New FTX CEO John Ray’s statement on bankruptcy case tells tale of an unmitigated disaster

FTX’s downfall this week culminated in the company filing for Chapter 11 bankruptcy on November 11th. The application includes all 130 companies under its umbrella, as well as the trading company Alameda.

With the announcement of this news, Sam Bankman-Fried has stepped down as CEO. John Ray, who oversaw Enron following the 2007 accounting scandal, took the blame following SBF’s resignation.

Commenting on the bankruptcy, Ray said the Chapter 11 filing would provide relief and allow for a thorough assessment of the situation to maximize recovery for all stakeholders.

Chapter 11 Filings allow a company to continue trading and are usually carried out in business restructuring cases.

a ‘A complete failure’

Submitted by Ray Chapter 11 Petitions and First Day Petitions with Delaware bankruptcy court on November 17.

After reading the FTX book, Ray blamed his former company management, saying he never encountered it.such a complete failure of the enterprise such a complete lack of control and reliable finsAn information. ”

In particular he pointed out compromised system integrity, inadequate regulatory oversight abroad, Control was put in the hands of a very small group. All of them were inexperienced and incapable of performing operations on the scale of FTX.

Ray says:

“FTX Group did not maintain centralized control of its cash. Failures in its cash management procedures included the lack of an accurate list of bank accounts and account signatories, as well as the creditworthiness of its banking partners around the world. Sufficient care was not included.Under my direction, the debtor has established a centralized cash management system with appropriate control and reporting mechanisms.”

aftermath

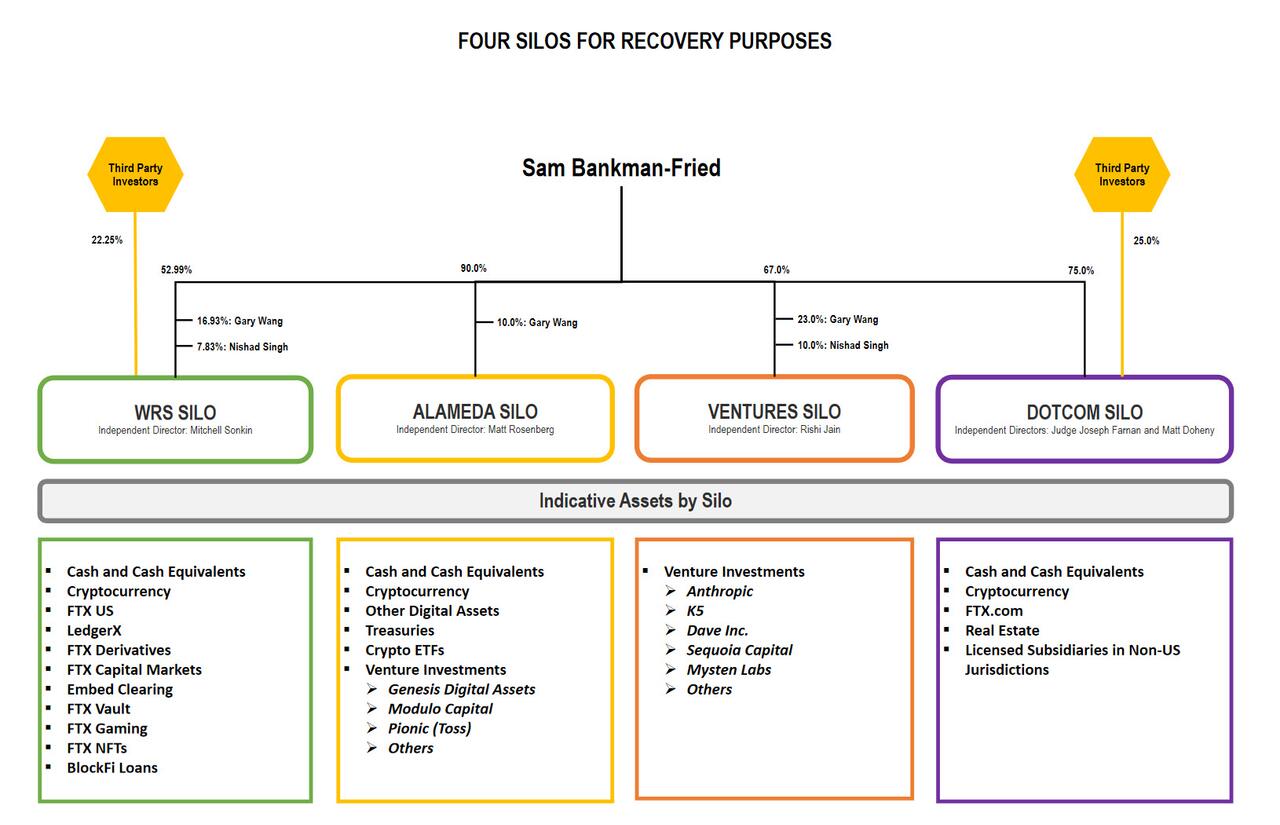

To manage the bankruptcy process, the business was divided into four groups or silos. For each silo, Ray included an unaudited balance sheet as of September 30, 2022. Here’s an overview:

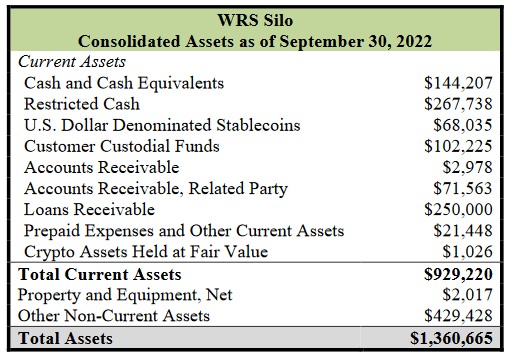

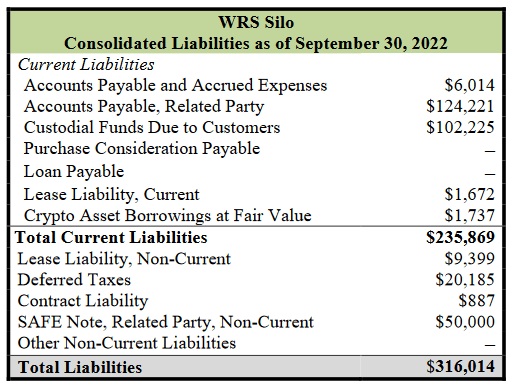

West Realm Shires Inc. Silos (WRS) include FTX US, LedgerX, FTX US Derivatives, FTX US capital markets and It embeds clearings, among other entities.

- Total assets on the balance sheet are $1.36 billion, of which $929.2 million is related to current assets. Total liabilities are $316 million and current liabilities are $235.9 million.

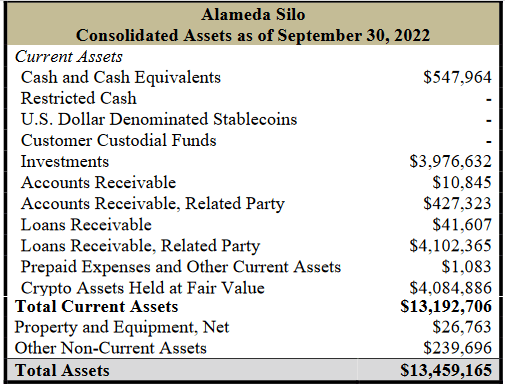

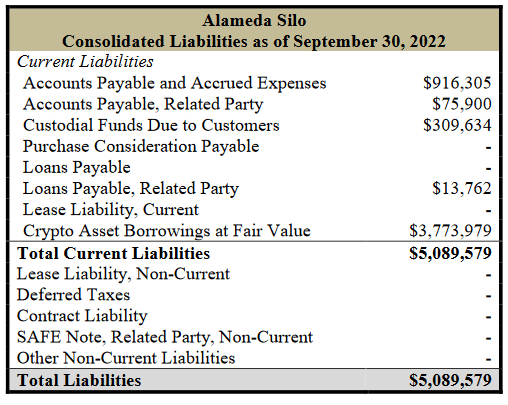

Alameda Silo Refers to an entity that specializes in Quant trading fund; it contains Alameda Research LLC Debtor under DEllaware, South Korea, Japan, British Virgin Islands, Antigua, Hong Kong, Singapore, Seychelles, Cayman Islands, Bahamas, Australia, Panama, Turkey, Nigeria.

- Total assets on the balance sheet are $13.5 billion, of which $13.2 billion are current assets. Total debt is $5.09 billion, all current.

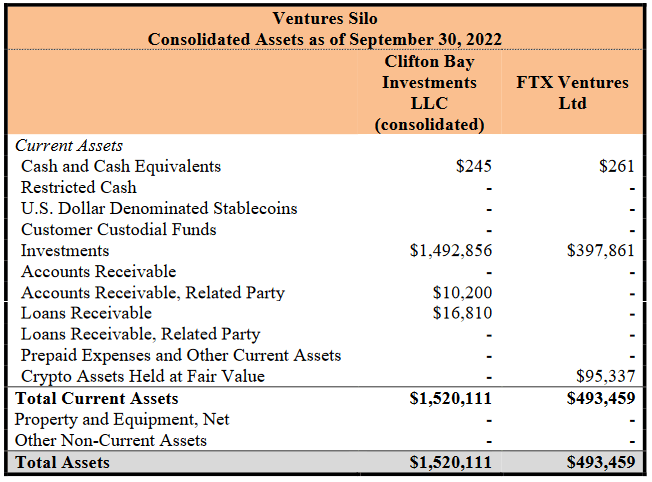

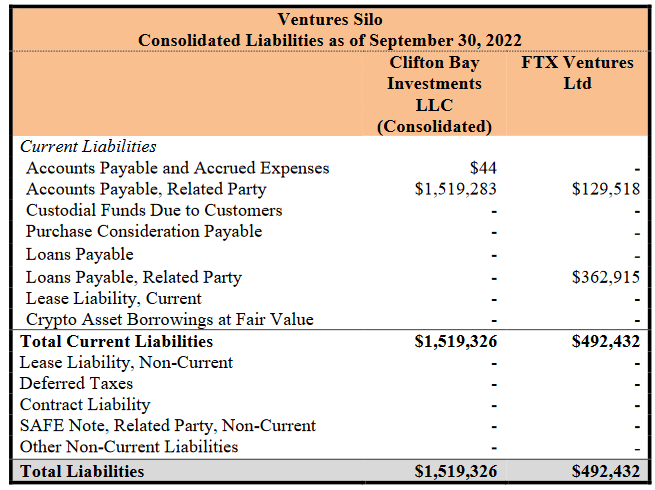

Ventures Silo The company is associated with private investment entities including: Clifton Bay Investments, LLC, Clifton Bay Investments FTX V, Inc.Entures Ltd., Island Bay Ventures Inc, and other entities.

- Clifton Bay Investments LLC and FTX Ventures Ltd have combined balance sheet total assets of $2,014 million, all of which are current. Similarly, total debt is $2.012 billion, which is the current value.

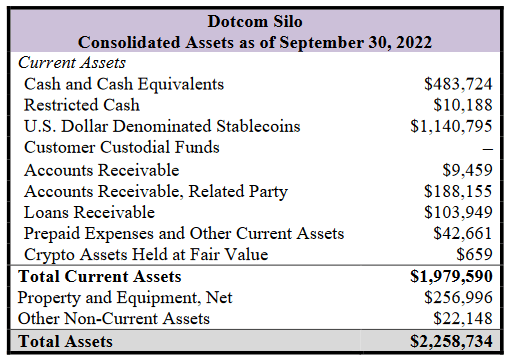

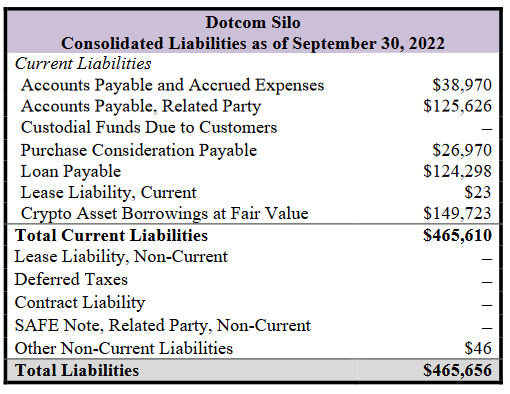

Dotcom Silo Retains specific marketplace licenses and registrations Includes FTX digital trading platform and exchange.

- Total assets on the balance sheet are $2.259 billion, of which $1.98 billion is liquid assets. Total debt is $466 million, all but $46,000 current.

In both cases, current assets exceed total liabilities. However, given the inadequate corporate management prior to arrival, Ray said:to be confident” any of the financial statements;

Ray said the FTX Group companies failed to maintain centralized control of their cash. That means you don’t have a list of bank accounts to check your cash balance. Similarly, the company’s controls were poor, with no cash management system or proper reporting mechanism in use.

WRS Silo’s audit firm is Armanino LLP, Ray said, “professionally familiar with the company. However, he is not familiar with the dot-com silo’s audit firm, Prager Metis.” Prager Metis prides itself on being “the first CPA firm to formally open its Metaverse headquarters in the Metaverse platform’s Decentraland”.

CEO said:

“I have considerable concerns regarding the information presented in these audited financial statements, particularly the dotcom silos. We do not believe it is appropriate to rely on audited financial statements as a guide.”

unchecked loan; purchase of house with company funds

The bankruptcy filing also revealed that Sam Bankman Freed had taken a $1 billion personal loan from Alameda Research.

Alameda also provided a $543 million loan to FTX Engineering Director Nishad Singh. The company also gave FTX co-CEO Ryan Salame his $55 million loan.

With a clear disregard for corporate processes, Ray argued:

“FTX Group corporate funds were used to purchase homes and other personal items for employees and advisors.”

The property is located in the Bahamas and the new CEO said “there are no documents” to identify the purchase as a loan.

Where can I find digital assets and other investments

Bewilderingly, Ray further portrayed a chaotic approach to bookkeeping and security. SBF and co-founder Gary Wang “controlled access to digital assets for the FTX Group’s core business.” Internal practices were described by Ray as “unacceptable”. A notable example of poor security hygiene was the use of a group email account as “root user to access sensitive private keys”.

There was no regular cadence to “adjusting positions on the blockchain,” but software was used to “hide any misuse of customer funds.” Ray specifically emphasized “Alameda’s exemption from secrecy” from certain documents to prevent funds from being liquidated without manual intervention.

It is said that new wallets are still being discovered. His one such cold wallet contains about $740 million, but the FTX Group company has yet to confirm the source of the funds. Additionally, it is unclear whether the funds should be split among multiple entities within the FTX Group.

Now, Ray has confirmed that $372 million was transferred without authorization after filing for bankruptcy, while $300 million in FTT tokens were also minted after the deadline. Additionally, FTX companies believe there are other crypto wallets that SBF and the former leadership team have yet to disclose.

Forensic analysts are employed to search for missing funds, trace transactions and attempt to link crypto assets. Ray commented that analysts “could uncover what could be a very large transfer of property in the company.” Court assistance was mentioned as a potential direction to resolve this issue.

Ray outlined the current state of the investigation.

“Based on the information I have received so far, it is my opinion that many FTX Group employees, including some senior management, were unaware of the shortfalls and potential.

Digital assets are mixed. ”

The new CEO believes that “current and former employees” may have been “most hurt” by FTX and SBF’s alleged failure to act.

Strikingly, Ray claimed Alameda and the major companies associated with FTX Ventures “did not keep complete books and records of their investments and activities.” The balance sheets of affected companies have been finalized from “bottom up” to cash records.

no paper trail

The SBF’s lack of record of key decisions was described by the acting CEO as one of its “most pervasive failures.” The communications application used by SBF was set to “auto-delete” messages, and employees were encouraged to do the same.

Among the seemingly basic tasks, Ray detailed that companies are currently “getting things down.”

Teams involved in bankruptcy proceedings include former directors of the SEC and CFTC, and members of the US Department of Justice’s Cybercrime Division. Ray and his staff have reached out to “dozens of regulators” for their insistence on transparency.

Current role of SBF

Ray took the opportunity to say that SBF “is not their mouthpiece” for the FTX companies involved in bankruptcy proceedings. He further confirmed that SBF is now in the Bahamas and explained that his communications were “unstable and misleading.”

recovery

Ray said the exact cash position is unknown at this time due to these cash management missteps. However, both companies are working with rehabilitation consultants Alvarez & Marsal to resolve the situation.

Funds found by FTX Group companies are “deposited into U.S. financial institutions.” Each “silo” of funds is segmented so Ray’s team can assign “costs to different silos and debtors.”

A cash management motion will be filed “immediately” to detail how cash will be managed going forward.