Nvidia’s Revenue Drops Further, But Demand for Ada GPUs Exceeds Supply

Nvidia announced its third quarter results for fiscal year 2023 on Wednesday as its latest products based on the Ada Lovelace and Hopper architecture began to launch. As expected, the company’s gaming and professional graphics solutions sales declined quarter-over-quarter and year-over-year. Yet at the same time, the company sold a ton of data center products, including its latest H100 computing GPU. Additionally, demand for his latest GeForce RTX 40 series was so high that Nvidia couldn’t keep up.

Colette Kress, Chief Financial Officer of Nvidia, said: “The first Ada GPU, the GeForce RTX 4090, launched in mid-October after tremendous demand and positive feedback from the gaming community. We are working hard to keep up with demand.”

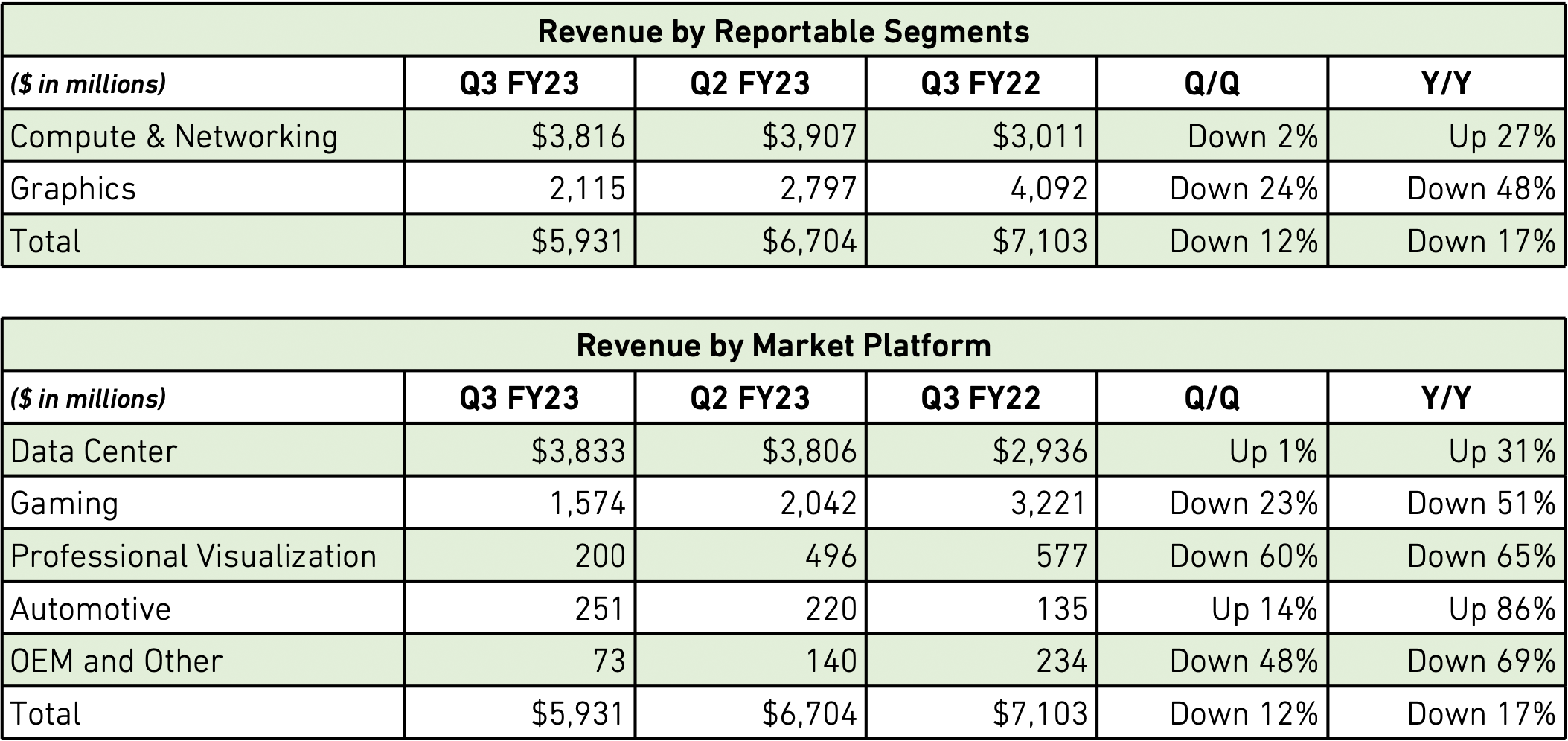

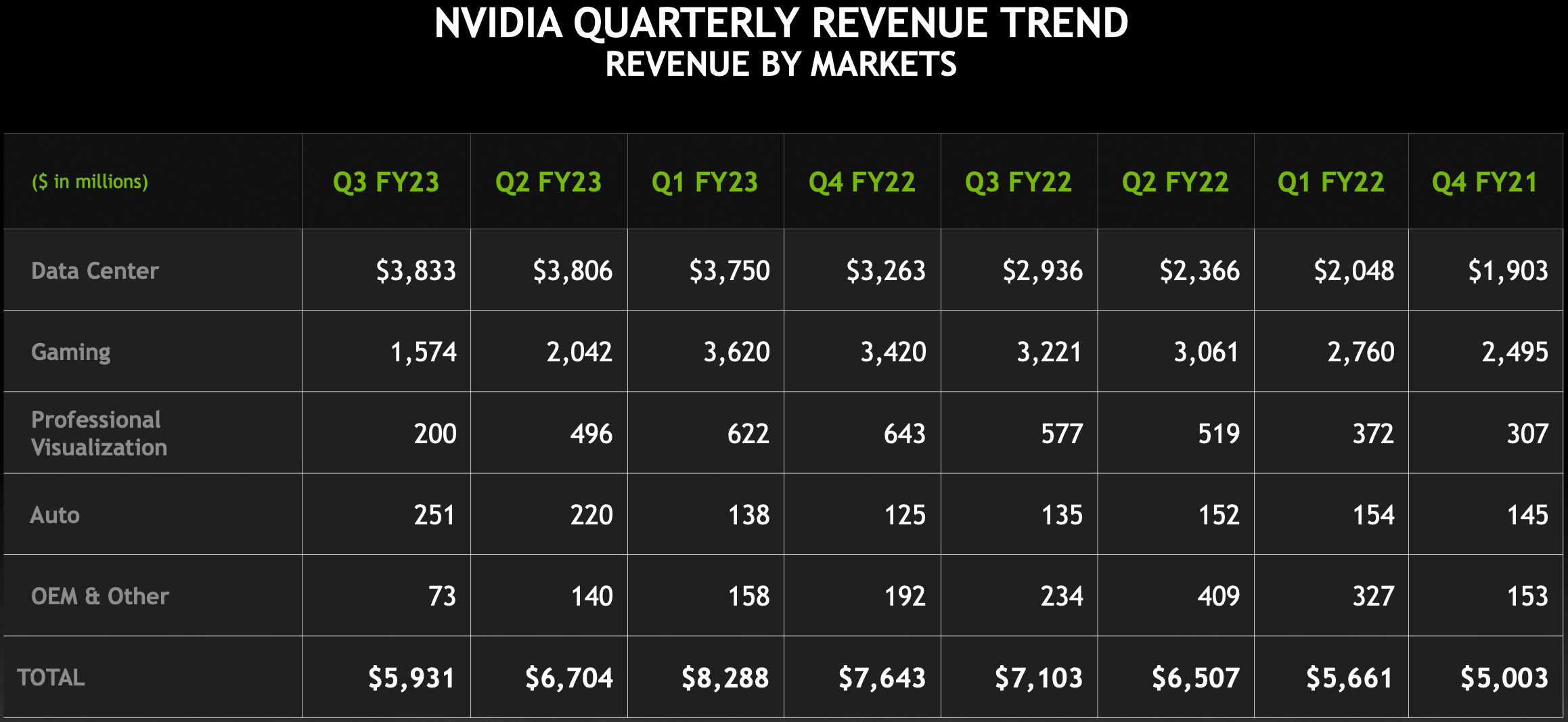

Nvidia’s third quarter 2023 revenue fell to $5.93 billion, down 12% quarter-on-quarter and 17% year-over-year. Net income fell to $680 million as the company’s gross margin fell to 53.6%, down from about 65% in the most recent quarter (but up from 43.5% in Q2 FY2023). Increased 4% quarter over quarter (QoQ). However, it is down a whopping 72% from the same period last year.

Client GPU is down

Nvidia’s consumer and professional graphics card sales declined in the third quarter of 2023. Nvidia’s gaming revenue totaled $1.57 billion, down 23% from the previous quarter and down 51% from the year-ago quarter. Additionally, Nvidia’s ProViz revenue fell 65% year-over-year and 60% quarter-over-quarter to $200 million. Sales of cheap GPUs to OEMs and CMP series GPUs to miners were the lowest in years at $73 million.

Graphics card sales are declining due to slowing client-side demand and an essentially non-existent mining GPU market. Mining, on the other hand, indirectly delays the sale of the client’s GPU, as the miner sells the board through his eBay and other platforms. Most of Nvidia’s GPUs available on the market are completely Expected. Supply (from both graphics card manufacturers and owners) exceeds demand.

Meanwhile, the company also began shipping all-new GeForce RTX 4090 and GeForce RTX 4080 products during the quarter, thus offsetting weaker sales of the GeForce RTX 30 series and positively impacting profit margins. Both GeForce RTX 40-series products available today are the best published graphics cards, have no direct competitors (not until December 13th), and have no second-hand market, making them uniquely positioned It is Still, the GeForce RTX 4080 and RTX 4090 have price tags of $1,199 and he $1,599, so Nvidia can’t sell them in bulk for obvious reasons, and the RTX 4090 can’t keep up with demand. I could not do it.

Interestingly, Nvidia said the successive declines in client GPU sales were not only due to lower demand for desktop discrete graphics cards, but also lower sales of laptop GPUs. says. Perhaps some customers are waiting for the arrival of a new generation of laptops based on Intel’s Raptor Lake and Nvidia’s Ada Lovelace GPUs, while others are wary of investing heavily in a device given the current economic climate. There is also

Let data center products shine

But while Nvidia is doing well in the high-end client PC segment, it’s also doing very well in the data center space. As a result, the company’s third-quarter DC revenue increased to $3.83 billion, up 1% from the previous quarter and up 31% from the same quarter in fiscal year 2022.

During the quarter, Nvidia began mass shipments of its H100 computing GPU based on the Hopper architecture, allowing it to supply its various customers with expensive SXM modules and PCIe graphics cards powered by this processor. Additionally, the company continues to ship various of his A100-based products to large cloud service providers as well as various other types of clients.

“[Our data center revenue] Mr Kress said: “This reflects very strong performance in the face of macroeconomic challenges, new export restrictions and persistent supply chain disruptions. Brought about by the expansion of consumer internet companies to load large language models, recommendation systems, generative AI, etc. The number and size of public cloud computing and internet services companies deploying Nvidia AI has grown. As we move forward, we need to extend the traditional definition of hyperscale to communicate different end-market use cases.”

With the US government restricting the sale of A100 and H100 computing GPUs to Chinese customers, Nvidia suggests other offerings (A30) to offset its inability to offer Chinese customers a more powerful option. but I’m guessing) had to be shipped. A headwind for the data center business. Over the next few quarters, these restrictions will be eased with the recently introduced A800 compute GPUs. This meets US government export requirements and Nvidia will continue to ship to Chinese customers over the long term. Nvidia’s clients, on the other hand, must qualify for new products before they can roll them out.

Given that Nvidia’s data center sales now exceed client product sales by a factor of 2.4, the green company can formally be called a data center company, or the AI company it prefers in recent years. I can do it.

Automotive products up

Nvidia’s products for the automotive market set an all-time revenue record of $251 in the third quarter of fiscal year 2023. This is an 86% increase from last year. Although the company continues to aggressively introduce new platforms for automotive applications, the actual sales are due to the self-driving media announced long ago and now on the market.

Outlook remains cautious

Nvidia expects fourth-quarter 2023 revenue to reach $6 billion ±2%, with gross margin up 63.2%. However, in the fourth quarter of 2023, he will have $6 billion in sales, which puts him 21.5% below the company’s earnings.

On the gaming side of the business, Nvidia expects revenue to increase as clients dispose of older products and restock with newer GPUs. Additionally, the company’s sales will increase as Nvidia continues to expand the availability of graphics options for his GeForce RTX 40 series. Still, it does not quantify that increase, nor does it provide any guidance as to how significantly client GPU sales will increase.

On the data center side, Nvidia plans to continue increasing sales of its H100-based products (in the form of SXM modules, PCIe cards, and DGX systems), leading to declining sales of compute GPUs to Chinese clients. offsets the