On-chain data showed FTX was in trouble right before it collapsed

On November 2nd, Coindesk went virtual after releasing undisclosed financial documents of Alameda Research, a VC and trading firm owned by FTX founder Sam Bankman-Fried and closely associated with the exchange. It caused the biggest collapse in currency history.

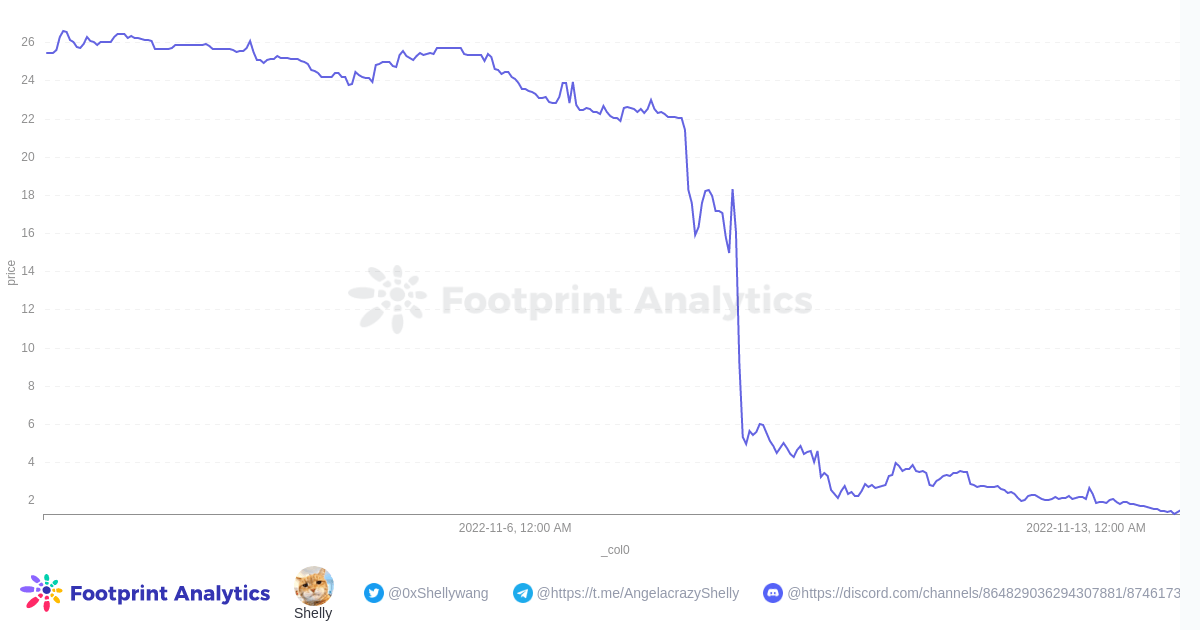

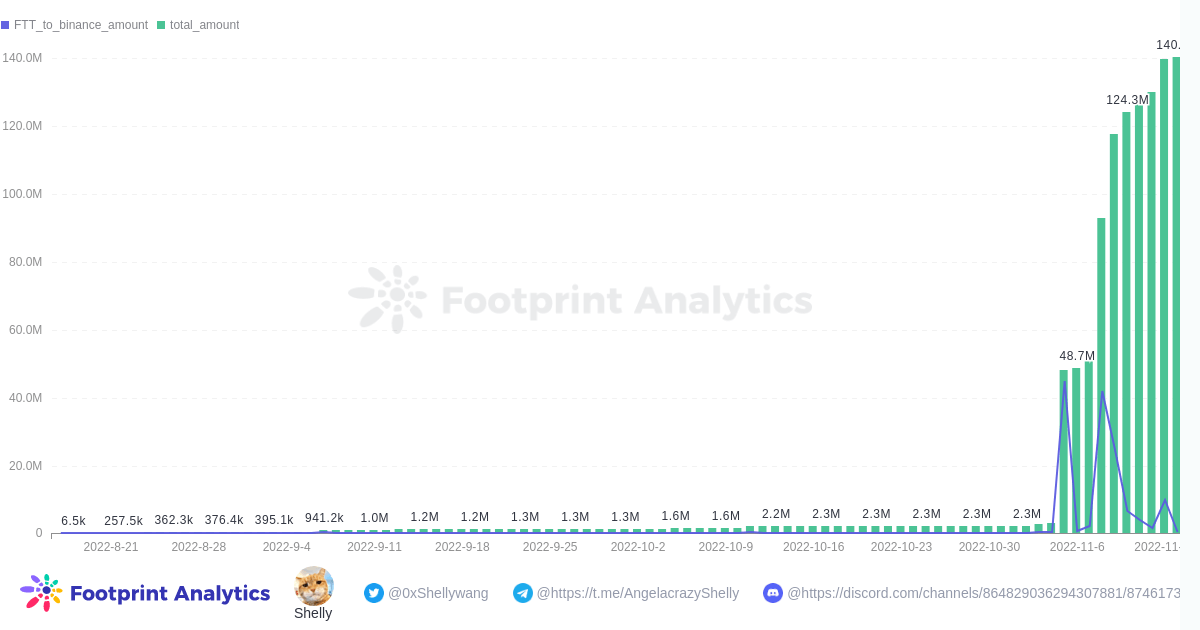

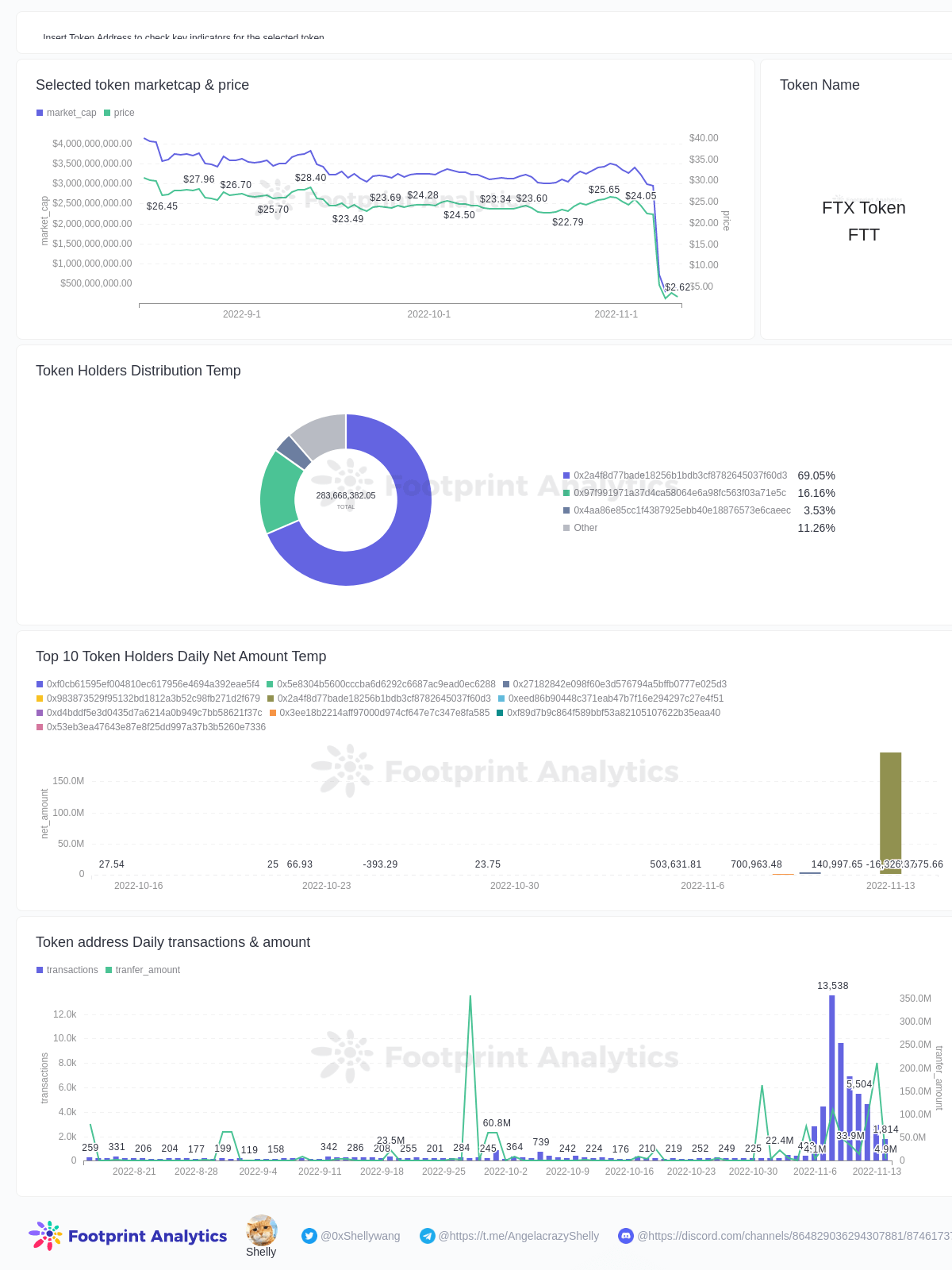

The following week saw 140 million FTT flow into Binance and the token fell from $26 to $2. This led to an execution on FTX, resulting in a “hack” that allegedly drained him $473 million from his reserves and led to the declaring bankruptcy of the world’s second largest trading platform.

Event overview

- November 2: Coindesk publishes Alameda’s undisclosed financial documents.

- Nov 6: Binance founder CZ has posted that Binance will sell all FTT coins in the coming months. Alameda CEO Caroline Ellison has suggested that she buy all of her FTT holdings in Binance for $22.

- Nov 6: FTT experiences its first plunge (down 10%) and returns to $24 after Ellison’s offer.

- Nov 8: FTX International suspends withdrawals.

- Nov 8: FTT plunges to $5

- November 8: Binance announced that it may be interested in acquiring FTX.

- Nov 11: Acquisition finished.

- November 11: Bankruptcy and FTX files of user funds disappear.

Impact of FTX Collapse on Entire Crypto Market

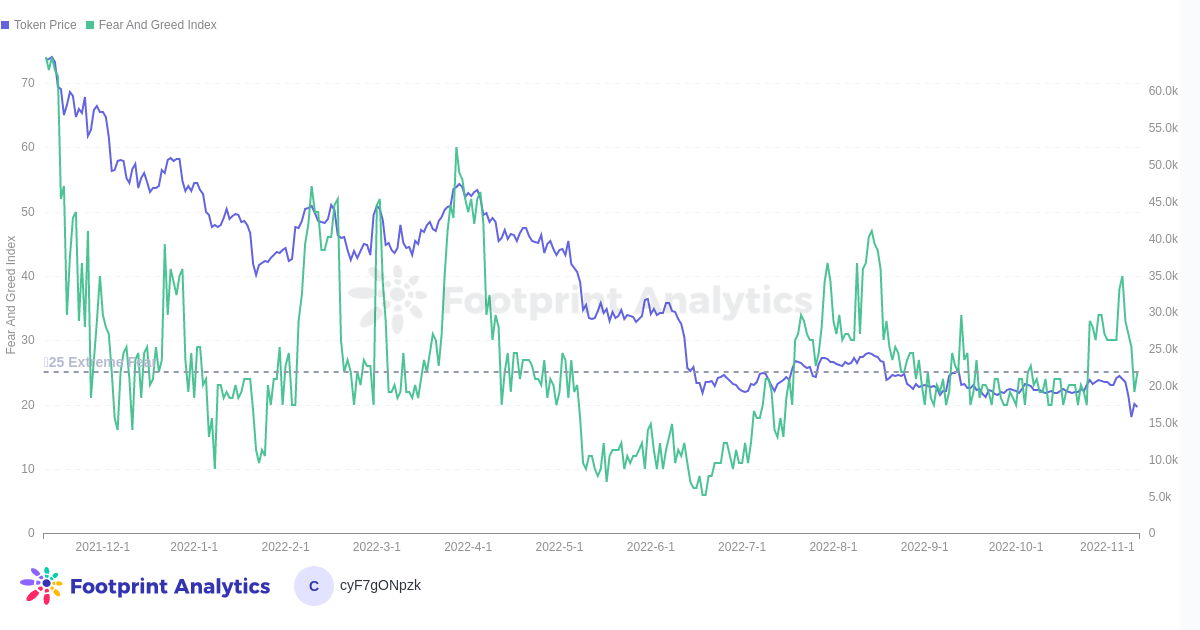

The collapse of FTX sent the market into a state of extreme fear once again, sending BTC to its lowest level of the year at $16,000.

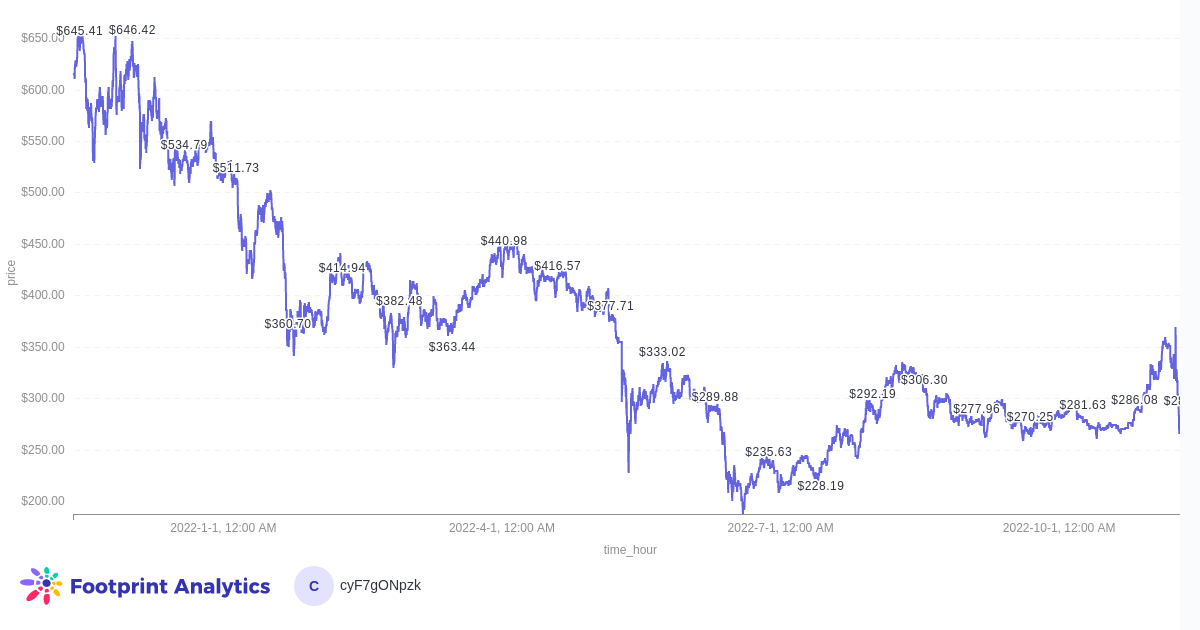

At first glance, it looks like Binance came out as the winner in this situation, with countless memes jokingly pointing to CZ as the genius mastermind behind his top rival’s downfall. BNB briefly surged to $368 on November 8th, but soon fell to a three-month low of $264. This situation will make the whole industry very trustworthy and centralized exchanges will bear the brunt.

What on-chain data taught us

Before FTX’s imminent collapse, there were serious signals on the chain indicating problems ahead.

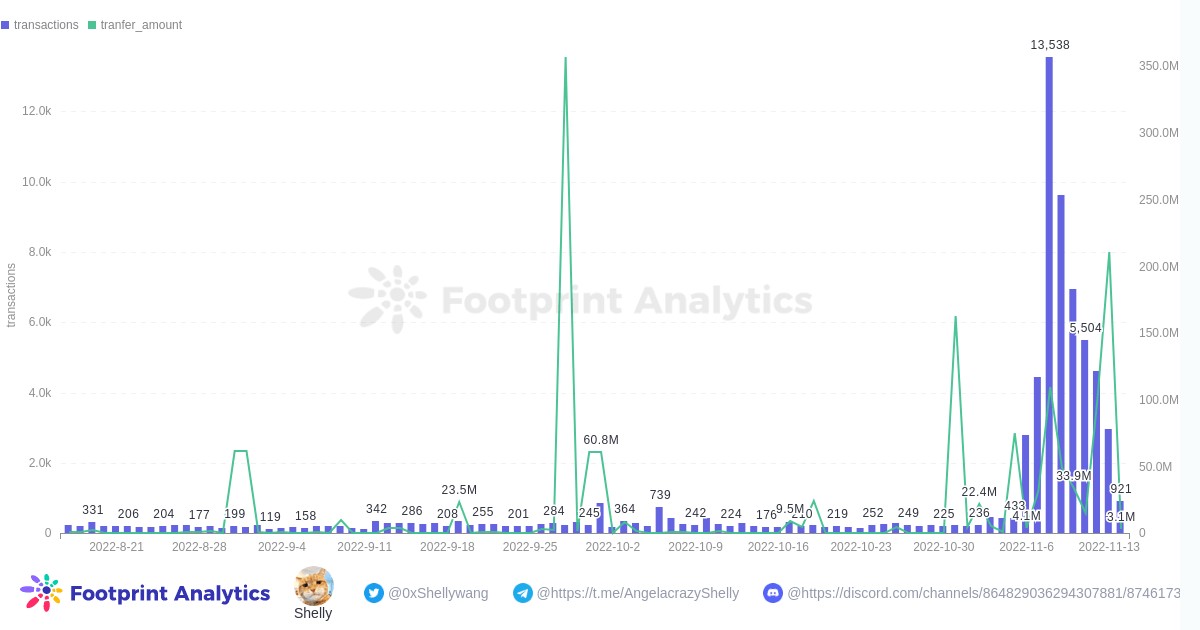

On November 5th, 75 million FTT were transferred from FTX. This marks a sale after this incident. Also in the FTT he confirmed two major dumps on Nov. 8 and He on Nov. 13 of about 110 million and 211 million respectively.

Over 140 million FTT tokens were transferred to Binance between November 2nd and November 8th. The spike in trading volume began on He 5 and He 6, with about 45 million and He 42 million respectively.

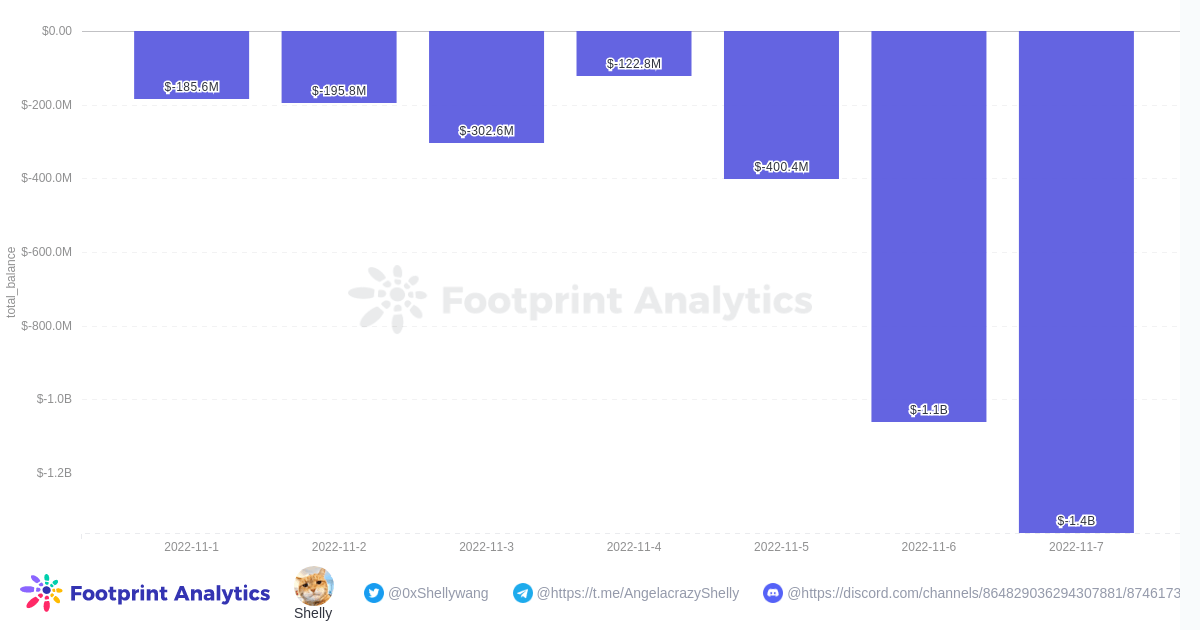

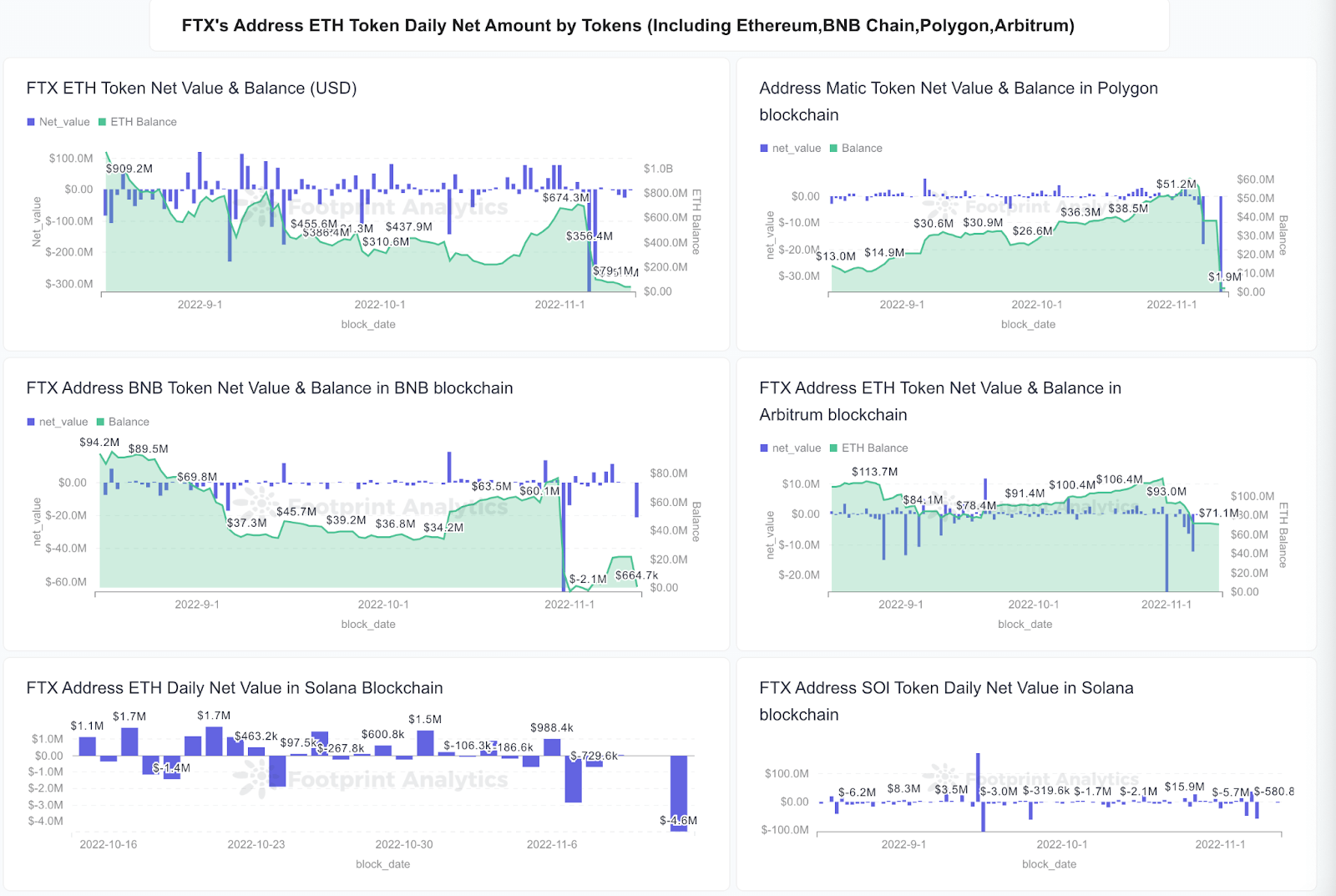

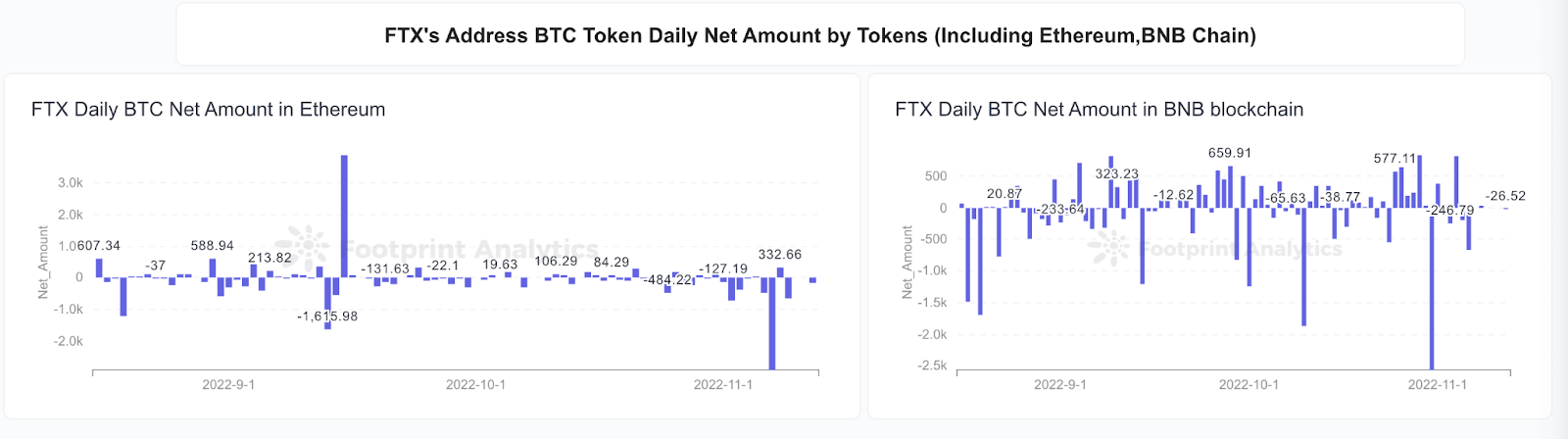

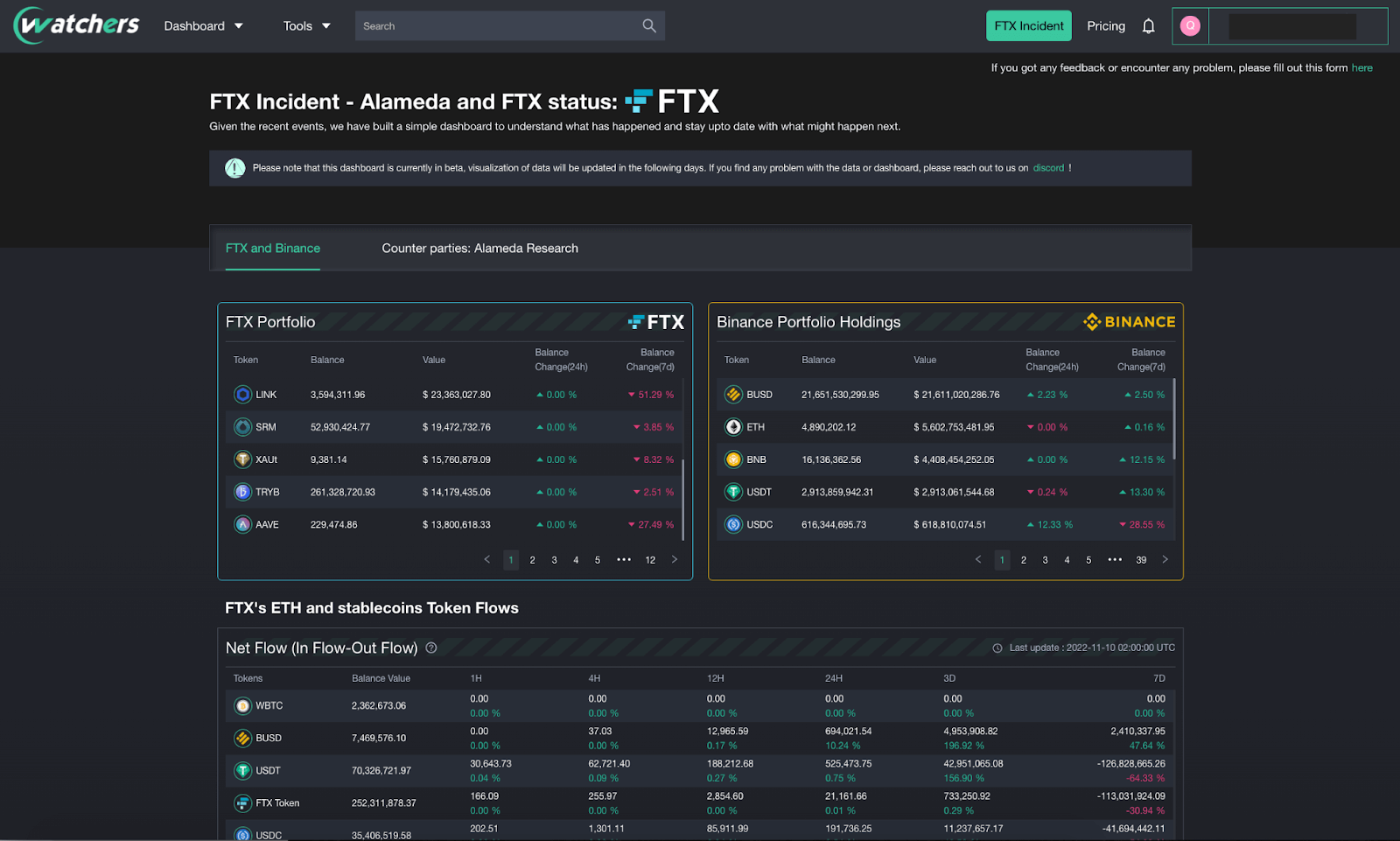

Over $1.4 billion has been drained from FTX’s Ethereum balance.

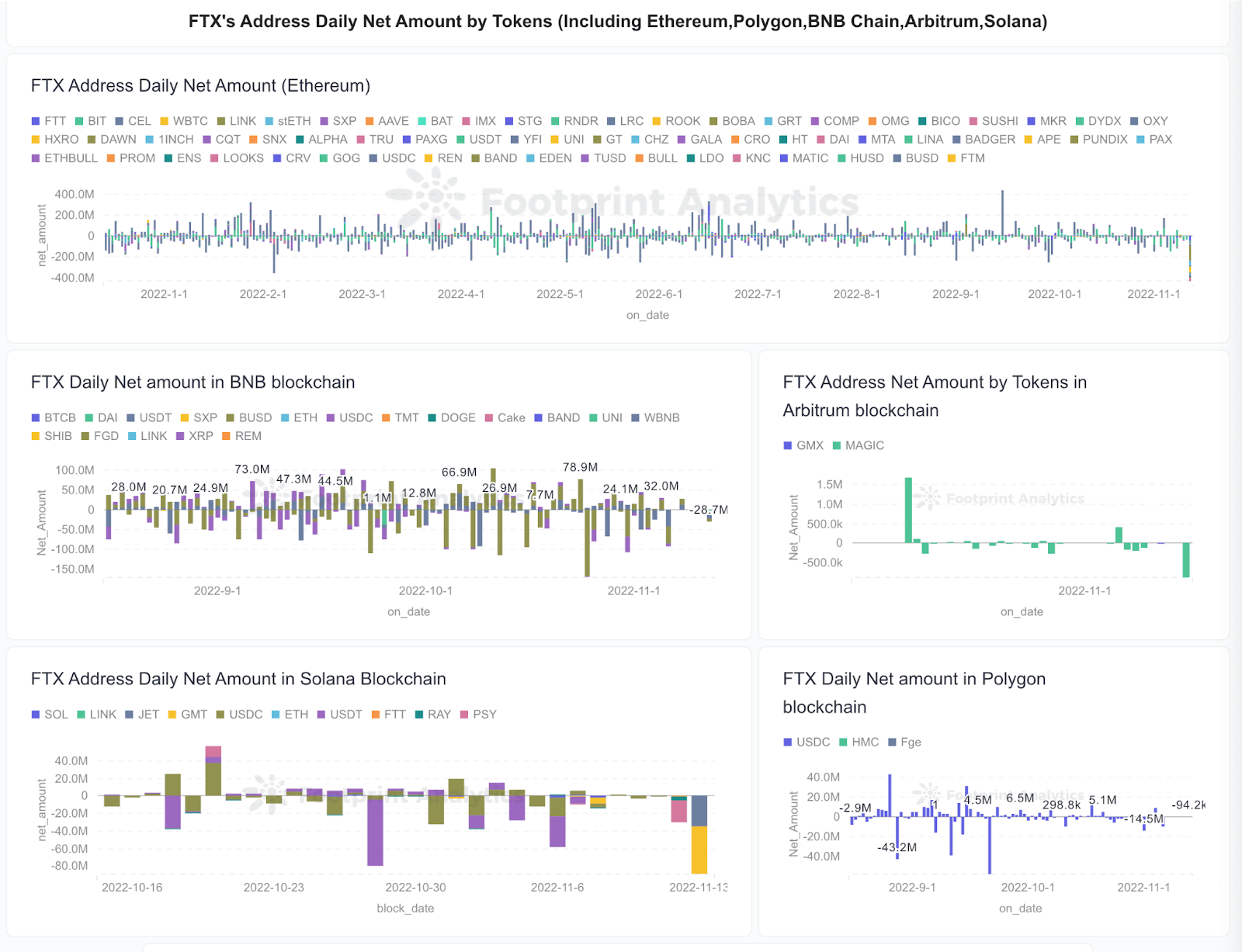

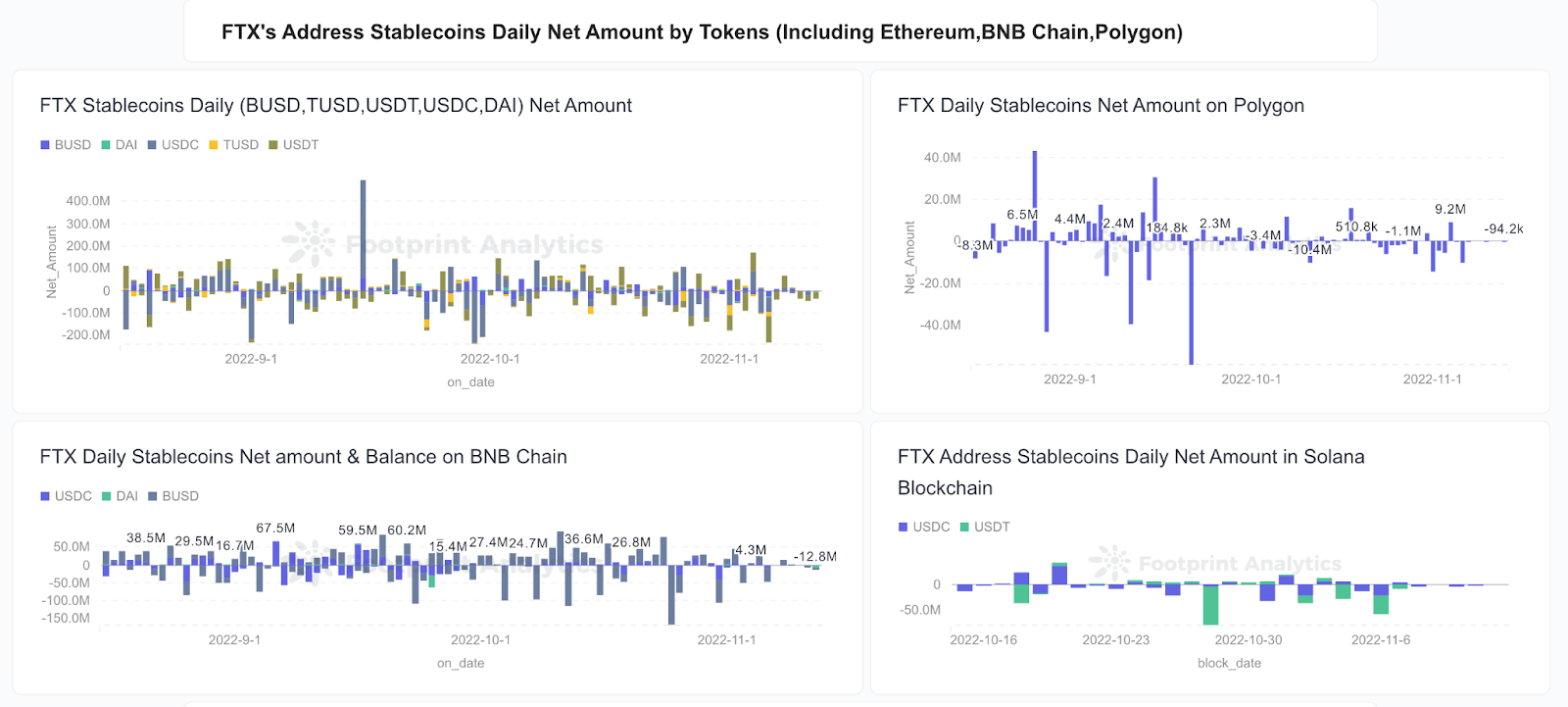

FTX’s major token balance has dropped significantly.

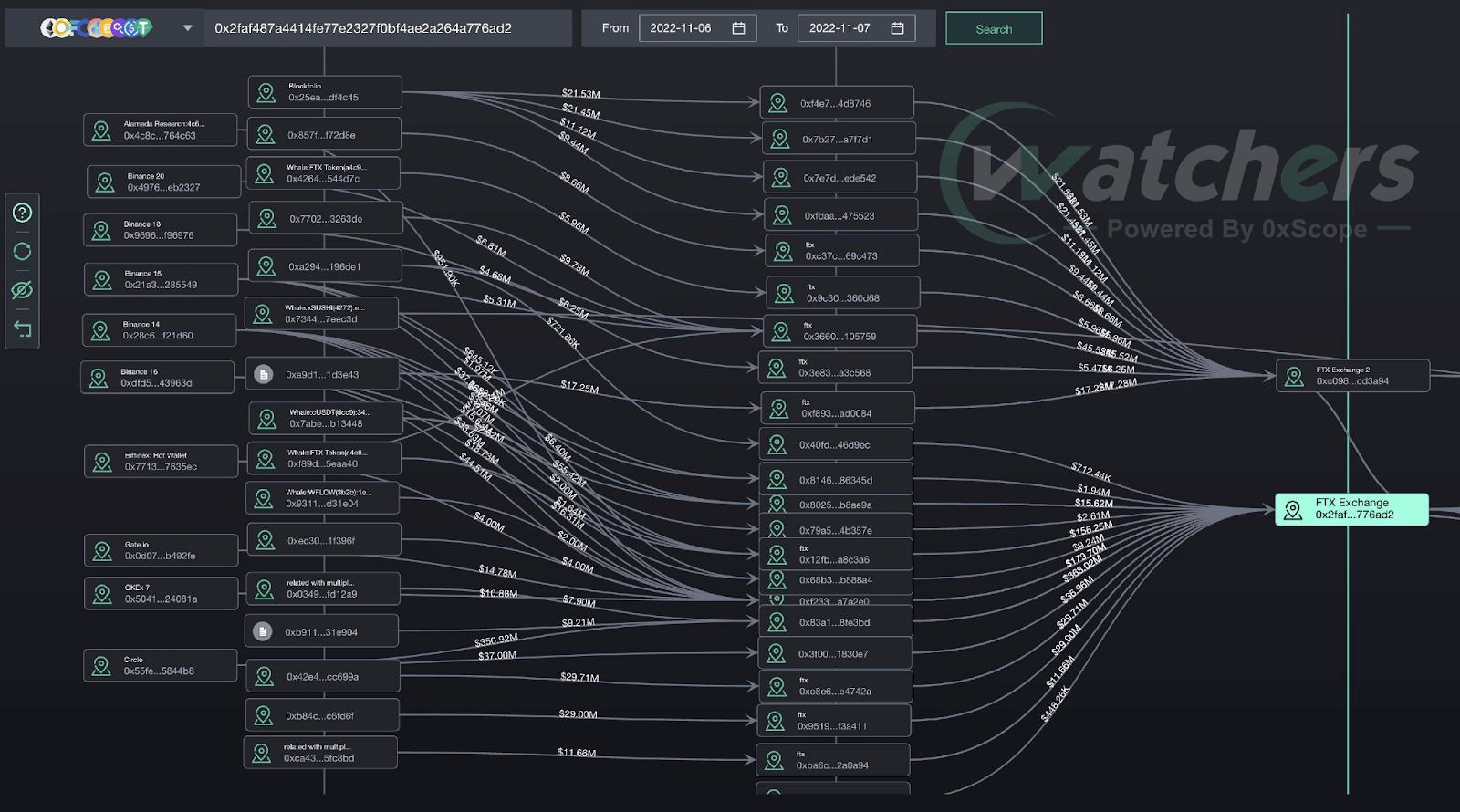

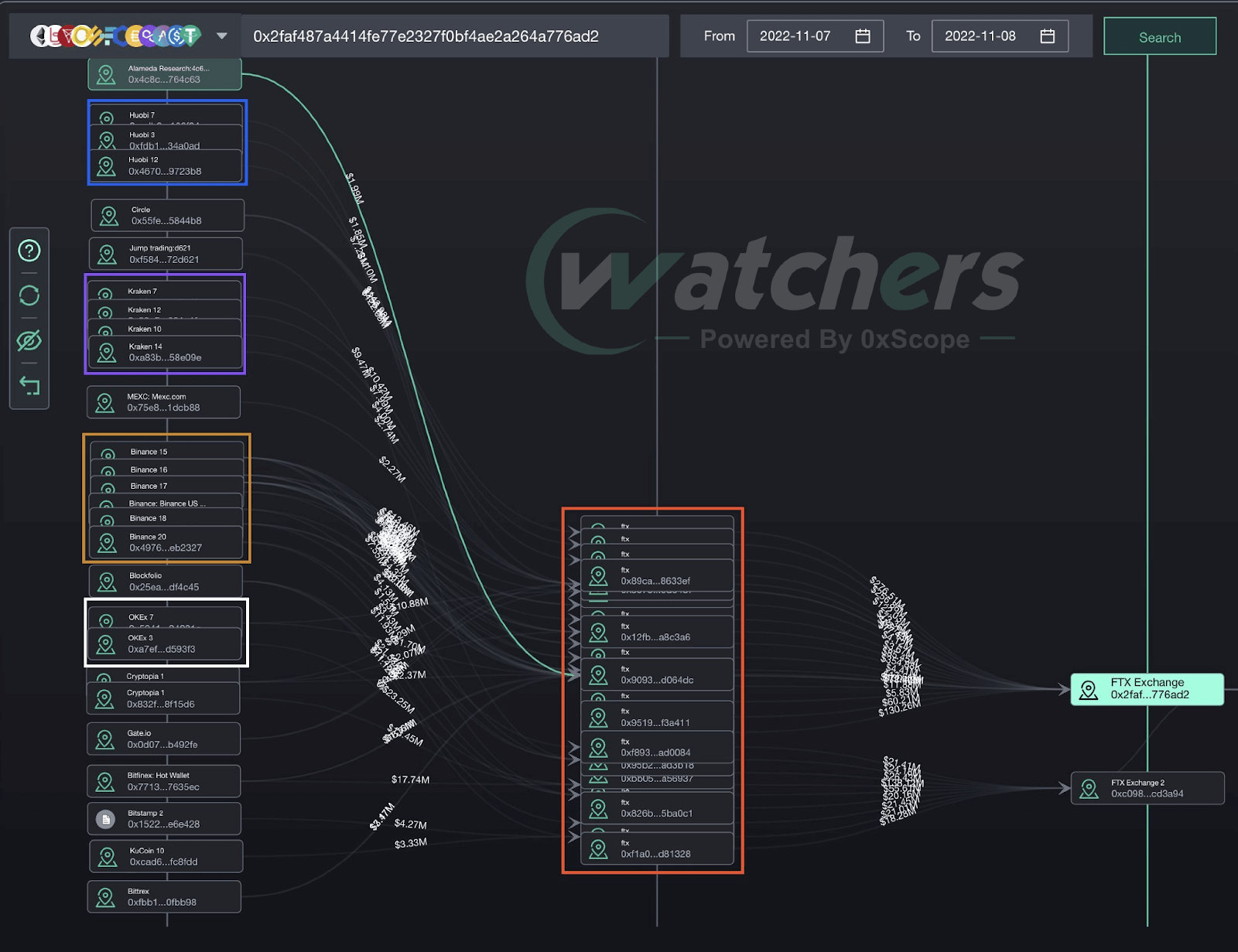

According to 0xScope, most of the funds into FTX come from other exchanges, especially Binance.

Since retailers do not deposit money at this time, this must be FTX’s own funds, and no transfers to cold wallets were found within two days.

Therefore, this signal strongly raises the possibility that FTX will move users’ deposited money to other exchanges for another purpose (market making by Alameda) and not have cold wallets for emergency purposes.

November 7th.

November 8th.

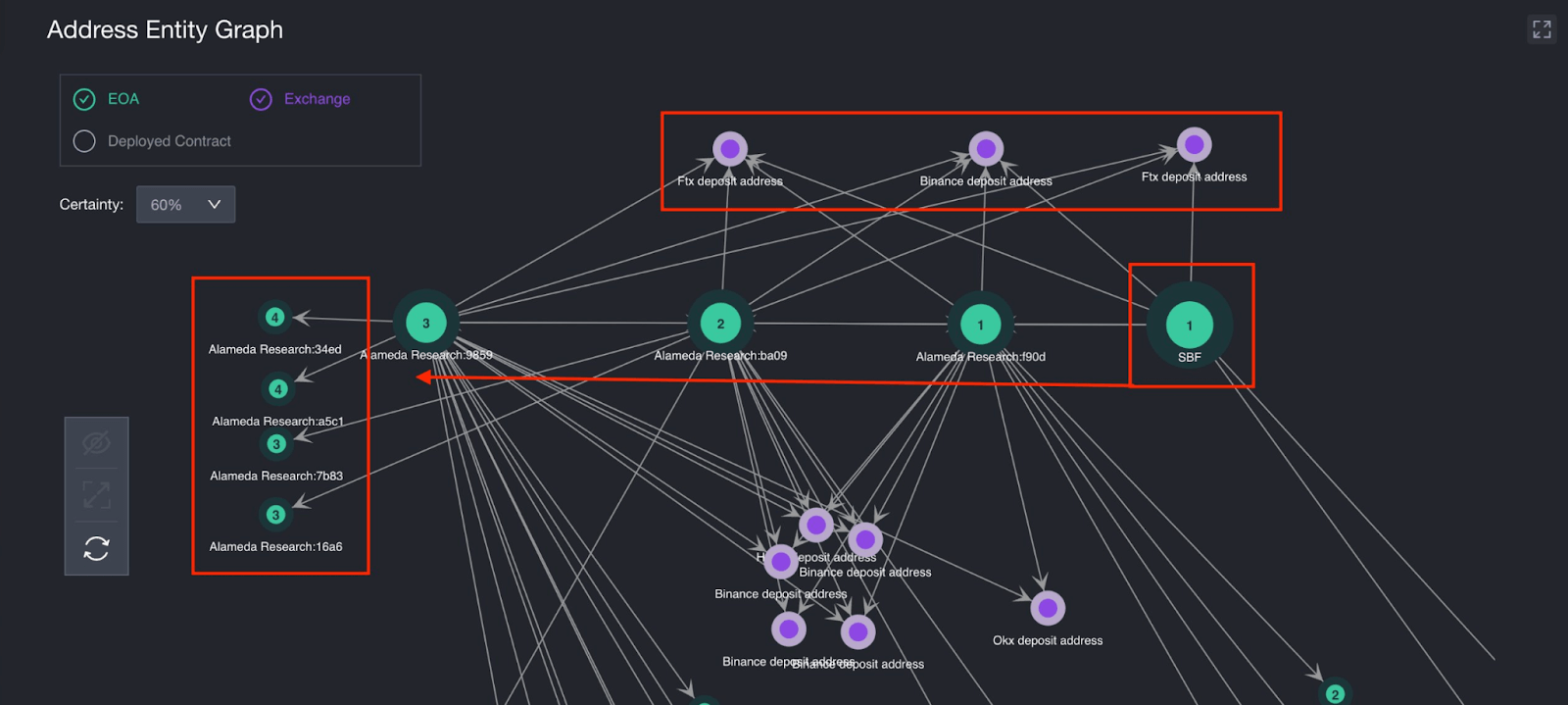

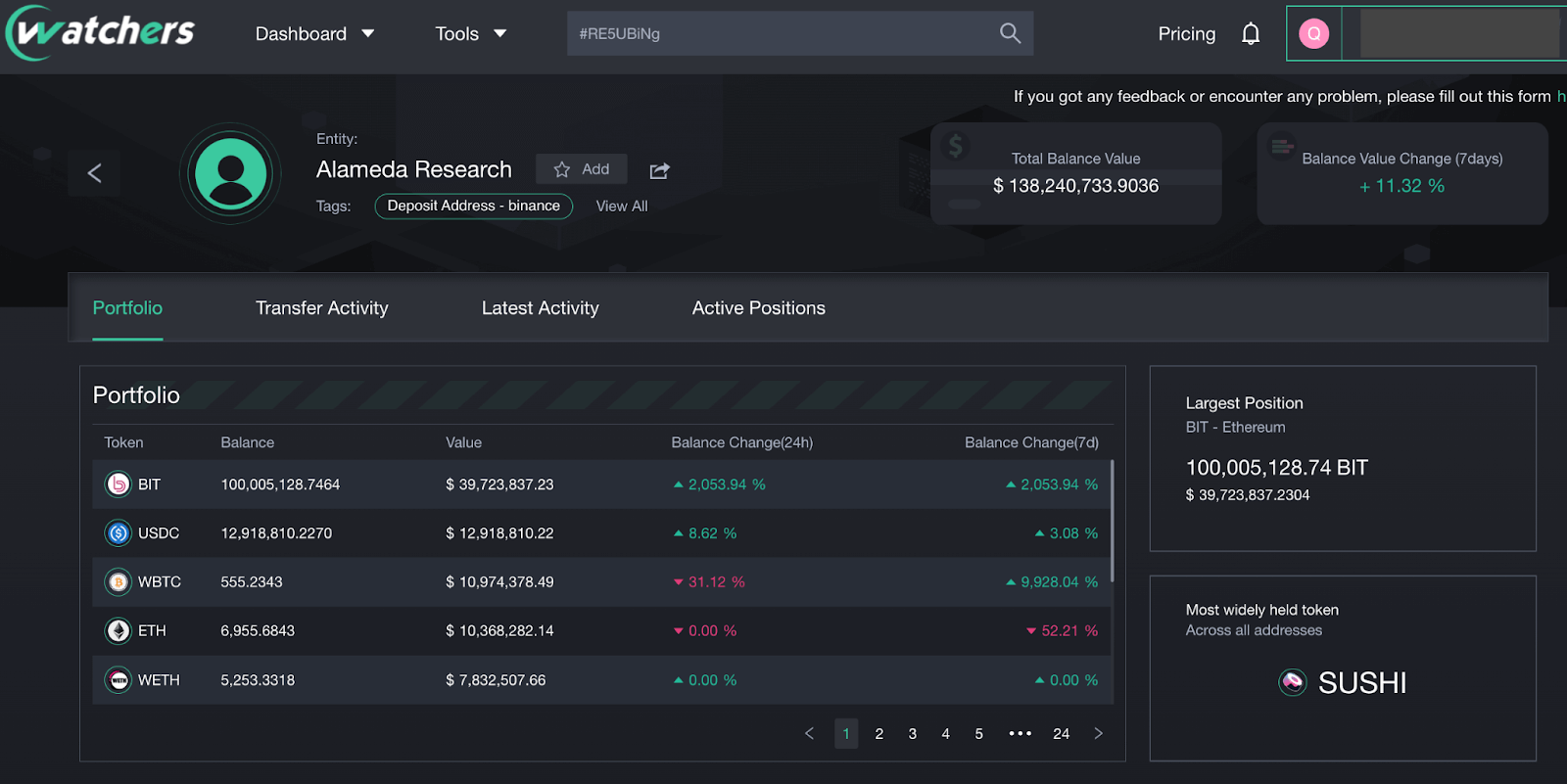

Long-term combinations of assets and accounts for both SBF individuals and Alameda are also tracked by 0xScope’s entity graph.

As shown in the graph, SBF’s address shares 3 Binance/FTX deposit addresses with at least 7 other Alameda Research addresses tagged.

This process can be applied to any address. The use case is to find connections between a set of selected addresses and identify groups of addresses. In some cases, you can use this tool to find addresses you’ve already forgotten.

This shows that within Alameda there is no difference between SBF and the company. SBF manages Alameda’s funds and accounts, allowing him to do whatever he wants.

By monitoring your on-chain data, you can spot early warning signs and keep your funds safe, regardless of which CEX or DEX you use. In the case of FTX, several key metrics point to a loss of trust in the platform, with insiders desperate to steal money.

Track and secure your assets with on-chain data

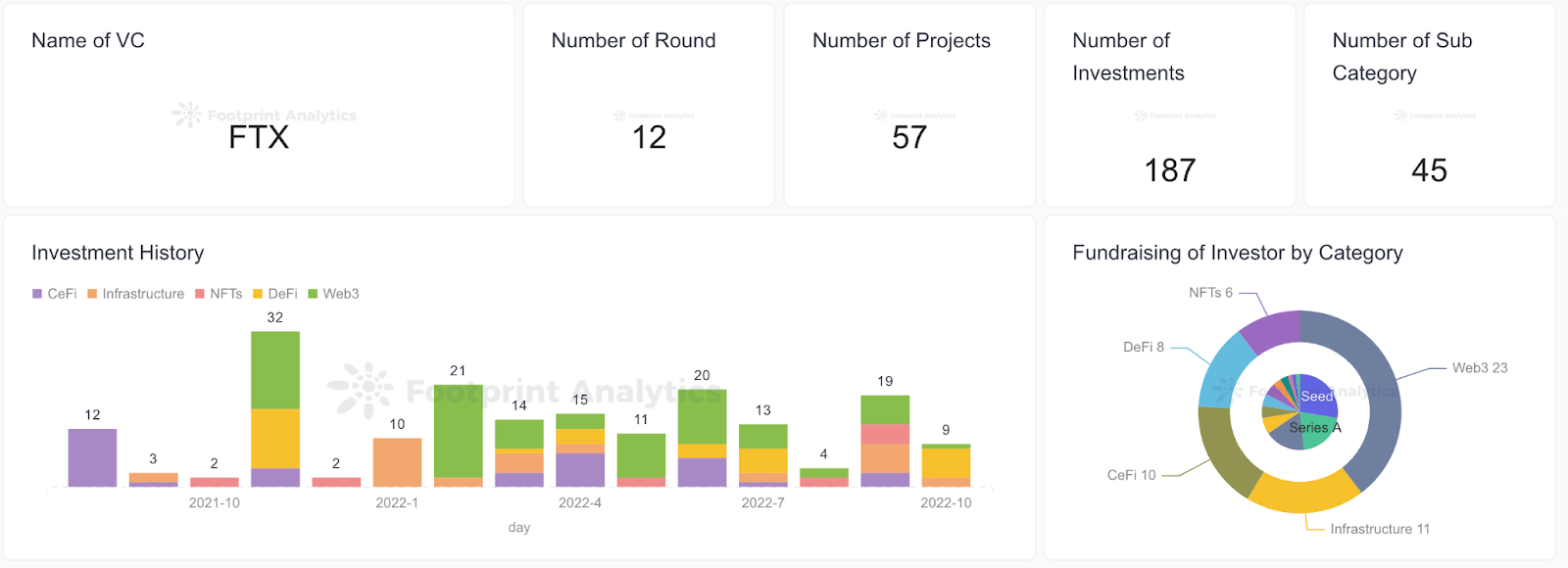

FTX has invested in over 57 projects with 187 investments. You can see specific projects in the dashboard below.

Key metrics to monitor your token include:

Monitor funds from other CEX wallet addresses

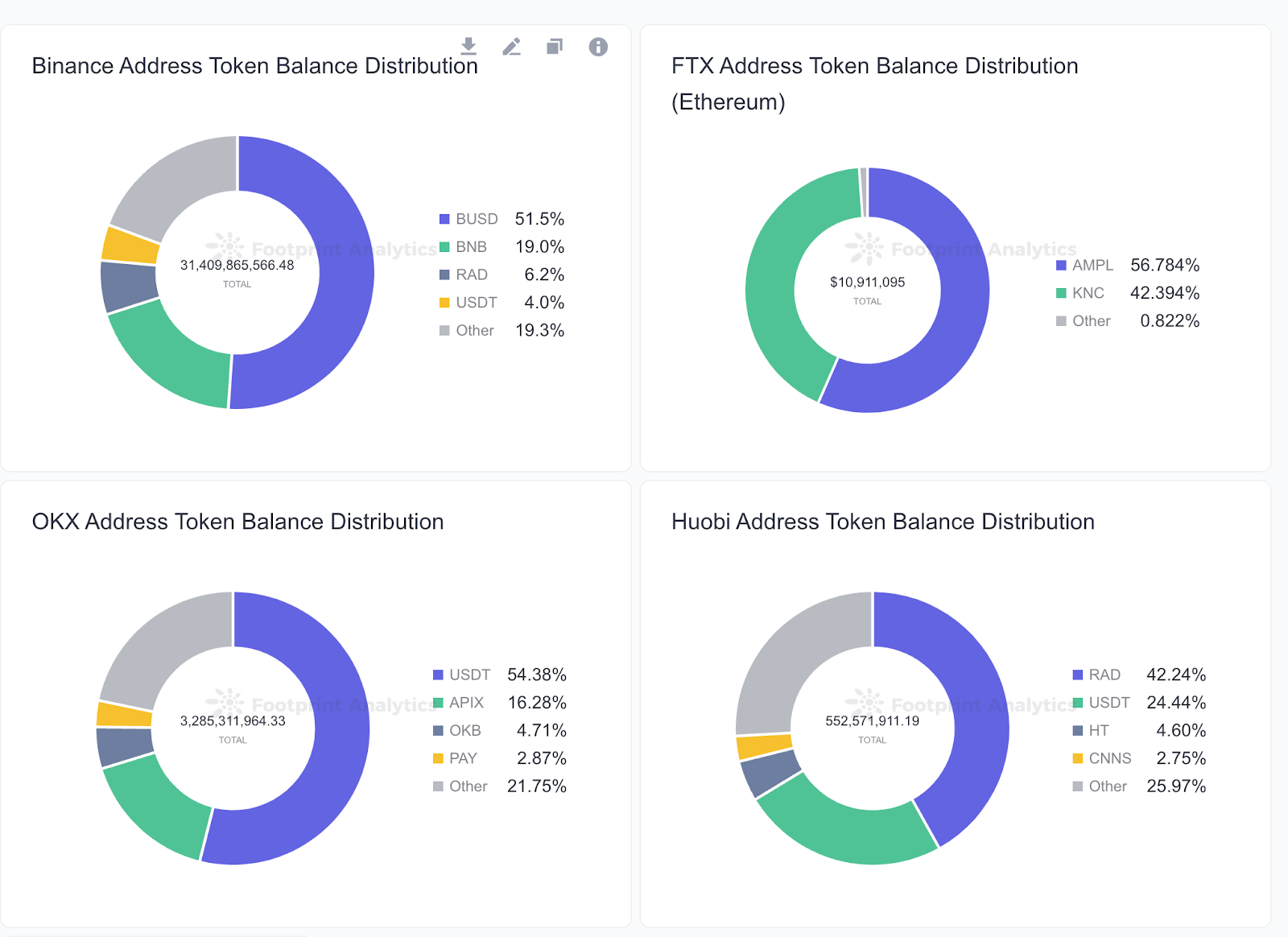

and Tweet On November 9th, CZ said all cryptocurrency trading platforms should have a Merkle tree reserve proof. Banks operate on partial reserves. Binance will soon launch proof of reserves with full transparency. Several exchanges have since published their corresponding reserve wallet addresses.

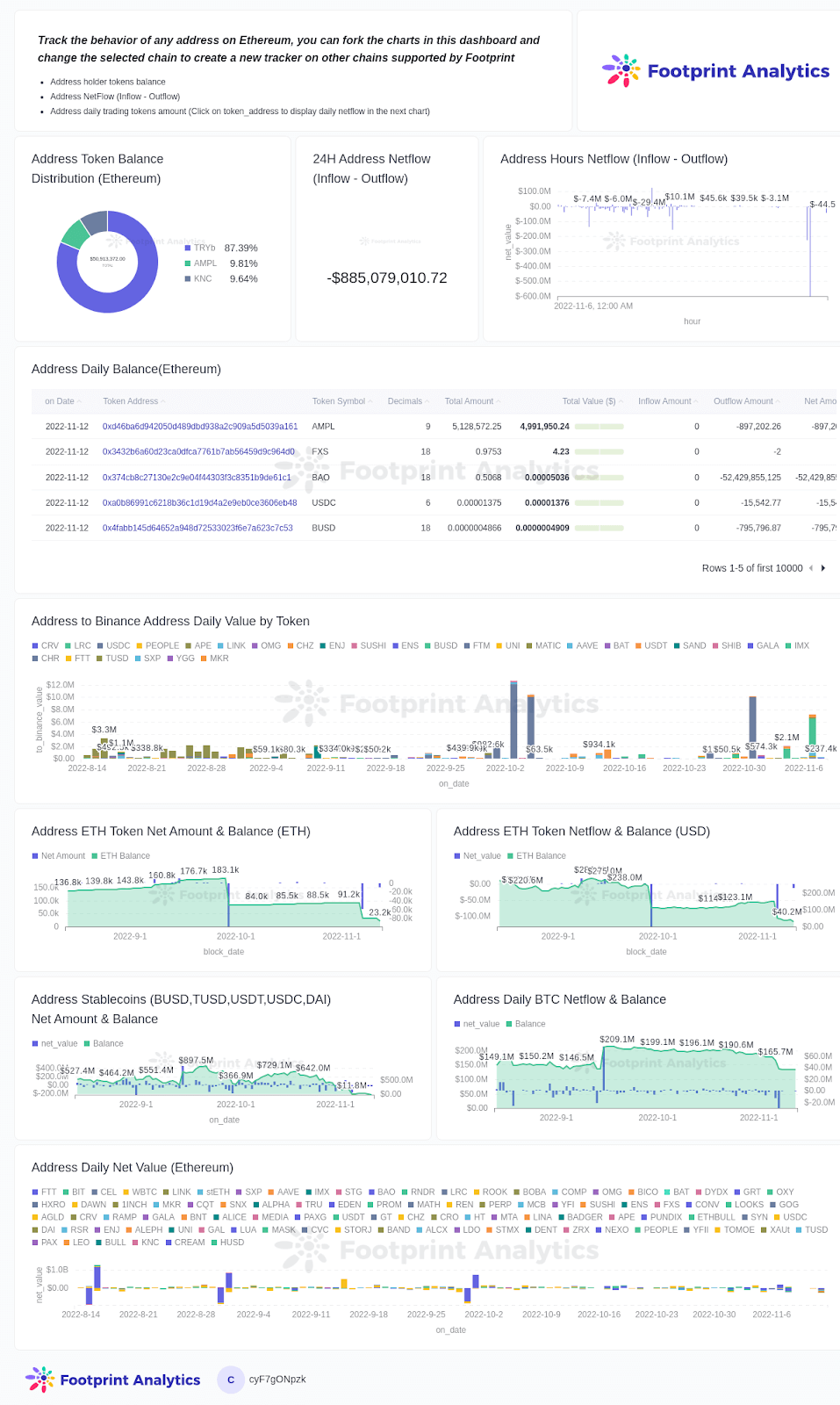

Footprint built some Dashboard According to the wallet addresses announced by FTX and Binance.

Users can also enter an address of their choice to monitor the following changes in the wallet.

- Token Balance Distribution

- 24 hours Netflow

- Wallet daily netflow and daily balance

Also, with the upcoming SQL API supported by Footprint, anyone can customize their own wallet tracker on their own website.

Clusters of addresses under the same entity for tracking related transactions are also available in 0xScope watchers. 0xScope tags several addresses, including KuCoin, Binance, Gate, OKex, MEXC, Kraken, Huobi, Circle & FTX, Alameda, etc., and connects them to clustering entities to attract various stakeholders to money. gives an overview of how the Users can also enter customized dashboards to monitor and analyze abnormal market movements and set reminders or alerts.

Contributors to this work are footprint analysis & 0x scope Community November 2022 by Sabrina

Source: Footprint analysis dashboard

The Footprint Community is a place to help data and crypto enthusiasts around the world understand and gain insights about Web3, the Metaverse, DeFi, GameFi, or any other area of the emerging blockchain world. Here you’ll find vibrant and diverse voices who support each other and move the community forward.

0xScope is the first Web3 Knowledge Graph protocol. It solves the problem of Web3 data analyzing addresses instead of actual users by establishing a new identity standard: new scoped entities from the data layer. It also utilizes the Knowledge Graph feature to unify the standards of various types of his Web2 data and Web3 data, greatly reducing the difficulty of data acquisition and improving the data penetration ability.