Growing Bitcoin transactions highlight Lightning Network’s importance

The industry has always recognized that there will come a time when increasing fees will make bitcoin trading highly impractical.

Many assumed that mass adoption would increase the cost of transactions, but it was the rise of Ordinals that caused a significant increase in fees.

Bitcoin imprinting on the blockchain appeared earlier this year and quickly gained popularity. As of May 1, Bitcoin has over 3.2 million inscriptions, and that number continues to grow as the quarter progresses.

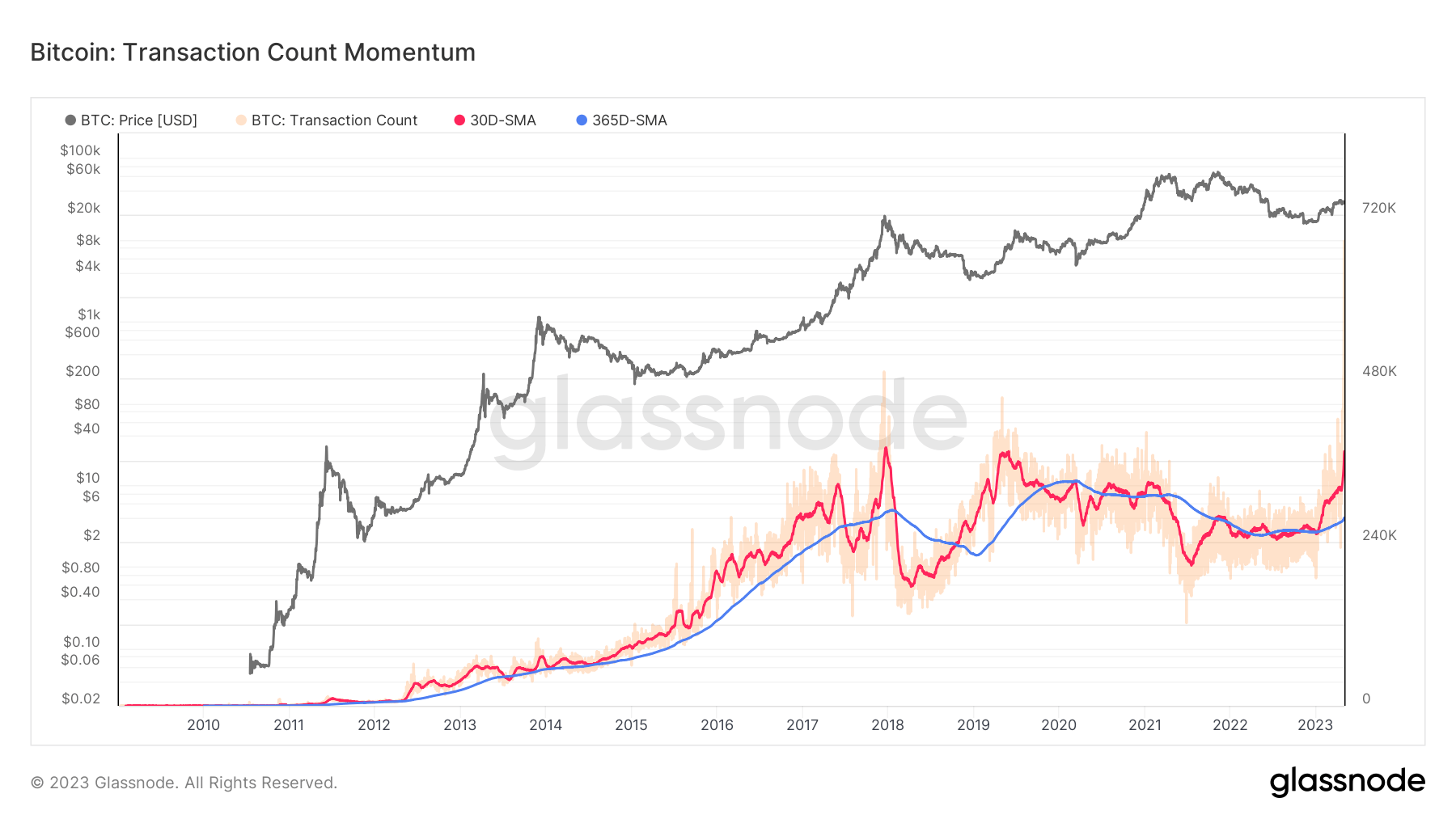

Ordinal Inscriptions pushed Bitcoin transactions to all-time high in 2023, with the network confirming over 682,000 transactions in a single day.

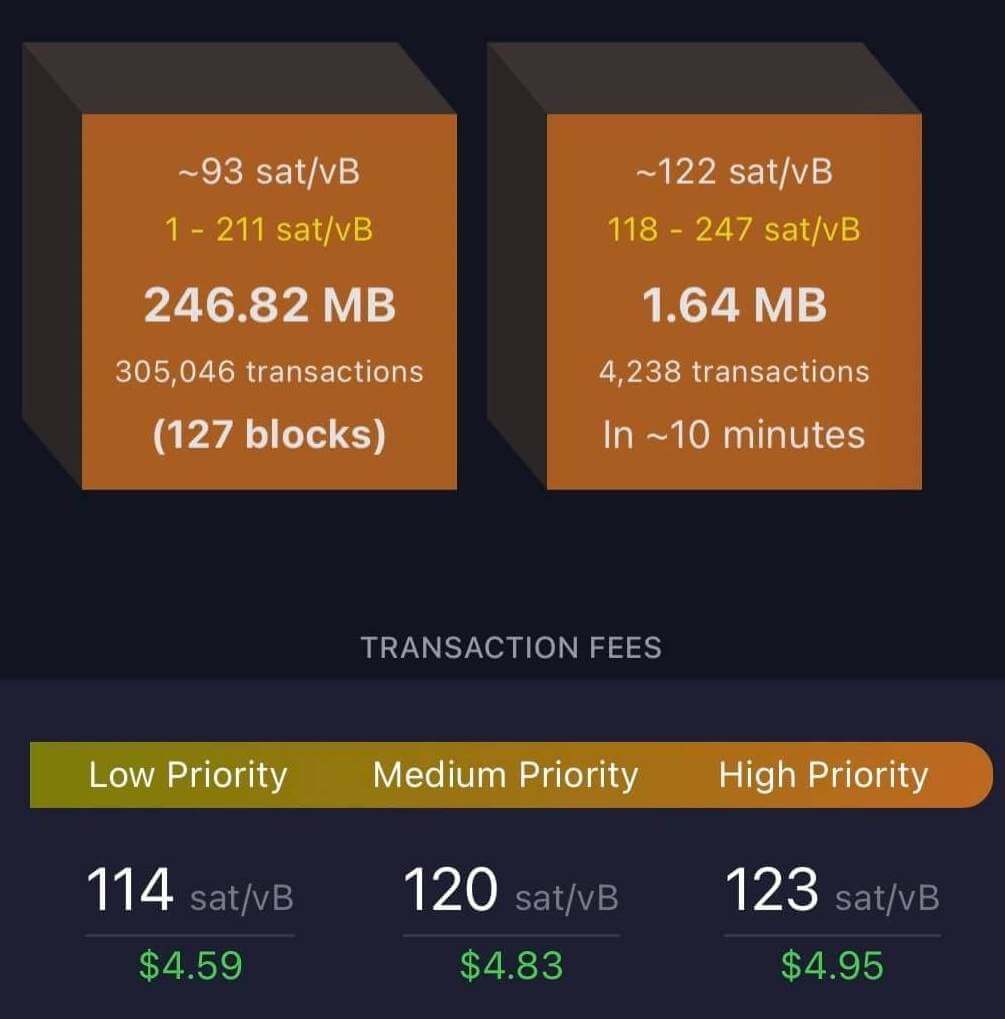

Such bursts of transactions naturally increase memory usage, filling some blocks with tens of thousands of transactions. According to Mempool data, the average fee for low-priority transactions he reached $4.59 on May 2, and the gap with high-priority transactions decreased to less than $0.40.

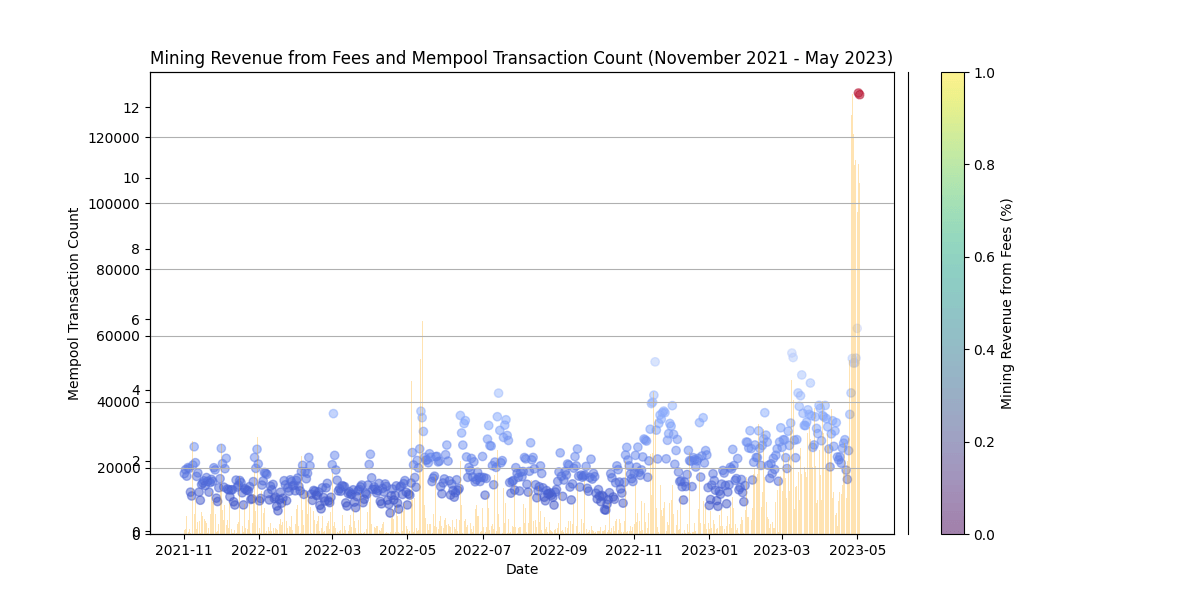

The growing popularity of Ordinal and the rising fees it has caused has reignited the debate about Bitcoin’s declining block rewards. As more miners enter the space, the cost of mining Bitcoin will rise, so there will come a time when the rewards will not be sufficient to encourage block production.

One proposed solution to this problem is an increase in miner fees. This allows miners to remain incentivized even if block rewards cannot cover the cost of mining. However, a significant increase in activity on the Bitcoin network would be required to realize the fee increase.

So far, Inscription has significantly increased the percentage of miner revenue that comes from fees. According to data analyzed by CryptoSlate, approximately 12% of miner revenue is now from fees, a level previously seen only in bull markets.

The Bitcoin inscription has drawn criticism from all corners of the crypto market. However, both parties seem to agree that they stress the need for a fast payment solution for BTC, namely the Lightning Network.

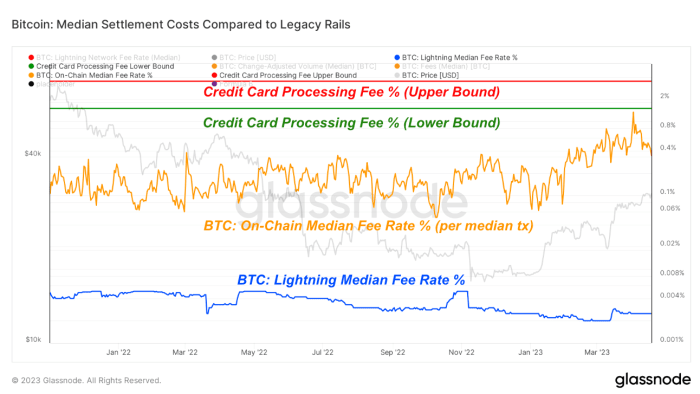

The payment protocol enables high-speed transactions between participant nodes while keeping fees incredibly low. According to Bitcoin Magazine’s analysis, the median fee for Bitcoin Lightning transactions was around 0.003%. This is significantly lower than the average US credit card processing fee floor of about 1%.

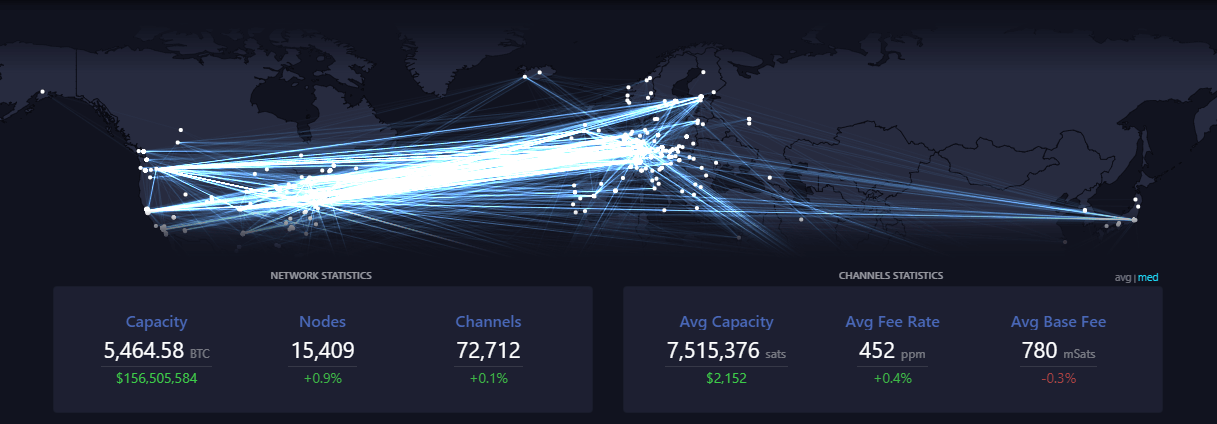

Ordinal’s popularity will certainly decline over time, but the network will see another project consuming even more block space.with capacity With 5,400 BTC, 15,400 nodes, and over 72,700 channels, the Lightning Network has established itself as the perfect solution for Bitcoin payments.

The importance of the Lightning Network highlighted by growing Bitcoin transactions first appeared on CryptoSlate.