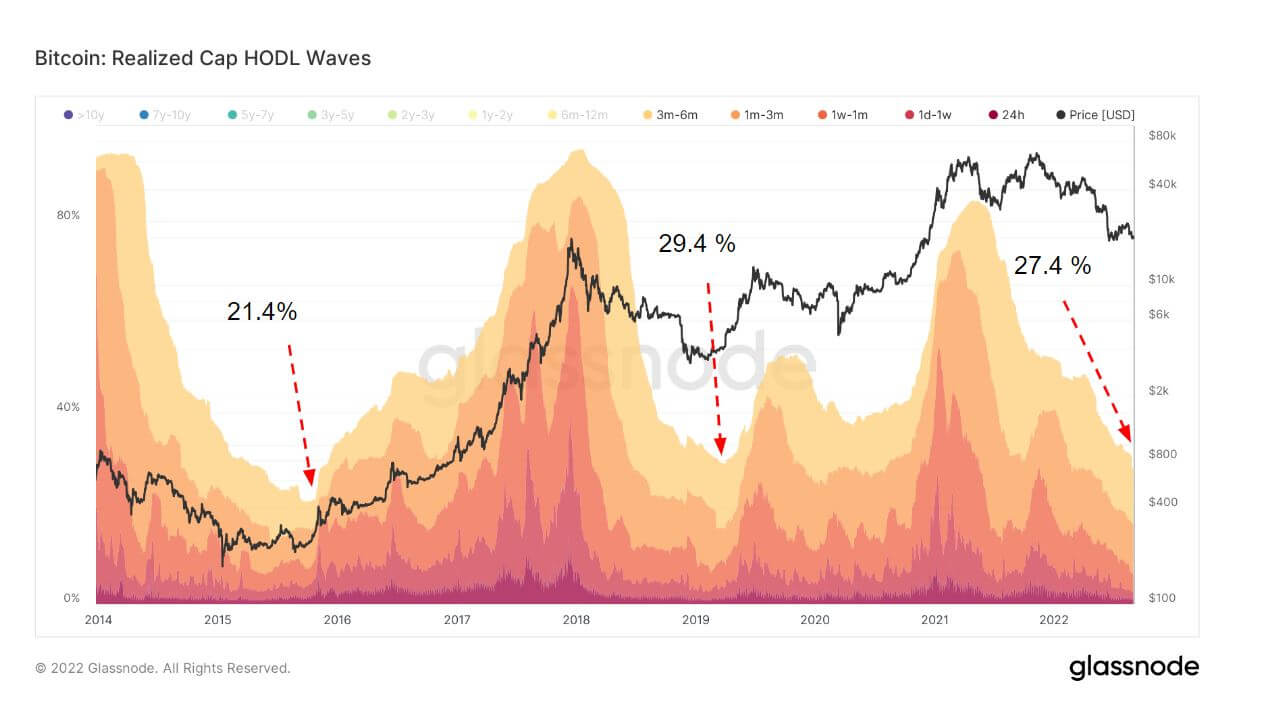

HODL waves show short-term holders at level lower than 2019 bear market bottom

HODL Waves is an index that summarizes all active supply addresses by age group. Each colored band shows the percentage of Bitcoin in existence that was last moved within the time period indicated in the legend.

CryptoSlate’s review of the current state of the HODL Waves chart shows that short-term holders are at lower levels than the bottom of the 2016-2020 halving.

Short-term holders are defined as the cohort holding bitcoin for less than 155 days. Short-term holders typically buy during bull markets and distribute when prices begin to fall due to increased price sensitivity.

The Realization Cap HODL Waves chart above shows that short-term holders hold a large amount of coins and have historically contributed to bear market bottoms. In 2015 he accounted for 21.4% of short-term holders, and in 2019 he exceeded 29%. Today it is 27.4%, marking a traditionally significant moment in the halving.

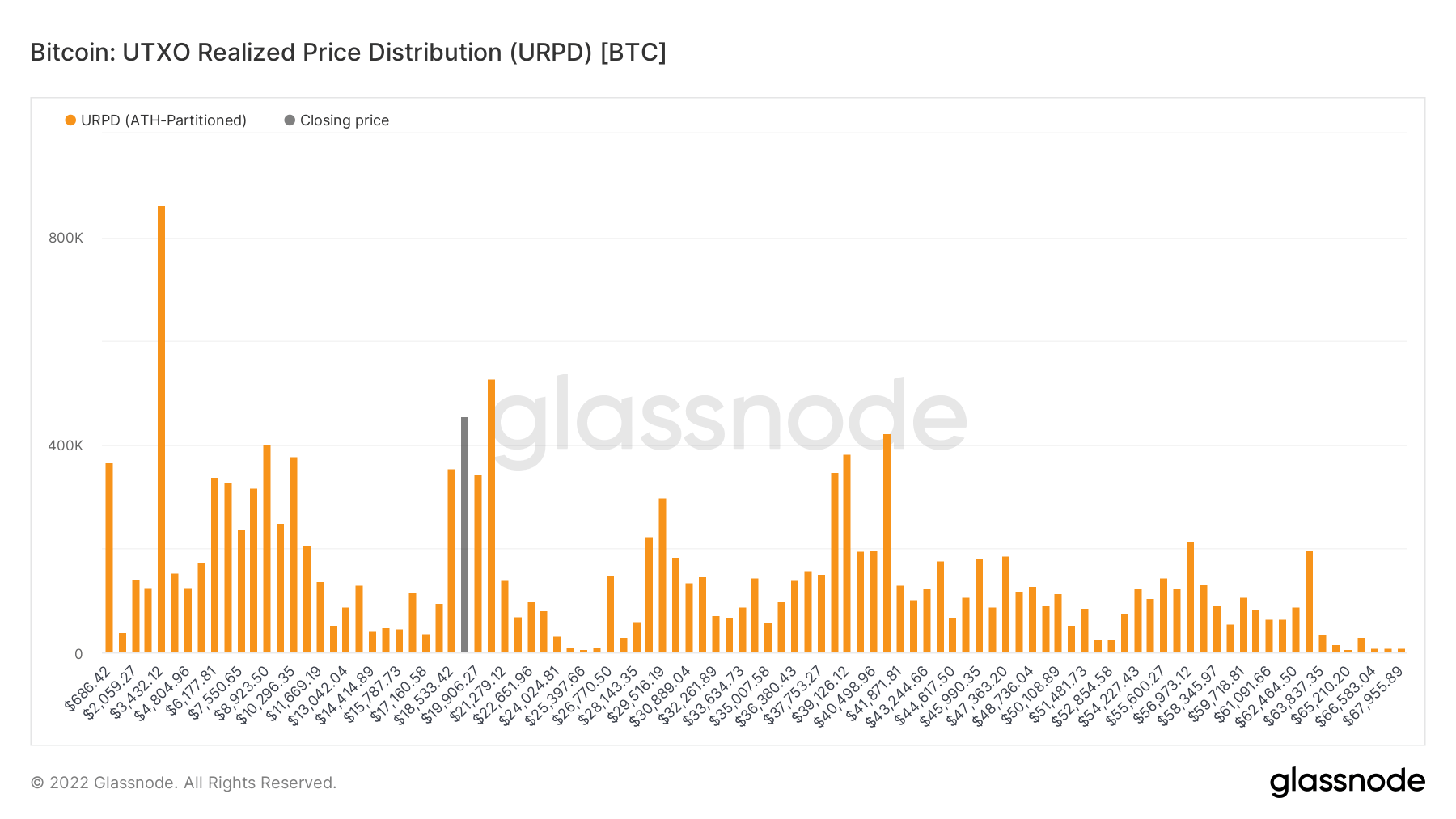

Short-term holders bought when BTC fell below the $20,000 sentiment support. The Unrealized Price Distribution (URPD) metric supports this paper because of the large amount of concentrated coin purchases around $17.5 million to $22,000. However, the overwhelming majority of holders are underlying long-term holders.

A key factor to remember is that Bitcoin has not had to navigate a global recession or quantitative tightening.Since 2009, Bitcoin has ridden a wave of rising asset prices in countless markets. I have benefited from. While short-term holders dip to levels typical of market bottoms, on-chain indicators will have to contend with other macro factors amid inflation spikes and continued money printing.

One possible positive indicator, however, is the fact that the US M1 money supply has finally declined after hitting a high of $20.69 trillion. The latest figures for August are due for him to be released in late September, but the latest figures for July show the money supply plummeting to his $20.51 trillion.

Strong on-chain data can be seen as a signal that Bitcoin is poised to head back towards a bull market when the global macro environment allows it.