Illegal on-chain cryptocurrency activities reach all-time highs of $20.1B

According to a recent report, the volume of illicit on-chain transactions in cryptocurrencies reached a record high of $20.1 billion, increasing for the second year in a row. report by Chainalysis.

The report states:

It should be emphasized that this is a lower bound estimate. Illegal volume measurements will steadily increase over time as we identify new addresses associated with illegal activity.

This figure does not include non-cryptocurrency criminal proceeds, such as traditional drug trafficking with cryptocurrency payments.

44% of the $20.1 billion comes from activities related to sanctioned entities. Last year, the US licensed cryptocurrency mixing services Blender and Tornado Cash, claiming they were used to launder billions of dollars out of North Korea.

Additionally, the U.S. Office of Foreign Assets Control (OFAC) has implemented some of the toughest crypto sanctions in 2022. OFAC sanctions are estimated to have cost him $15 million in potential revenue over the past two months.

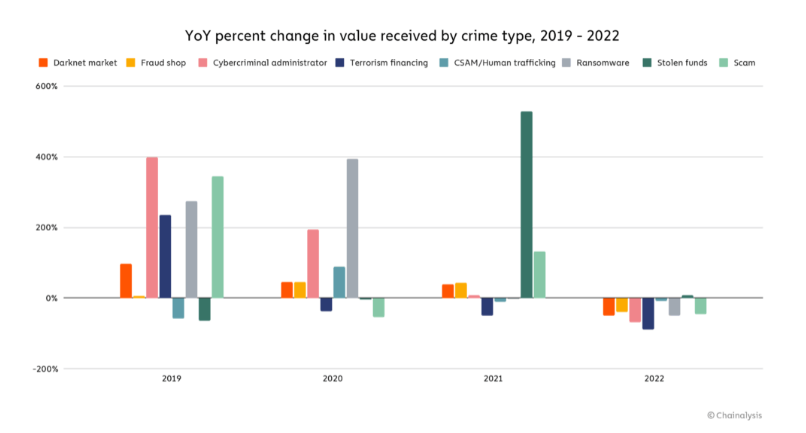

Decrease in traditional crypto-related crime

On the positive side, transaction volumes related to more traditional cryptocurrency-related crimes such as darknet marketing and terrorism financing declined. In contrast, the percentage of stolen crypto assets increased by 7% year-over-year.

According to Chainalysis, the market slump in 2022 could explain the slump since the crypto market fell. $3 trillion to $1 trillion last year.Before research Cryptocurrency scams show that bear markets are less profitable. The report states:

In general, lower amounts in overall cryptocurrency tend to correlate with lower amounts associated with cryptocurrency crime.

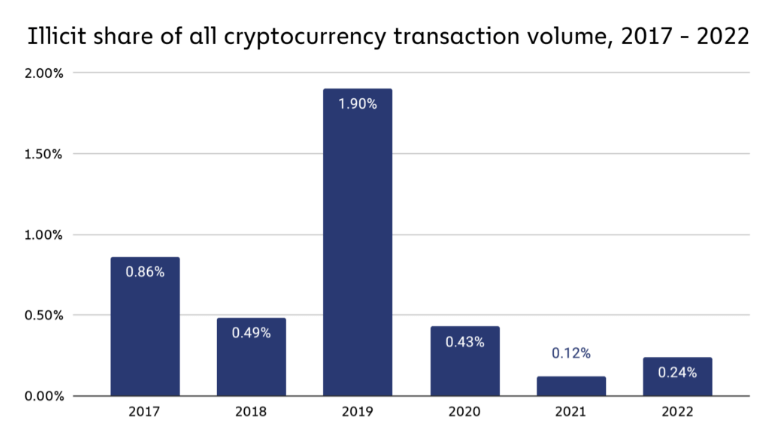

It is worth noting that illicit cryptographic activity increased for the first time since 2019, from 0.12% in 2021 to 0.24% in 2022.

Additionally, cryptocurrency illegal activity is less than 1% of the total. Crypto-related crime increased in 2022, but Chainalysis claimed the trend continued to trend downward.