Intel Posts Largest Loss in Its History as Sales Plunge 36%

Intel’s first-quarter revenue beat its own expectations, but the company said on Thursday Posted It was the biggest loss in history as margins plummeted to new lows over the past few years. The company expects short-term results to continue with weak demand for his PCs and servers, but remains optimistic about the outlook for the next few years after its next-generation products hit the market.

Largest loss among low margins

Intel’s first quarter revenue fell to $11.7 billion. That’s $200 million more than the company predicted in January, but it’s still down 36% year-over-year. The company lost $2.8 billion to him during the quarter as gross margin dropped to 38.4%. Intel paid out a $1.5 billion dividend despite its biggest ever loss.

“While we remain cautious about the macroeconomic outlook, our focus is on what we have in control as we deliver on IDM 2.0: driving consistent execution across our process and product roadmaps to drive a $1 trillion market. It’s about moving the foundry business forward to maximize the opportunity, said Intel CEO Pat Gelsinger.

Client PC and Mobile Eye business units profitable, others bleeding

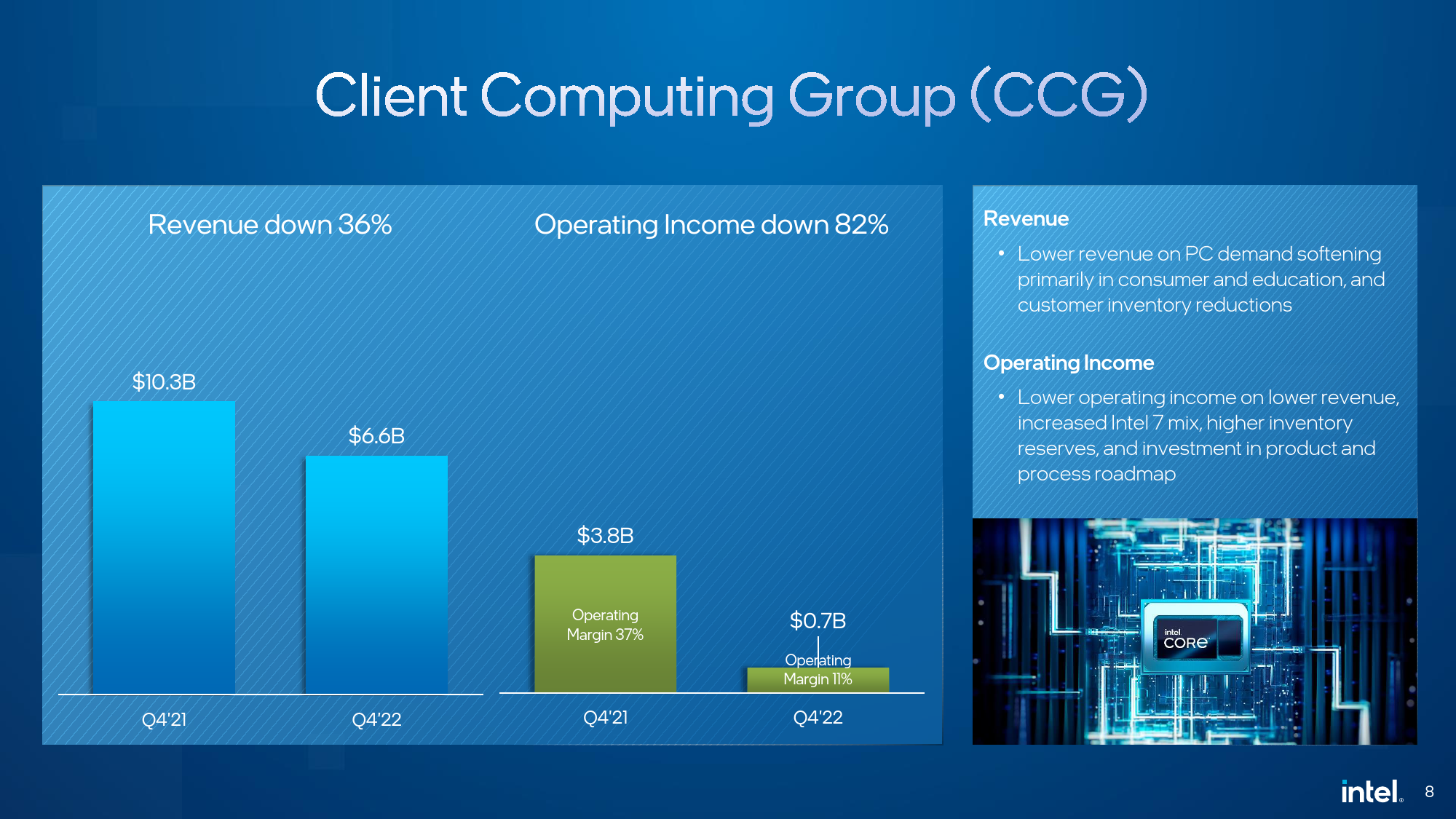

Intel’s Client Computing Group (CCG) maintained its position as the company’s largest revenue generator, but revenue in the first quarter of 2023 was $5.8 billion (down 38% year-on-year), down from $9.3 billion in the same period in 2022. decreased sharply. Cheaper CPUs are becoming more popular as the total available market (TAM) declines, PC OEMs continue to destock, and consumers remain cautious about spending. CCG was still a profitable business unit for Intel as it made his $520 million, but its operating margin dropped to his 9%.

Intel’s CFO, David Zisner, said in an earnings call to financial analysts and investors: […] As we discussed last quarter, there was a significant depletion of customer inventory during this period. Inventory levels remain elevated, but we expect the market to approach equilibrium as we exit the second quarter. Mixing resulted in successive decreases in ASP. ”

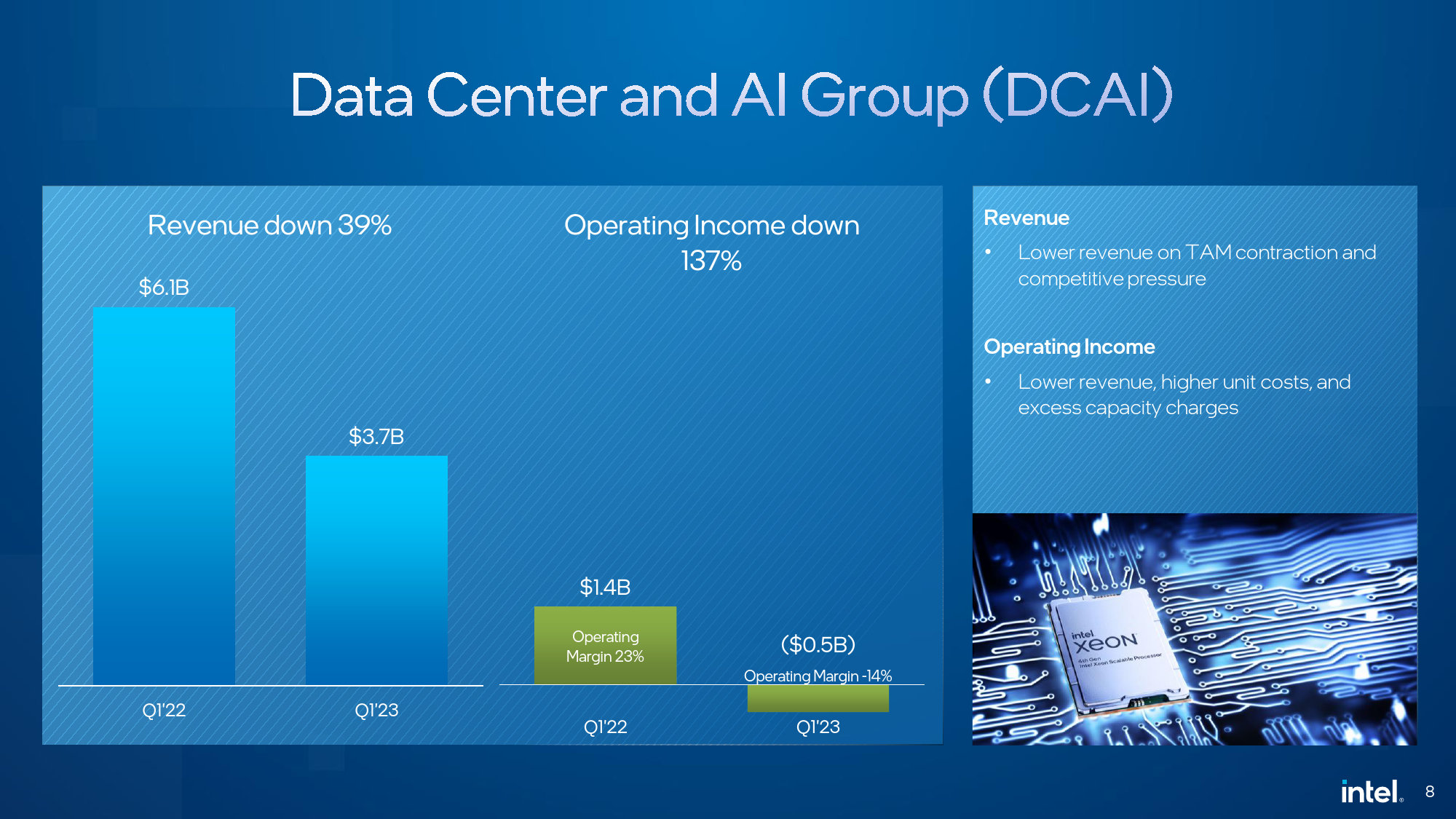

Q1 2023, Intel’s Data center and AI group (DCAI) experienced a sharp 39% year-over-year decline in data center hardware revenue, with revenues down from $6.1 billion in Q2 2022 to $3.7 billion in the prior quarter. Operating profit margin dropped to -14%, losing $580 million.

Intel said rising product costs, investment in next-generation products at new process nodes, the merger of its AXG business, and the securing of inventory related to its service systems business, which it sold to Mitac earlier this month, will all contribute to the DCAI results. I blame it on being the cause of evil.

“All CPU market segments continue to experience significant year-over-year TAM contraction, and we expect demand to remain soft in the second quarter,” said Zisner. “In the first quarter, he said CPU market share remained stable and he is excited about the market expansion of the 4th Generation Xeon Scalable Processor ‘Sapphire Rapids’.

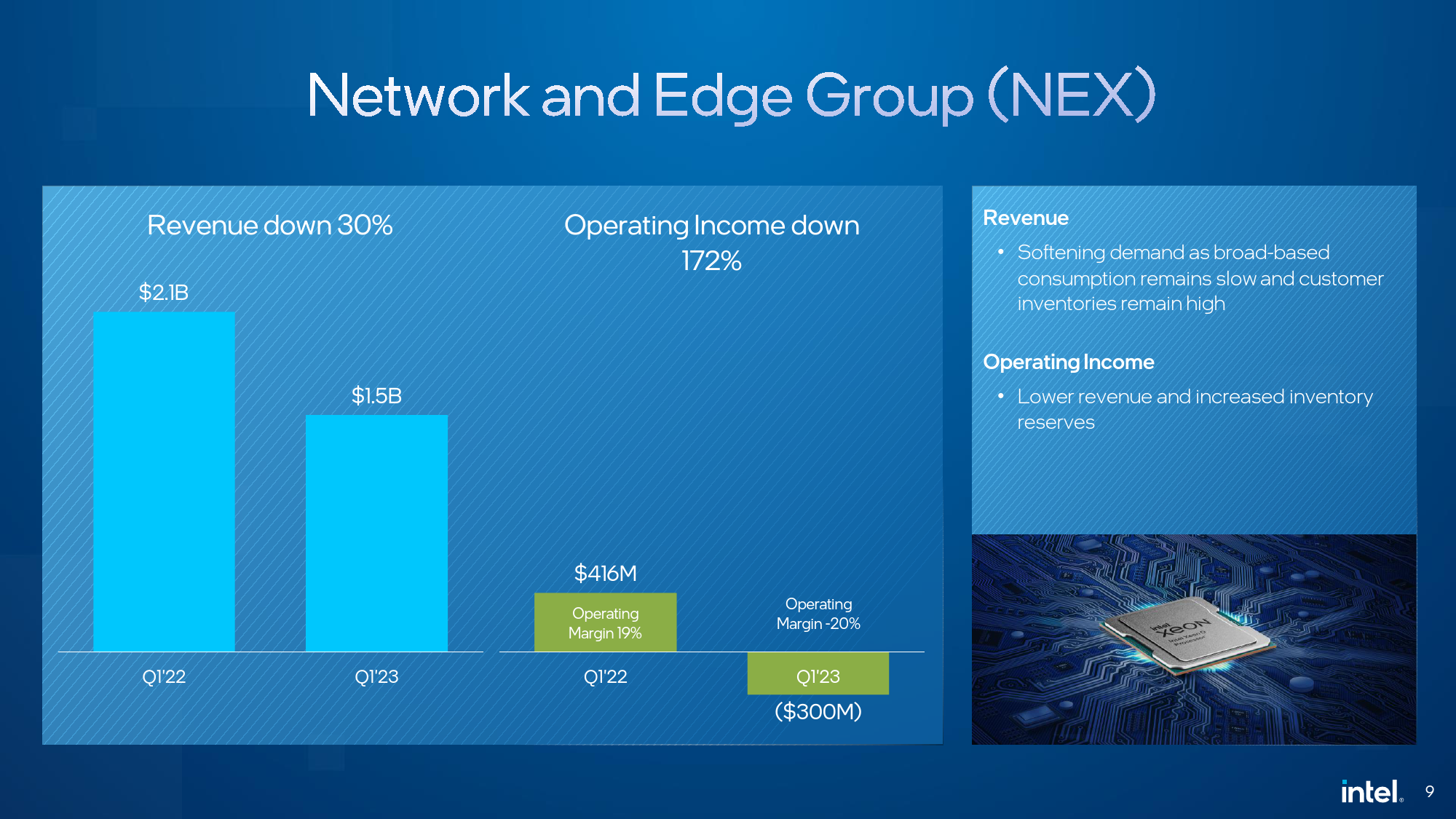

while intel Network and edge groups (NEX) was able to maintain profitability in recent quarters, but lost $300 million in revenue in the first quarter, dropping to $1.5 billion. Gross margin for this business unit decreased to -20%.

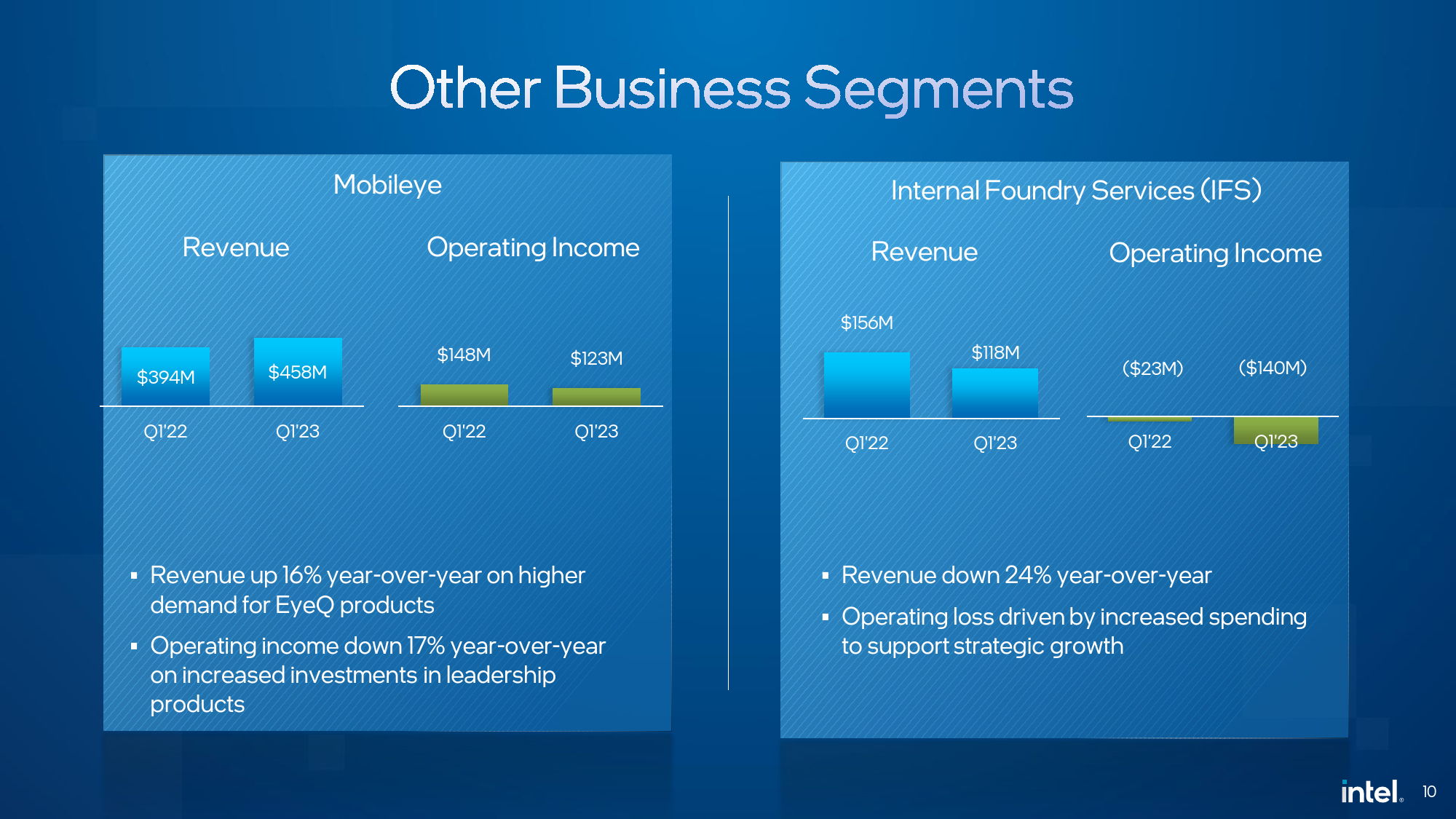

Intel’s $458 million in revenue in Q1 2023 mobile eye The division was the company’s only division to show 16% year-over-year revenue growth. Meanwhile, operating profit fell 17% year-on-year to he $123 million as he increased investment in new products.

as for Intel Foundry Services It had revenue of $118 million and lost $140 million in excess of revenue due to increased fab start-up costs. However, while IFS’ revenue fell overall, the company said the unit posted 67% consecutive growth in packaging revenue.Meanwhile, Intel continues to work with Chinese authorities. , approves the acquisition of Tower Semiconductor in the second quarter.

A pessimistic outlook for the second quarter

Intel forecasts second quarter 2023 revenue of $11.5 billion to $12.5 billion. This represents a significant decline from Q4 2022 earnings. $0.62 per share.

Intel’s first quarter results certainly aren’t anything to brag about, but the company remains optimistic as revenue beats its own expectations. So the market is performing better than we thought it would be a few months ago.

“We are encouraged by our earnings in the first quarter and expect gradual improvement in growth through 2023,” said Zisner. We continue to focus on being able to control execution and prioritizing owner capital. Delivering on our roadmap commitments will help us meet customer expectations for our products and generate strong earnings growth and free cash flow. We are confident that we will be able to meet and exceed the expectations of our owners.”