Market hedged the shortest amount in over 2 years as Bitcoin rose to $21k

Investors betting on Bitcoin hit a record high as the market entered the New Year. The bears appeared to be in full control of price action when Bitcoin climbed above $16,000. crypto slate Analysis shows that those who were shorting bitcoin were not in as strong a position as investors first thought.

About $200 million of bitcoin purchases on the spot market were enough to force a massive short sale due to lower trading volumes. Additionally, several large trades executed on major exchanges moved the needle just enough to create a brief short squeeze that pushed Bitcoin from $16,800 to over $21,000.

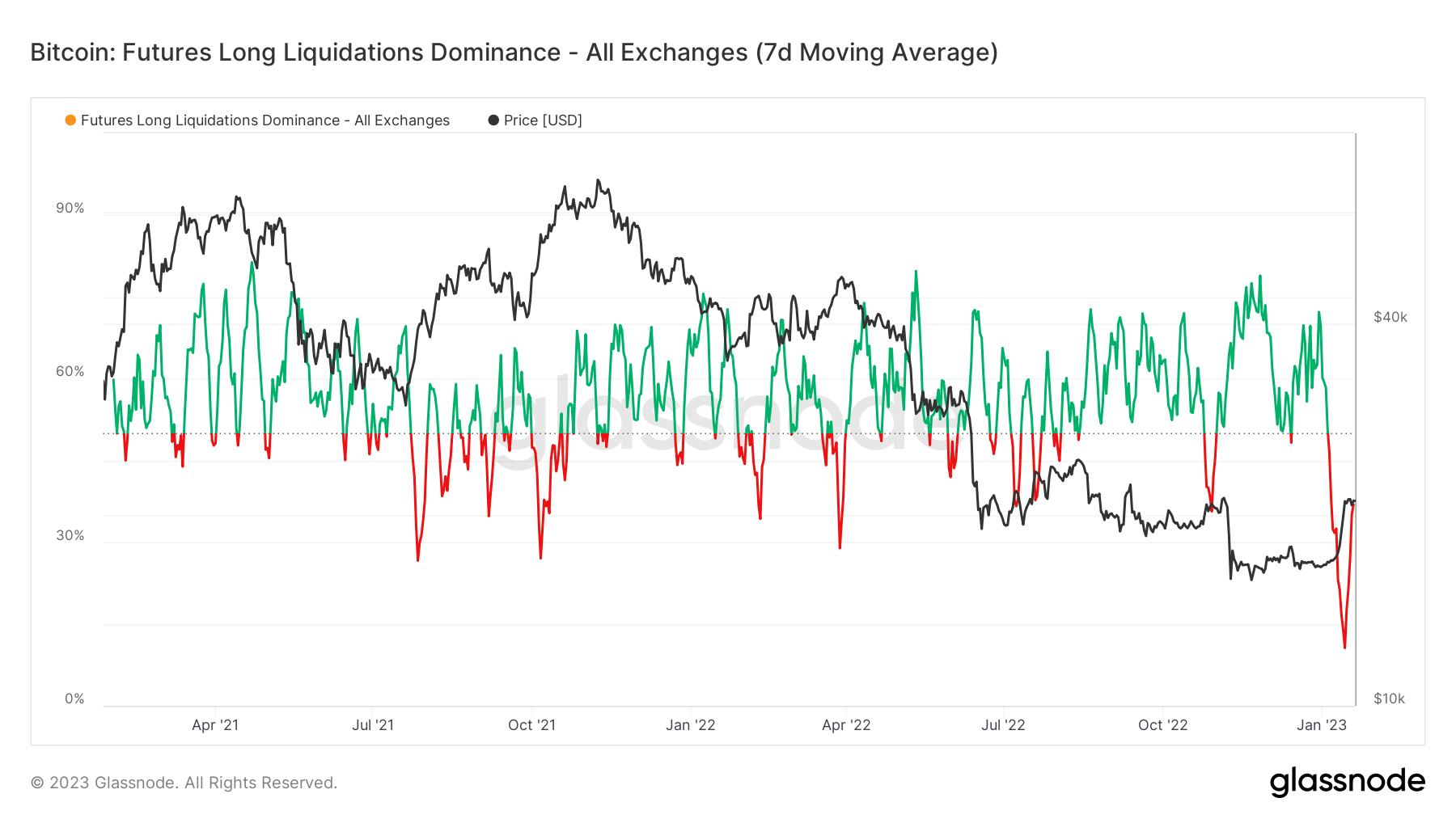

The chart below shows the futures long liquidation dominance (i.e. long liquidation / (long liquidation + short liquidation)). The 50% mark in the middle of the chart represents equal amounts of long and short liquidations. A value above 50% indicates that more longs have been liquidated, and a value below 50% indicates that more shorts have been liquidated.

Liquidations have become dominated by failed short positions that have been “rekt” by the Bitcoin price rally. Over two years, the dominance rose to its highest level as people betting on Bitcoin lost.

past liquidation

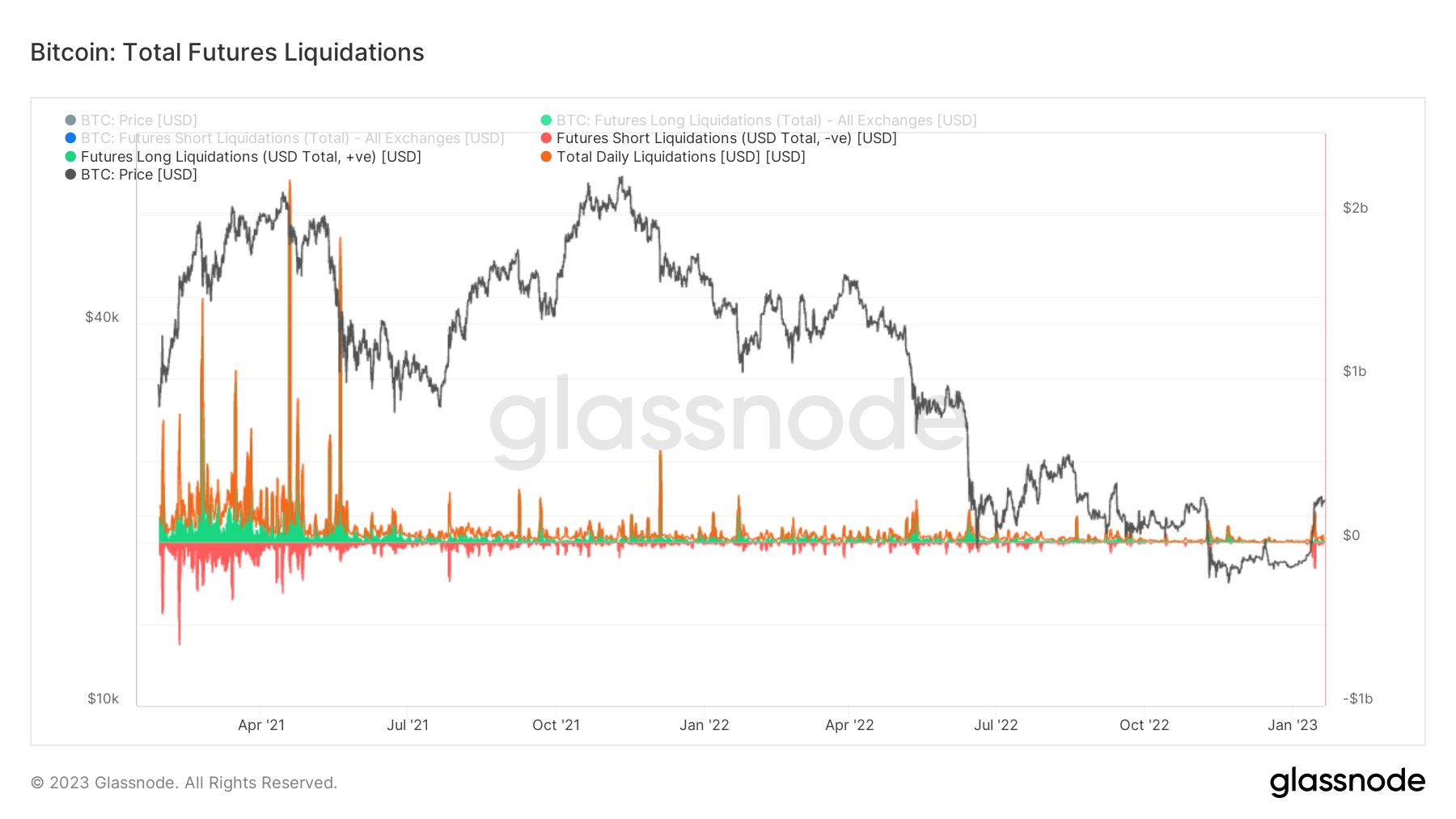

In 2021, the derivatives market exploded due to increased financial supply. Some argue that the printing of money from central banks created a liquidity surplus, artificially creating a bubble within the crypto market. However, as inflation rose and global markets became increasingly uncertain, this bubble burst and we saw global asset prices fall, including cryptocurrencies.

The market has been so bullish throughout 2021 that multiple long liquidations have crossed the $1 billion mark in many cases. The abundant leverage created small price movements, and when the leverage was wiped out, there were significant price spikes and crashes.

Liquidations have become more modest throughout 2022. As liquidity tightened, interest rates rose and cryptocurrencies continued to underperform. Notable events such as the FTX and Luna crashes have caused massive liquidations. However, nothing compares to futures trading in 2021.

Entering 2023, cryptocurrency sentiment is bearish, with the fate of DCG, Genesis and Grayscale looming over the market. As a result, the crypto market was hedged very short, with most betting on more pain. Still, buying bitcoin for around $200 million on Binance was enough to blow the short and bitcoin claim his $21,000.