Is ETH inflationary or deflationary after the Merge?

One of the most heated debates surrounding Ethereum’s move to a proof-of-stake network focused on ETH issuance. The main story behind the merge was that ETH was supposed to be a deflationary currency.

ETH issuance has dropped significantly since the merge was completed on September 15th. The estimated annual issuance on the PoS network is around 600,000 ETH. The exact annual issuance amount will vary from year to year as it will be determined based on the number of validators participating in the consensus mechanism.

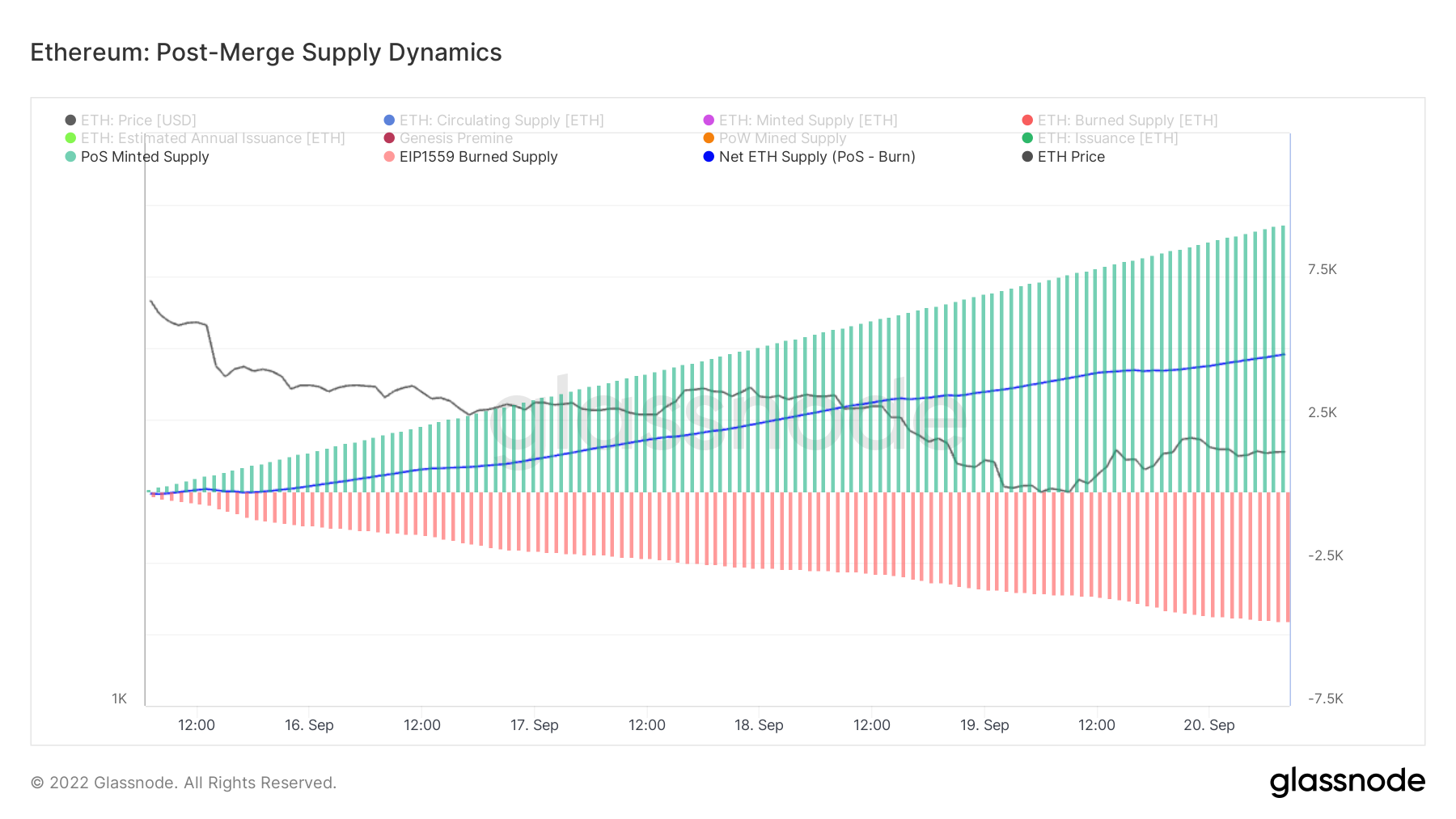

However, while issuance has decreased in theory, the actual supply of ETH has increased since the network abandoned Proof-of-Work. Supply growth is currently positive, increasing by over 4,000 ETH since the merger. At the current pace, supply is set to grow by 0.21% per year.

The Merge has so far failed to make Ethereum a deflationary currency. Minted supply from PoS networks exceeds the implemented burn rate EIP-1559.

According to Glassnode data, the supply of Ethereum has increased on an hourly basis since Proof-of-Work was permanently stopped issuing. The graph below shows that the supply mined by PoS exceeds the supply consumed by EIP-1559. This has increased the net supply of ETH after the merger.

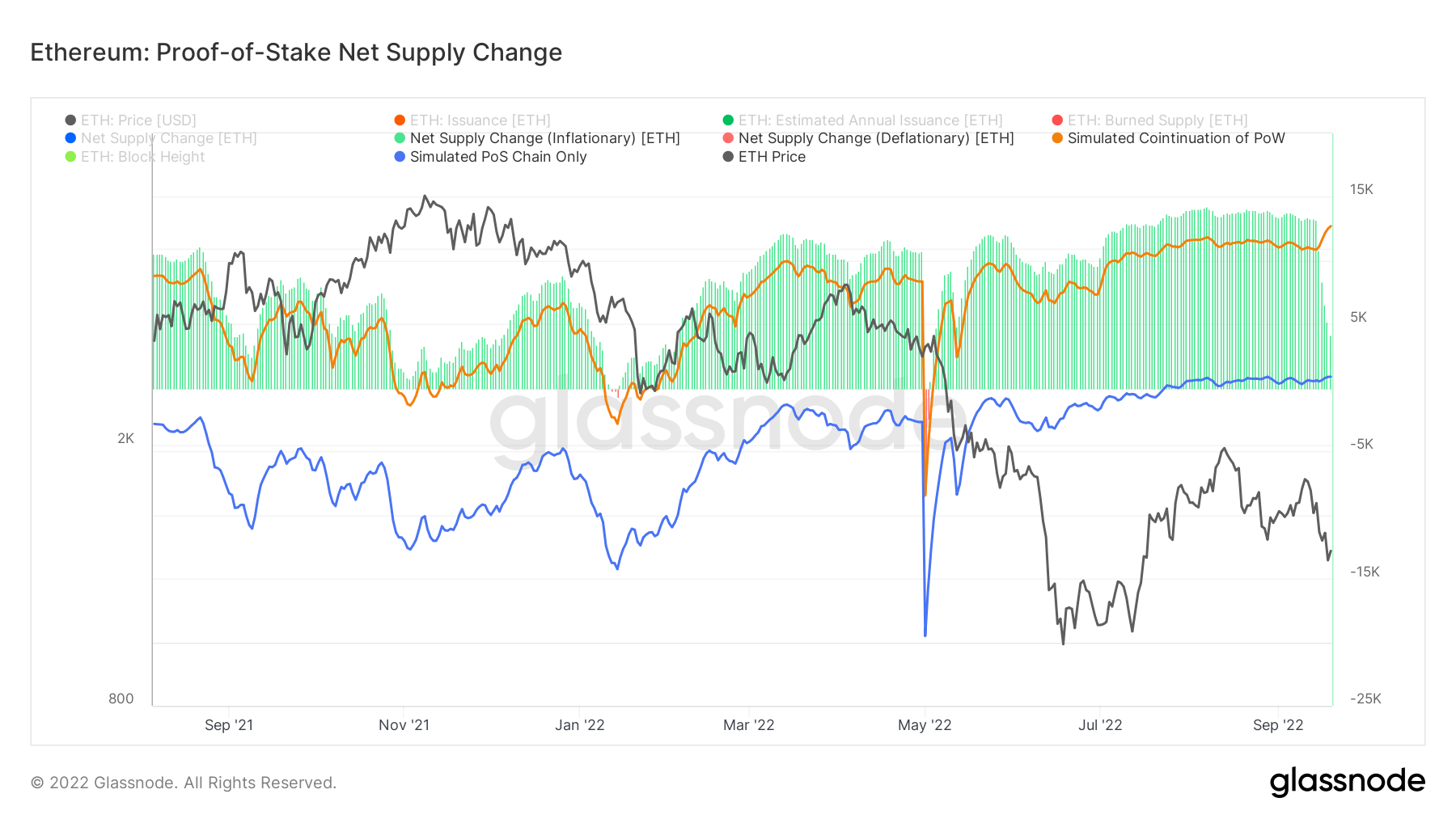

An analysis of Ethereum supply and issuance before the merger shows that the network has been under inflationary pressure for almost two years.

PoS issuance of ETH started shortly after the beacon chain creation event on December 1, 2020, long before the merge. However, PoW issuance he did not stop until September 15, 2022. EIP-1559, Implemented Transaction Pricing Mechanism On August 5, 2021, fixed transaction fees per block.

This implementation time discrepancy further exacerbates the pressure on the network.

Since EIP-1559 was implemented, ETH has been in deflation for very short periods (January and May 2022). The graph below shows the disparity between periods of inflation and deflation. The former is shown in green and the latter in red.

Nevertheless, PoS has managed to significantly reduce the supply of ETH.In the graph above, the orange line represents the simulated supply if Ethereum continued to exist as a PoW system. I’m here. The blue line represents the simulated supply if Ethereum existed as a PoS system for the past year. The data clearly show that the PoS system will significantly reduce his ETH supply.

The graph also shows that inflationary pressures on Ethereum have steadily declined since the merge. However, it remains to be seen whether the drop in pressure will ultimately lead to deflationary supply.