Generational buying opportunity intact as Bitcoin retains 60-day MA

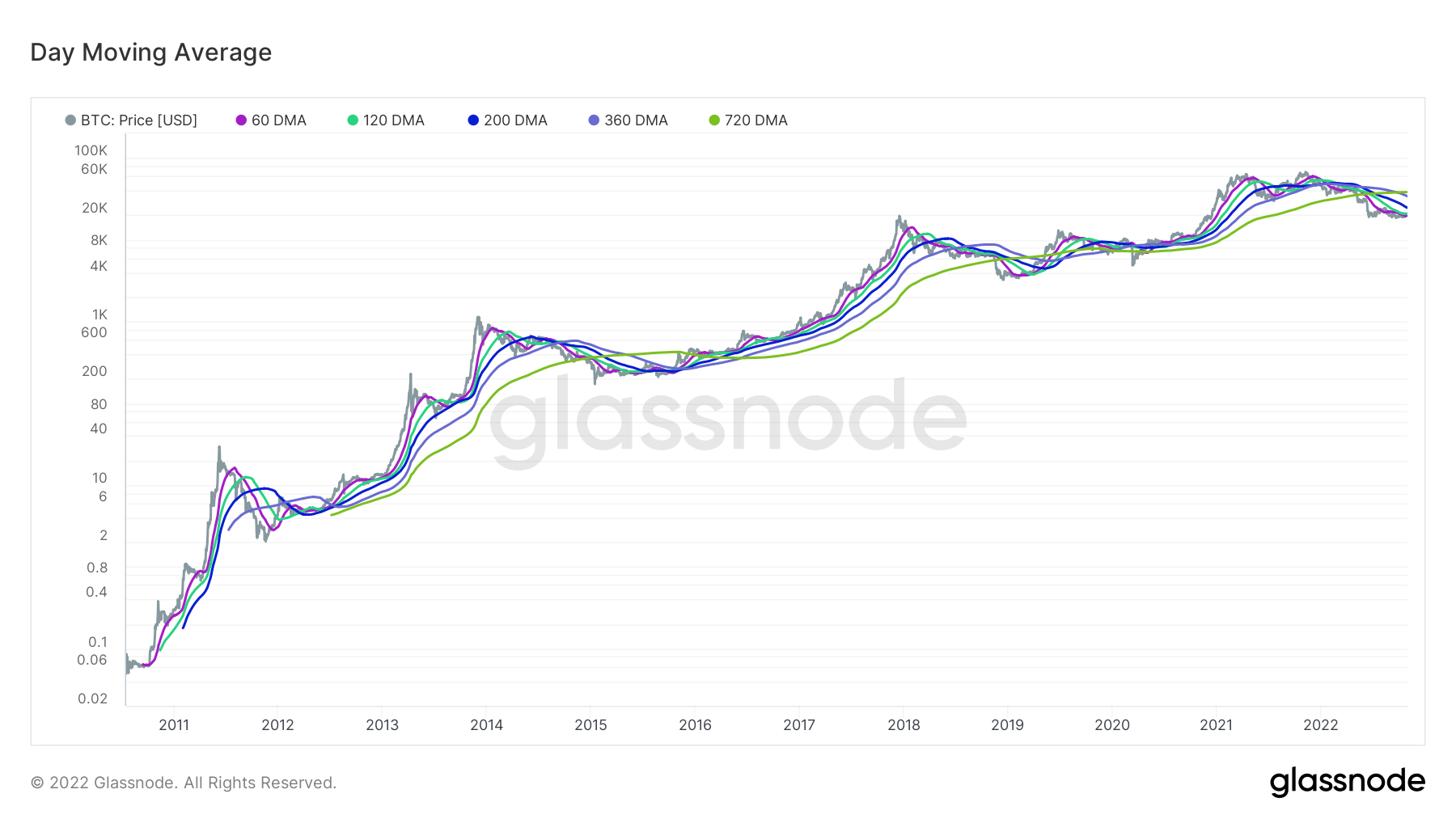

Last month, CryptoSlate reported that Bitcoin’s price fell below all five major medium- to long-term moving averages for only five times in its history.

Previous instances of this happening have seen BTC rise significantly, with some technical analysts calling these events “intergenerational buying opportunities.”

It’s been 6 weeks since your original post, how’s Bitcoin doing?

Bitcoin moving average

A moving average refers to a technical analysis indicator used to identify the trend direction of a particular crypto asset.

It is calculated by summing all price data points during a given period and dividing the total by the number of periods. Any duration can be used. However, five time periods commonly used to assess medium- to long-term trends are 60 days, 120 days, 200 days, 360 days, and 720 days.

The moving average cannot be used as a trading signal by itself as the data is plotted using historical data. Rather, it is often used in combination with other indicators to form an overall assessment of future trends.

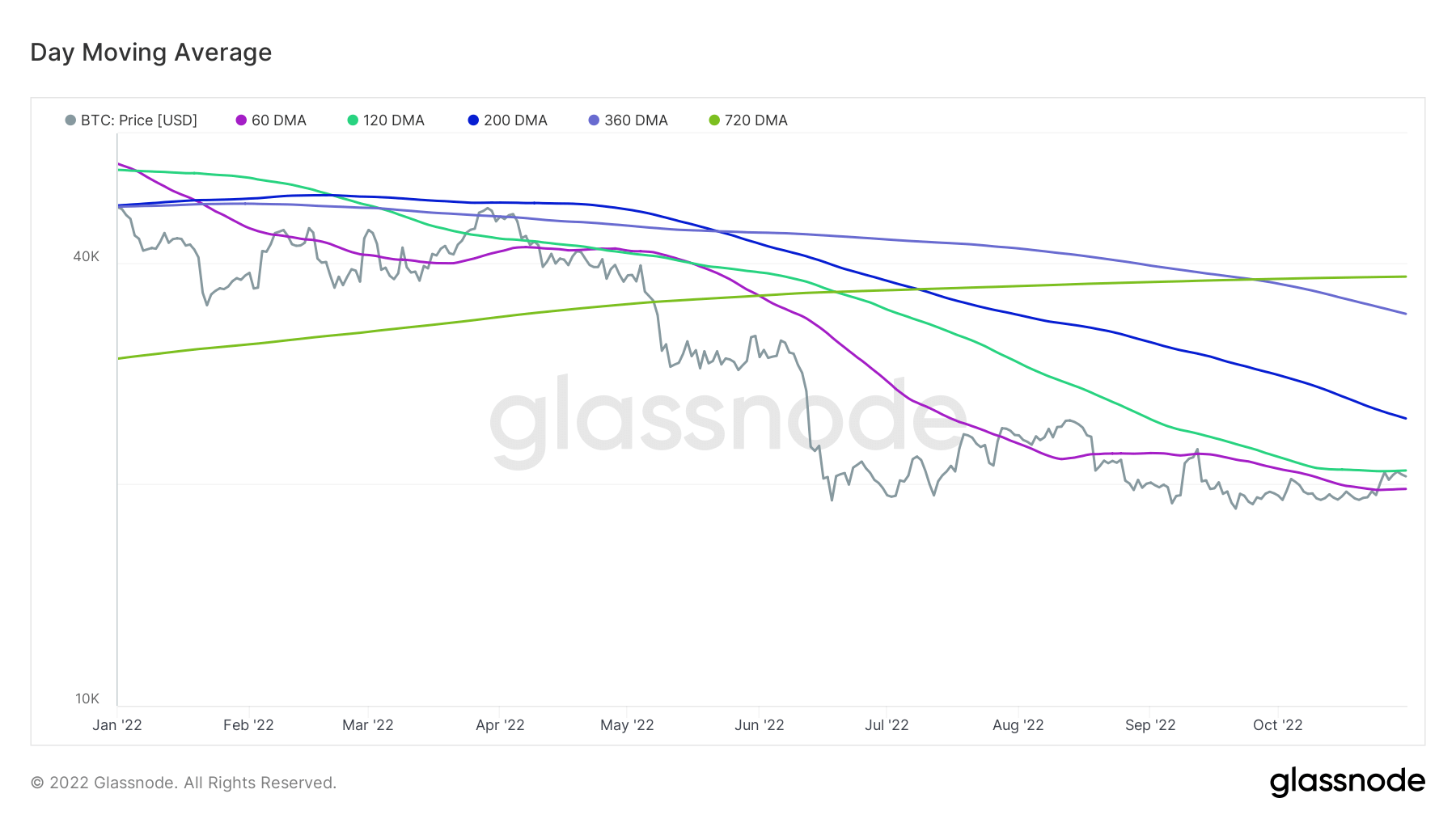

The chart below shows that Bitcoin is still below the major moving averages, except for the 60-day moving average, and BTC crossed this period on Oct. 25.

Data analyzed by CryptoSlate shows BTC remains above the 60-day moving average despite a sharp sell-off at 14:00 (UTC) on October 31st, indicating an uptrend in ‘intergenerational buying’ is left as is.

zoom in

An analysis of the five major moving averages on the year-to-date timeline shows that Bitcoin is currently above the 60-day moving average line.

Furthermore, after crossing the 60-day moving average, BTC retested the 120-day moving average twice, both of which were rejected. For Bitcoin to regain this level, it needs to build on the daily close above $20,900.

Last week’s rally to $21,000 brought welcome relief and a renewed sense of optimism. But Bitcoin’s failure to build on this for its next foothold is causing sentiment to stutter.

It remains to be seen whether the present, coupled with ongoing macro uncertainty, will serve as a generational buying opportunity.