Here’s why miner capitulation is actually good news for Bitcoin

Bitcoin’s highly volatile price has devastated much of the cryptocurrency market and is currently dragging down miners. Often considered the foundation of the Bitcoin network and its most resilient player, miners are suffering from rapidly declining profit margins.

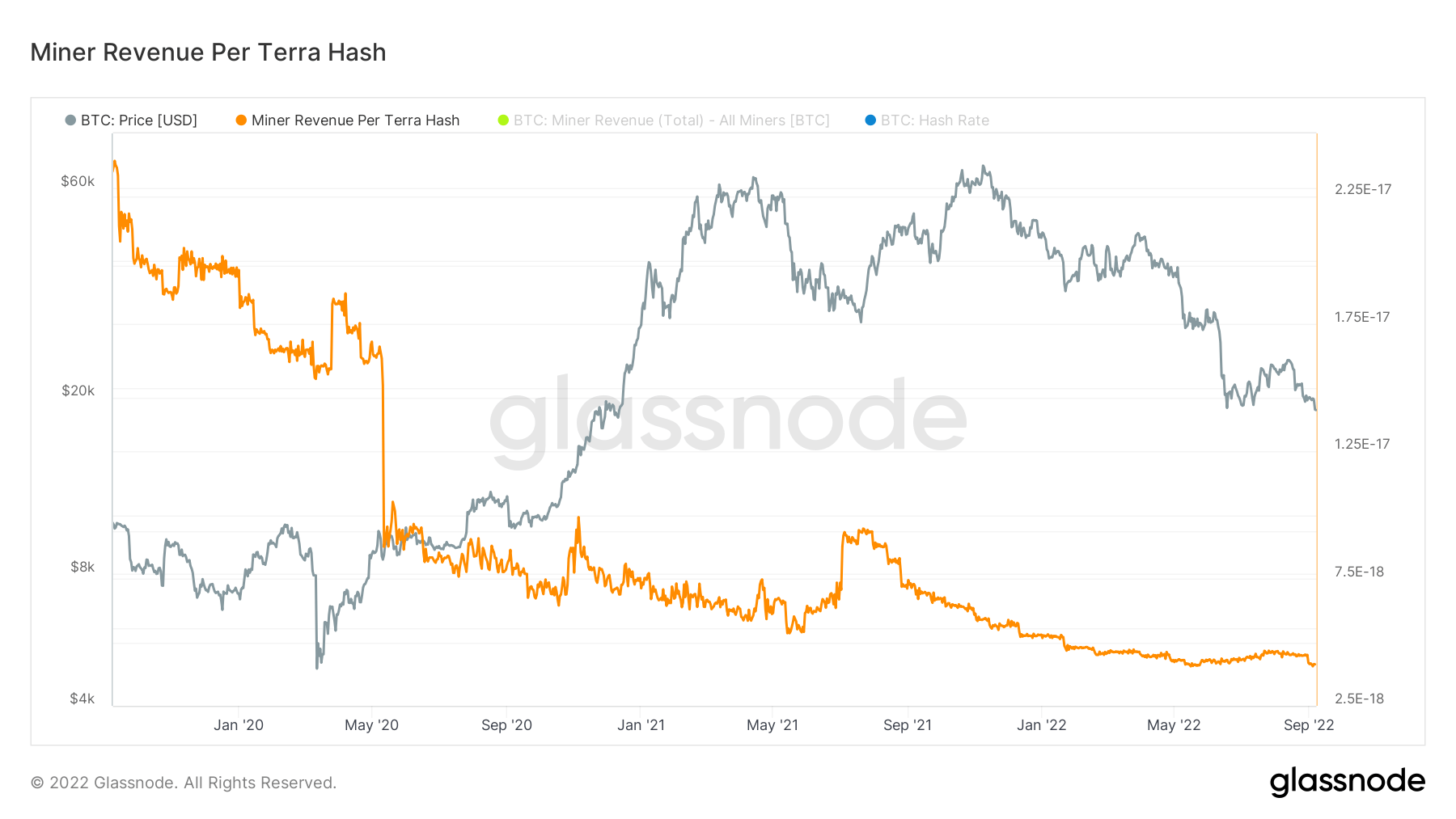

Bitcoin mining difficulty is currently just 1% below its all-time high, keeping most miners out of the network. He is nearing one of the lowest mining profitability points as mining revenue per terrahash dipped below his $5,000 in early September.

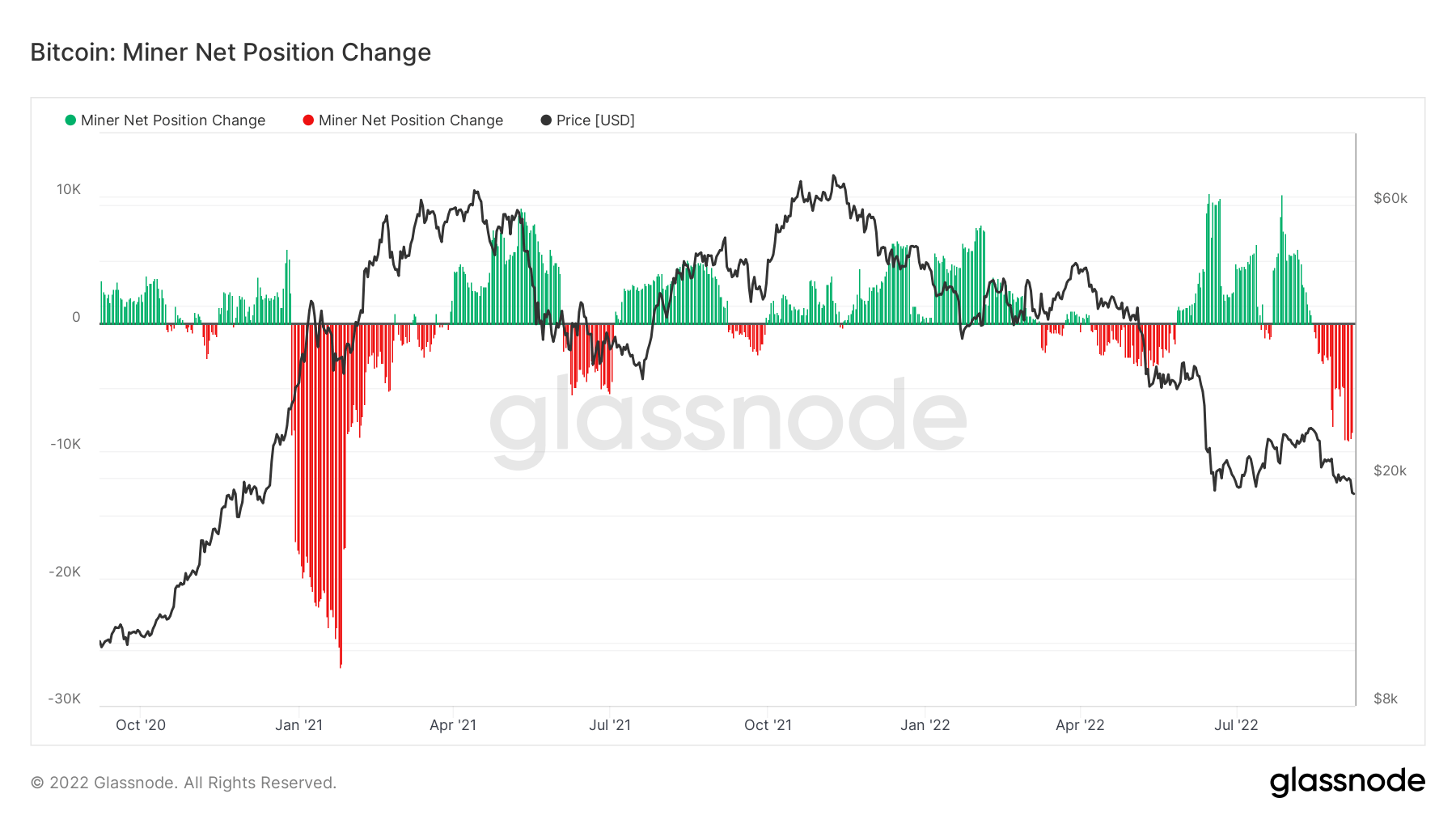

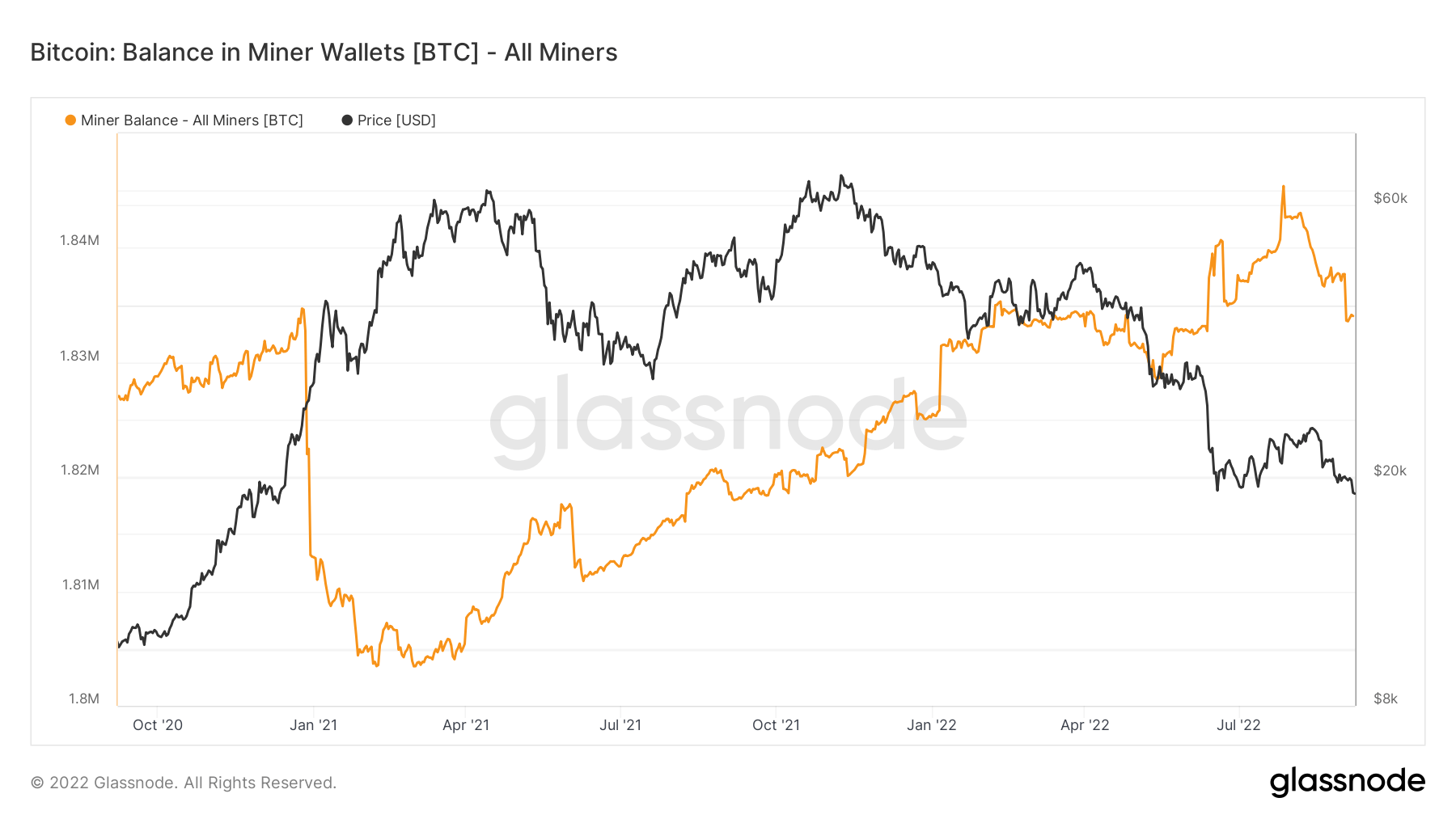

Faced with increasing mining difficulty and declining profitability, miners have been forced to sell their bitcoin holdings in bulk. Miners have sold over 12,000 BTC since July, when the total supply of Bitcoin held at miner addresses peaked at 1.84 million BTC.

data from glass node It shows that a similar capitulation occurred in November 2021 when Bitcoin hit an all-time high.At the time, miners had sold around 30,000 BTC. If miners follow a similar pattern throughout the fall, we could see even bigger selling in the coming weeks.

Hashribbons show the worst surrender is over, but shrinking miner balances paint a different picture.

However, the massive sell-off seen in the last two months may actually be good for Bitcoin in the long run. Fluctuations in mining profitability, albeit brutally, cleanse the network of unprofitable operations and weaker miners that cannot withstand volatility. When the market stabilizes, the Bitcoin network sits on the shoulders of the most resilient and most profitable miners, strengthening it for future cycles and volatility.