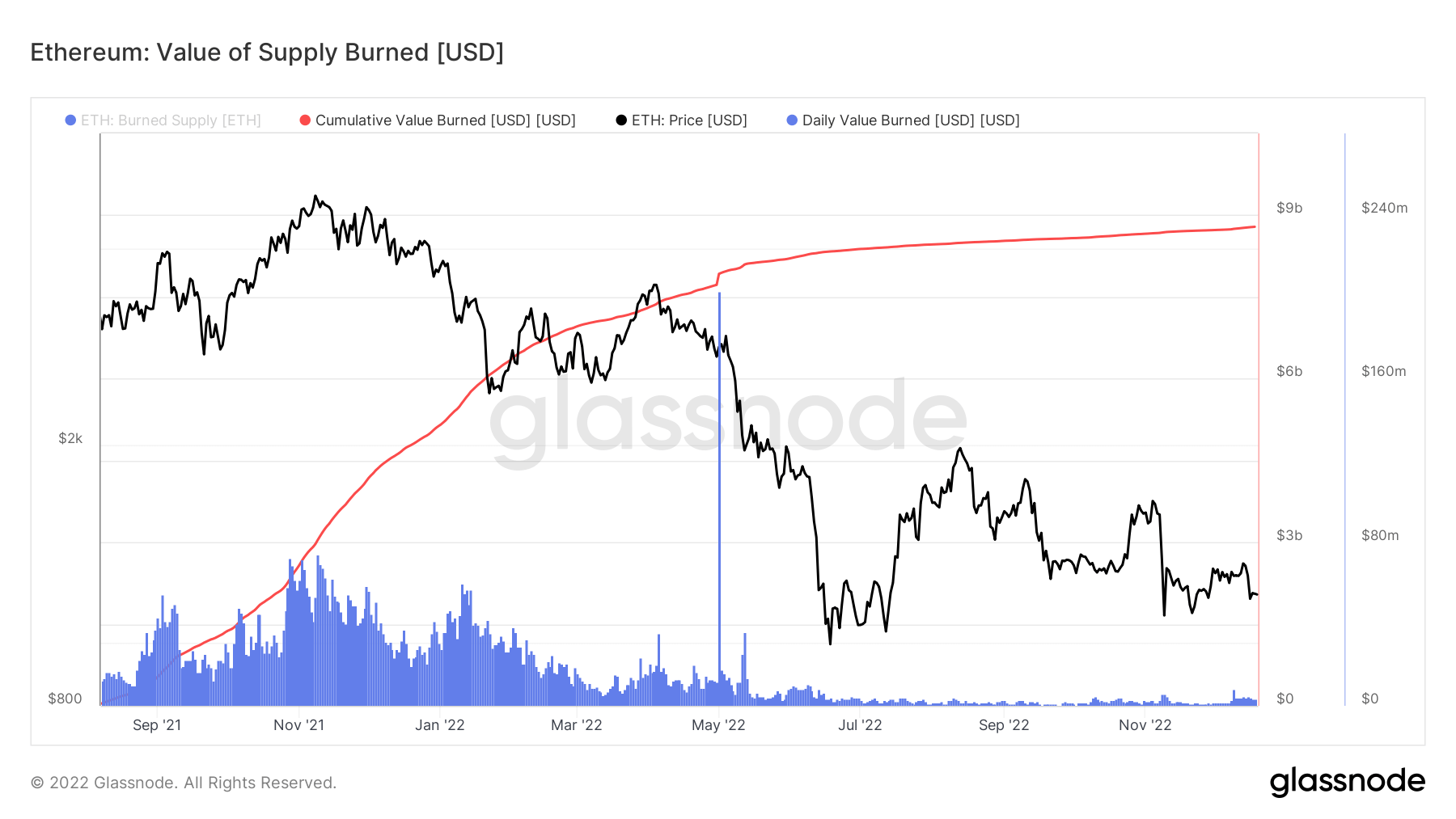

Multiplying the burned base price by the spot price at the time of burning gives the value of supply burnt metric.

Since June 2022, daily spending has dropped significantly to approximately $4 million per day. The cumulative total of all burns to date is just under $9 billion.

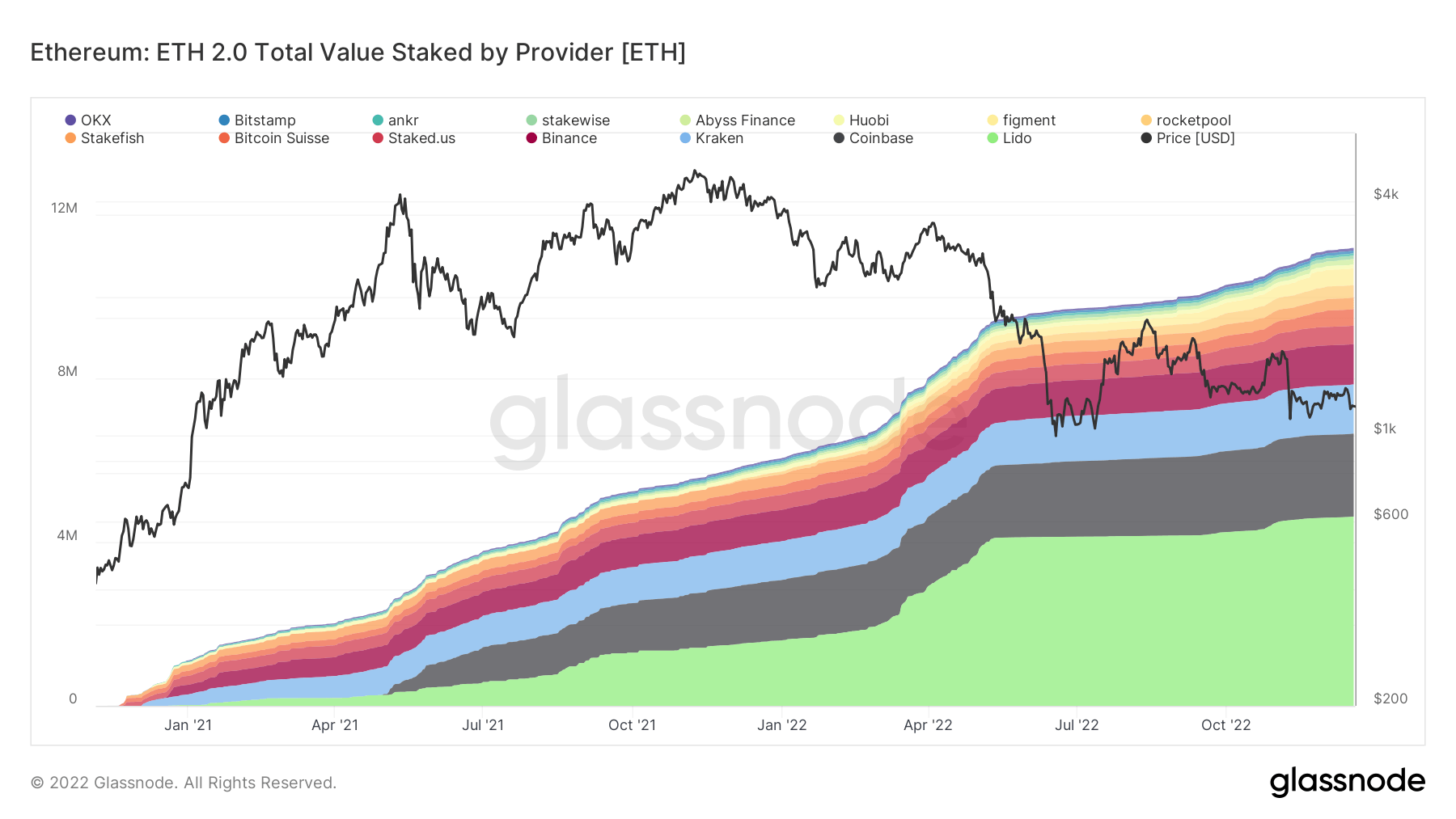

Staking indicator

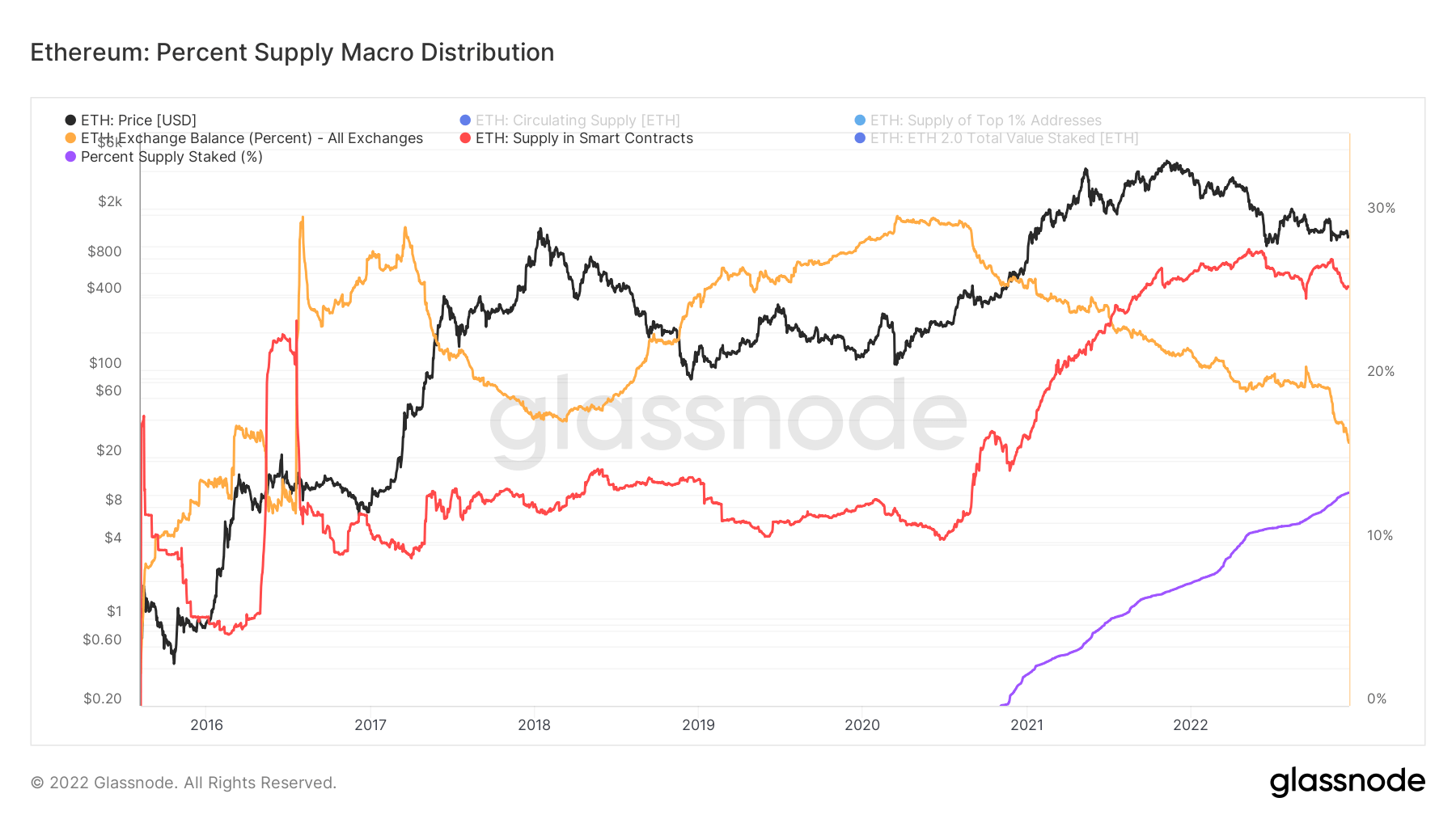

About 13% of the Ethereum supply is staked.this is significantly Less than BNB chain 90.2%, Cardano 71.6%, Solana 68.6%.

It is currently not possible to unlock staked ETH. This may be a factor in the relatively low percentage of staked supply relative to other large caps. However, once enabled, whether this will cause a massive de-staking of tokens, resulting in a reduction in the issuance of daily ETH staking rewards, or more based on being able to enter and exit staking with fewer restrictions? It is unclear if many tokens will be staked.

Since late 2020, ETH supply on exchanges has decreased from 30% to 16.5%. In contrast, Smart’s contract supply reversed, rising from 15% to 26%. The two will cross in mid-2021.

The total number of ETH staked is approaching 12 million. However, the distribution of this is very concentrated to a small number of validators, such as:

- Lido – 4.6 million

- Coinbase -2 million

- Kraken – 1.2 million

- Binance – 1 million