Industry veterans on CoinList opine on what’s in store for 2023

Ah Recent research We have tapped the crypto-native community to determine what lies ahead for the industry this year. Identifying quality cryptocurrency and blockchain applications requires both guts and foresight. As such, early crypto adopters could be a good indicator of what will happen in 2023.

More than 1,000 people participated in the survey and shared their concerns and excitement about this year.

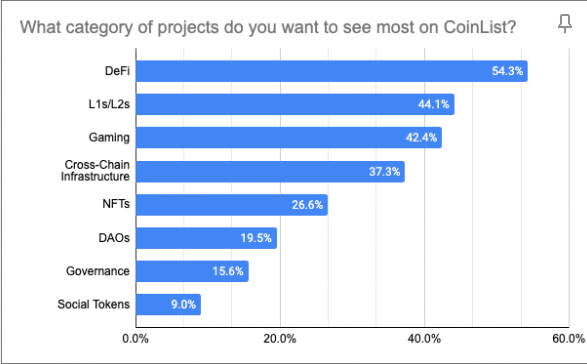

Over half of respondents identified DeFi as the project category they most wanted to see on CoinList. Layer 1 and Layer 2 blockchains are the second most in-demand category, followed by games. Cross-chain infrastructure ranked him fourth, with about 37% of respondents choosing it, while NFTs were requested by just over 26% of respondents.

The DAO, which surged in popularity last year, had less than 20% approval. coin listusers. At the same time, governance tokens, touted as one of the most innovative uses of cryptocurrencies, were claimed by just 15% of respondents.

Analyzed by CryptoSlate, these findings confirm the current market sentiment. Despite last year’s significant decline, the DeFi sector remains one of the key drivers of the cryptocurrency market and could recover in 2023.

In a related question, nearly half of respondents said they believe DeFi and gaming will be the two megatrends driving crypto adoption.

A deep dive into these sectors shows that experienced crypto users are eyeing the growing network.

When asked which blockchain they plan to interact with the most besides Ethereum, the highest-ranking choice was among the highest-ranking cryptocurrencies on the market.The blockchain chosen by CoinList respondents was Cosmos ( ATOM), Binance Smart Chain (BSC), L2 rollup and sidechains Arbitrum, Polygon and Optimism each received about 40% of the votes.

Last year’s growth champions, Solana and Avalanche, were the blockchains of choice for 17% and 13% of users respectively. Polkadot ranked slightly higher, chosen by her 29% of respondents.

Sui and Aptos were picked by more than a third of respondents, suggesting they could compete with incumbent chains for a slice of the market in 2023.

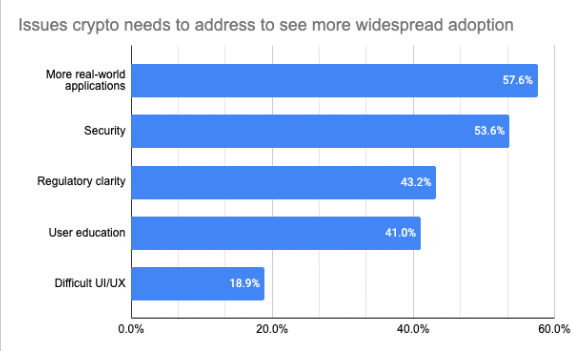

However, a more realistic application needs to be launched to capture a significant portion of the market. More than half of the survey respondents identified this as the main issue hindering adoption. Security was also a major concern for more than half of respondents, with regulatory clarity ranking third for him, with 43% identifying it as a pressing issue for the industry.

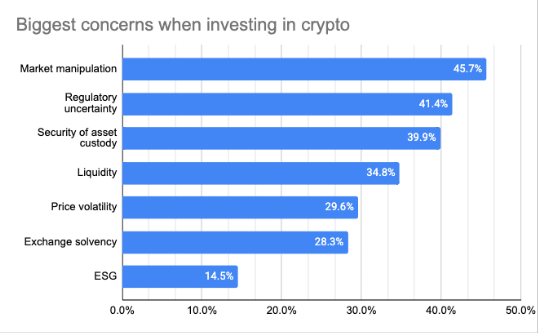

Regulatory uncertainty was a recurring motif in the survey, with over 41% of respondents saying it was their top concern when investing in cryptocurrencies. Market manipulation ranks slightly higher, with just over 45% of respondents identifying it as a pressing concern.

Given the number of debacles the industry has seen in the last year, it’s no surprise that fund security was the top concern for nearly 40% of respondents. Liquidity, or lack thereof, was a pressing concern for about a third of respondents, as was price volatility.

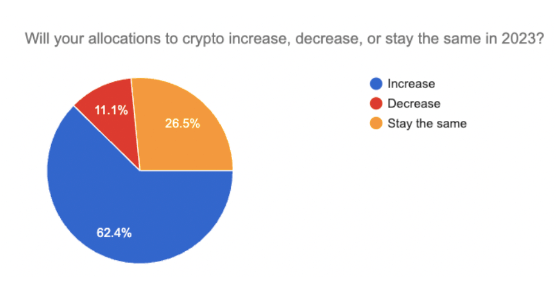

Nevertheless, over 62% of respondents said they plan to increase their allocation to cryptocurrencies. About a quarter of respondents said their asset allocation would remain unchanged, but only 11% said they would sell their holdings.

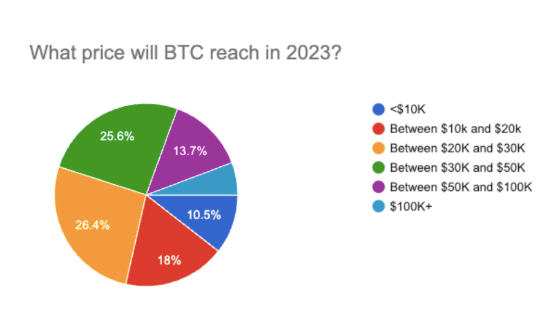

A plan to increase allocations to cryptocurrencies does not mean that respondents believe the market will return to its 2022 highs. We believe it will hover between $20,000 and $30,000. Just over a quarter think he will reach $30,000 to $50,000, and less than a fifth think he will be below $20,000.