FTX has paid over $100M to lawyers and consultants handling its bankruptcy case

As of April 30, FTX debtors said they had paid more than $100 million to 14 consultancies and law firms handling bankruptcy cases, according to a court on May 30. filing.

Sullivan & Cromwell are top earners

FTX paid law firm Sullivan & Cromwell (S&C) $39.58 million for its services, making it the highest-earning firm of those firms, according to filings.

S&C is the company’s turnaround lawyer and has played an active role in FTX’s bankruptcy case. The firm previously described its services to failed exchanges as “one of the most complex and multidisciplinary operations of any law firm.”

The firm initially faced fierce opposition from Sam Bankman-Fried, who accused the law firm of pressuring FTX to file for bankruptcy in the days after the bombing. S&C’s involvement in the lawsuit was also contested by Rep. Tom Tillis, Elizabeth Warren, John Hickenlooper, and Cynthia Lumis, who disclosed their past relationship with FTX in a Jan. 9 report. Quoted. letter to court.

Another top-earning company in FTX’s bankruptcy case is Alvarez & Marsal North America, which is acting as financial advisor in the bankruptcy case. The company earned $32.7 million.

Landis Russ & Cobb, Quinn Emanuel Urquhart & Sullivan, AlixPartners, Kroll, and Jefferies LLC have all made profits between $257,149 and $5.01 million.

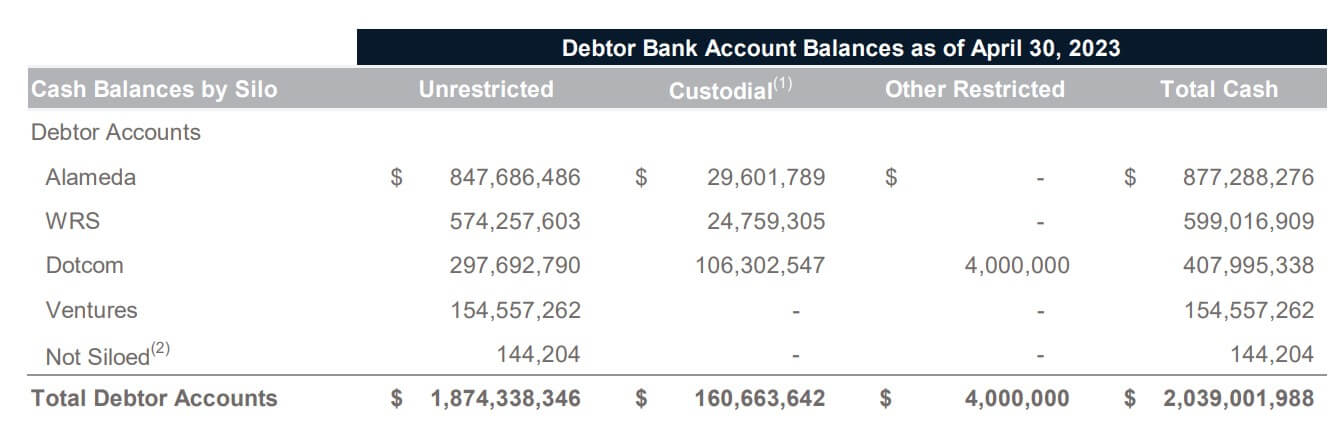

FTX has $2.03 billion in bank deposits

FTX bankruptcy debtors reported that four silos of the bankrupt crypto empire held $2.03 billion in unnamed banks as of April 30.

A breakdown of these bank account balances shows that Alameda Silo, which consists of major trading firm Alameda Research and its subsidiaries, had bank deposits of $877.28 billion. In contrast, 599.01 billion was banked in West Realm Shires silos, including FTX US and Ledger X.

The dotcom silo, which consists of FTX.com and other exchanges, held $407.99 billion in banks, while FTX Ventures held $154.55 billion in these traditional financial institutions. rice field.

Additionally, Deck Technologies, Inc. (another entity that is not one of the four silos that make up FTX’s primary accounts) has $144,204 in the bank.

FTX debtors said they maintain accounts in foreign currencies across a number of legal entities. The bankrupt company did not provide the names of these banks or details about the holdings of each bank.

Earlier this year, several US banks were reportedly linked to bankruptcy exchanges. The lawsuit alleges that the defunct Signature Bank abetted and abetted the FTX scam by “allowing” the mingling of exchange users’ funds through the Signet network.

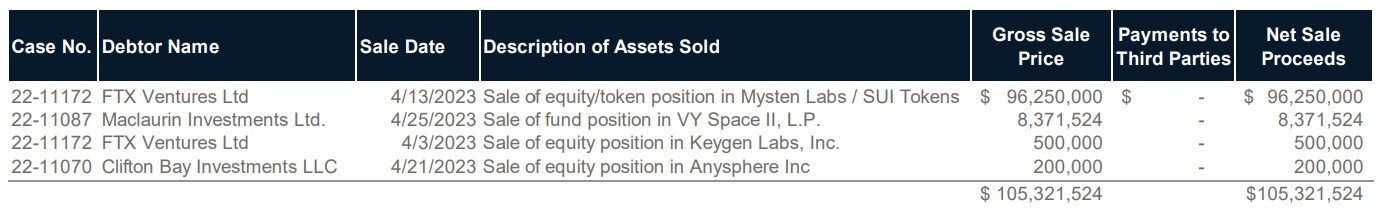

FTX made $105 million

The financial report also showed that the bankrupt company made $105.32 million through the sale of four different assets.

The exchange earned $96.25 million from the sale of Mysten Labs SUI token shares and token positions, according to filings. crypto slate The bankruptcy exchange reportedly undervalued SUI’s holdings by a factor of about 1,000, with the token valued at over $1 billion.

Meanwhile, the company sold its fund position in VY Space for $8.3 million on April 25, and its equity positions in Keygen Labs and Anysphere for $500,000 and $200,000, respectively.

Other updates

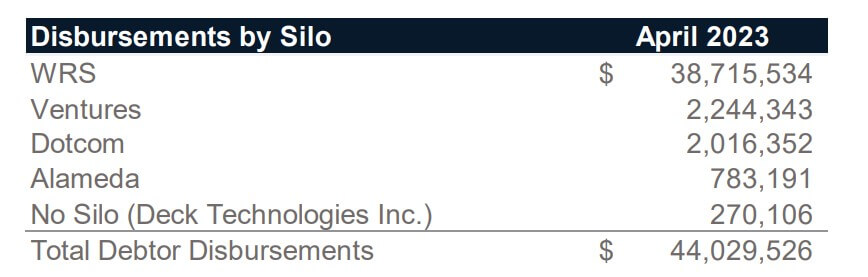

FTX made a payment of $44.02 million in April, according to court filings. The application did not contain details about when these payments were made or to whom.

FTX also said it had 107 full-time employees, down from 320 when it filed for bankruptcy in April and paid $386,033 in post-filing taxes.