Miners finally see some relief as difficulty decreases 7.32%, making it the largest difficulty reduction in 2022

The crypto industry has always been very volatile, but few could have predicted the turmoil it will experience in 2022. This year has been an unprecedented one for the industry, with every aspect affected by the collapse of Luna and FTX.

Bitcoin miners remain the most affected by the crisis, aside from retail investors who have suffered substantial losses in these black swan events.

But it’s not just the price of Bitcoin that keeps miners under the radar.

Dozens of mining companies went public last year, acquiring cheap debt in the process. Debt, originally intended to expand the business, is now a burden. The rapid decline in cryptocurrency prices has made it nearly impossible for many to pay off their loans while struggling with rising energy prices and skyrocketing equipment costs.

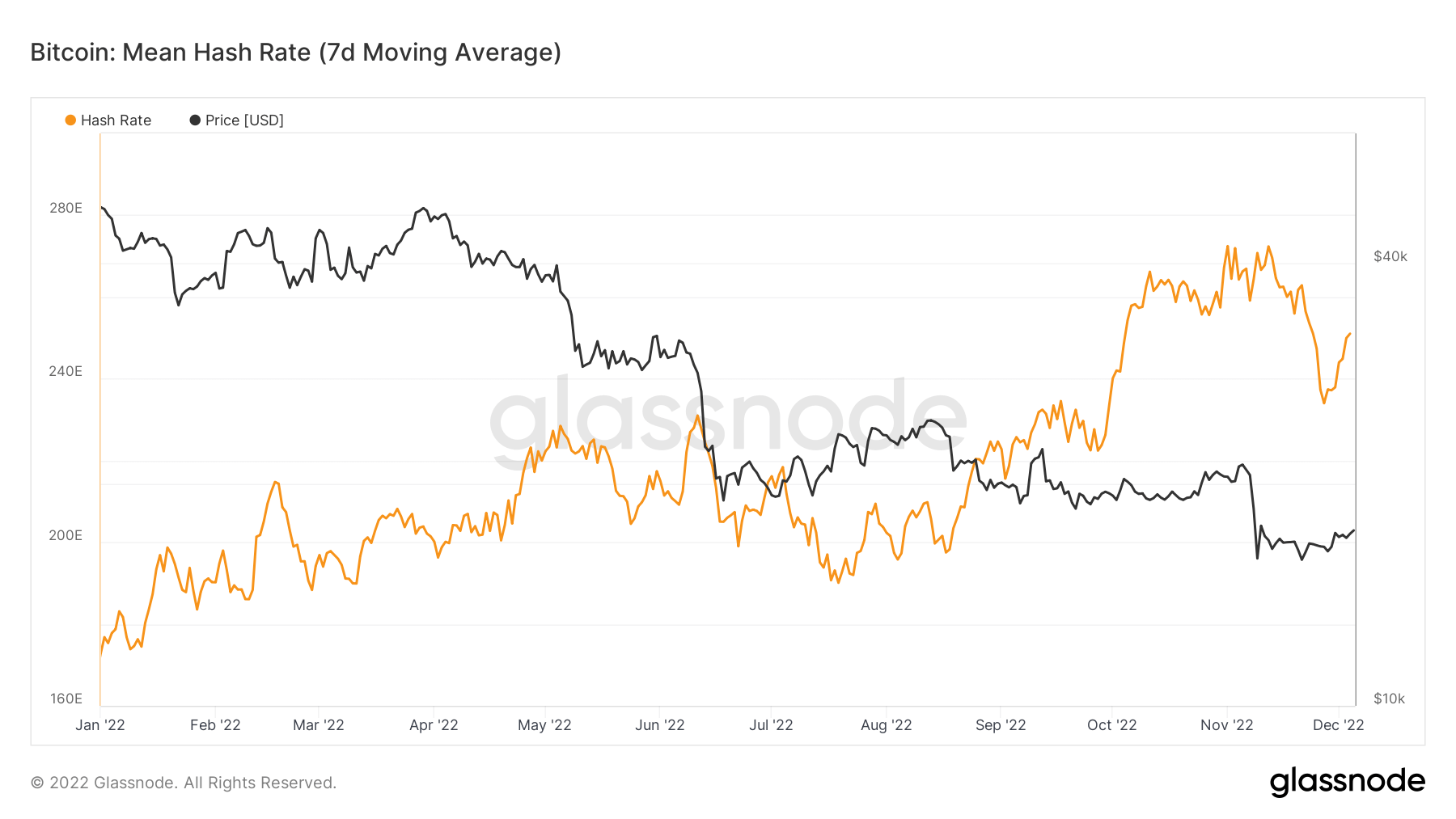

This has forced many miners to scale back or stop operations altogether.As a result, the 7-day average is hash rate It has decreased by 8.4% over the past month and by 4.6% since the current difficulty epoch began.

Bitcoin hashrate peaked in mid-November after recording a parabolic rise in August. But that rapid rise was followed by his biggest one-day drop since July 2021, down 13%.

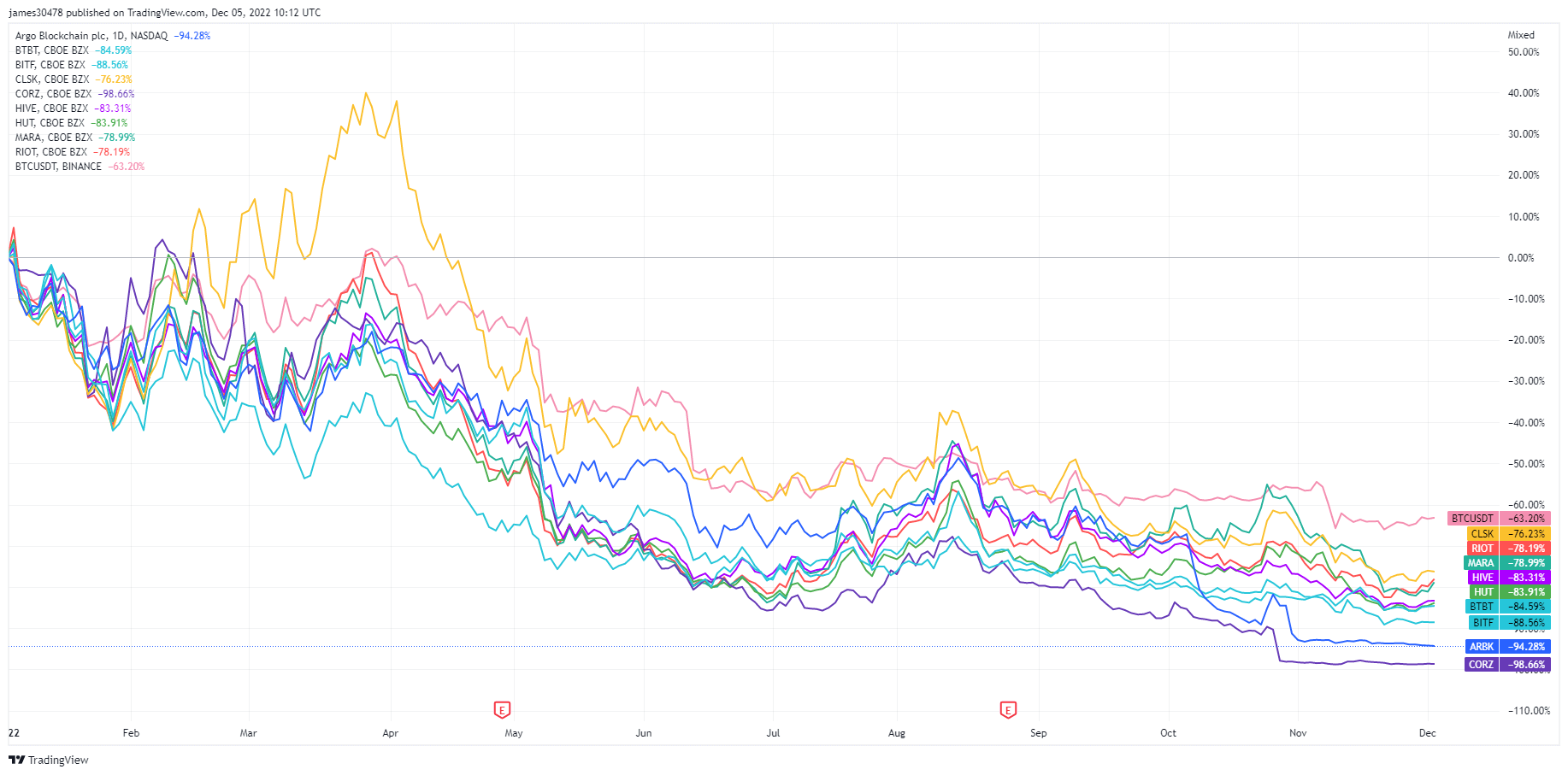

So far, the market has experienced two major minor capitulation events this year. Many public Bitcoin miners have survived by emptying Bitcoin’s balance sheet, negatively impacting stock prices.

Since the beginning of the year, the stock prices of all nine of the largest public Bitcoin miners have plummeted, with some losing 98.66% of their value.

However, the struggling industry could see some easing in the coming days.

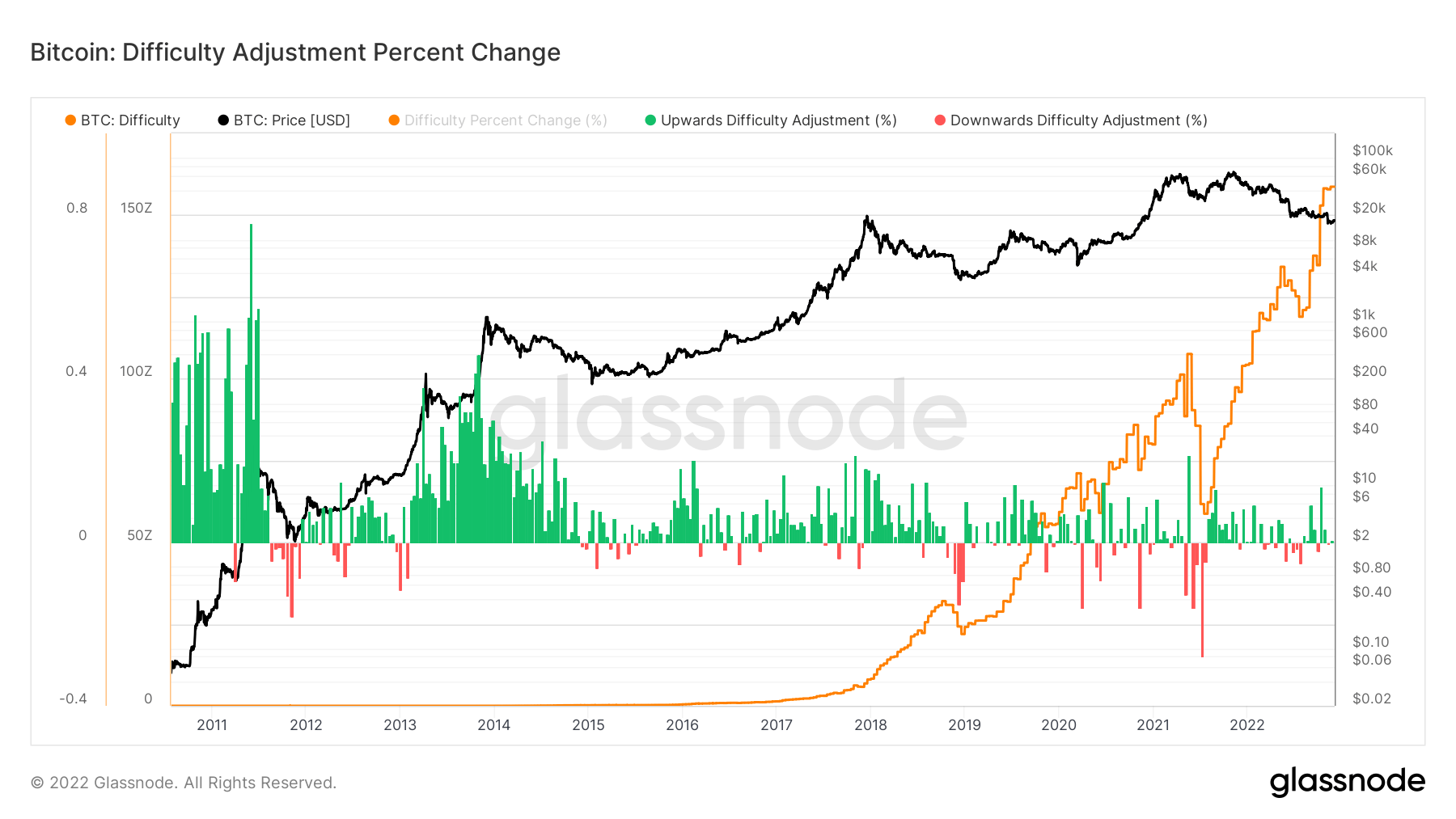

Bitcoin mining difficulty dropped by more than 7% in the early hours of December 6th. While the massive drop may seem insignificant, this is the industry has seen since July 2021, when China enacted its controversial bitcoin mining ban. This is the most important adjustment of all.

A 7.32% drop in difficulty should give miners peace of mind at the end of the year and at least some support for their narrow profit margins. However, it remains to be seen how the global hash rate will react to the decrease in mining difficulty as it could be another week before we see any noticeable change.

Despite this, Bitcoin mining difficulty remains double what it was in June 2021. Additionally, the global mining difficulty has continued to increase throughout the year and is now triple what he was in June 2021.