Futures OI exceeds 500K Bitcoin – volatility, liquidations increase as a result

meaning

- Futures Open Interest is the total funds (in USD value) allocated to open futures contracts.

- Liquidation is the sum of liquidated volumes (in USD value) from long and short futures contract positions.

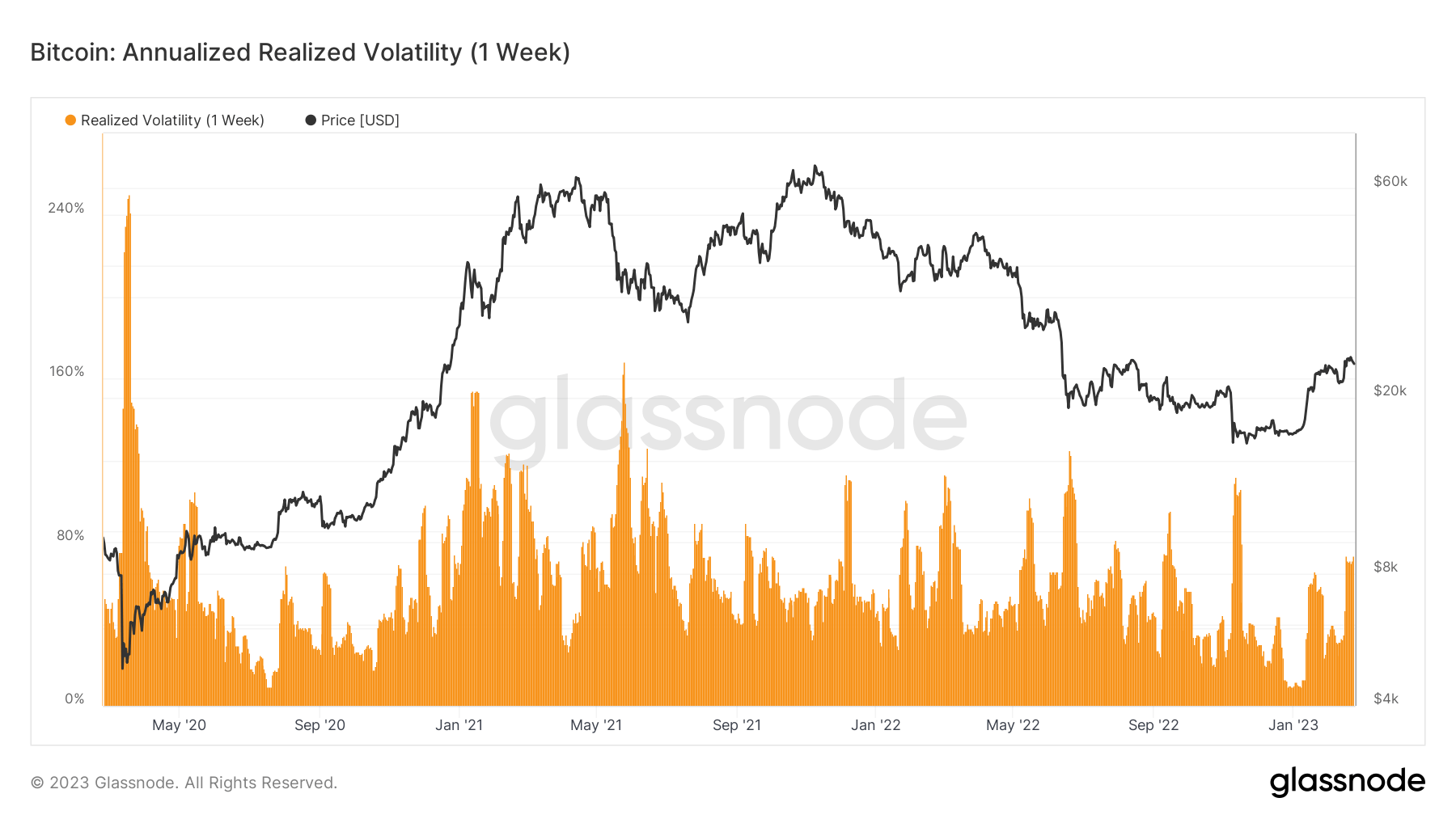

- Realized volatility is the standard deviation of a return from the market average return. A high value of realized volatility indicates that the market is at a high risk stage.

quick take

- Futures open interest surpassed 500,000 BTC for the first time in February, up more than 20,000 BTC in February as investors piled into futures contracts.

- Bitcoin’s momentum is up 50% YTD in February, largely due to an increase in long liquidations as investors pile onto Bitcoin’s positive momentum as a result of an increase in futures contracts.

- Furthermore, realized volatility has also increased, with Bitcoin price volatility exceeding 70%, the highest level since the collapse of FTX.

Futures OI Posts Over 500K Bitcoin – First Appeared on CryptoSlate as a result of Increased Volatility, Liquidations.