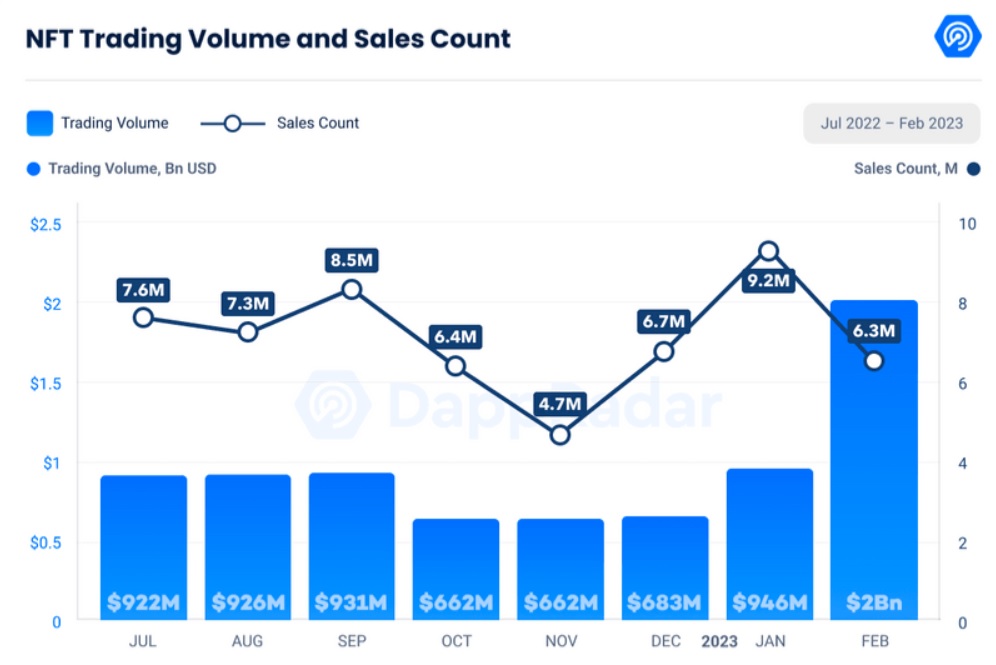

NFT trading volume returns to pre-LUNA crash levels in February

According to an industry report from DappRadar, the non-fungible token (NFT) market volume increased to $2 billion in February, reaching pre-LUNA crash levels.

NFT trading volume surged 117% from $956 million in January. data indicate.

Despite a significant surge in NFT trading volume, the number of sales fell by 31.46% to 6.3 million from 9.2 million in January.

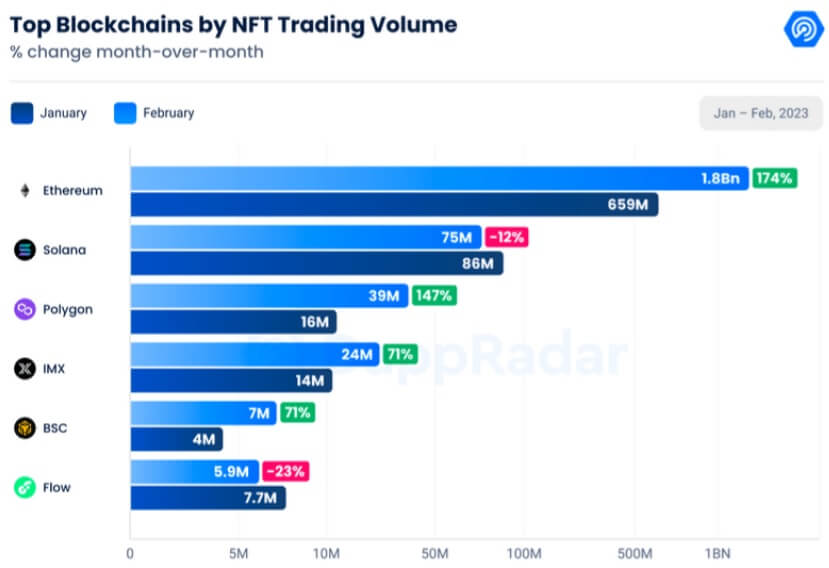

In February, Ethereum (ETH) remained the top blockchain by NFT trading volume. The chain’s trading volume he hit $1.8 billion, up 174% from his $659 million in January. Based on these figures, ETH accounts for 83.36% of his total NFT market.

Solana (SOL) and Polygon (MATIC) became the second and third chains after ETH, with the highest NFT trading volume in February. SOL ranked second, driving his $75 million trading volume, but he still recorded a 12% decline from his $86 million in January. Meanwhile, MATIC recorded a 147% increase in his February, taking him to $39 million from $16 million the previous month.

Blur vs. OpenSea

Blur surpassed OpenSea in trading volume in February. Blur facilitated over $1.3 billion in trading volume throughout his month, while OpenSea placed him second with $587 million. These figures show that Blur accounts for his 64.8% of total NFT market volume, while OpenSea accounts for his 28.7%.

X2Y2 and LooksRare recorded $39 million and $29 million in transaction volume, accounting for 1.9% and 1.4% of the total market respectively, placing them third and fourth in the rankings after OpenSea.

Profit Seeker vs. Art Lover

The difference in trading volume shows Blur to be the busiest NFT market, but OpenSea still holds the most users. Blur currently has 96,856 users, while OpenSea has 316,199 users. To catch up with OpenSea on that front, Blur is trying to increase its user count by issuing airdrops to loyal users.

Concerning this contrast between number of users and trading volume, DappRadar said:

“this [the contrast in numbers] We confirm that Blur’s trading patterns are driven primarily by NFT whales farming on the platform, rather than typical trading activity. ”

In support of this perception of blurring, Whale recently sold 139 NFTs, earning $9.6 million.

Certain segments of the community have criticized Blur for stripping NFTs of their art and attracting people by driving big revenue. Aaron Sage, a representative of this crowd, recently wrote:

“I wish the NFT space would switch lenses on art and culture (even monkey hoots in clubhouses and lazy lions Twitter raids) like they used to.“