Intel Bitcoin mining chips discontinued despite chip efficiency, $63M revenue boost in 2022

Intel announced the end of its first-generation Blockscale 1000 series bitcoin mining ASIC on April 18, but the chip contributed to both efficiency and revenue increases in 2022, up from 2021. .

Announced — first reported tom’s hardware — cited “more focus on IDM 2.0 operations” as the reason behind the decision to deprecate the chip.

However, the chip is part of the Accelerated Computing Systems and Graphics Group (AXG) revenue segment, which posted an increase of $63 million in 2022 compared to 2021.

Efficient but not cost effective

Intel Blockscale 1000 series chips have been deployed by at least one public Bitcoin (BTC) mining company by 2022 and have proven to be efficient and profitable.

December 2022, Canadian Bitcoin Mining Company Hive Blockchain mined A total of 213.8 BTC — worth $3.15 million — using Intel’s Bitcoin mining ASIC to do so.

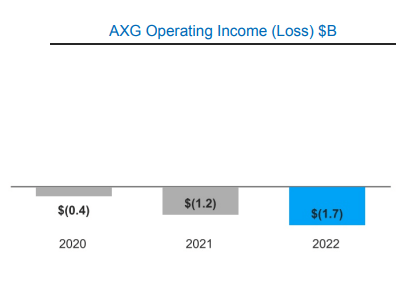

However, despite the efficiency and profitability improvements provided by Intel’s Blockscale 1000 series chips, Intel’s operating margin cost will increase by almost 50% from $1.2 billion in 2021 to $1.7 billion in 2022. bottom.

According to the company’s annual report, these operating costs were “due to increased inventory reserves and investments taken” in Intel’s product roadmap. report.

It promised to “deliver five technology nodes over four years” in 2022, one of which was the first Intel Blockscale ASIC. Intel has attempted to accelerate his IDM 2.0 strategy by “investing in manufacturing capacity around the world.”

Intel said the 2022 results were “impacted by an uncertain macroeconomic environment resulting from inflation, the war in Ukraine and the 2019 COVID-19 shutdown.” [its] Chinese supply chain. “

Cause of discontinuation

Intel’s reasons behind discontinuing its bitcoin mining chips are backed up by a $500 million year-over-year increase in operating costs in 2022, giving further justification to the firm’s decision finality. .

Regarding its IDM 2.0 strategy, the company said:

“In 2022, we have aggressively adjusted our capital investments to meet changing business conditions, but we have still made significant investments this year to support our IDM 2.0 strategy.”

The $63 million increase in revenue for 2022 comes first on CryptoSlate after the Intel Bitcoin mining chip was phased out despite the efficiency of the chip.