Glassnode data reveals bullish trends for Bitcoin amidst latest rally

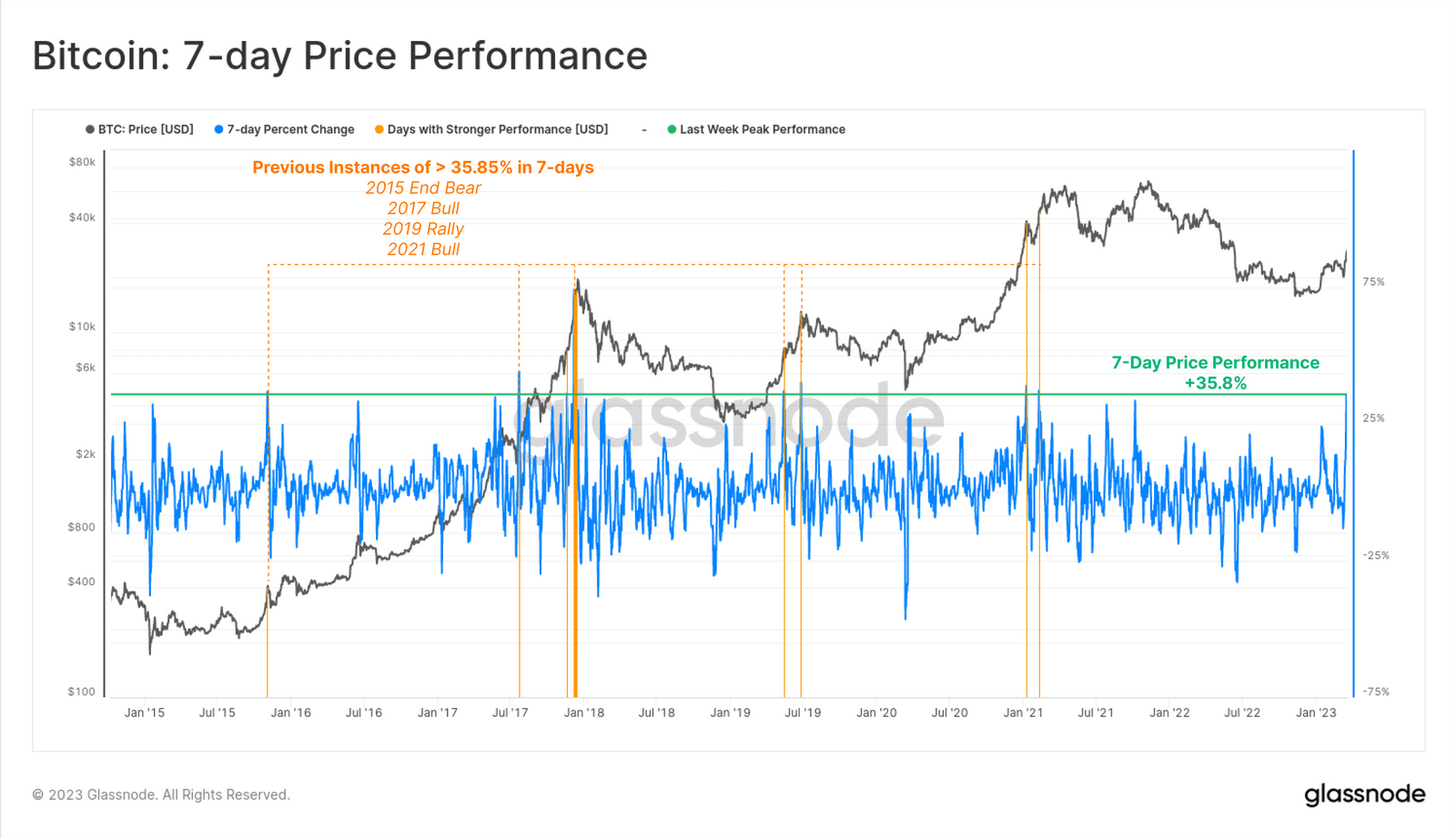

Bitcoin had one of its best weeks ever, closing up 35.8%.

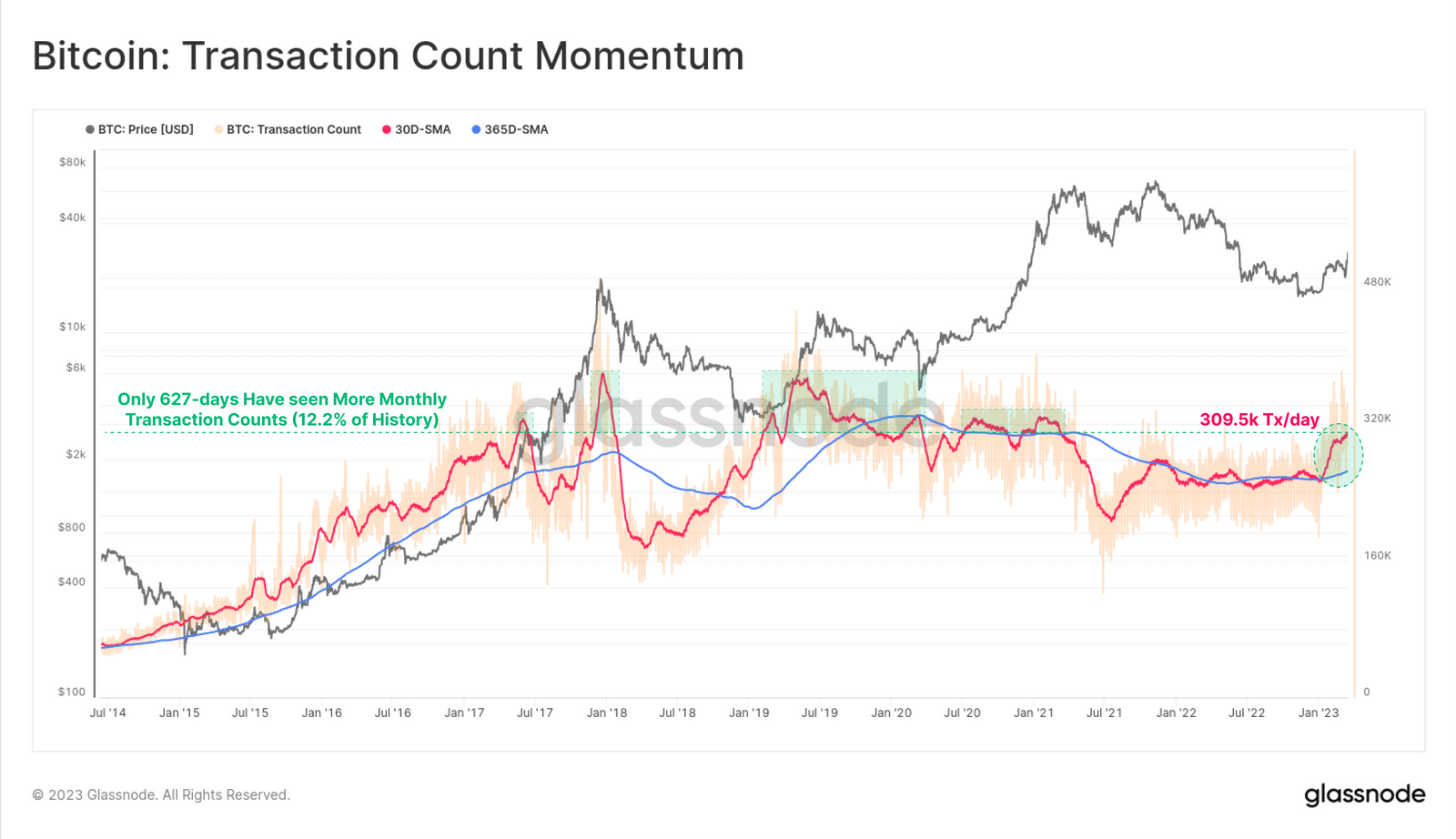

According to an on-chain analytics firm, Bitcoin’s monthly average number of transactions reached 309.5k per day. This is the highest level since April 2021. glass nodeDespite High Price Performance, ‘Hot Coin’ Shares Still Close to Cycle Lows — It shows that most owners of old coins have no incentive to make a profit.

But with Bitcoin’s price now seemingly shifting into the $30,000-$32,000 range, does the recent rally mean we’re out of bear market territory?

Glassnode data looks bullish

During the week of March 20, the monthly average number of transactions reached 309.5k per day. This is the highest level since April 2021 and well above the annual average. Bitcoin transaction activity increased by less than 12.2% for the entire day. This metric is usually a positive sign as it is associated with increased adoption, network effects, and investor activity.

Glass Node approximates the number of distinct new entities operating on the blockchain as the best measure of unique new users. According to their analysis, this metric hit 122,000 new entities per day, but the days of high new user adoption occurred between the 2017 peak and the 2020-21 bull market. was only 10.2%.

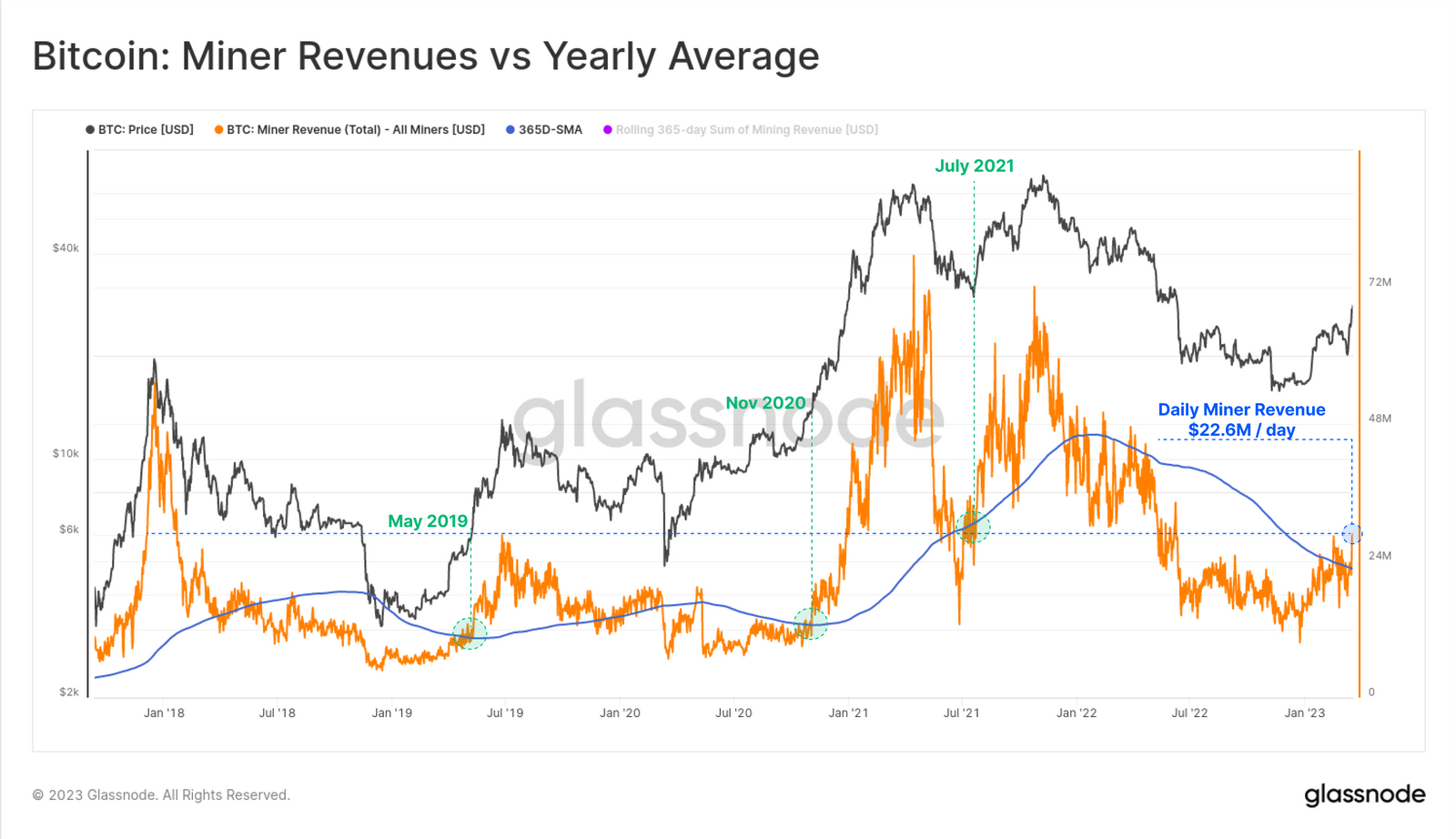

Bitcoin miners are also pouring in

Miners are one of the main beneficiaries of this influx, generating up to $22.6 million in total revenue per day. In the week of March 20th, the miner’s earnings reached his highest level since June 2022 and is certainly above the annual average.

Similar to the activity model described earlier, this trend is often seen at transition points to more favorable markets.

green mining revenue

Miners are definitely one of the lifebloods of the crypto ecosystem. However, increased mining activity also leads to network congestion and gas costs. This is a classic precursor to a more constructive market.

High network fees can make small transactions more costly, but it benefits miners who receive those fees to secure the blockchain.

Miner earnings are back at $22.6 million/day, the highest since June 2022, according to on-chain data, which points to Bitcoin returning to bullish territory, Glassnode says. says. Despite the strong price performance, the proportion of “hot coins” is still close to cycle lows, indicating that most old coin owners are unwilling to make a profit.

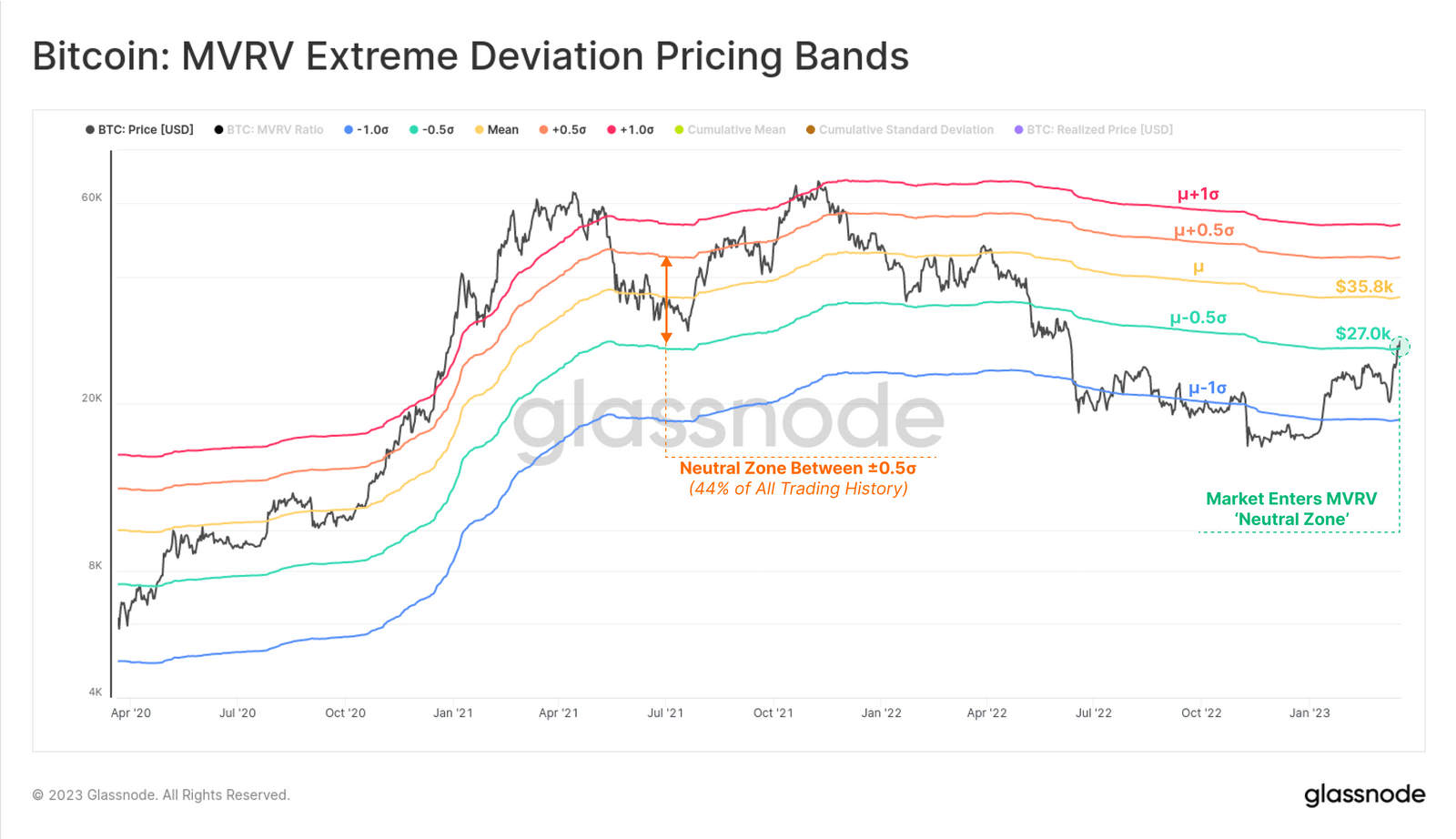

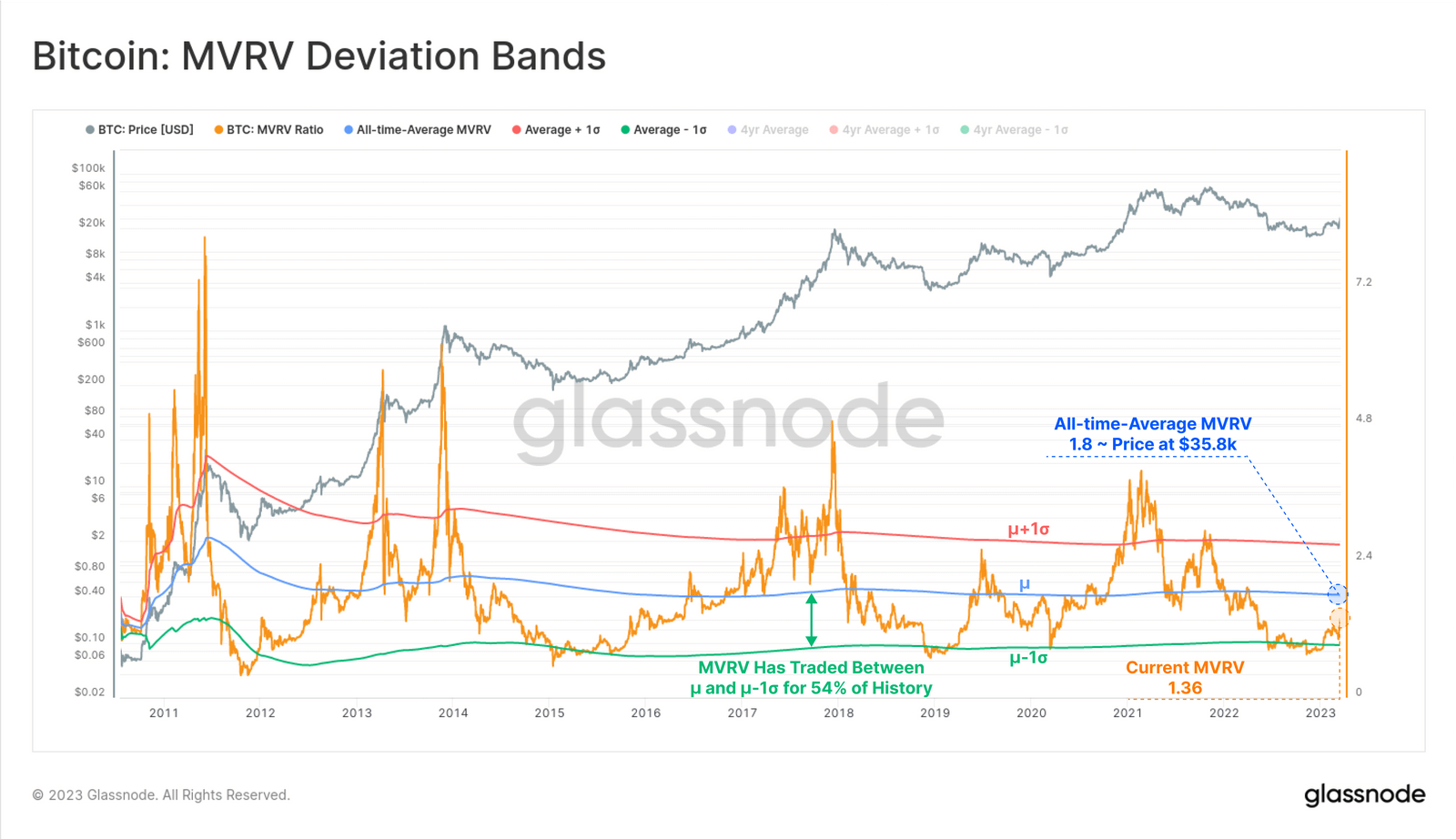

Glassnode’s report also analyzed Bitcoin’s MVRV (market value to realized value) ratio. This measures the unrealized profit multiple within the coin supply. After surpassing $27,000 this week, the ratio climbed to 1.36, returning to the “neutral zone.” This suggests that prices are no longer heavily discounted compared to the average on-chain market cost base.

Finally, a glass node Conclusion The future of Bitcoin is bright

“Bitcoin investors experienced one of the highest weekly gains ever on the back of stress, consolidation and liquidity injections across the global banking system. It suggests that the coin market is emerging from the conditions historically associated with severe bear markets and returning to greener pastures.”