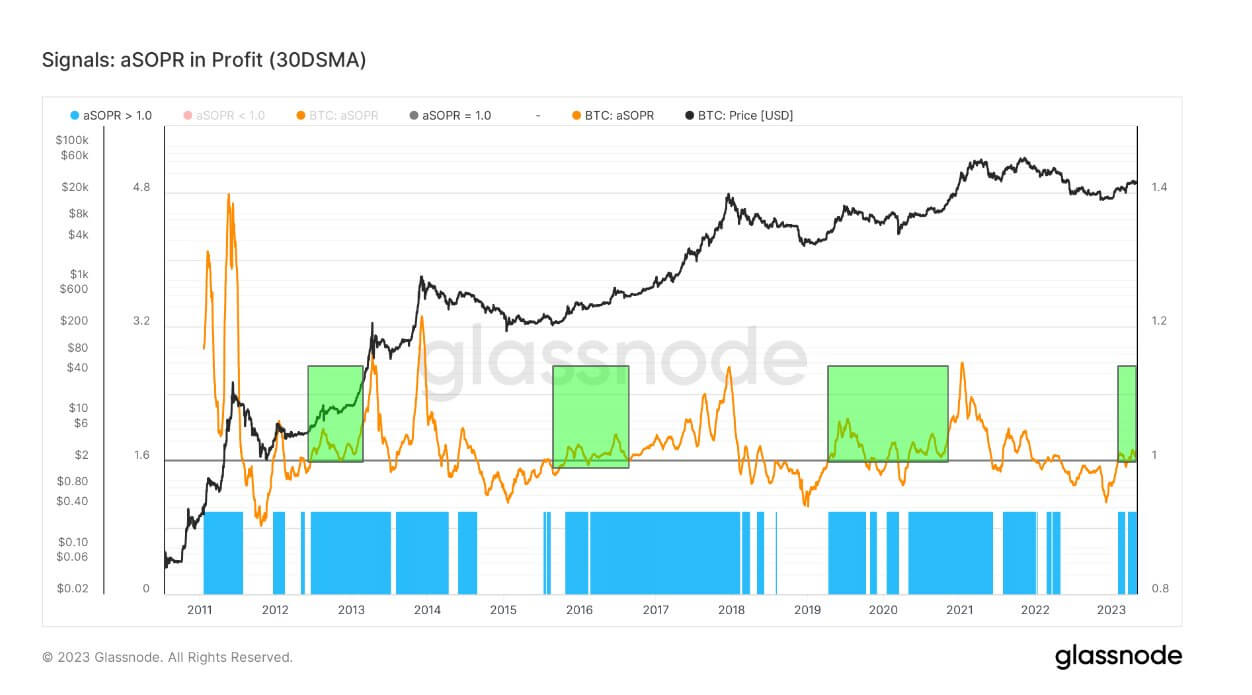

Profit realization on the rise: aSOPR holds steady above 1.0 since March’s SVB collapse

quick take

- Profitability on Consumed Output (SOPR) is calculated by dividing the realized value (in US dollars) by the value (in US dollars) of the consumed output at the time it was produced.

- Adjusted SOPR is SOPR that ignores all outputs with lifetimes less than 1 hour.

- The aSOPR has remained above 1.0 since the SVB collapsed in March. This means that the market is currently profitable on average on-chain spending.

- This is generally consistent with healthier demand inflows (to absorb profit-taking) and more constructive opinion of the asset.

- We tested 1.0 at the end of March, and as with previous bear markets, we plan to test it a few more times. Similar to 2019, it may dip below 1.0 to wash away leverage.

- Both long-term and short-term holders realized profits for the first time since May 2022, but this was on a downward trend in prices. So, we are in a similar period to early 2020 when it comes to price increases.

Rising Post Profit Realization: aSOPR has stabilized above 1.0 since March’s SVB collapse first appeared on CryptoSlate.