Implied volatility shows only sideways movements for Bitcoin

The crypto derivatives market has grown so much over the past few years that it can be used as an indicator of future price movements. Bitcoin options have captivated the cryptocurrency industry and rapidly become a mature product, a move that has the power to shake the rest of the market.

Similar to traditional financial markets, Bitcoin Options give holders the right, but no obligation, to buy BTC at a preset price on the contract’s maturity date. Options are usually priced using an indicator called implied volatility (IV). It shows the market’s view of the likelihood that the price of a particular security will change.

Implied volatility (IV) is often used by investors to estimate the future volatility of security prices. However, while IV can predict price movements, it cannot predict price direction. High implied volatility means that there is a high probability of large price movements, and low IV means that the price of the underlying asset is likely to remain almost unchanged.

As such, IV is considered a good indicator of market risk.

Bitcoin’s implied volatility shows that the market sees little risk in Bitcoin.

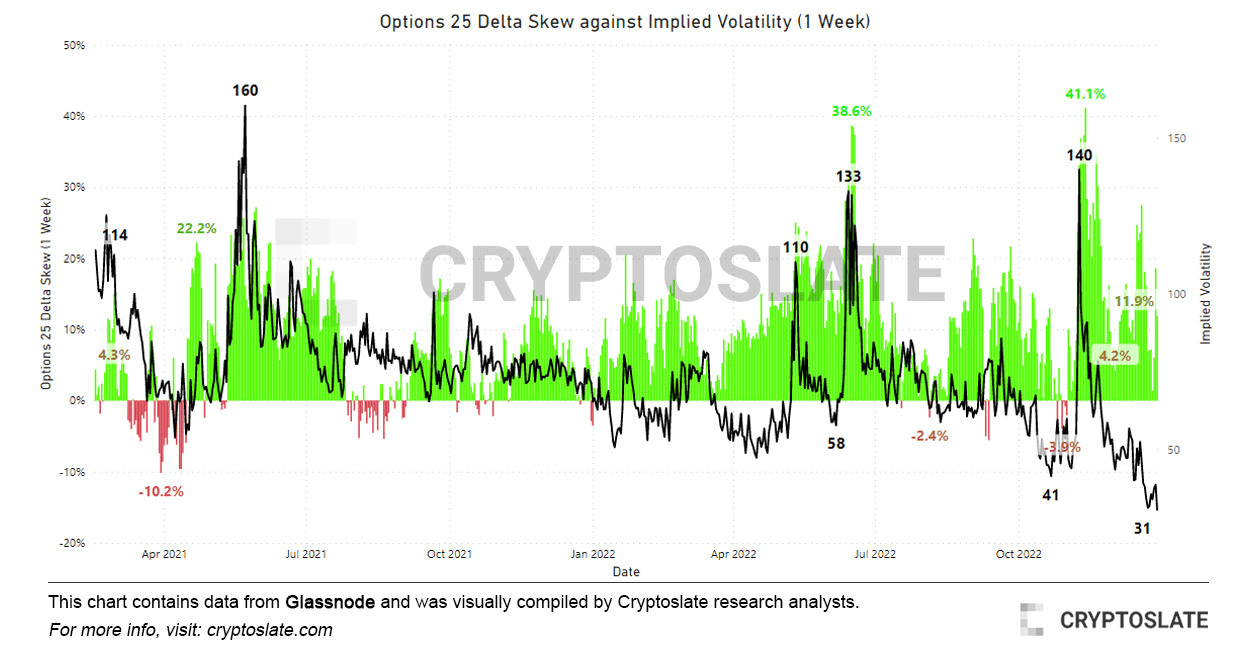

Bitcoin’s implied volatility is currently at its lowest level in two years. Sharp drops in IV have historically followed aggressive spikes caused by black swan events. Spikes were seen in the 2021 Defi Summer, the June 2022 Terra collapse, and the November 2022 FTX drop.

However, the decline in implied volatility seen at the end of 2022 suggests that the derivatives market will not see significant price movements in the near future.

Comparing Bitcoin’s implied volatility to Option 25 delta skew further confirms this.

When applied to option contracts, skew measures the implied volatility between different strike prices with the same maturity. Simply put, it shows the ratio of put options to call options. Delta is a measure of the change in an option’s price due to changes in the underlying security.

The 25 delta skew looks at a put with a delta of -25% and a call with a delta of 25% and nets off to reach the data point. A 25 delta put skew of -25% means that the cost of the put option is 25% below the underlying spot price and vice versa.

This indicator basically measures how sensitive the option price is to changes in the Bitcoin spot price. Data analyzed by CryptoSlate shows that put option premiums have fallen from the extreme levels recorded in his November and his June. 25 Spikes in delta skew are usually correlated with extreme increases in price volatility, making them a sure indicator of a bear market.

25 Delta skew dropped sharply in December and increased slightly in the first few days of 2023. This, along with lower implied volatility, points to a calmer market in the coming days and weeks.