On-chain Bitcoin metrics show the bottom may not be in

CryptoSlate’s analysis of on-chain Glassnode metrics showed mixed results for Bitcoin’s bottoming out.

A previous study, released on Sept. 27, looked at the Profit Supply Rate (PSP), Market Value to Realized Value (MVRV), and Profit and Loss Supply Rate (SPL) indicators. All of this indicated that a bottom was forming at that point.

Revisiting these same metrics, we find that PSP and MVRV are still bottoming out, but SPL is no longer bottoming out.

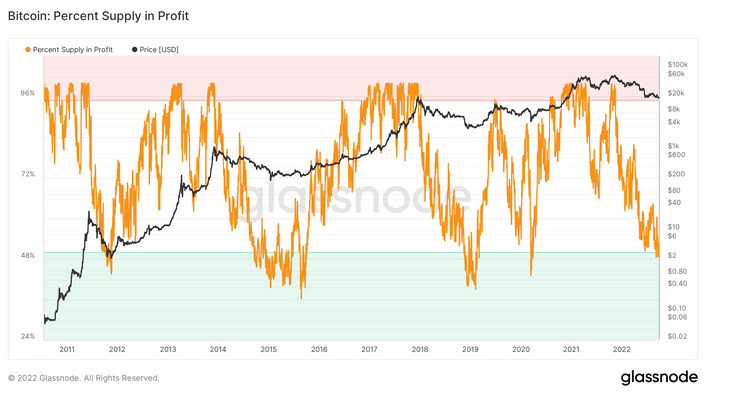

Bitcoin address share in profit

Bitcoin: The Percent Supply in Profit (PSP) metric refers to the percentage of unique BTC addresses that have an average purchase price lower than the current price.

During the bear market, the percentage of profitable Bitcoin addresses was always below 50%. Crossing this threshold usually coincides with a bullish price move.

The chart below, dating back to 2010, shows the current reading below 50%, suggesting the card is bottoming out.

However, the analysis shows that the profit margin on BTC supply is much lower than the historical 50%, with profitable addresses dropping to 30% in 2015, the most extreme example on record.

2015 was an anomalous period, swinging above and below the 50% threshold many times before a definitive PSP breakout occurred towards the end of the year. This corresponds to BTC regaining $1,000.

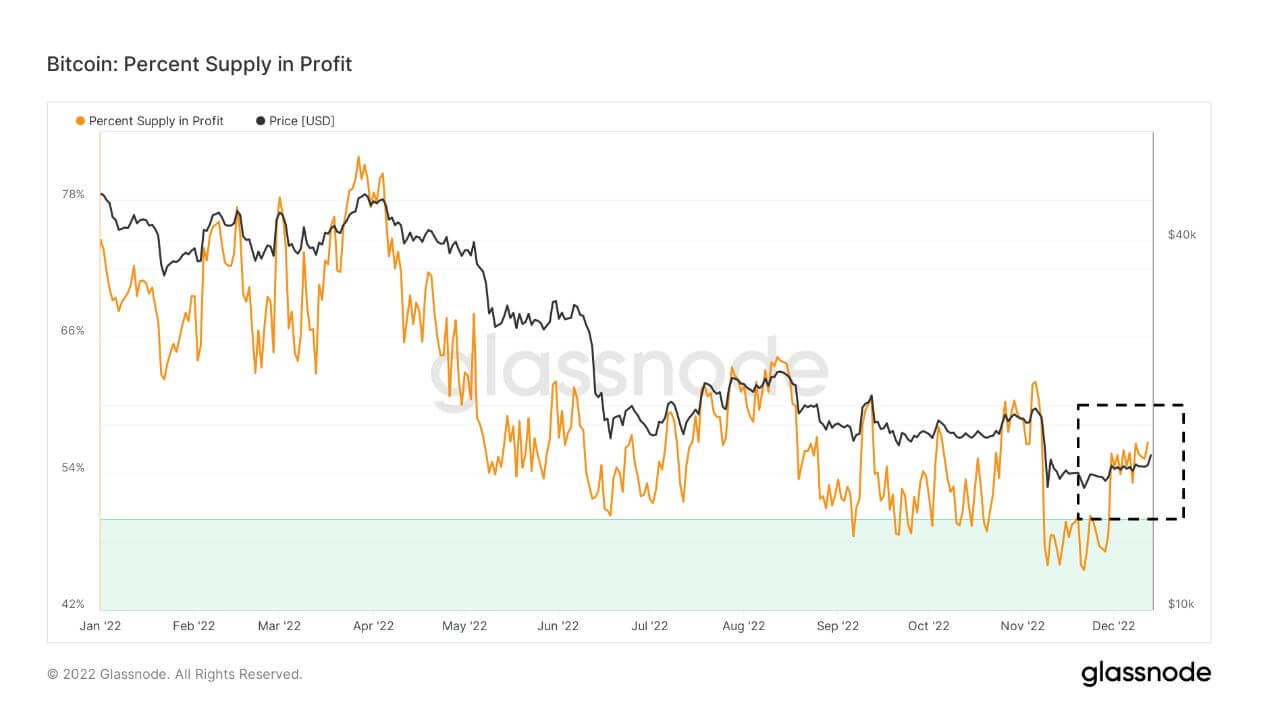

Extending the movement to 2022, PSP is below the 50% threshold, but was above it in December.

A decisive break above the previous local top of around 60% could indicate a price reversal. But another scenario could be a repeat of 2015. This could lead to instability near the border, lower PSP levels and selling pressure being the dominant factor.

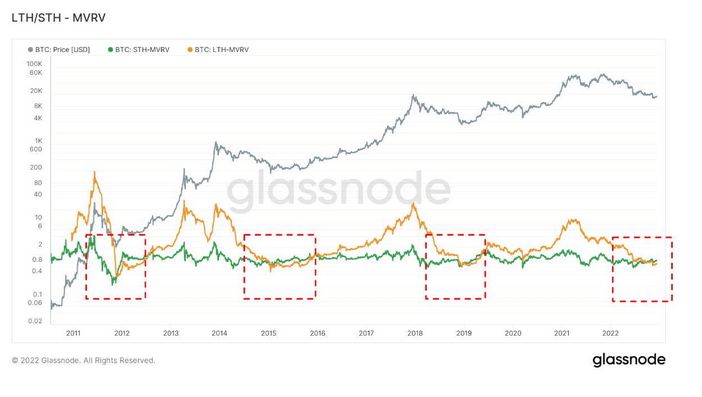

Realized value from market value

Market Value to Realized Value (MVRV) refers to the ratio between market cap (or market value) and realized cap (or stored value). By collating this information, MVRV shows when the price of Bitcoin is trading above or below its “fair value.”

MVRV is further divided by long-term and short-term holders. Long-term holder MVRV (LTH-MVRV) refers to unused transaction output with an expiry of at least 155 days, and short-term holder MVRV (STH-MVRV) refers to unused transaction expiry of 154 days or less.

The previous cycle bottom was marked by the convergence of the STH-MVRV and LTH-MVRV lines, with the former outperforming the latter, signaling a bullish reversal in price.

STH-MVRV moving above LTH-MVRV was pointed out in the September 27 investigative report. An updated chart now shows this pattern holding, suggesting that the bottom is still near.

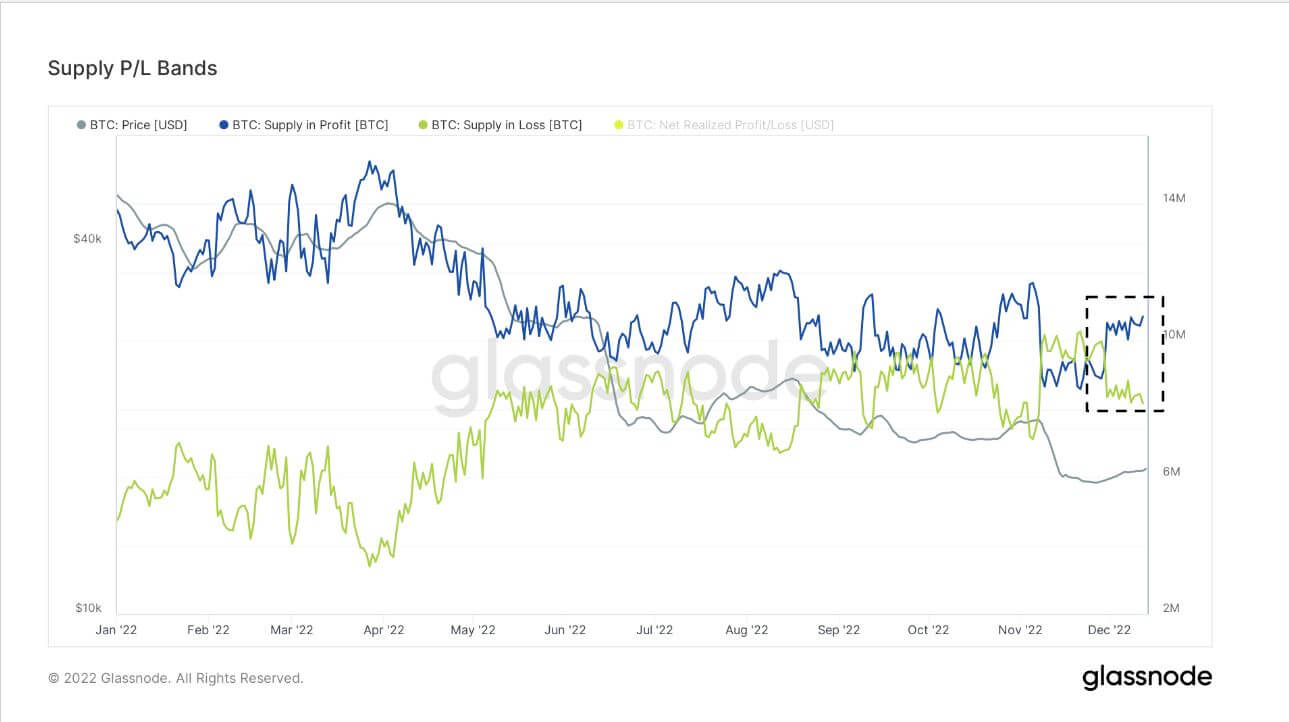

supply at profit and loss

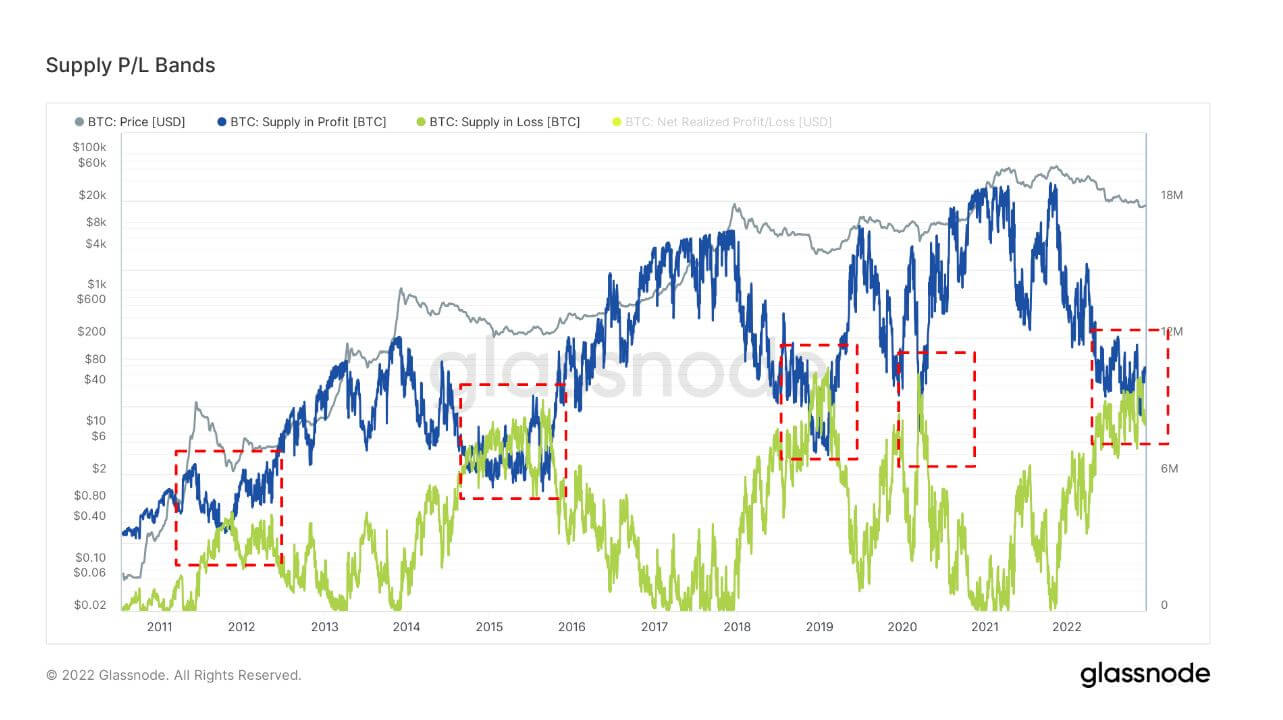

By analyzing the number of BTC tokens that were lower or higher than the current price when the price last moved, the profit and loss supply (SPL) metric shows the cyclical supply of profits and losses.

The bottom of the market cycle coincides with the convergence of profit supply (SP) and loss supply (SL) lines. A price reversal occurs when the SL line crosses the SP line. Now the convergence of SP and SL is happening.

Analyzing this on the expanded timeframe of 2022 shows that convergence occurred around September and began to bottom out. However, since December, the SP and SL lines have diverged significantly, nullifying any bottoming out.