Gemini, GUSD start losing followers as metrics hit all time lows

Glassnode data analyzed by crypto slate US-based cryptocurrency exchange Gemini and its stablecoin Gemini Dollar (GUSD) are showing that they are beginning to lose the trust of their followers and community as their metrics plummet to all-time lows.

GUSD holders and trading volume

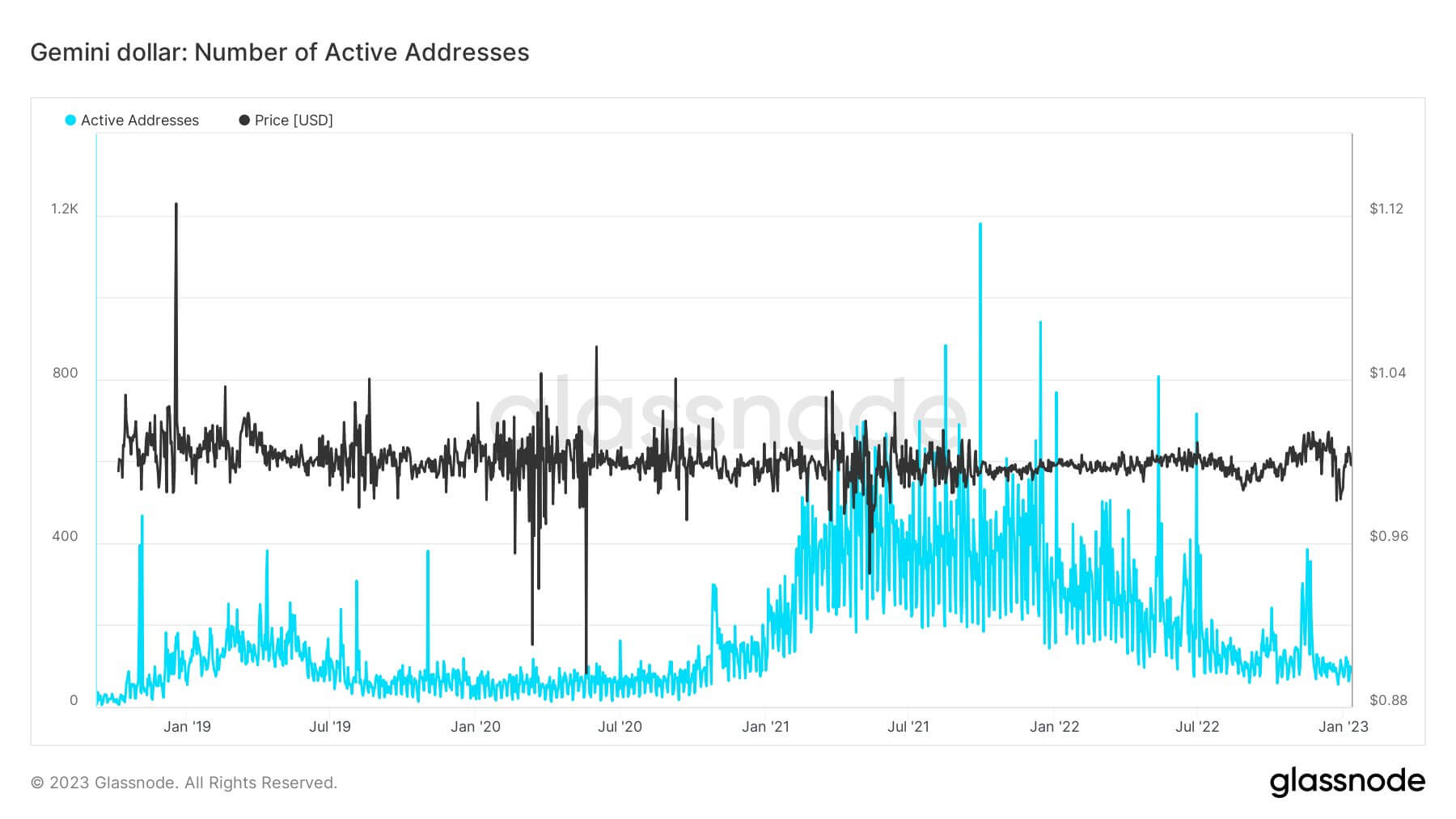

The number of active addresses holding GUSD has dropped to 2020 levels. The chart below shows the number of active wallets since early 2019.

The number of wallets started increasing at the end of 2020 and reached almost 1200 by the end of 2021. Since then, active addresses holding GUSD have dropped by 91.6%, returning to 100 in January 2023.

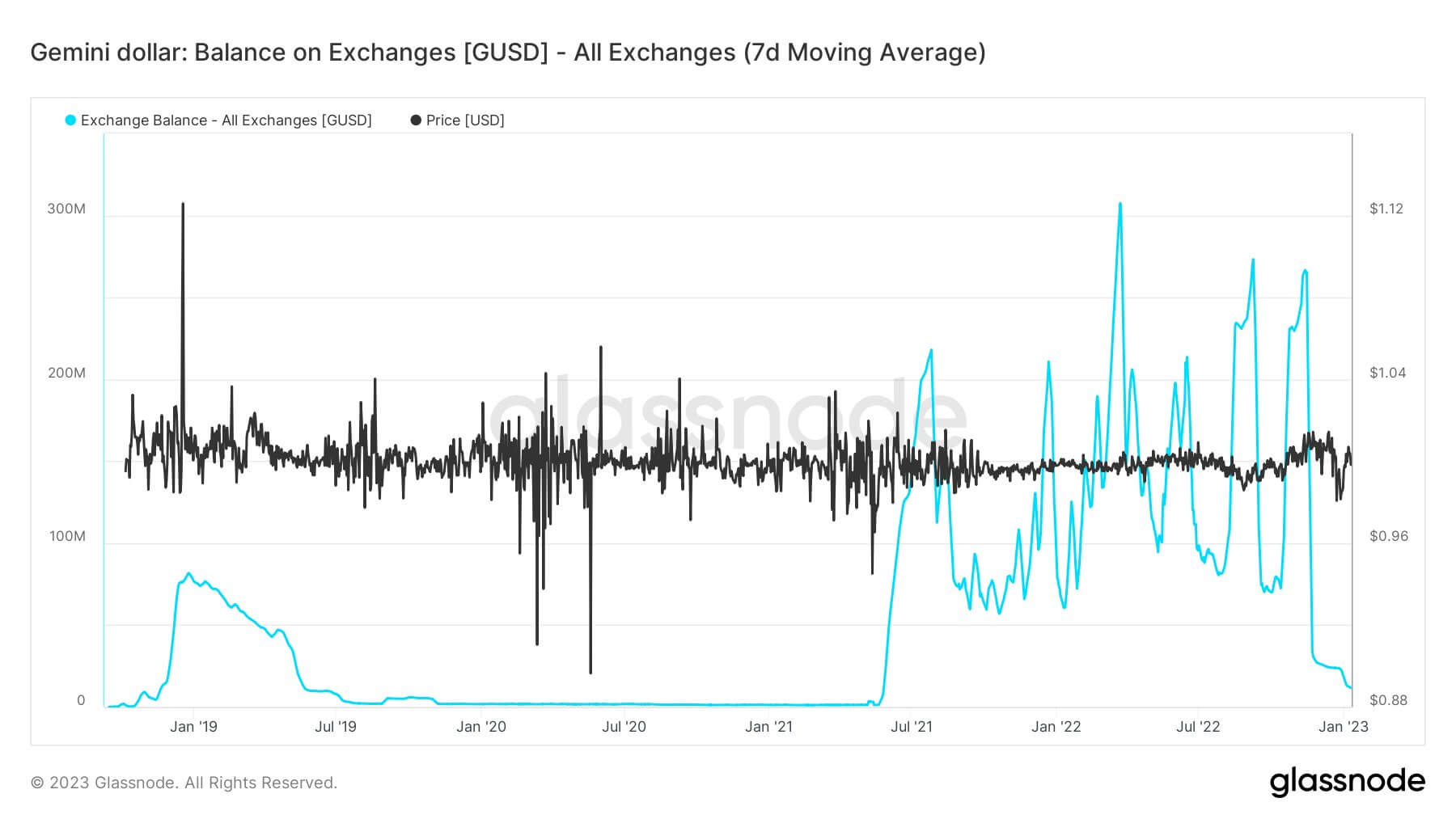

BUSD balances on exchanges also recorded a significant decline. The chart below shows his BUSD balance held on exchanges since early 2019.

The exchange’s BUSD volume began increasing exponentially in July 2021 and topped $300 million in May 2022, just before FTX collapsed.

However, BUSD volume began to record ups and downs after the FTX disaster, eventually registering a 96% decline in January 2023, dropping from around 260 million to just over 10 million.

what happened?

The name Gemini has been making news headlines ever since Terra Luna fell apart. Gemini laid off his 10% of staff in June 2022 as soon as the winter market began. In July 2022, Gemini made her second layoff, laying off his 15% of employees. In both decisions, the exchange pointed to market turmoil and reiterated the need to control costs. But at the time, most crypto companies were laying off staff, so Gemini didn’t stand out.

gemini acquisition

The real chain of events that undermined community trust in Gemini began on November 16, 2022, when Gemini’s earning program stopped withdrawals due to market turmoil. Addressing users, the exchange said it is trying to fulfill customer withdrawal requests as quickly as possible.

Gemini Earn is a program that allows individual investors to lend crypto assets to institutional investors in exchange for a certain interest rate. To facilitate these services, Gemini partnered with third-party crypto lenders, including his Genesis, which stopped withdrawals for its own customers on Nov. 16, the same as Gemini Earn. Genesis said it was experiencing an unusual amount of withdrawal requests that exceeded the company’s liquidity. He added that its parent company, Digital Currency Group (DCG), is also doing everything in its power to level the situation.

Since then, discussions between DCG, Genesis and Gemini have continued, including DCG CEO Barry Silbert and Gemini CEOs Cameron and Tyler Winklevoss, with tensions rising daily. On December 5th, Gemini formed an ad hoc committee to come up with a solution to the liquidity crisis.

On January 2, Cameron Winklevoss wrote an open letter to Silbert, claiming that Gemini Earn’s liquidity crisis was caused by Genesis and that Genesis was in trouble. Cameron Winklevoss gave Silbert until January 8th to pay off his debts and resolve Gemini’s liquidity crisis. Silbert responded shortly after the open letter was published, stating that neither he nor his DCG owed Genesis anything.

Gemini Earn users filed a class arbitration lawsuit against Genesis and DCG on January 3, alleging that Genesis violated its agreement with Gemini Earn users. On January 4th, Genesis’ CEO released a statement saying the company was working hard to resolve the issue but needed more time.

The issue remains unresolved and Gemini has announced that it will officially discontinue the earning program on January 11, 2023. The exchange added that returning user funds is currently a top priority, reminding Genesis that it is responsible for returning all assets to users. .