Financial web3 project userbases decline; blockchain gaming has 5x user retention versus web2

Levan Kvirkvelia, an on-chain analytics platform get together reached out to crypto slate He shares his findings analyzing over 100 “web3 services”.

Clusters, still in beta, analyze data from critical blockchain services. This includes user retention, bot activity, and active users. The platform currently supports polygons and BNB chains.

Data from the cluster is 100+ projects reviewed by the cluster, only five increased their user base year-over-year. However, it was the web3 games that stood out within the crypto, with usage retention rates 3x to 7x higher than web2. Kvirkvelia concluded that the data suggested:

“The next big thing is gaming, not finance…users are not tied to the use of crypto financial instruments.”

The platform allows users to create dashboards from on-chain data similar to Dune. However, the cluster focuses on bot interaction and user retention to measure true human interaction with blockchain projects rather than raw financial data.

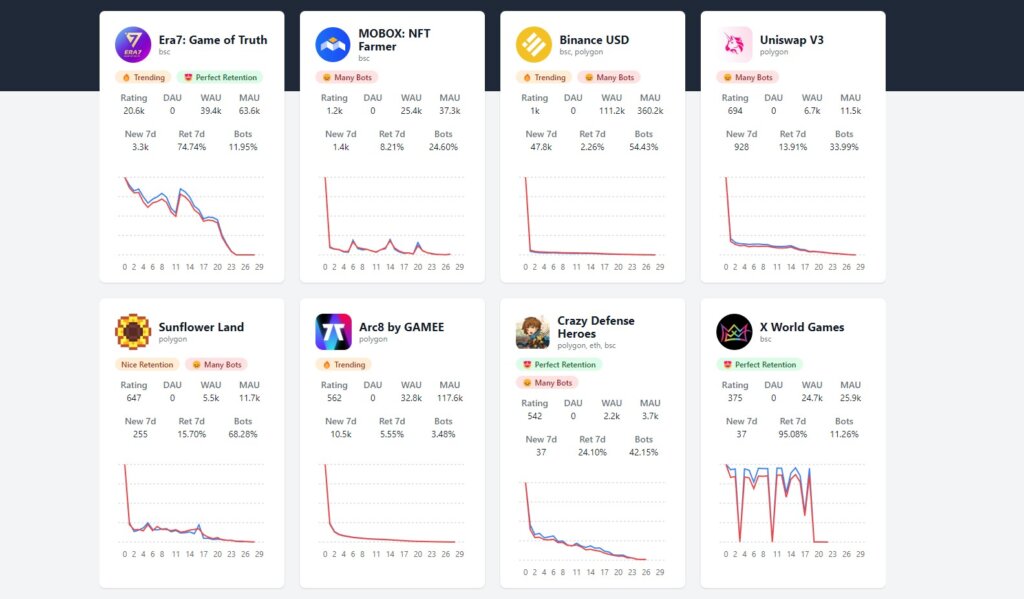

From the cluster ranking page, 5 out of the first 8 projects have a label warning users that they have a high level of active bots within the project. Sunflower Land on Polygon has 11,700 monthly active users, but 68.28% are reported to be bots.

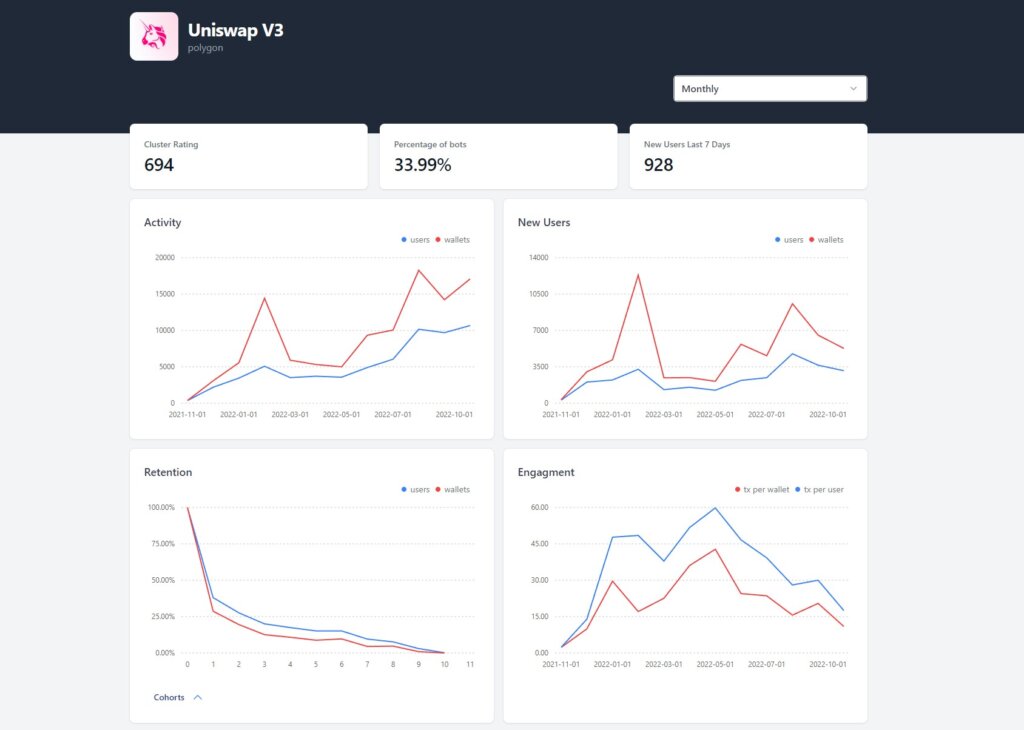

According to Cluster, 33.99% of Polygon’s Uniswap V3 activity is also the result of bot actions. For web3 DEX, this amount of bot activity is unlikely to be a significant issue. Because arbitrage and trading bots are often used to level prices and provide a better experience for end users. However, the high number of bots on the web3 gaming platform may be a more serious cause for developer alarm.

Activity on Polygon’s Uniswap V3 has been steadily increasing throughout 2022, but the number of transactions per user has been declining since May. DEX has an amazing user retention rate of 13.91% over 7 days, double Average retention of apps on web2.

Kvirkvelia shared a dashboard created by the cluster team that analyzed all major stablecoins on the BNB chain and Polygon. He noted the difference between wallets and user interactions, noting that many projects have much less user adoption than the number of active wallets.

Kvirkvelia assumed that the number of wallets is twice as many as new users across all stablecoins on chain. Active wallets may therefore not be the most accurate metric for measuring web3 projects that require real human interaction.

And the problem is retention! In the month following registration, only 16% of the user’s girlfriend uses the wallet, and in the eighth month he is 2%.

Without fixing retention, Web3 would need 50 billion to reach 1 billion users. pic.twitter.com/7yvWyboArF

— Levan Kvirkvelia (@LevanKvirkvelia) October 24, 2022

However, Kvirkvelia found that while user acquisition is relatively high, user retention on web3 declines by eight months.he said

“If you don’t fix retention, you’ll have to get 50 billion to reach 1 billion users on Web3.”

User retention may be a real problem for many financial web3 projects, but one area that doesn’t have this problem is web3 games. Kvirkvelia presented data showing that web3 games have slow user growth but high “retention rates of 10-30% for several months.”

Web3 retention rates are 3-7 times higher than web2 games, with only 4% of users returning to the game after a month. It’s a revolution! pic.twitter.com/q01gdk6TfW

— Levan Kvirkvelia (@LevanKvirkvelia) October 24, 2022

Web3 game projects seem to have the opposite problem as financial projects.Attracting users is the biggest problem in this space, which is not surprising given the current state of affairs Received in traditional gaming media. Sites such as Kotaku regularly downplay and downplay the benefits of blockchain technology in gaming.

For those looking for thrilling gameplay in the world of blockchain and NFTs, it’s not always easy. Projects like Polkastarter Gaming and Xborg are trying to shine a light on the great gameplay of the latest web3 games, but it’s not easy. Recent announcements from Polkastarter Gaming Gam3 Award Later this year, we hope to showcase what web3 gameplay has to offer.

web3 games have problems attracting users.

This is the average new user graph for the game. You attracted users once (for example, during a release), but users are no longer coming.

I think one of the reasons for this problem is the lack of web3 ads pic.twitter.com/y50vgg1mrr— Levan Kvirkvelia (@LevanKvirkvelia) October 24, 2022

According to Kvirkvelia, the high user retention rate for web3 games is “revolutionary!” But “the lack of web3 ads is one of the reasons he’s having this problem.”

Much of this data has been distorted by the bitcoin price decline since the beginning of the year, but it is encouraging to see the growth of the web3 gaming space. Financial instruments are likely to take a hit during the global financial crisis and will have a significant share in 2022.