Investors hold Bitcoin, Ethereum over stablecoins in risk-off environment

Glassnode data analyzed by crypto slate Suggests investors are more confident holding Bitcoin and Ethereum than stablecoins in the current risk-off environment

As previously mentioned, billions of stablecoins have converted to fiat currency in recent months. A key factor in this was Binance’s bankruptcy FUD, which sparked a run on the exchange.

But as FUD calms down, on-chain indicators show rising purchasing power for Bitcoin and Ethereum compared to stablecoins.

The purchasing power of BTC and ETH is on the rise

Stablecoins serve multiple functions, including facilitating on/off ramping and storing value, especially in Southern Hemisphere countries experiencing high inflation.

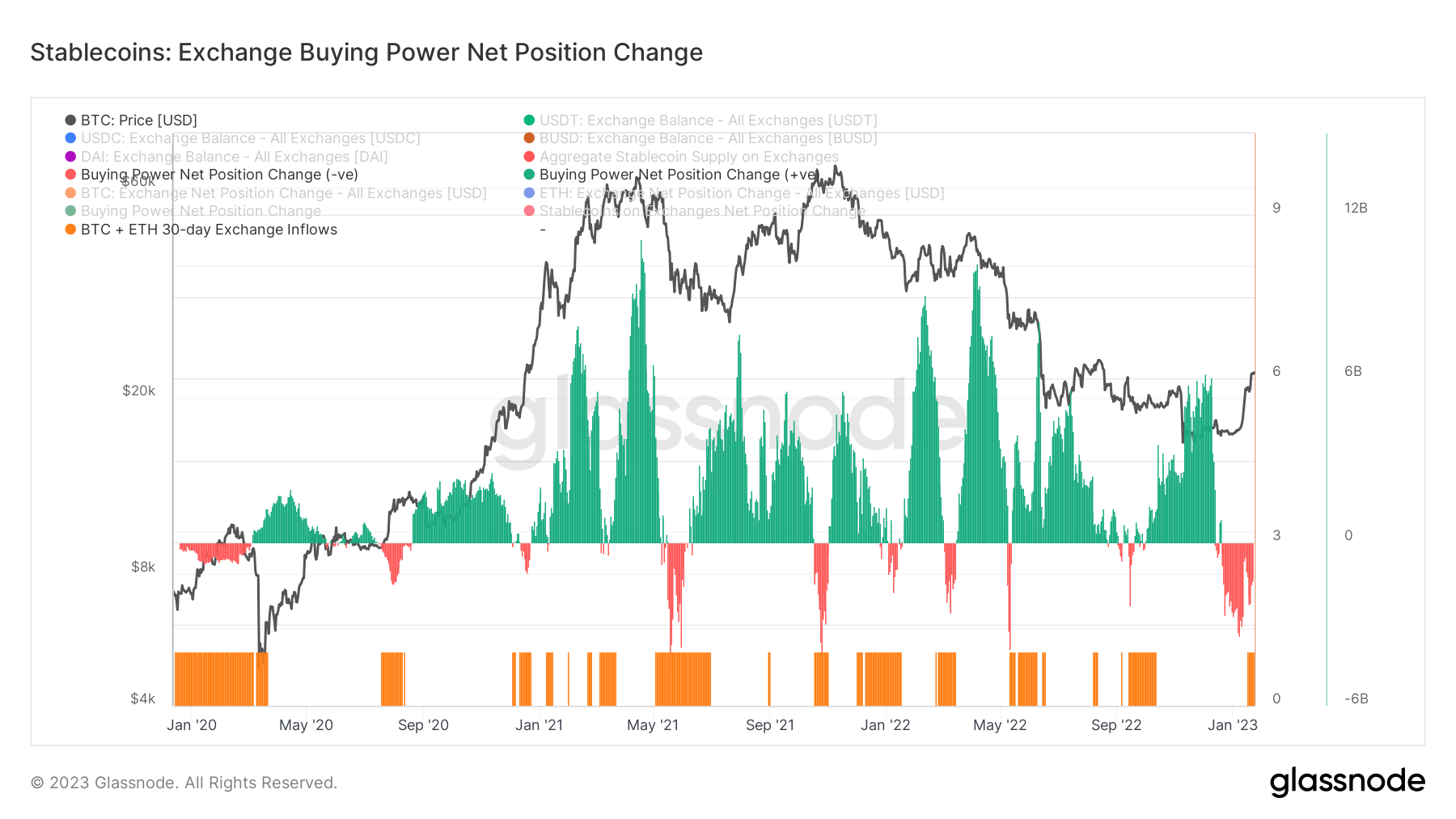

The chart below shows the 30-day change in stablecoin purchasing power on exchanges. This works by considering the supply of the top four stablecoins of USDT, USDC, BUSD, and DAI, and then subtracting the USD-denominated change in his BTC and ETH exchange flows over the period.

The green graph shows the increasing amount of stablecoins flowing into exchanges compared to BTC and ETH flows. This suggests that stablecoin denominated purchasing power is proportional to the purchasing power of BTC and ETH.

In contrast, the red chart shows a decline in stablecoin volume relative to BTC and ETH. In other words, the purchasing power denominated in BTC and ETH is greater than that of stablecoins.

Orange bars indicate positive 30-day USD volumes for BTC and ETH. That is, if the stablecoin were converted to BTC and ETH instead of USD.

Typically, during risk-off sentiment, stablecoin volumes increase as investors move to minimize the impact of price volatility. However, the chart below shows that investors are acting against expectations by increasing the inflow of BTC and ETH to the exchange.

The last time this happened was for a short period in October. Notably, the current volume dominance of BTC and ETH over stablecoins has been extended by about 7 weeks at this point. This shows confidence in the top two tokens holding the current price level.

Bitcoin/stablecoin supply ratio

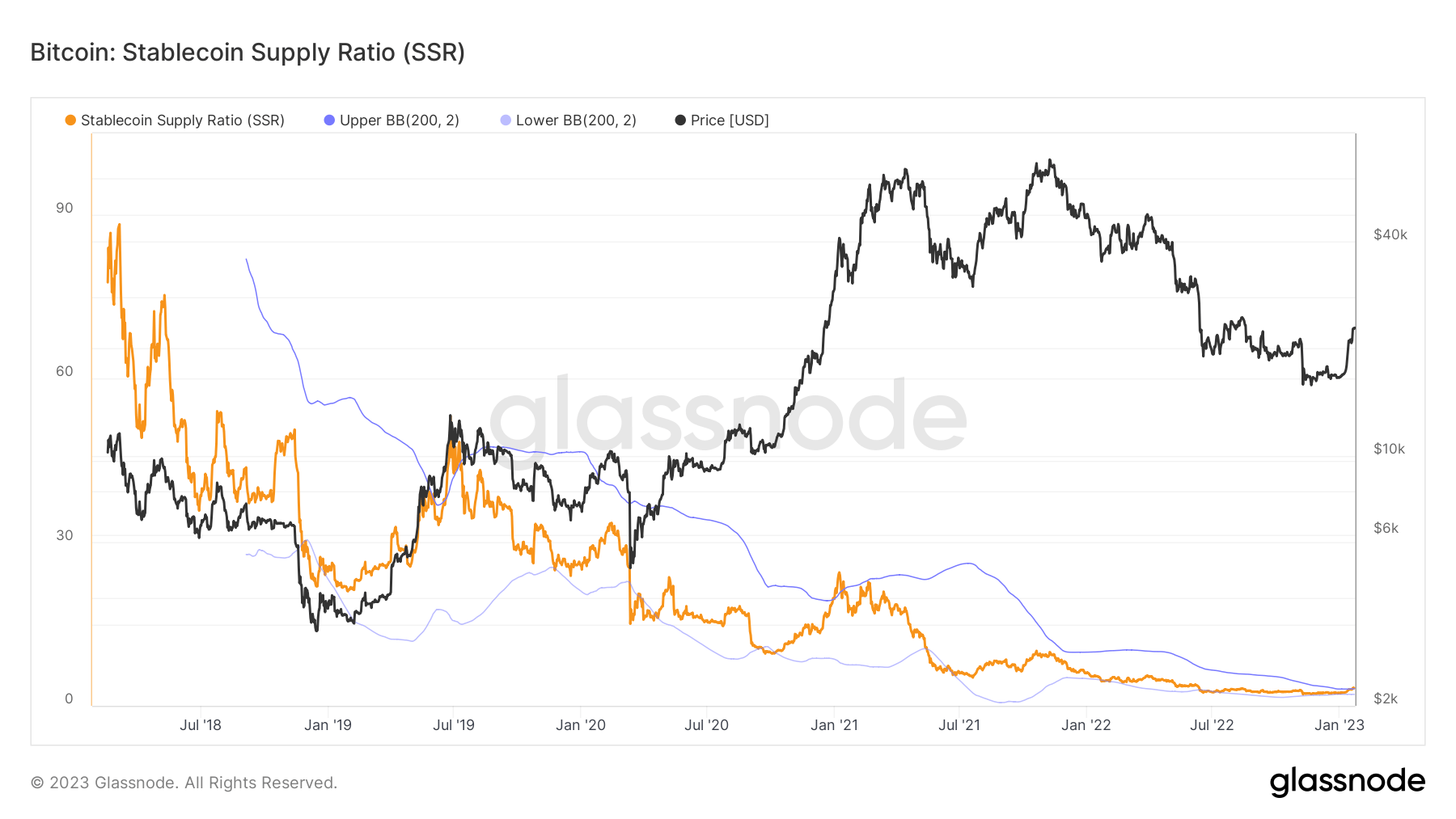

The Stablecoin Supply Ratio (SSR) metric refers to the ratio of Bitcoin supply to stablecoin supply expressed in BTC.

A high SSR indicates low potential buying pressure and is considered bearish. Conversely, a low SSR means high potential buying pressure, making the situation bullish. If the SSR is low, the current stablecoin supply has more “buying power” to buy BTC.

The chart below shows that the SSR has crossed the upper line for the first time since January 2021. This coincides with BTC rising to $65,000. The last time the upper limit was breached was in July 2019, when BTC surged to $14,000 after his $3,300 market bottom.

The above points to a bullish tailwind despite the current risk-off environment.