FTX seeks bailout to shore up liquidity; 60K BTC withdrawn from exchanges

The biggest news in the cryptoverse on Nov. 10 included SBF planning to raise funds to bail out FTX and make users whole, SEC Chairman Gary Gensler investing in FTX after its collapse. Advocating for more home protection, Sequoia Capital is amortizing its $200+ million investment in FTX, and more. Not worth it.

CryptoSlate Top Stories

Leaked Slack message shows SBF plans to raise funds for FTX bailout

Sam Bankman-Fried plans to raise more money to pay back customers and investors affected by the collapse, according to a leaked slack message reportedly sent to FTX employees is.

SBF added that FTX International could merge with FTX US to increase liquidity and fund operations.

Sequoia writes off $200M+ FTX investment as ‘worthless’

VC firm Sequoia had about $63.5 million invested in FTX and FTX US before the crypto exchanges started struggling.

In light of FTX’s collapse, Sequoia has informed investors that it is writing off more than $200 million in bad debt on FTX.

SBF aims to increase the liquidity of FTX International. Funds to go “direct to user”

FTX CEO Sam Bankman-Fried (SBF) apologized in a November 10th tweet for exceeding users’ margin deposits, which caused the collapse of FTX. As a result, FTX has a higher asset value than user deposits.

SBF said it is exploring all possible options to raise funds and liquidate existing collateral in order to refund users affected by the collapse.

The crypto market rocked as stablecoin reserves dried up, Curve 3pool concentrated on USDT, 60k BTC left Binance, and Alameda shorted USDT.

Following reports that Binance stopped storing FTX due to an $8 billion hole in its balance sheet, Binance announced its proof of assets, This reveals that Binance held approximately $18.3 billion worth of assets in reserves.

However, the collapse of FTX has created problems with stablecoin liquidity. Curve 3’s pool became imbalanced as USDT, DAI, and USDC balances were adjusted to 84%, 8%, and 8%, respectively. Rumors have also surfaced that FTX’s Alameda is looking to sell about $550,000 worth of USDT.

With the growing fear, uncertainty and suspicion rocking the cryptocurrency market, some bitcoin holders have withdrawn around 60,000 BTC from exchanges, demonstrating sentiment to sell assets to avoid further contagion.

SEC’s Gensler says investor protections need to be increased after FTX debacle

Securities and Exchange Commission (SEC) Chairman Gary Gensler has told CNBC that he has warned crypto exchanges, including Sam Bankman’s FTX, that failing to comply with regulatory laws will undermine investor protection. Told.

Gensler said the best way for cryptocurrency exchanges to be formally registered with regulators would be to protect investors and prevent market crises caused by big players “mixing together” to trade with customers. I repeated.

Solana Postpones Token Unlock Amid Double-Dip Fear, Developers Unaffected

By design, Solana was supposed to unlock around 18 million SOL tokens between November 9th and November 10th. However, due to the collapse of the FTX ecosystem, Solana has postponed the unlock date until he is November 12th. Solana’s struggle token (SOL).

Counterintuitively, the Solana developer staking unlock has completed today, releasing approximately 353,687 SOL tokens to the market.

Bitcoin surges to $17,800 on better-than-expected CPI data

The November 9 FTX crash sent Bitcoin down to a 103-week low of around $15,600. Within 24 hours, Bitcoin traded at $17,800, he surged 7.5% following the release of October’s Consumer Price Index (CPI) data.

Markets had expected inflation to rise by around 7.9%, but CPI data for October revealed inflation to remain at 7.7% year-on-year.

Kraken’s Jesse Powell Says Crypto Community Should ‘Raise the Bar’ to End Bad Guys

Kraken founder Jesse Powell said in response to the collapse of FTX that the crypto community is open-minded and trusting, but must adopt rigorous standards when verifying crypto projects before promoting them. Said there was.

Powell called on venture capital firms to go through a rigorous due diligence process before backing projects and approving them to the public.

The Kraken chair added that U.S. regulators need to provide a clear regulatory framework for crypto businesses to operate and serve in a supervised manner.

research highlights

FTX, Alameda Use Binance As Broker In Parasitic Relationship

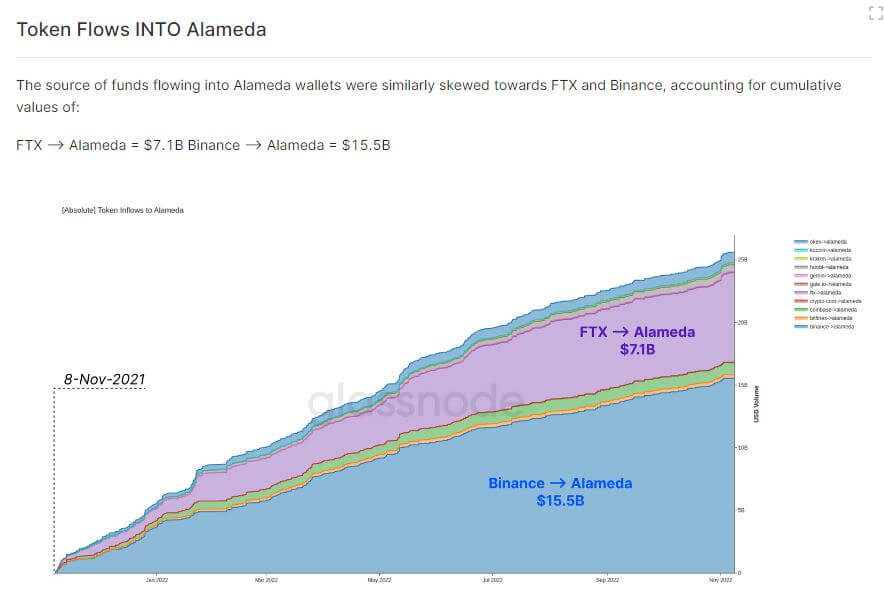

On-chain data analyzed by CryptoSlate shows that between November 2021 and November 2022, Sam Bankman-Fried’s Alameda Research transferred approximately $49 billion worth of tokens to FTX, and 42 billion in September 2022. It revealed that more than 100 million dollars had been transferred.

According to the chart, Alameda reportedly received about $25 billion worth of stablecoins and altcoins, of which $7.1 billion came from FTX and over $15.5 billion from Binance wallets.

In line with on-chain data, Binance played an intermediary to facilitate the movement of funds between Alameda and FTX, causing the crypto market crash of 9/11.

M2 money supply could be a better measure of inflation than CPI

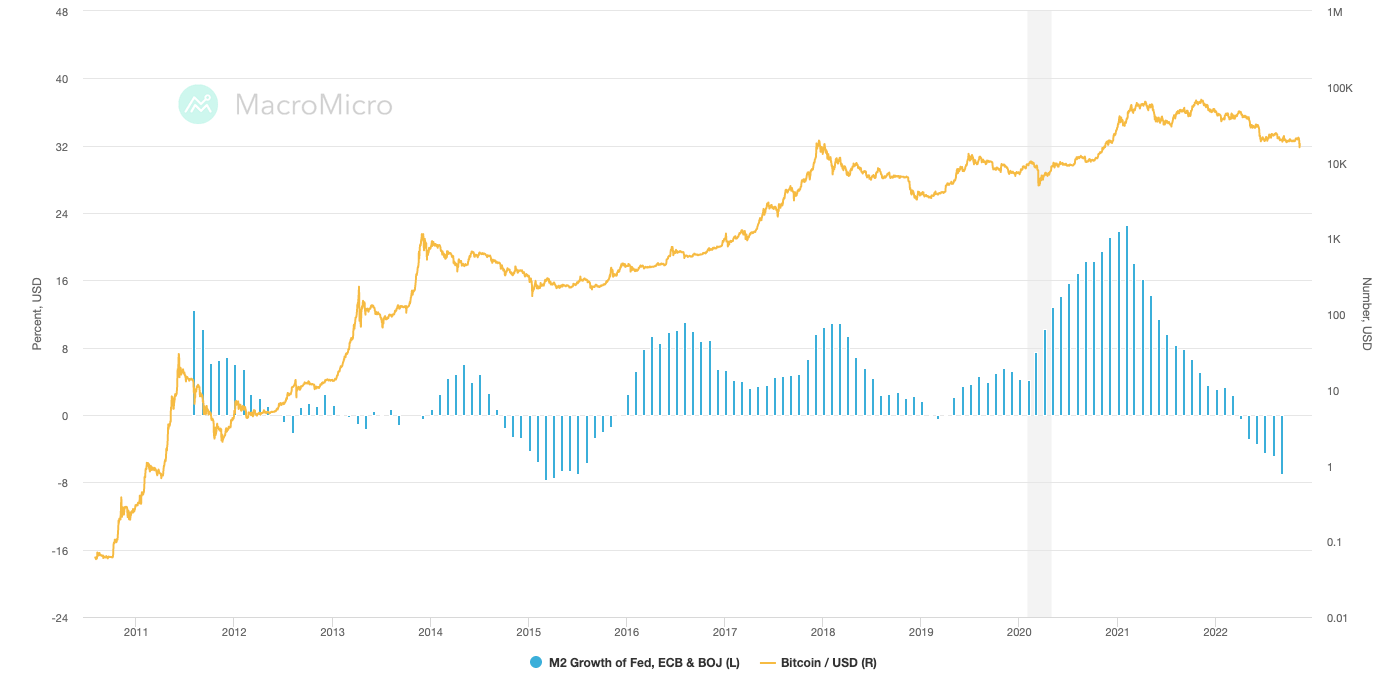

Many economists believe that the M2 money supply (which includes cash and current accounts, savings deposits, and money market securities) is a better measure of inflation than the M1 used to track the consumer price index (CPI). I believe it is.

CPI data for October shows inflation at 8%, while the M2 figure is above 25%. Many consumers believe that inflation may be approaching the 25% mark set by M2.

Additionally, the M2 figure is of increasing interest from crypto analysts as it tracks the price performance of Bitcoin.

From the chart, during the 2015, 2019 and 2022 periods, the M2 numbers decreased, coinciding with the Bitcoin price decline. As a result, the global M2 is becoming an important indicator in determining Bitcoin price volatility.

News from the Cryptoverse

Tron supporting FTX

FTX has announced that it will work with Tron to enable TRX, BTT, JST, SUN, and HT token holders to exchange their assets 1:1 to external wallets.

The first installment will allow you to withdraw approximately $13,000,000 worth of assets, with more to roll out in the coming weeks.

Iranian firm trades nearly $8 billion via Binance

Reuters report Major cryptocurrency exchange Binance is said to have facilitated $7.8 billion worth of transfers from Iranian companies that have been sanctioned by the US government.

The funds flowed between Binance and Novitex, Iran’s largest cryptocurrency exchange, using the cryptocurrency Tron to cancel on-chain identities.

crypto market

Over the past 24 hours, Bitcoin (BTC) is up more than 4% to trade at $17,476, while Ethereum (ETH) is up 9% to trade at $1,297.