Intel Is Back to Profitability But Lowers Expectations for Q4 2024

Intel has announced financial results for the third quarter of fiscal year 2023. Intel is back in the black after posting his $15.3 billion in revenue, down 20% year over year. Still, the company had to lower its guidance for the fourth quarter due to weak macroeconomic conditions and continued challenges in its client and data center business units.

Revenue remained flat, profit margin increased

Intel’s third quarter 2023 revenue totaled $15.3 billion, down 20% from the same period last year, but was within the company’s guidance provided in July. Additionally, Intel’s gross margin dropped to 45.9%. That’s high compared to the company’s gross margin in the second quarter, but it’s still well below the company’s historical performance and long-term goals. The company’s net income fell 85% year-over-year to $1 billion.

Intel CEO Pat Gelsinger said:

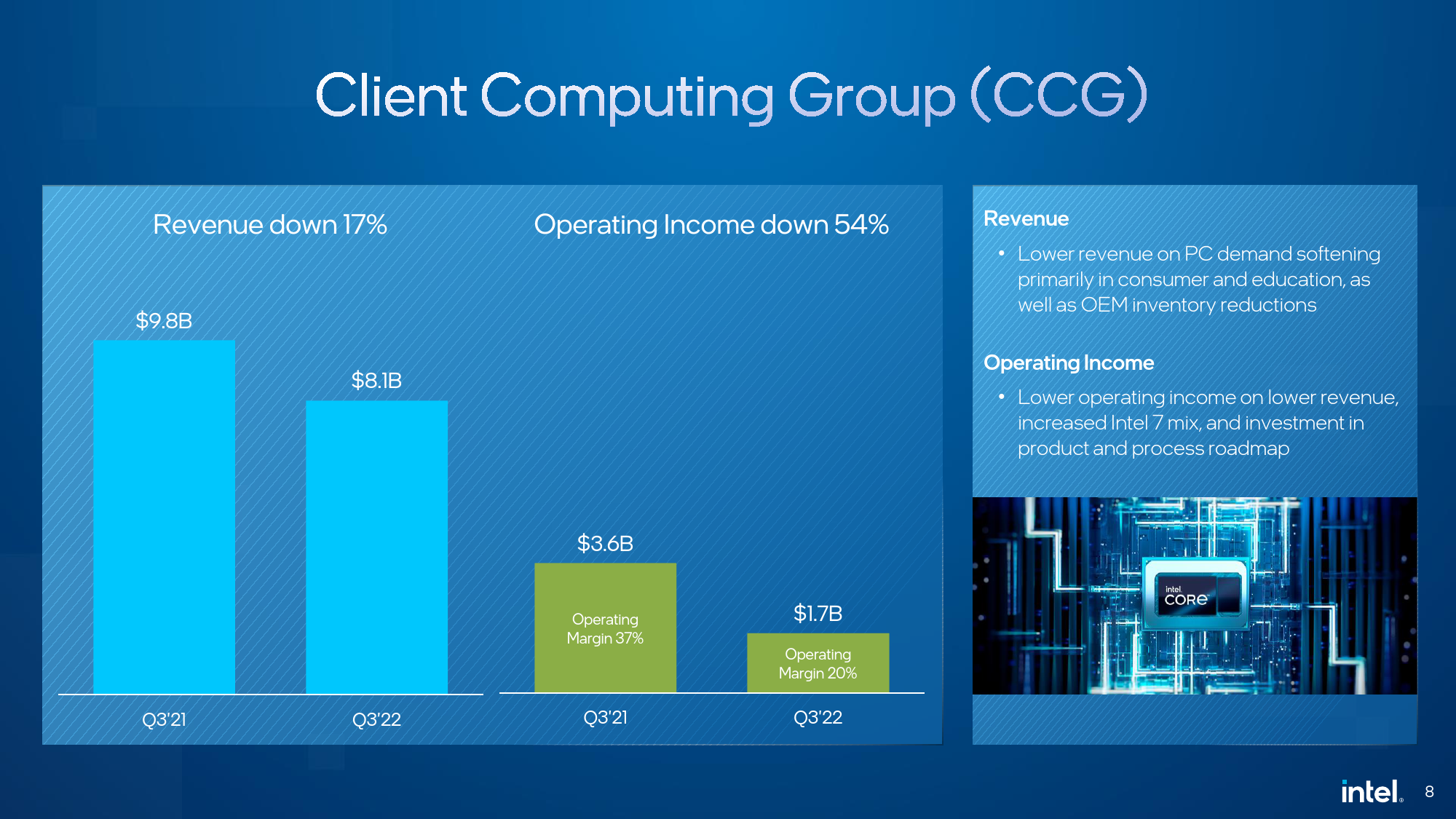

Client PC Group makes some profit as data center unit posts zero profit

Intel’s Client Computing Group earned $8.1 billion in Q3 2022, down 17% from the year-ago quarter. Meanwhile, the group’s operating profit totaled $1.7 billion, down from his $3.6 billion in Q3 2021. Sales of Intel processors and chipsets for client systems declined. This is due to softening demand for his PCs from consumers, the education sector, small businesses, and his OEM inventory cuts. Intel emphasized that PC maker inventory levels declined somewhat during the fourth quarter, but remained high enough to impact the company’s CPU and chipset shipments for some time.

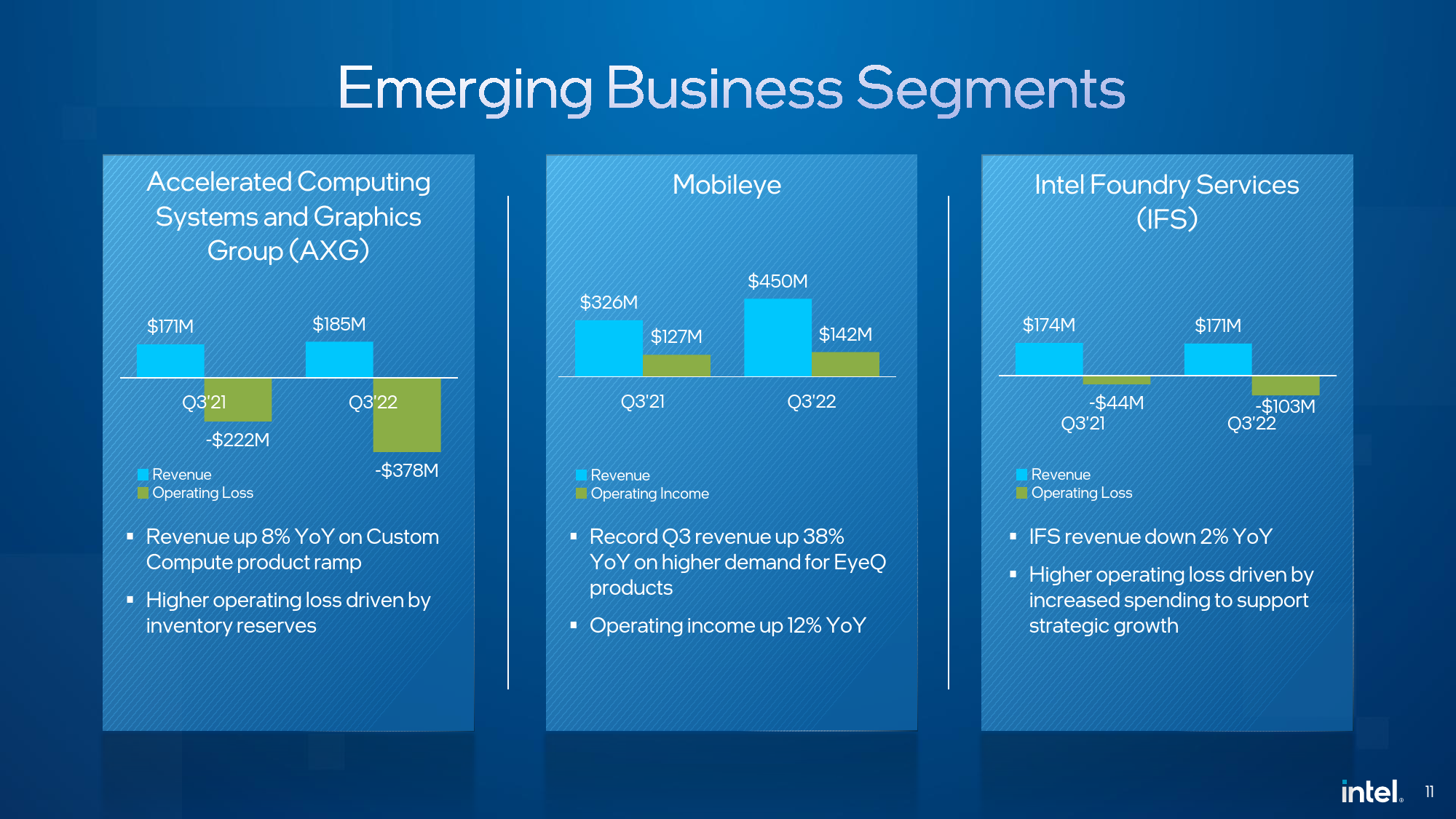

Intel’s Accelerated Computing Systems and Graphics Group (AXG) revenue increased to $185 million from $171 million a year ago. That’s not because the company has finally started shipping its long-awaited discrete graphics processors for desktops, laptops, and servers, but because of “a rise in custom computing offerings.” Intel hasn’t named the product, but we can speculate that the device in question may be Intel’s cryptocurrency mining chip. The Ponte Vecchio computing GPU is currently in production, but Intel hasn’t announced mass shipments, so it’s possible that the cryptocurrency mining chip drove his AXG performance.

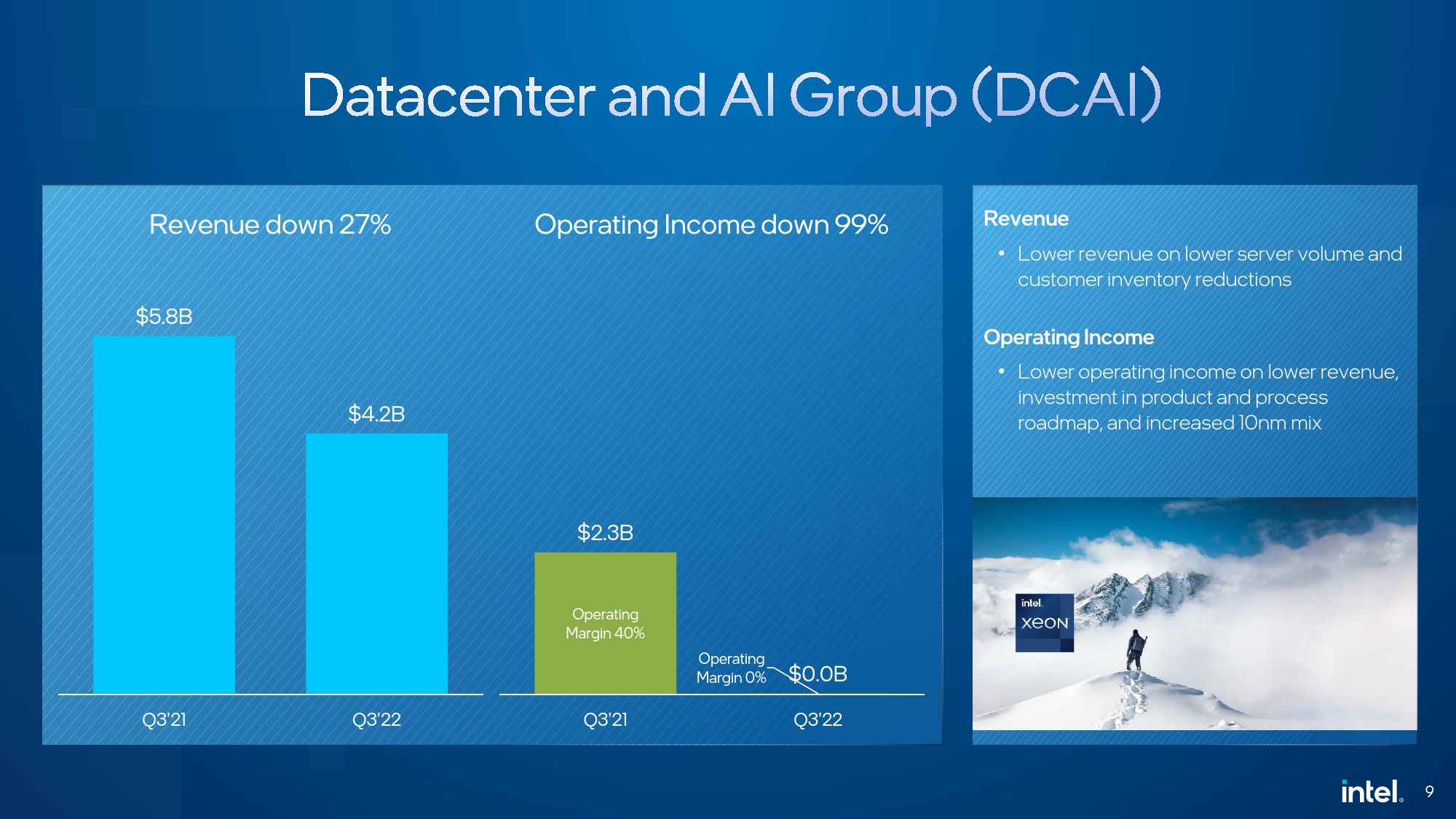

Intel’s Datacenter and AI Group (DCAI) generated $4.2 billion in revenue (down 27% year over year) with zero operating profit. Increased competition from AMD and the delayed launch of Sapphire Rapids also had a big impact on DCAI’s performance, but Intel said that a decrease in server volume and cuts in customer inventory were responsible for such terrible results. I believe it is.

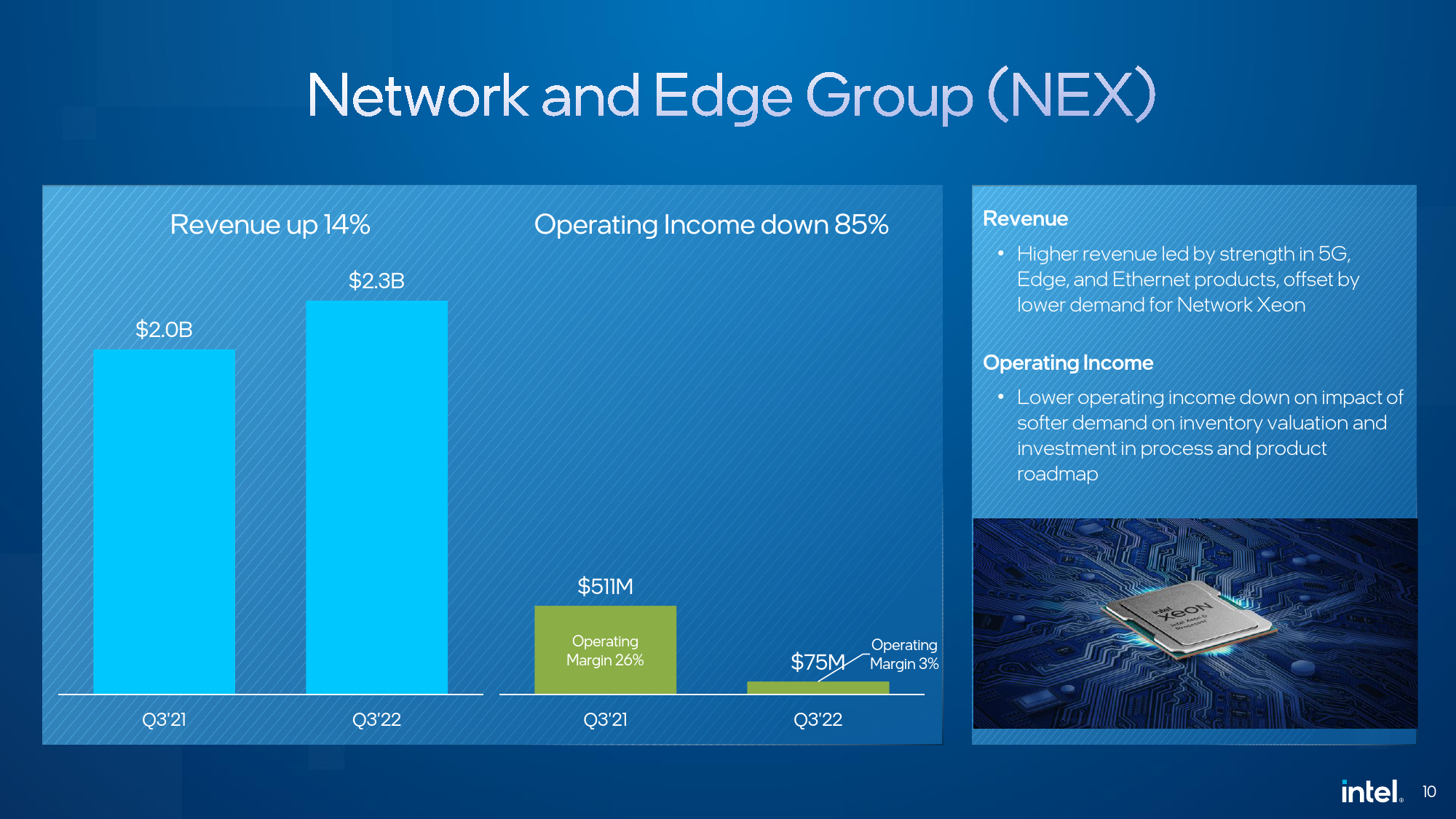

Intel’s Network and Edge Group was the only business unit with year-over-year revenue growth. NEX generated $2.3 billion, up 14% year-over-year, but operating profit declined from $511 million to $75 million in Q3 2021. did. According to Intel, strong demand for its 5G, edge, and Ethernet products caused a drop in his Xeon CPUs for networking, offsetting profits.

Intel’s Mobileye business, which just went public earlier this week, posted revenue of $450 million, up 38% year-over-year, while profitability climbed to $142 million (12% year-on-year).

As for Intel’s Foundry Services, $171 million in revenue was basically flat at $174 million in Q3 2021, but the loss fell as the company increased spending on new fabs and tools. It expanded to $103 million.

Revises full-year forecasts and prepares for global recession

Intel expects fourth quarter revenue of $14 billion to $15 billion (down 23% to 28% year-over-year), with gross margin remaining at around 45%. Q4 2023 is unlikely to be a breakthrough quarter for Intel, so the company now has full-year revenue between $63 billion and $64 billion, down 14% to 16% year over year. , is expected to decrease. $2 billion to $4 billion from July guidance. The company’s gross margin is expected to be 47.5%.

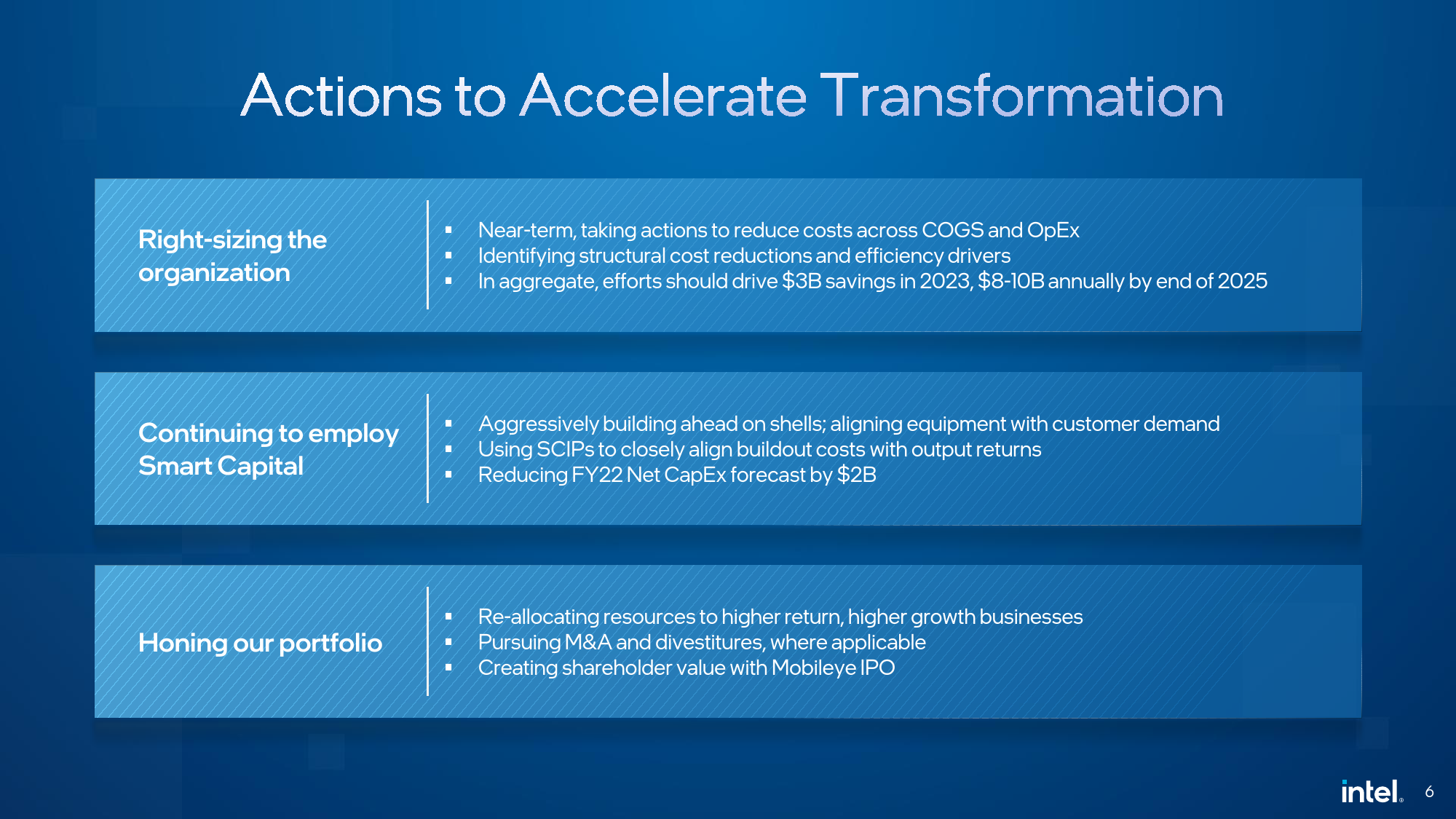

Intel expects the macroeconomic downturn to last for at least a few more quarters, which is why Intel has a cost-cutting program of $3 billion in 2023 and $8 billion by the end of 2025, or $10 billion. . Significantly reduce labor.