Is the crypto bottom in? On-chain says yes, macro says pain occurs after the fed pause

prologue

The crash of Terra (LUNA) in June 2022 was the spark that ignited the flames devouring the cryptocurrency market. A chain reaction of bankruptcies for prominent industry players continued throughout the year, culminating in the collapse of one of the industry’s largest cryptocurrency exchanges, FTX.

When FTX collapsed, billions of dollars in customer deposits were wiped out, pushing the market to a three-year low. Bitcoin has hit $15,500 and threatened to drop further as the FTX contagion spreads.

Since then, Bitcoin has recovered and has been hovering around $23,000 since the end of January 2023, registering a remarkable return.

However, the market still looks volatile. FTX, Celsius, and other large corporate bankruptcy proceedings are still underway, which could lead to even more price volatility. The looming recession creates macro uncertainty that underpins the market.

The industry seems divided. Some believe Bitcoin has bottomed out in November 2022, while others expect volatility to rise and even lower levels in the coming months.

CryptoSlate explored the factors that could push Bitcoin to new lows, and the bottom-marking factors were set to present both sides of the debate.

We analyze potential market bottoms as we delve into the three metrics in the tweets below.

Why the Market Has Bottomed – Whales Are Piling Up

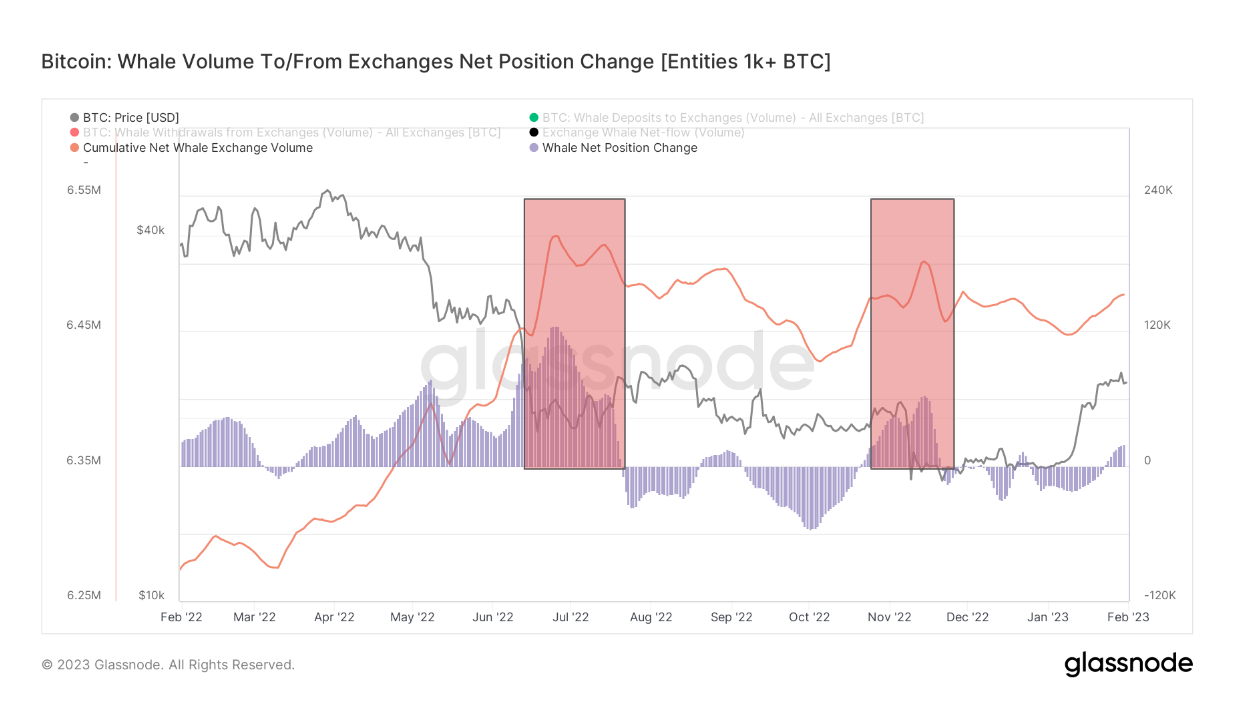

Changes in the net position of addresses above 1,000 BTC indicate the bottom of a strong cycle. These addresses, called whales, have historically accumulated Bitcoin during extreme price movements.

Whales began accumulating massive amounts during Terra’s collapse in June 2022, scooping up around 100,000 BTC in just a few weeks. After a three-month decline, the whale began to accumulate again at the end of November 2022, shortly after his FTX collapse. When Bitcoin prices stabilized in December, Whale began selling his holdings and reducing his net position.

There was also some increase in net whale positions at the end of January, although currency volumes do not indicate significant accumulation.

Increased supply of long-term holders

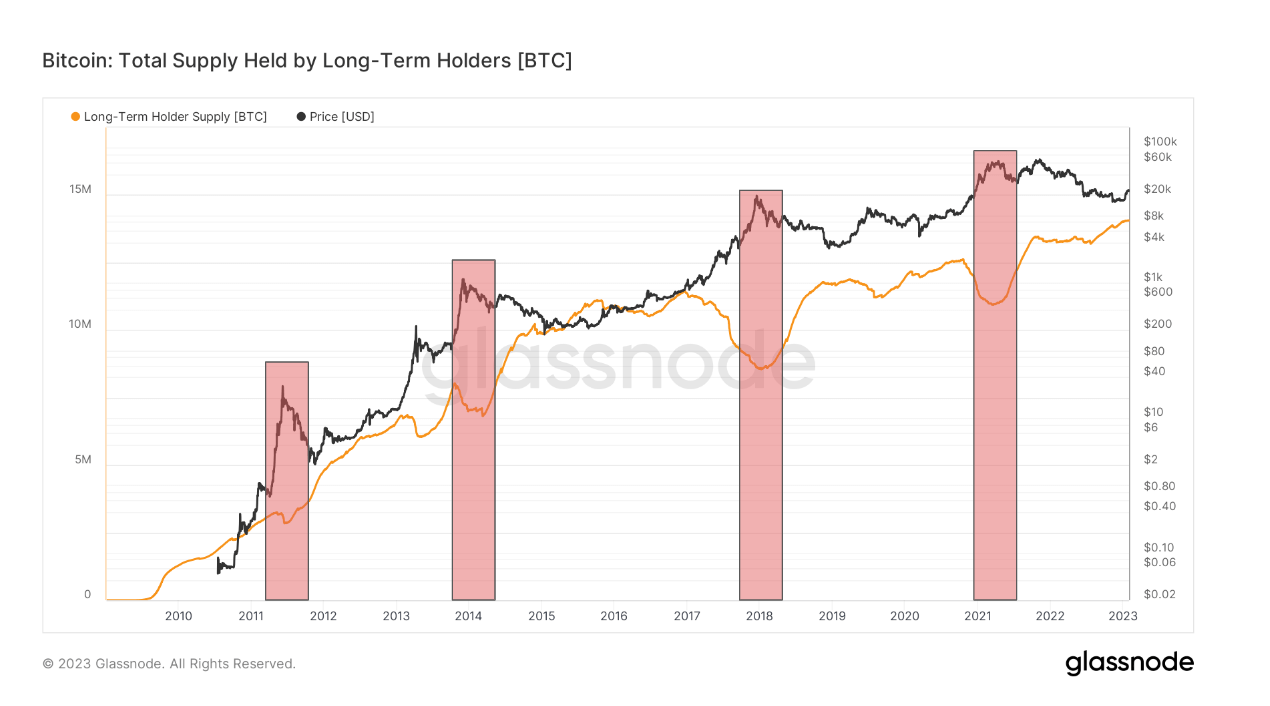

Long-term holders (LTH) make up the foundation of the Bitcoin market. Defined as addresses that have held BTC for more than 6 months and have historically sold at market highs and accumulated at market lows.

Bitcoin supply held by long-term holders is often viewed as an indicator of market cycles. Markets tend to bottom out when supply increases sharply. When supply starts to decline, the market can approach its all-time high.

However, LTH supply is not affected by Black Swan events. A rare exception to this trend occurred in November 2022, when the collapse of FTX caused many LTHs to reduce their holdings.

However, despite the decline, LTH supply has recovered in 2023. A long-term holder, as of February he holds 14 million BTC. This represents an increase of over 1 million BTC since the beginning of 2022, with LTH now holding around 75% of the Bitcoin supply.

CryptoSlate analyzed Glassnode data and found that the LTH supply continues to grow. There is little sign of surrender among the LTHs, indicating that a bottom is likely.

Perpetual funding rate is no longer negative

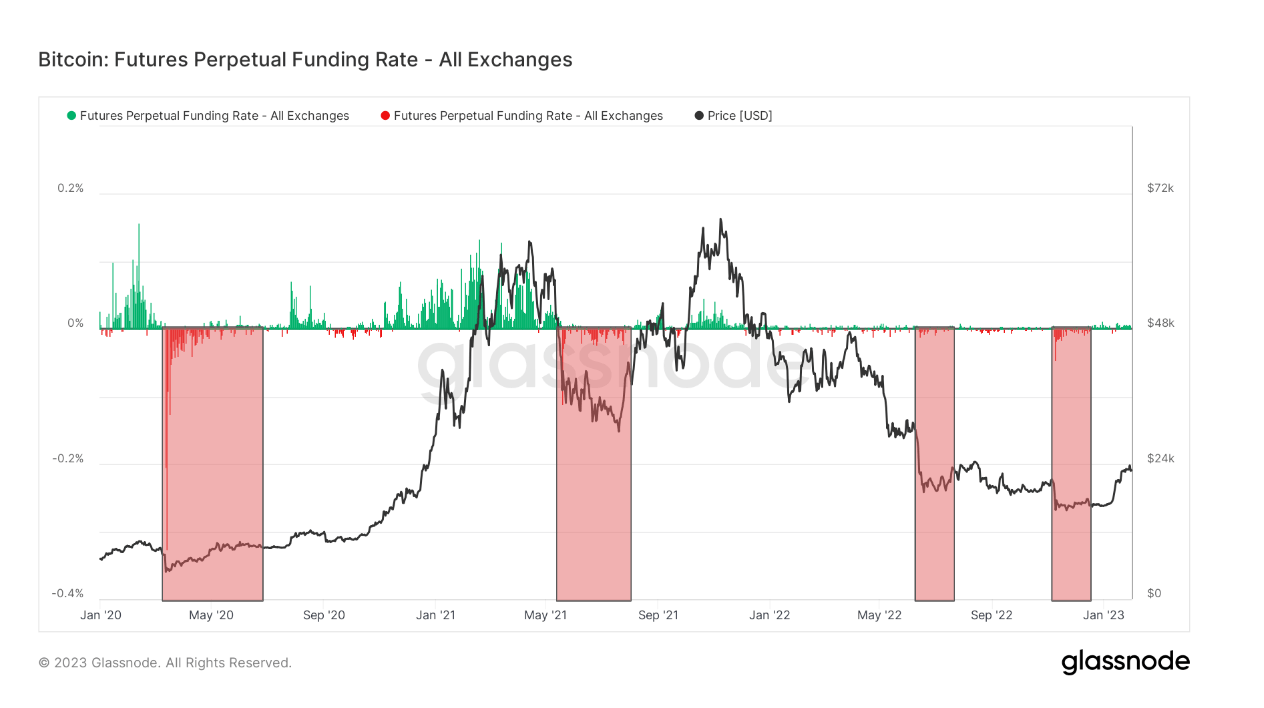

Perpetual futures, unique to the crypto market, are a solid measure of investor confidence in Bitcoin.

Perpetual futures are futures contracts that do not expire, allowing investors to close their positions at any time. In order to match the price of the contract with the market value of Bitcoin, the exchange utilizes the funding rate. A long position pays a fee to a short position if the execution price is higher than his BTC spot price. If the contract price is lower than the BTC spot price, the short position will pay a fee to the long position and the contract price will be readjusted to the Bitcoin market value.

A positive funding rate indicates more long positions in perpetual futures contracts, indicating that investors expect the Bitcoin price to rise. Negative interest rates show plenty of short positions and the market is gearing up for a bitcoin price drop.

Since the beginning of 2020, the market has faced very negative funding rates every time the Bitcoin price bottomed out. In 2022, negative funding rates spiked sharply in June and November, indicating investors severely shorted the market during the Terra and FTX collapses. A sharp rise in negative interest rates is always correlated with a market bottom — numerous short positions in perpetual contracts add to the strain on a struggling market.

The 2023 funding rate was almost entirely positive. The market may be in a recovery phase as there is no data to show an extreme spike in negative funding rates.

The total supply of profit is increasing

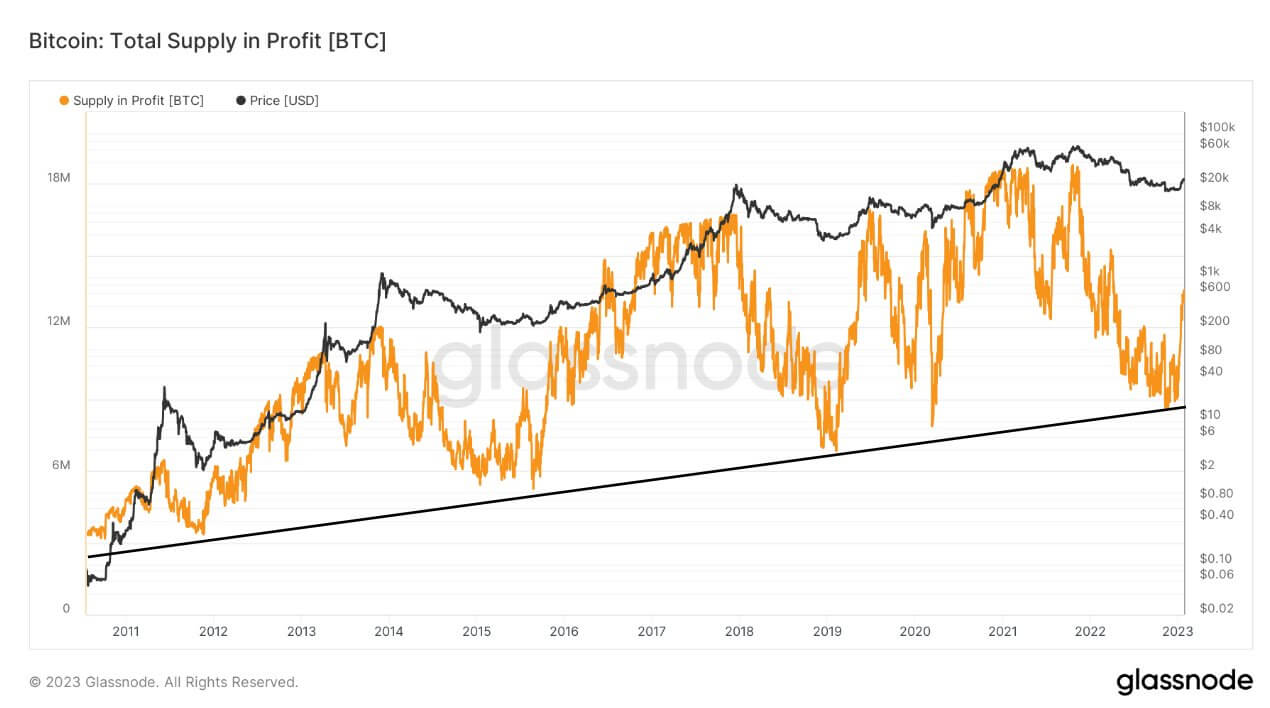

The repetitive nature of market cycles allows us to recognize patterns in Bitcoin price movements. In every bear market since 2012, Bitcoin has posted higher lows than in the previous cycle. These lows are measured by calculating the drawdown from the ATH price BTC reached in the cycle.

- 2012 – 93% drawdown from ATH

- 2015 – 85% drawdown from ATH

- 2019 – 84% drawdown from ATH

- 2022 – 77% drawdown from ATH

Higher lows from cycle to cycle increase the total supply of profitable Bitcoin. This is also due to coin loss, and this number keeps increasing with each cycle, essentially becoming a forced hold.

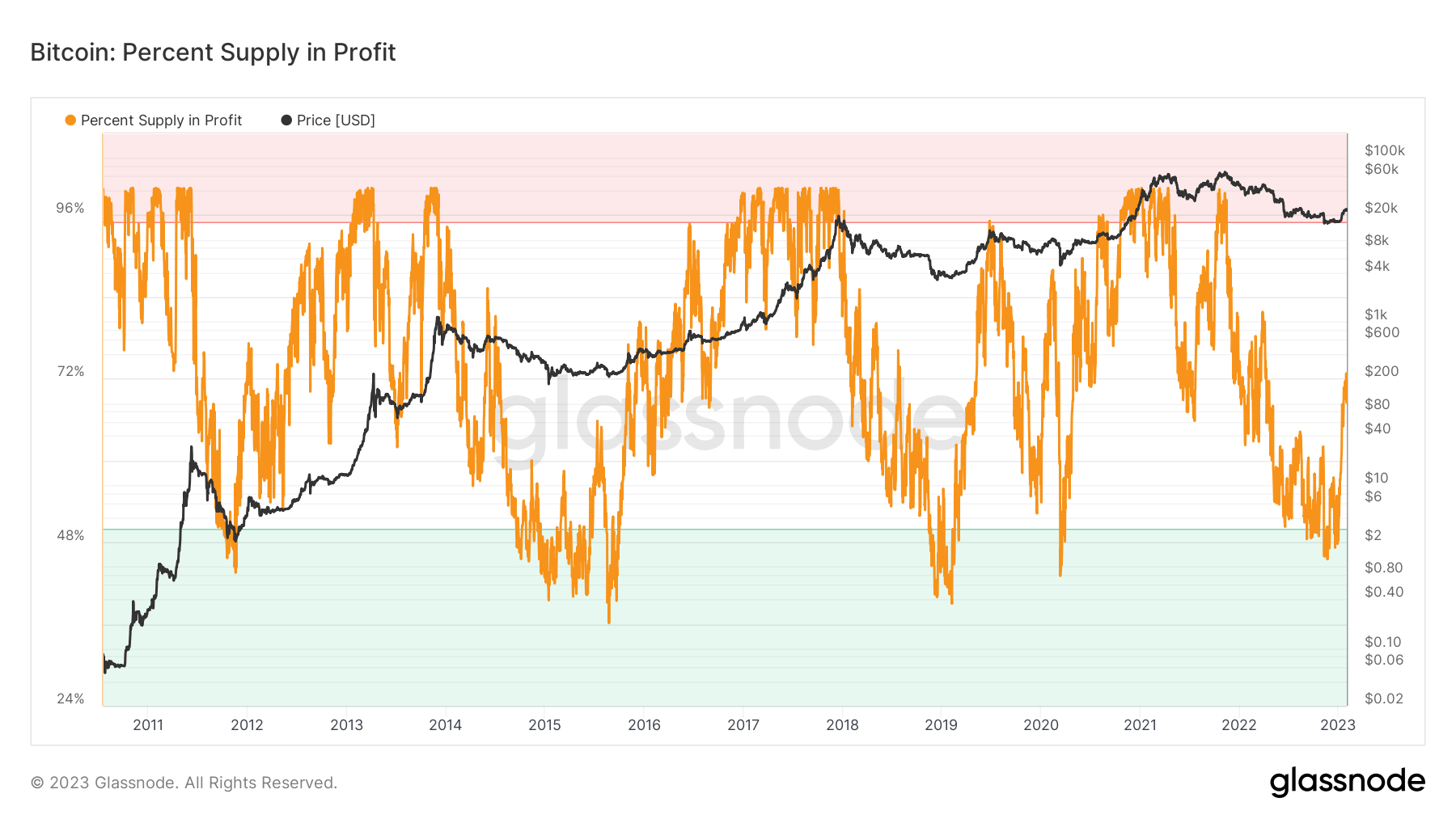

Cycle troughs formed every time the Bitcoin supply profit margin fell below 50%. This happened in November 2022, when profit supply dropped to 45%. After that, profit supply increased to around 72%, indicating a recovery in the market.

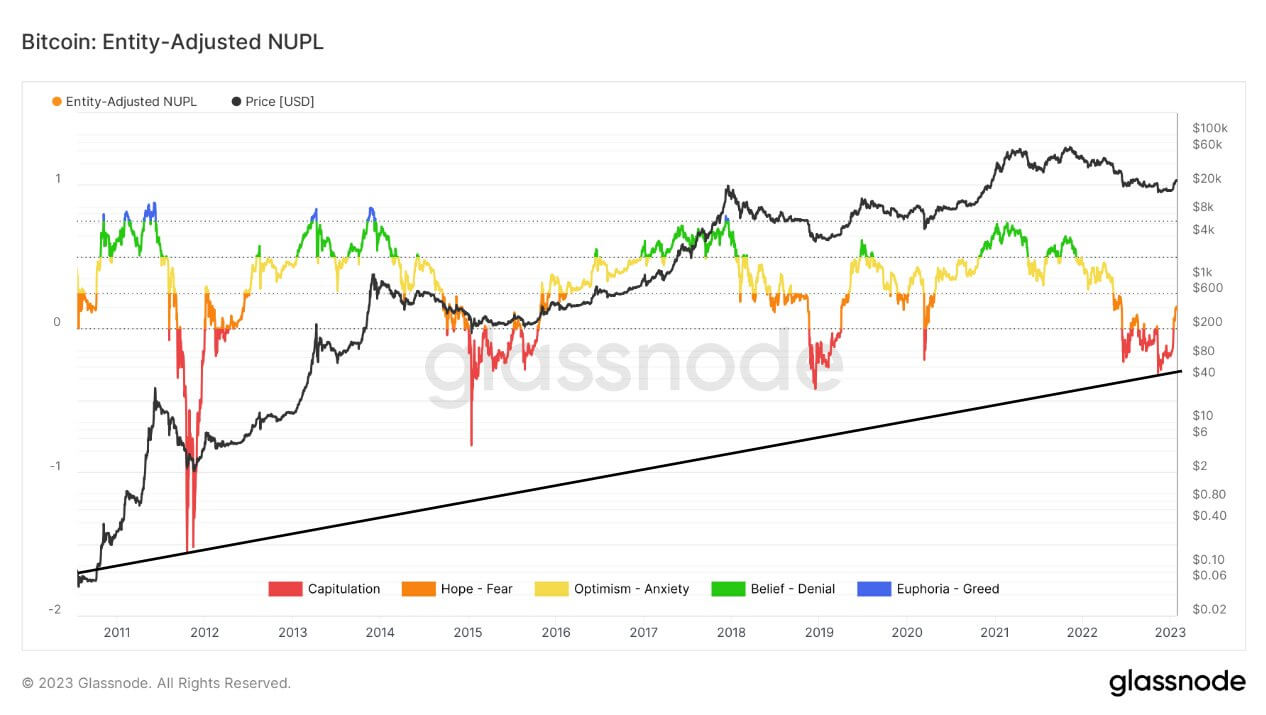

These indicators suggest that Bitcoin bottomed out in November when it fell to $15,500. Net Unrealized Gain/Loss (NUPL) is a metric that compares Bitcoin’s market value to realized value and is a good measure of investor sentiment.

The Entity Adjusted NUP now shows that Bitcoin has exited the surrender phase and entered the hope/fear phase that historically portended higher prices.

The on-chain indicator is flashing green

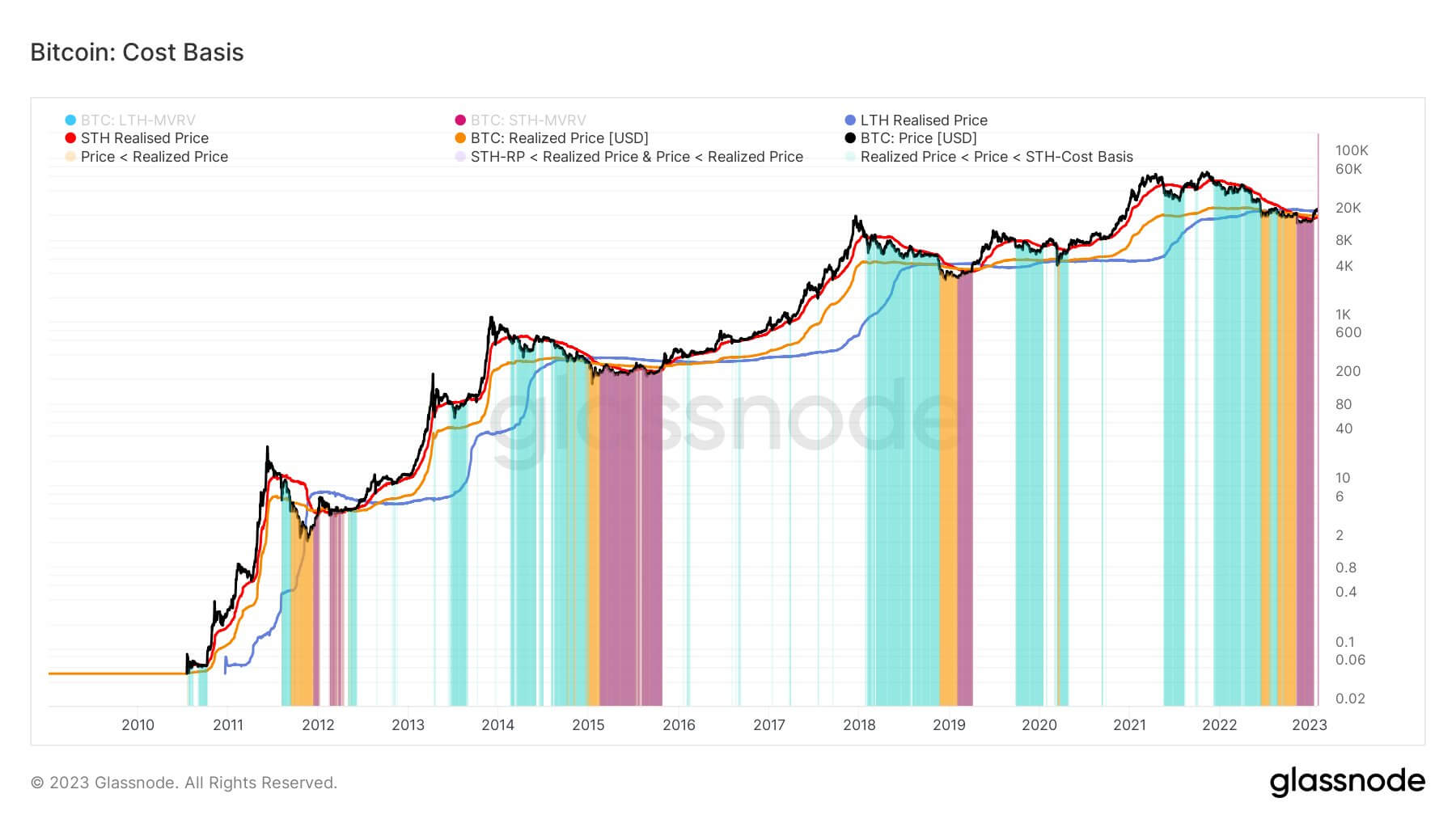

Bitcoin has regained multiple cost bases since its November decline. The market began to recover each time the spot price of BTC rose above the realized price.

As of February 2023, Bitcoin has surpassed short-term holders’ realization price ($18,900), long-term holders’ realization price ($22,300), and average realization price ($19,777).

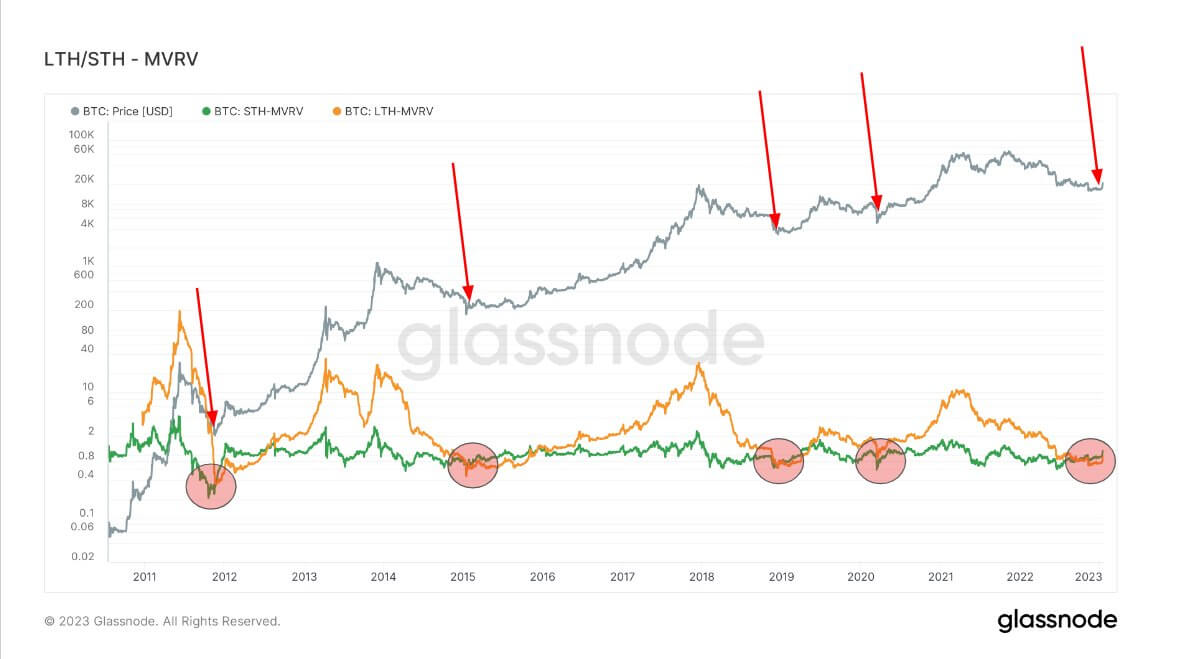

The MVRV ratio is a metric used to measure a network’s valuation through its realized cap. Unlike the market cap, the realized cap approximates the value paid when all coins were last moved. The MVRV ratio can be applied to coins belonging to long-term holders (LTH) and short-term holders (STH) to better understand hodler behavior.

The market bottoms out when the LTH MVRV ratio falls below the STH MVRV ratio. Data from Glassnode show the two bands converging in his November.

Each time the ratio diverged, the market entered a recovery phase leading to a bull market.

Federal Reserve suspends rate hikes

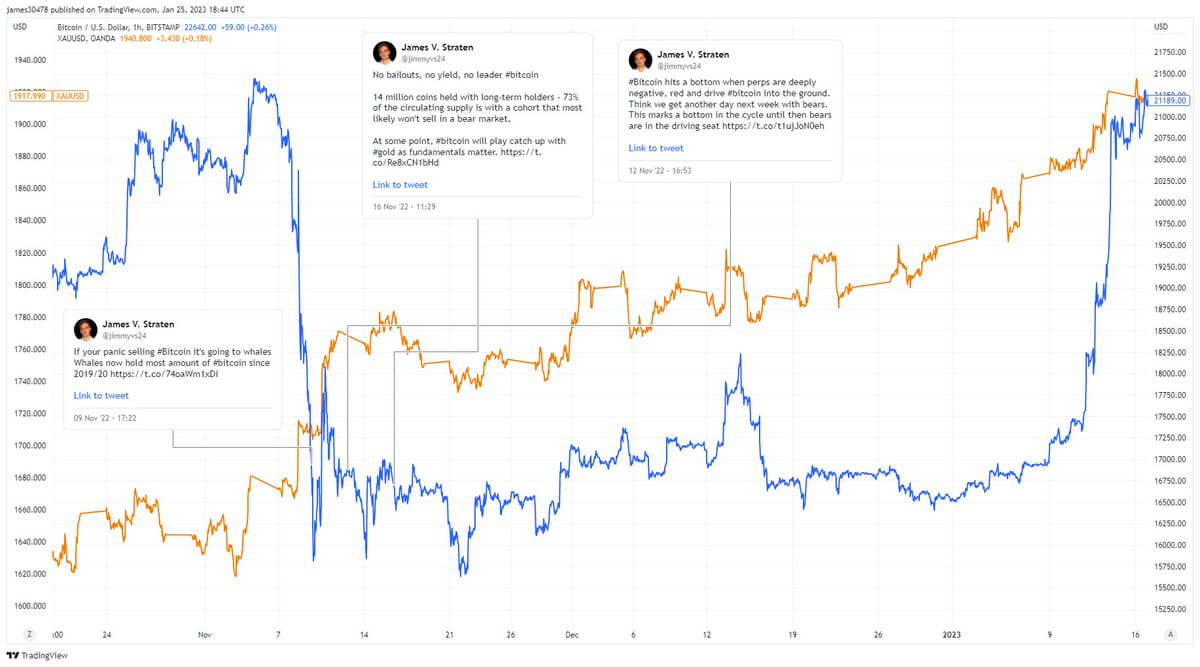

Since 1998, the upper bound of the Fed’s rate hike schedule has correlated with the lower bound of the gold price. The chart below shows the bottom with a black arrow.

After dropping to $400 an ounce in 2005, the gold price rose to $1,920 an ounce in just over six years.

Bitcoin has been compared to gold for a long time, but only in 2022 did it show a significant correlation. As of February, Bitcoin and gold prices show an 83% correlation.

If gold repeats its historic reaction to rising interest rates, its price could continue to rise into the spring. The 83% correlation suggests that a bottom has already formed, with Bitcoin price likely to rise in the coming months.

Why the Market Won’t Bottom – Narrative Uncertainty

The crash of Terra (LUNA) in June 2022 set off a chain of events that shook investor confidence in the market. The subsequent bankruptcies of other large industry players such as Three Arrows Capital (3AC) and Celsius have revealed the over-leveraged nature of the cryptocurrency market.

Some believe this culminated in the demise of FTX in November 2022, but many fear the chain reaction to its demise could continue into 2023. , a fund invested in almost every corner of the market, could fall next.

Bitcoin’s rise to $23,000 did not dispel these concerns. The impact from FTX has yet to be felt in the regulatory arena, with many industry players expecting tighter regulation at best. Uncertainty-weakened markets are highly volatile and could quickly form another trough.

US dollar volatility

The purchase price of the US dollar has been eroding consistently over the past 100 years. Any attempt to curb the money supply was thrown out the window during the COVID-19 pandemic when the US Federal Reserve (Fed) embarked on an unprecedented mass printing of banknotes. In 2020, about 40% of all US dollars in circulation were printed.

DXY is deflationary with respect to the M2 money supply, causing significant volatility across other fiat markets. Unpredictable fiat currency makes it difficult to pinpoint Bitcoin prices and see bottoms.

Unstable fiat currencies have historically caused unnatural volatility in the prices of real assets and commodities.

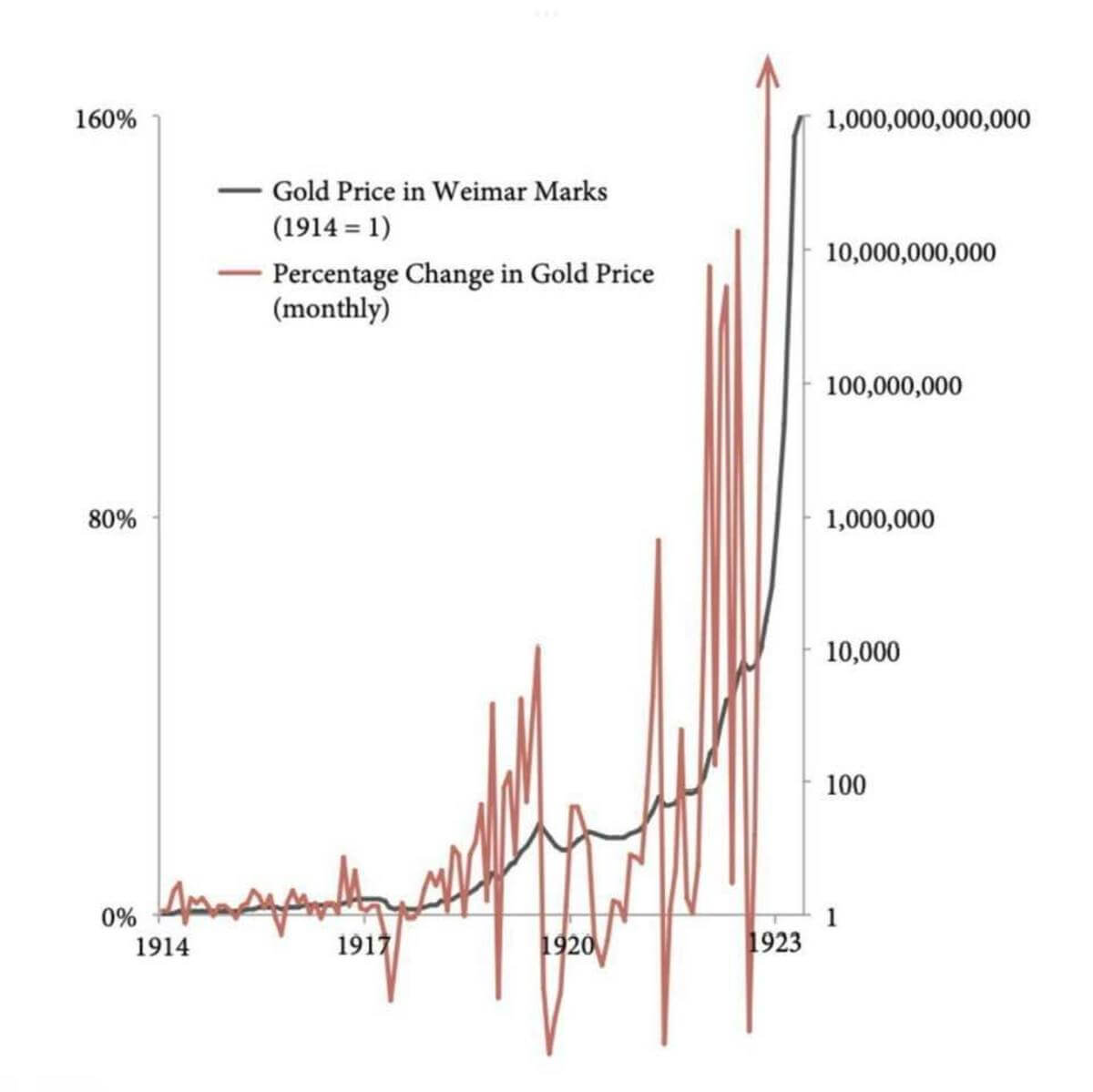

After World War I, the Weimar Republic suffered from hyperinflation, rendering the papermark worthless. This caused the price of gold to rise significantly as people flocked to put their rapidly devalued fiat currency into more stable assets.

However, while the overall price of gold rose between 1917 and 1923, the value of gold on the Papiermarks experienced unprecedented fluctuations. The statutory price of gold he rose 150% and fell 40% month-on-month. The volatility was in Papiermark’s purchasing power, not the gold purchase price.

The US and other big economies are far from hyperinflation like this, but fiat currency volatility could have the same effect on Bitcoin’s price.