How social media killed Silicon Valley Bank

Below is a guest post by web3 strategist Toby Fan. Blockchain Founders Fund Managing Partner Aly Madhavji said:

Social media has forever changed the way we view and respond to the financial crisis. Banks need a better way to deal with what is now called ‘social media risk’. Phone viral games at exponential scale leave little time for nuanced research and thoughtful reactions. Incorporating social media into their overall risk framework helps banks shape narratives and public perceptions through proactive and transparent customer engagement. Aggregation and monitoring tools are becoming increasingly important to watch for early signs of trouble and navigate the landscape of rapid information uptake and uncontained spread.

The recent failures of some of the largest crypto-related banks ($SIVB, $SI, $SBNY) have caused anxiety in the technology, cryptocurrency and banking sectors. While many start-ups were wondering if they could meet their payroll obligations, a local bank felt the whiff of a bank run for the first time since the subprime mortgage crisis.

$SIVB’s crowdsourced interpretation of information on financial health gave depositors a crash course (no pun intended) in game theory 101 — turning many startups and tech companies into textbook Put yourself in the prisoner’s shoes of the payoff matrix: withdraw your deposit now, or hold the risk or bag.

how everything went wrong

On March 8, Moody’s downgraded $SIVB’s bank deposits and issuer ratings.On the same day, $SIVB announced a proposed sale of $2.25 billion in equity and a balance sheet restructuring showed a realized loss of $1.8 billion from the sale of fixed income assets. Recent Fed rate hikes.

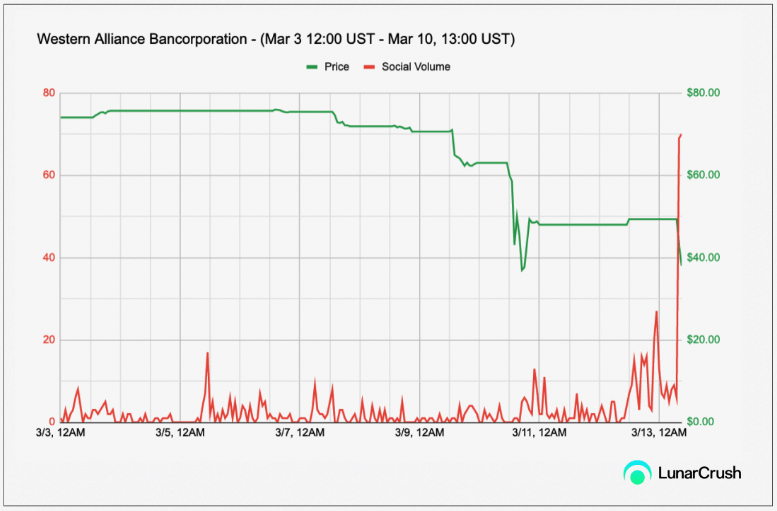

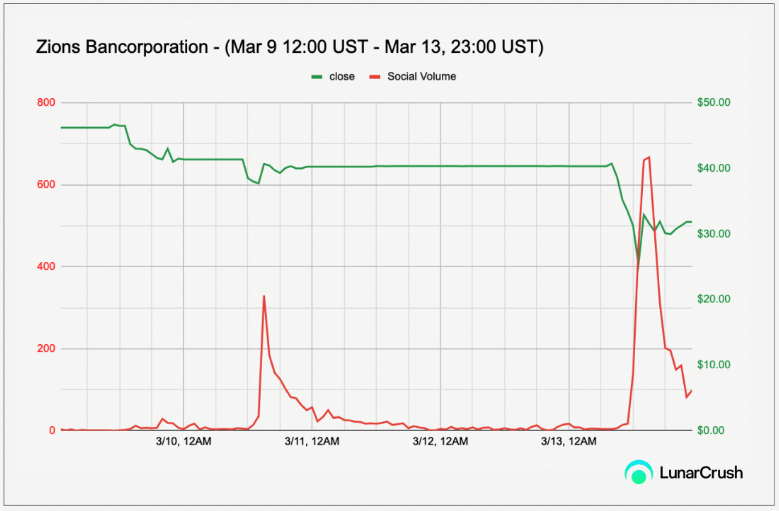

As with many previous bank runs, depositors—many of them VC-funded and cryptocurrency companies—wasted no time playing the chicken game. Within a day or two, $SIVB’s balance sheet dried up and the stock plummeted. By March 10, regulators had closed $SIVB and controlled deposits. Many regional banks followed suit, with market capitalization ($FRC, $WAL, $CMA, $ZION) falling sharply before recovering on news of the FDIC’s deposit insurance backstop. There have been similar instances of bank runs in financial history, but what made this one so exceptional was the speed with which it happened and the medium through which the contagion spread.

The financial contagion spread rapidly on social media. Social media platforms like Twitter dominate the cryptocurrency and startup space. The speed at which information (and different interpretations) spreads is orders of magnitude faster than traditional news and linear media. Even regulators have acknowledged the impact of social media on the recent crisis.Confirmed by House Financial Services Committee Chairman Patrick Henry “This was the first bank run on Twitter.”.

You may remember Washington Mutual, which experienced similar deposit outflows during the 2007-2008 financial crisis. Similar to $SIVB, WaMu started posting heavy losses due to mortgage defaults, even though he had more than $188 billion in deposits. When Lehman Brothers collapsed on September 15, 2008, WaMu’s depositors began to withdraw en masse. Withdraw $16.7 billion (approximately 11% of total deposits) from checking and savings accounts in 10 daysThe speed of the outflow of funds was unprecedented at the time and ultimately led to WaMu’s bankruptcy. Compare this with $SIVB. 1 dayequivalent to 25% of total deposits.

This time, not only was the unprecedented rate of information coming in, but the proximity of social distancing (between Twitter followers, friends, and subreddits) helped the news spread like wildfire. In formerly traditional media, news spread from centralized parties to the masses (one-to-many transactions) — social media is a many-to-many transaction, and the social distance between sources is far greater. Close to rent these assets. A level of social proof that was not always present in traditional media. And once the information reaches a critical mass, it becomes true because the inertia of diffusion makes the story omnipresent. As they say, a person’s perception is their reality.

The power of viral stories

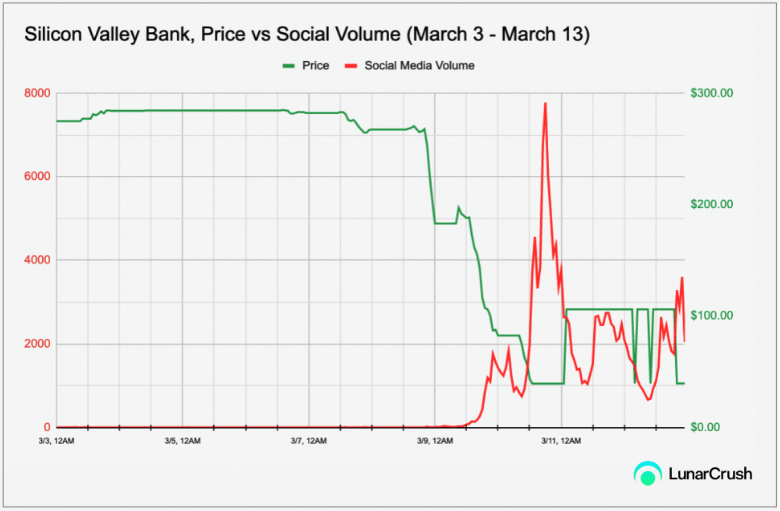

By monitoring aggregate social media data, we can see examples of this rapid spread, and even early signs of it. Take Silicon Valley Bank, for example.

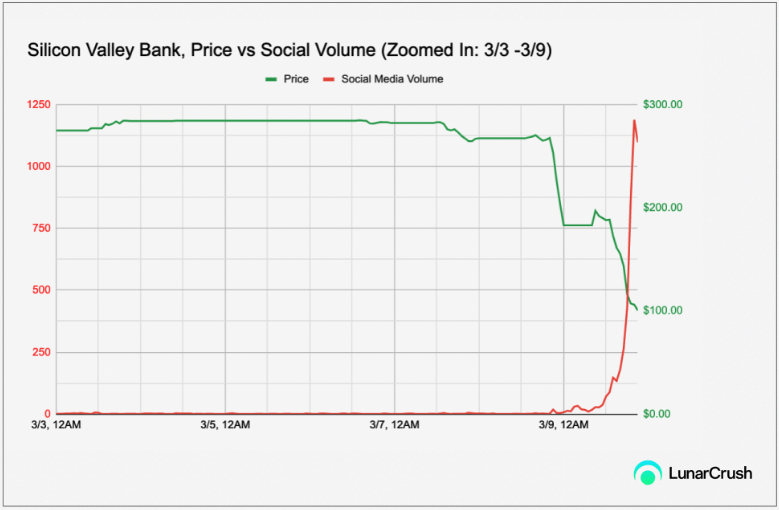

Red is social media volume (individual tweets/posts/news articles from Twitter, Reddit, and 1000+ news sources) and green is $SIVB stock price. We can see that the amount of social media has skyrocketed after the fact. But as we scale further, we begin to see chat growth (indicating a strong rate of social media reach) before the parabolic surge in social media volume.

If we zoom in further on the number of days leading up to a significant $SIVB drop, we can see industry insiders and analysts whispering before the big relative spike just before the stock starts to fall. With a little extra research around the time social media activity began to pick up, analysts could have gleaned the following hidden gems by Matt Harney.

lower funding

+

Businesses with negative cash flow (average)

=

Liquidity outflow:

🆘Silicon Valley Bank Startup Banking Total Client Funds in 2022 Negative $57 Billion

Source = Latest MS “Venture Vision” pic.twitter.com/ZMD7miBuyE

— Matt Harney (@SaaSletter) March 7, 2023

Alternatively, this may have come from Rusil Sarka, who issued an early warning to all parties involved with the bank.

If there is an abnormal outflow of deposits, banks will have to sell assets to meet withdrawals when bonds need to be marked to market.

The same thing happened to Silicon Valley Bank in 2021 when interest rates were low.took $91 billion of that money and invested it in mortgages— Lucille (@rusilsarkar) March 6, 2023

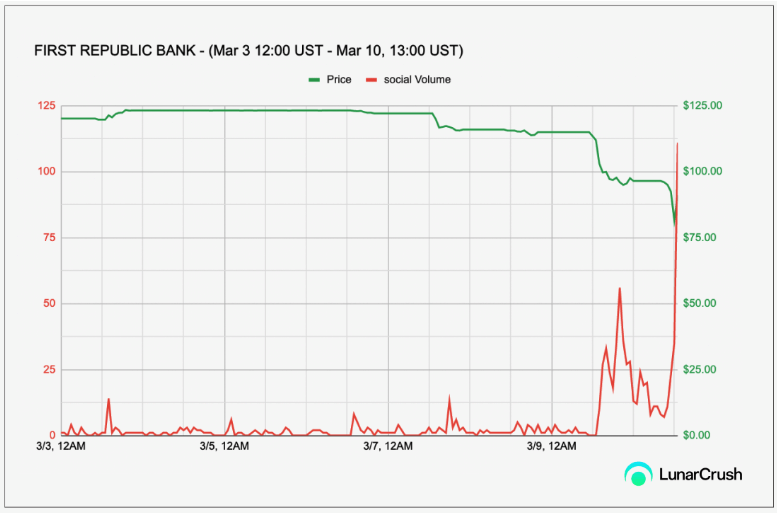

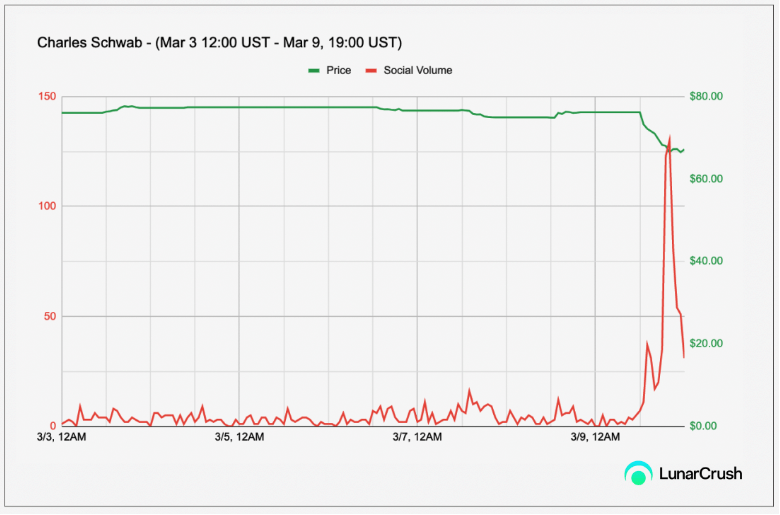

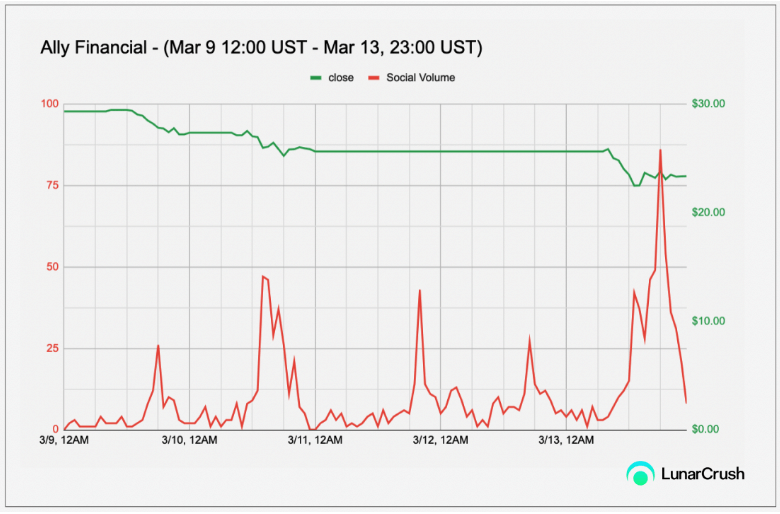

A similar pattern can be seen in the $SIVB-affected regional bank stocks. That means banks like First Republic, Western Alliance, Comerica, Zions and PacWest experienced drawdowns of up to 65% in a single day. These sharp drops were preceded by a parabolic rise or sudden rise in social volume, demonstrating the speed and conviction of social media contagion.

Social media is a real financial risk

Monitoring social chatter for anomalous or anomalous increases can help catch early hints of quiet (but quickly becoming less quiet) developments. These large deviations in social activity often result in self-sufficient alpha information. Getting the public’s attention and spurring action in a short period of time often generates game theory dynamics in which those who act first gain the most (or lose the least), and then behavior and participation become more attractive. Party.

“Social media is accelerating the spread of financial information, thereby increasing the potential for market contagion. Banks should recognize ‘social media risk’ as part of their overall risk framework and need to manage. Tools like LunarCrush’s Moonrise help monitor and track early warning signs, allowing financial institutions to shape the narrative and engage customers more effectively. ”

One thing is clear that the dust has settled in the banking sector’s rough week. Banks need to meet customers where they are and quickly manage stories and crises in their preferred medium. A good communication strategy may have helped stem the impact, but the key was to capture these stories first and early in development. Maintaining a high social media presence will help industry participants more quickly prepare to respond to and manage these crises in the future.

The data here is Luna Crash APIis a social media monitoring engine that provides access to accurate, high-latency data on 4000+ crypto assets, 300+ NFT collections, and 700 stocks.

author:

Toby Fan, Web3 Strategist twitter | | LinkedIn:

Toby Fan, Web3 Strategist twitter | | LinkedIn:

Toby Fan is the Head Web3 Strategist at LunarCrush, aggregating real-time social media data for cryptocurrencies, NFTs, and traditional equities. He graduated from his UC Santa Cruz, where he majored in econometrics and information systems, and led research in the department on the dynamics of commodity markets in China and the United States. Toby is also an active CoinMonks contributor (https://medium.com/@tobyornottoby) and is a member of the BlockBros DAO. Aly Madhavji, Managing Partner of Blockchain Founders Fund, Loyal VC and LP of Draper Goren Holm twitter | | LinkedIn

Aly Madhavji, Managing Partner of Blockchain Founders Fund, Loyal VC and LP of Draper Goren Holm twitter | | LinkedIn

Aly Madhavji Blockchain Founders Fund, invest and venture build top-notch startups. He is an exclusive partner of his Loyal VC and Draper Goren Holm. Aly consults emerging technology organizations such as INSEAD and the United Nations for solutions to alleviate poverty. He is a Senior Blockchain Fellow at his INSEAD and has been recognized as a “Blockchain 100” Global Leader by Lattice80.

Disclosure: Blockchain Founders Fund is an early stage investor in LunarCrush. The information contained herein is not intended to be construed as financial advice.