Pantera CEO calls 2023 ‘best time ever’ to start a crypto company with $121B VC funding available

Crypto Investment Firm Pantera Capital Announces “One Year Ahead” letter On January 23rd, we disclosed data to investors showing the resilience of the blockchain industry.

Pantera Capital CEO Dan Morehead shared an overview of the company’s outlook for 2023, stating:

“Blockchain’s resilience in the face of terrible macro markets for risky assets and historical idiosyncratic disasters is impressive.”

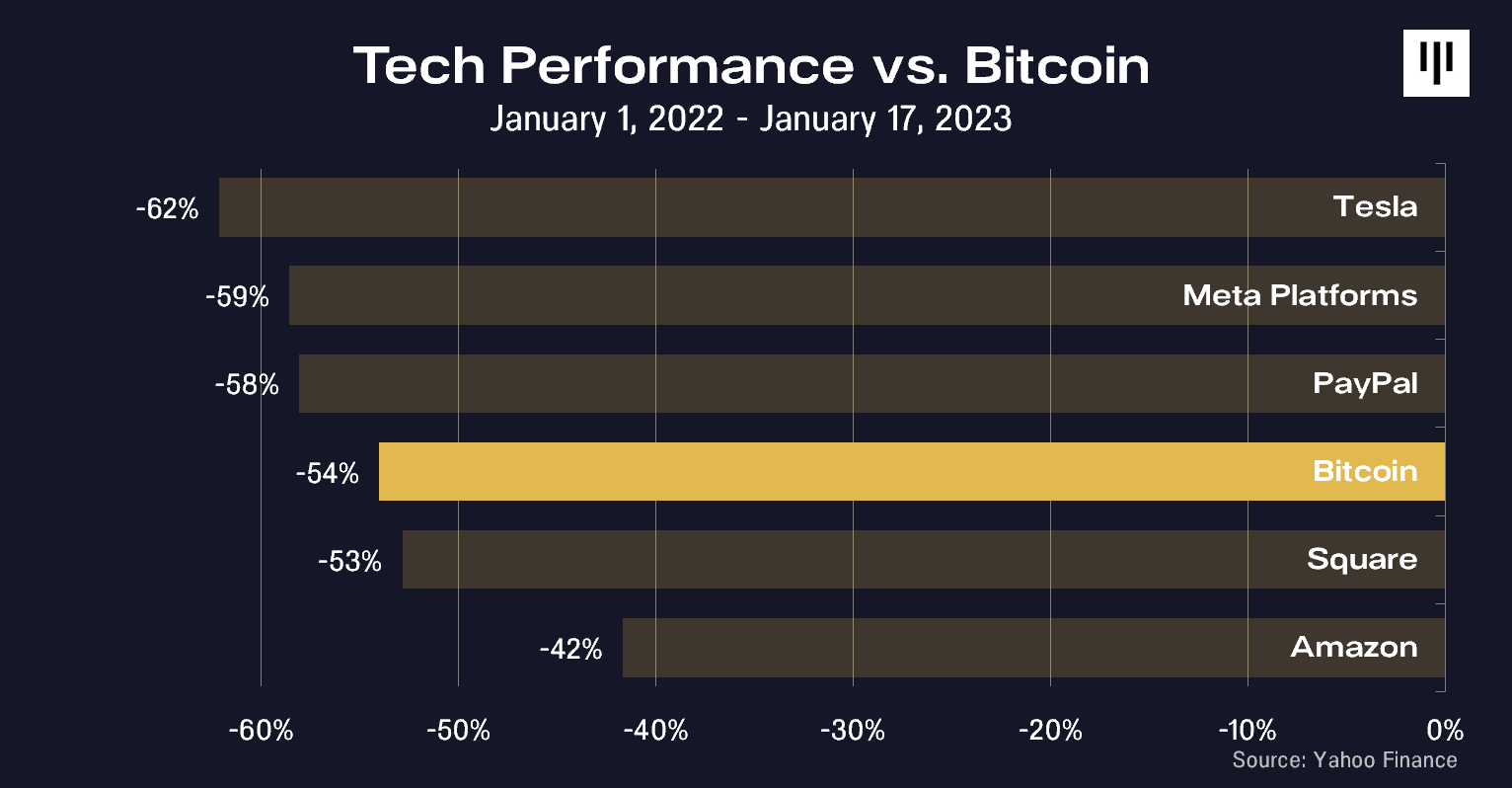

When compared to tech giants, Bitcoin has outperformed Tesla, Meta, and PayPal over the past 12 months. However, Pantera’s data cut off on his January 17th, meaning it doesn’t explain the continued rise in Bitcoin prices. At the time of writing, Bitcoin is currently down 48% and outperforming Square on the chart below.

In a letter to investors, Morehead said he was not surprised that Bitcoin performed so well, citing his experience of the past three bear markets. He made it clear that he thinks it has already passed.

“We believe we have already hit bottom and blockchain assets will soon continue their 13-year upward trend of 2.3x per annum.”

DeFi resilience to CeFi

In a letter, Pantera CO-CIO Joey Krug shared his outlook for 2023, calling 2022 “probably the most turbulent year in cryptocurrency history.” Comparing 2022 to his 2014, Krug compared cryptocurrency projects that failed last year to projects that collapsed following the first Bitcoin halving. Specifically, Krug said, “Many projects and companies have exploded that exemplify the antithesis of the fundamental principles of cryptocurrencies.”

Krug has identified a core problem with many ‘cryptocurrency’ companies that have flourished in recent years. Crypto is built on permissionless technology and has always been designed to eliminate the need for trust. But many companies that went bankrupt in 2022 required users to trust them. This trust appears to have been abused.

“Real crypto such as on-chain, smart contracts and protocol-based crypto really mitigates these problems because we don’t have to give all our money to one entity that claims to trust us. because there isn’t.”

Additionally, Krug has attacked those who oppose the relevance of smart contracts and the issue of “risky” DeFi lending. Indeed, Smart said he pointed out that “if the loan is not repaid, it is not the computer’s fault” due to poor contract design.

While centralized exchanges have failed, Kurg pointed out that “decentralized exchanges involved in lending to little-known counterparties have not exploded.” It was CeFi, not DeFi, that “exploded” in an industry that has been heavily tested over the past 12 months. As FTX, Voyager, BlockFi and Celsius failed, companies using blockchain technology to protect their lending activity continued to operate.

Krug attributes DeFi’s success to its trustless nature and more resilient risk management system.

For 2023, Krug says, “Despite the lower prices, I think the space is clearly in a much better position than it has been.” Improving the underlying infrastructure and developer tools has been praised by his CO-CIO at Pantera, who believes the world’s financial system will eventually all be built on blockchain. .

“The average person will have an app on their phone that gives them access to DeFi, where there are no banks or brokers, lower fees, global liquidity, and a 24/7 marketplace. You can do financial transactions.”

Post-2023 work should focus on making DeFi as easy as possible and increasing the liquidity of the ecosystem. emphasized. So his outlook for 2023 is that it will be time to build.

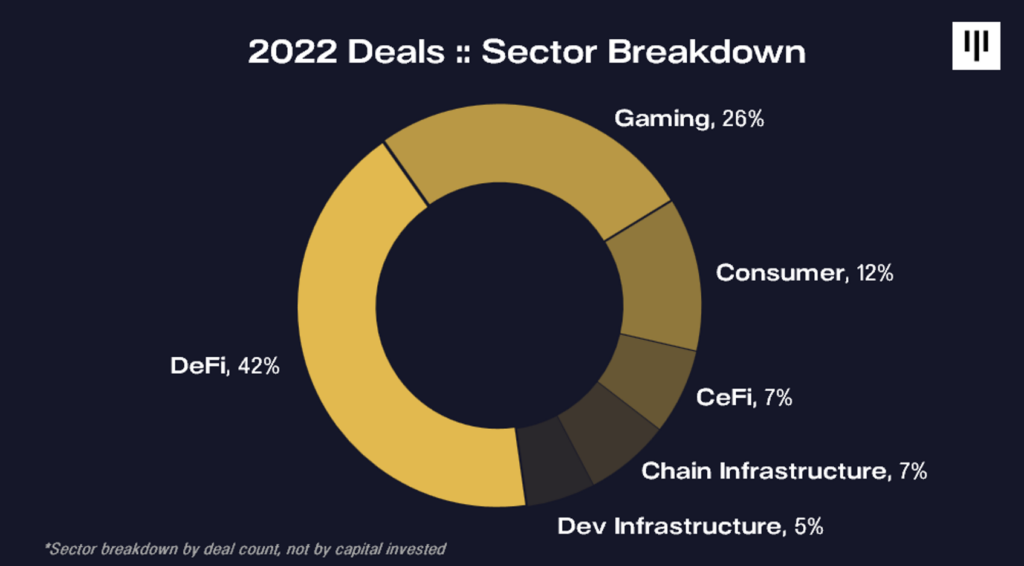

Blockchain sector breakdown

Pantera Capital General Partner Paul Verradittakit also summed up his take with a breakdown of key metrics for 2022. The chart below shows investment levels across the crypto industry, showing that DeFi and gaming are the sectors with the most significant deal counts.

Pantera is very bullish on the cryptocurrency market in 2023. “We believe now is the perfect time to launch a company in the blockchain space.” The letter further notes that $121 billion raised in the first half of 2022 is now awaiting deployment into the crypto sector. made it clear.

of full text A detailed review for 2022 is included and can be found on Pantera’s website.