Miner selloff slows down amid back-to-back difficulty increases

Bitcoin (BTC) price hikes have slowed miner sales and mining difficulty has risen by 1% in a row since the beginning of August, according to Glassnode figures.

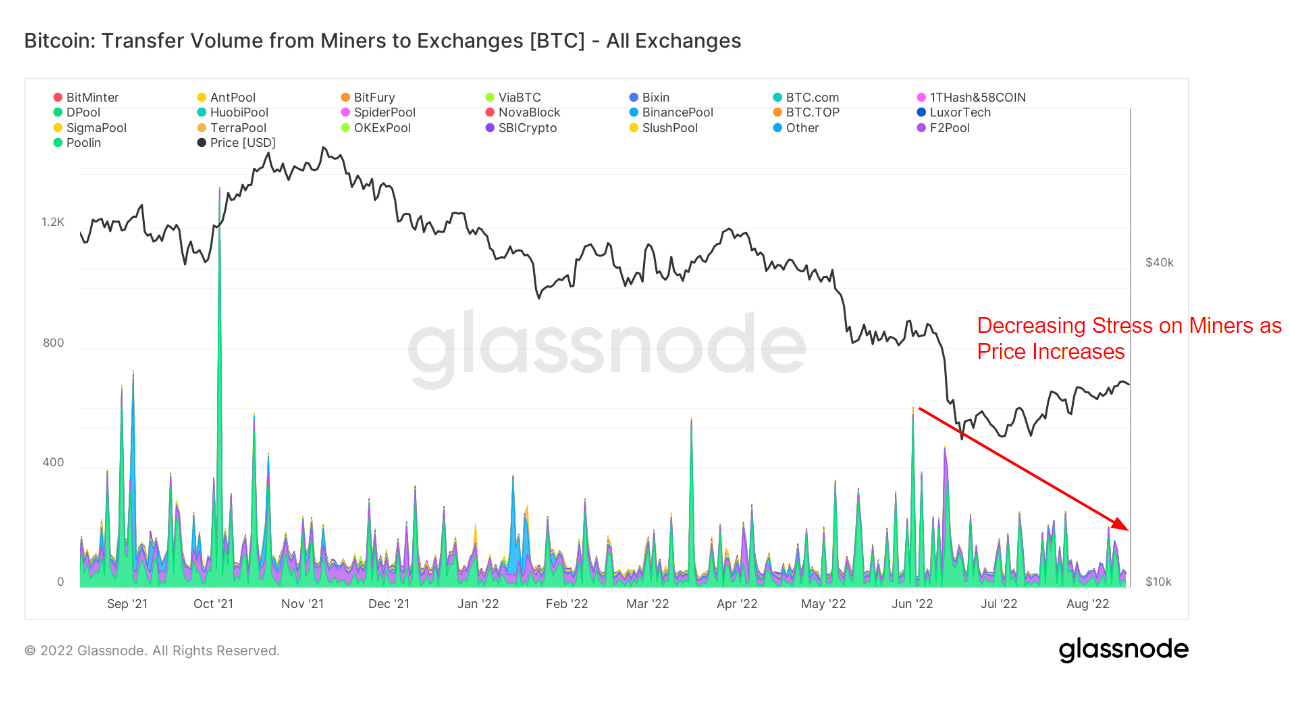

Minor liquidations began shortly after the Luna crash in May. The chart above shows coin transfers from miner wallets to exchanges. Only direct transfers are involved, and the miner sold over 600 and 400 coins at his peak on two different days.

However, figures in recent weeks show that the number of coins sold to exchanges by miners is declining. This decline corresponds to Bitcoin’s recent price rally, indicating less stress on miners.

minor liquidation

The Winter Market began after the Luna crash and has been giving miners a hard time since day one. As soon as Bitcoin fell to his $20,000 level, all mining equipment older than 2019 became unprofitable. As such, mining companies began to face financial problems. Giants such as Compass Mining and Core Scientific are just two of his examples of the many mining companies that have had to sell most of their holdings and equipment to pay their bills.

Difficulty up

The recent rise in the Bitcoin price may alleviate some of the financial concerns of miners, and the worst may be past from a mining perspective.

The chart above shows that the 60-day and 30-day hash ribbons are still reversing, but appear to be bridging the gap due to less stress from improving price levels.

However, that is subject to change as the difficulty may increase by more than 1% on August 18th. This is the second rise since the beginning of the month.

The last consecutive rise in mining difficulty was in April 2022, just before the Luna collapse ignited a bear market.