FTX crash pushes Bitcoin to self-custody; Ethereum switched for stablecoins

Data analyzed by CryptoSlate shows that after the FTX demise, investors moved large amounts of Bitcoin (BTC) into self-custody wallets and invested in stablecoins from Ethereum (ETH).

Bitcoin retreats to self-control

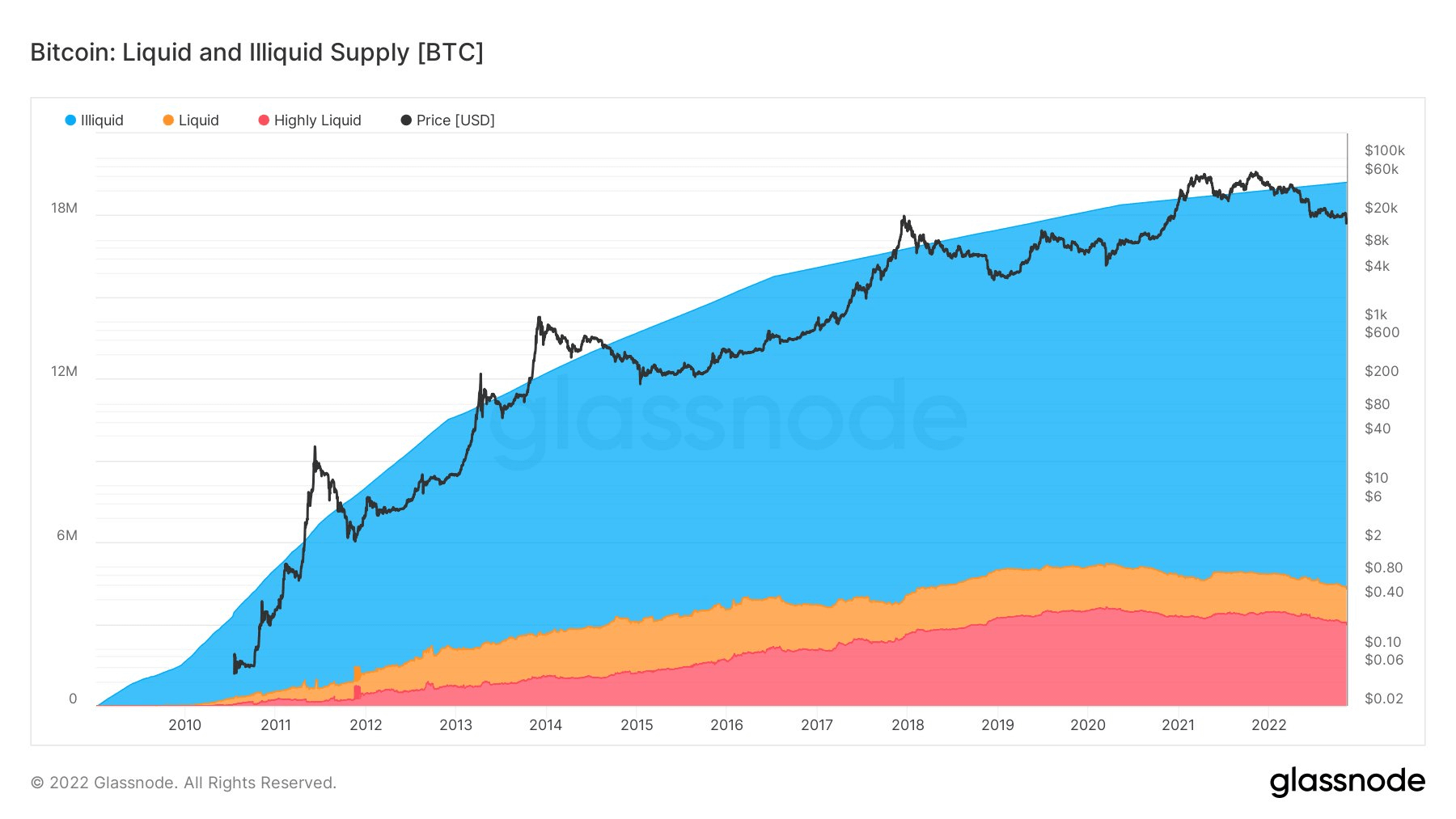

The chart below shows the amount of liquid, illiquid and liquid Bitcoin since 2008.

As of November 2022, the amount of Bitcoin held in self-custody wallets has reached almost 15 million. Of the 19,204,000 supply currently in circulation, this figure shows that 78% of all bitcoins are self-stored.

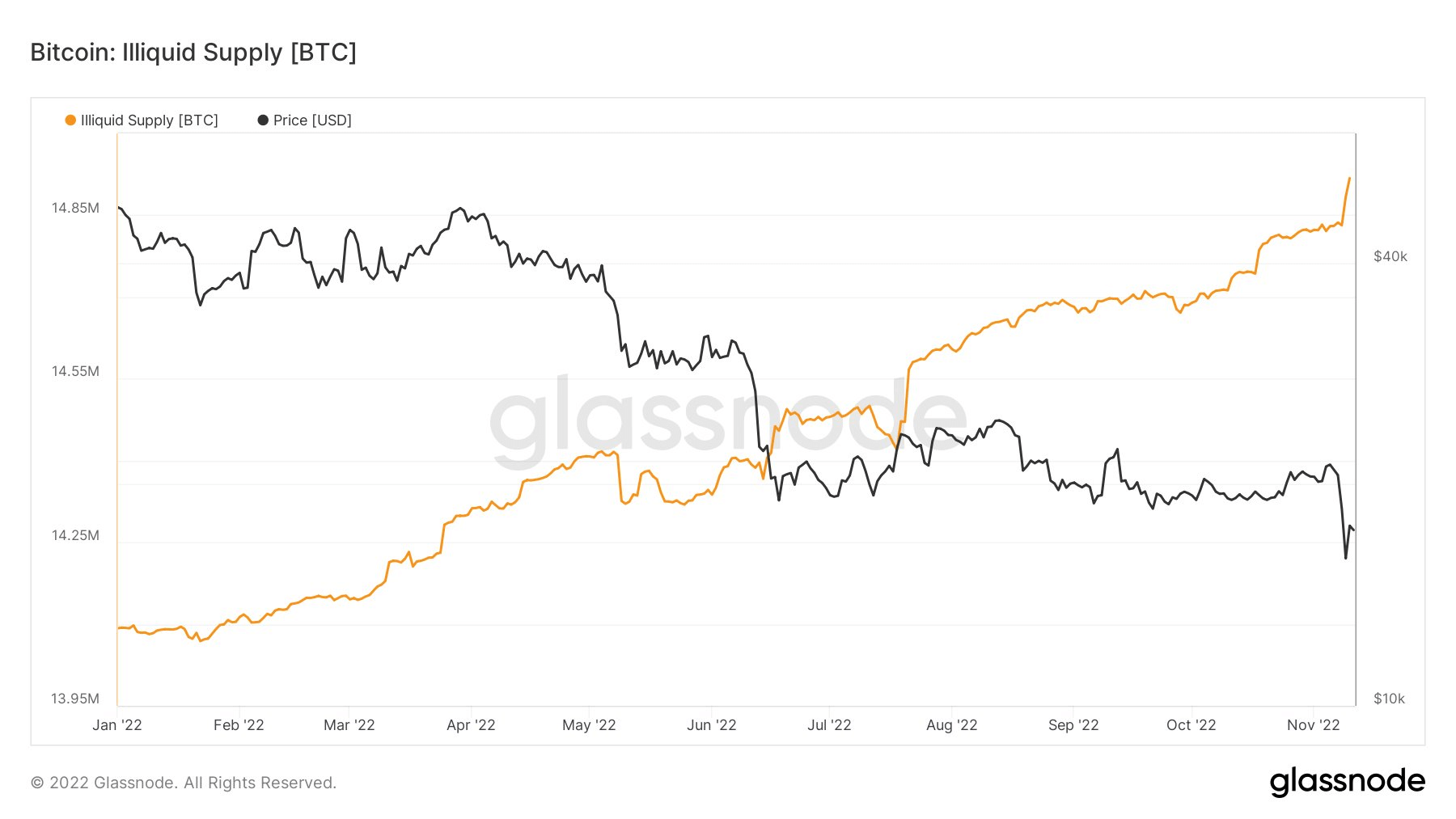

The chart below shows in more detail the illiquid bitcoin supply since the beginning of the year, showing a sharp increase this week.

This sharp increase may be the result of valuable lessons the community has learned from recent events regarding FTX’s liquidity crisis. FTX recently pledged to do all it can to provide liquidity, but has yet to back off on its commitments.

Stablecoins on Ethereum

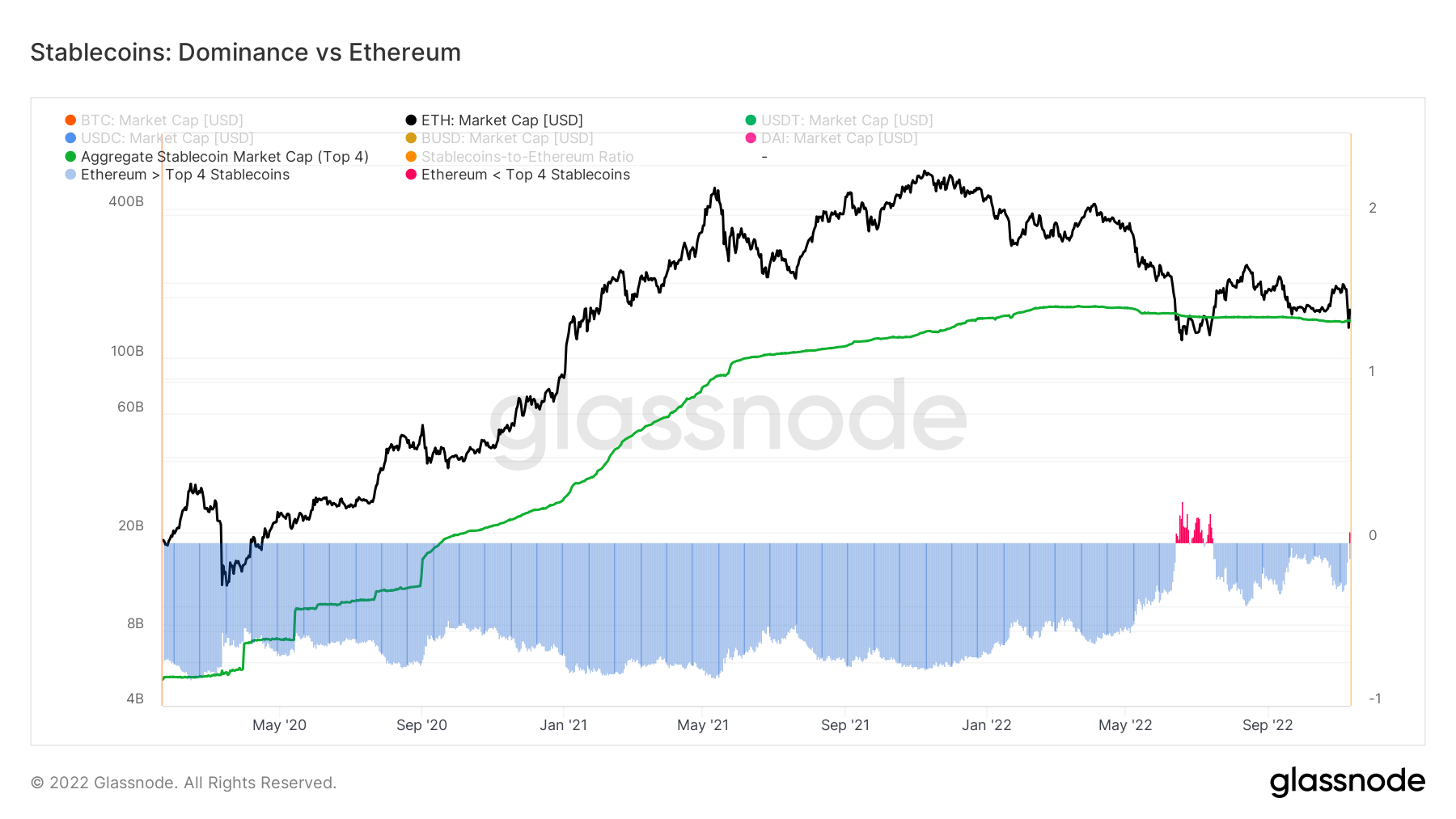

The chart below collects the supply of the top four stablecoins (Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI (DAI)) on different blockchains and transfers them to Ethereum. compared to the market capitalization of

The data shows that the dominance of stablecoins has surpassed that of Ethereum as of November 11th. This is a once-in-a-lifetime event in cryptocurrency history in June 2022, indicating investors are moving large amounts of money into stablecoins as Ethereum’s market cap declines. A strong indicator.