Research: Withdrawal price – A new way of assessing Bitcoin

To assess the health of the crypto market, we need to look at more than the price of Bitcoin.

Looking at the percentage of profitable Bitcoin holders means they bought BTC at a price below the current spot price, which is a solid indicator of future moves.

Holders whose BTC appreciates in value are more likely to sell, which can lead to market volatility. People whose holdings have fallen in value are more likely to hold them, leading to buying pressure.

This indicator, called realized price, has historically been a reliable but unreliable indicator of market movements.

Another way to get closer to the realized price is to look at exchange withdrawals. That said, looking at the average price at which Bitcoin was withdrawn from exchanges gives us a more reliable estimate of the overall market cost base for BTC.

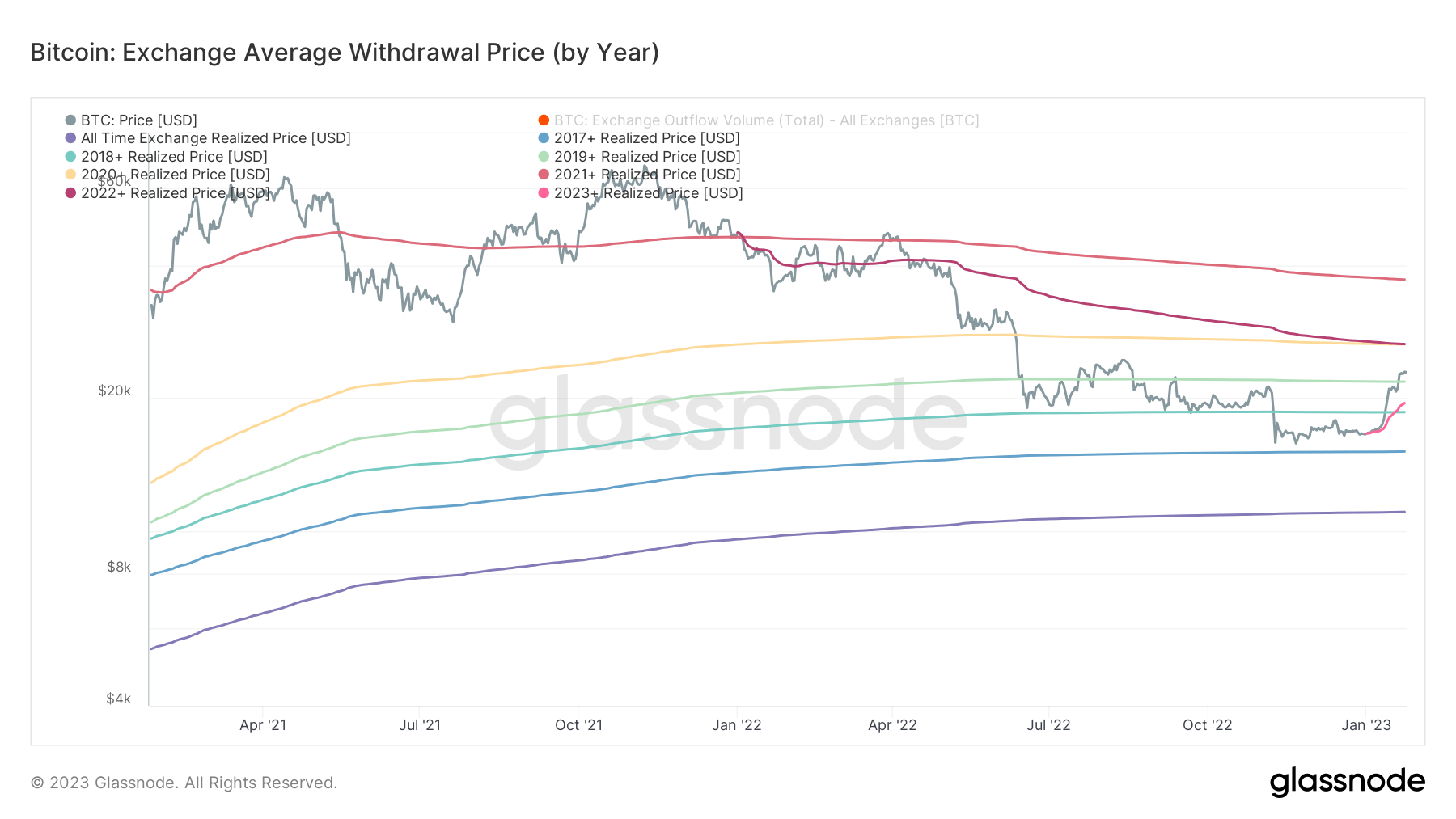

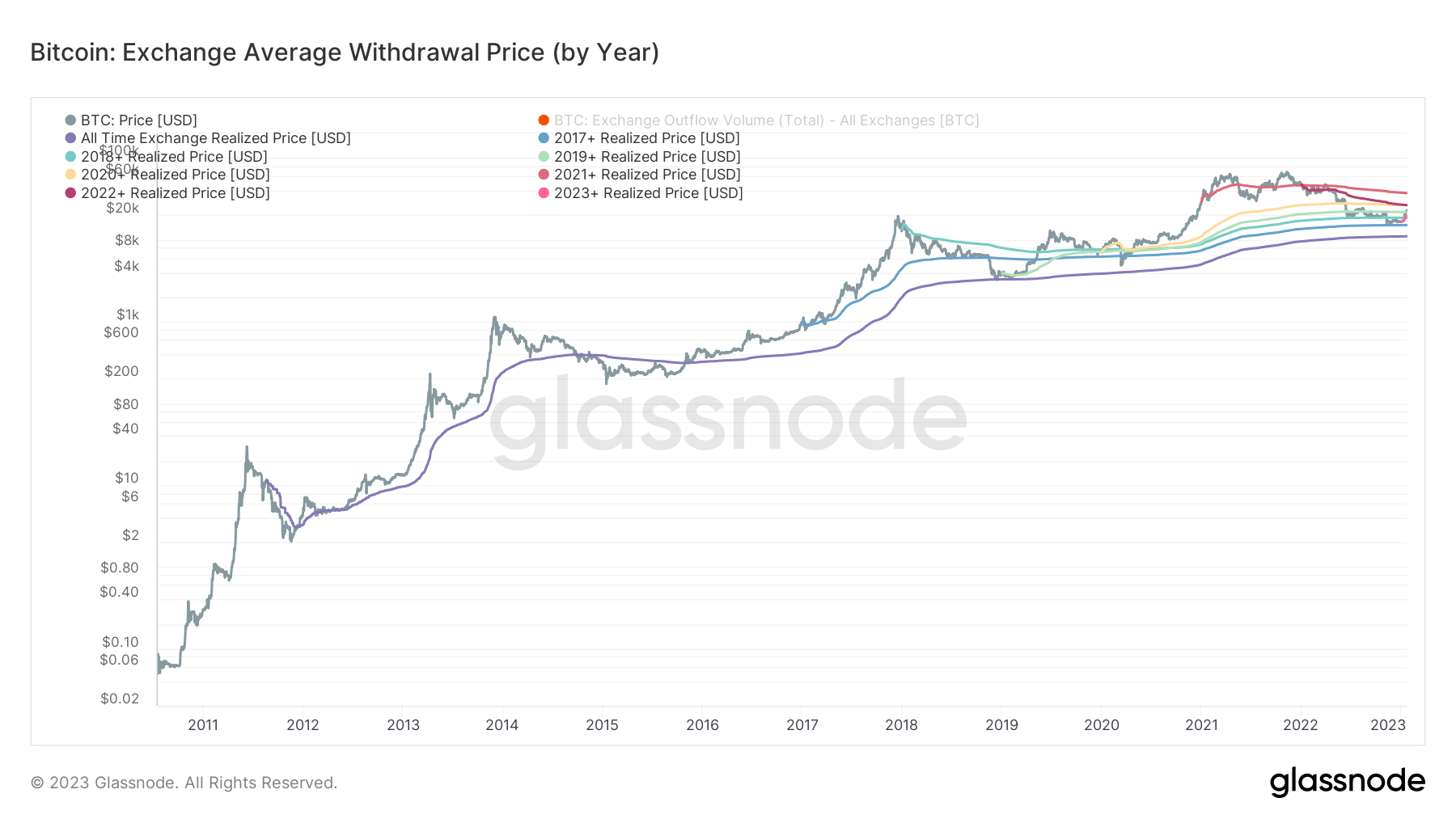

CryptoSlate’s analysis looked at the average withdrawal price for each year from 2017 to 2023 and the average withdrawal price from 2011 to 2022.

data from glass node We have shown the average Bitcoin withdrawal price curve ranging from $15,139 to $37,232.

- 2017 = $15,139

- 2018 = $18,598

- 2019 = $21,817

- 2020 = $26,513

- 2021 = $37,232

- 2022 = $26,564

- 2023 = $19,496

The average Bitcoin withdrawal price from 2011 to 2023 is $11,037.

When Bitcoin reached $23,000, it crossed multiple cost-based levels, including both realized prices and short-term holder realizations. The long-awaited slow recovery has benefited investors who bought his BTC before the COVID-19 pandemic.

But during the 2020 pandemic, those who bought BTC in 2021 and 2022 lost the value of their positions. An investor who bought the decline at the beginning of January 2023 has already made a profit as Bitcoin’s price continued to rise throughout his month.

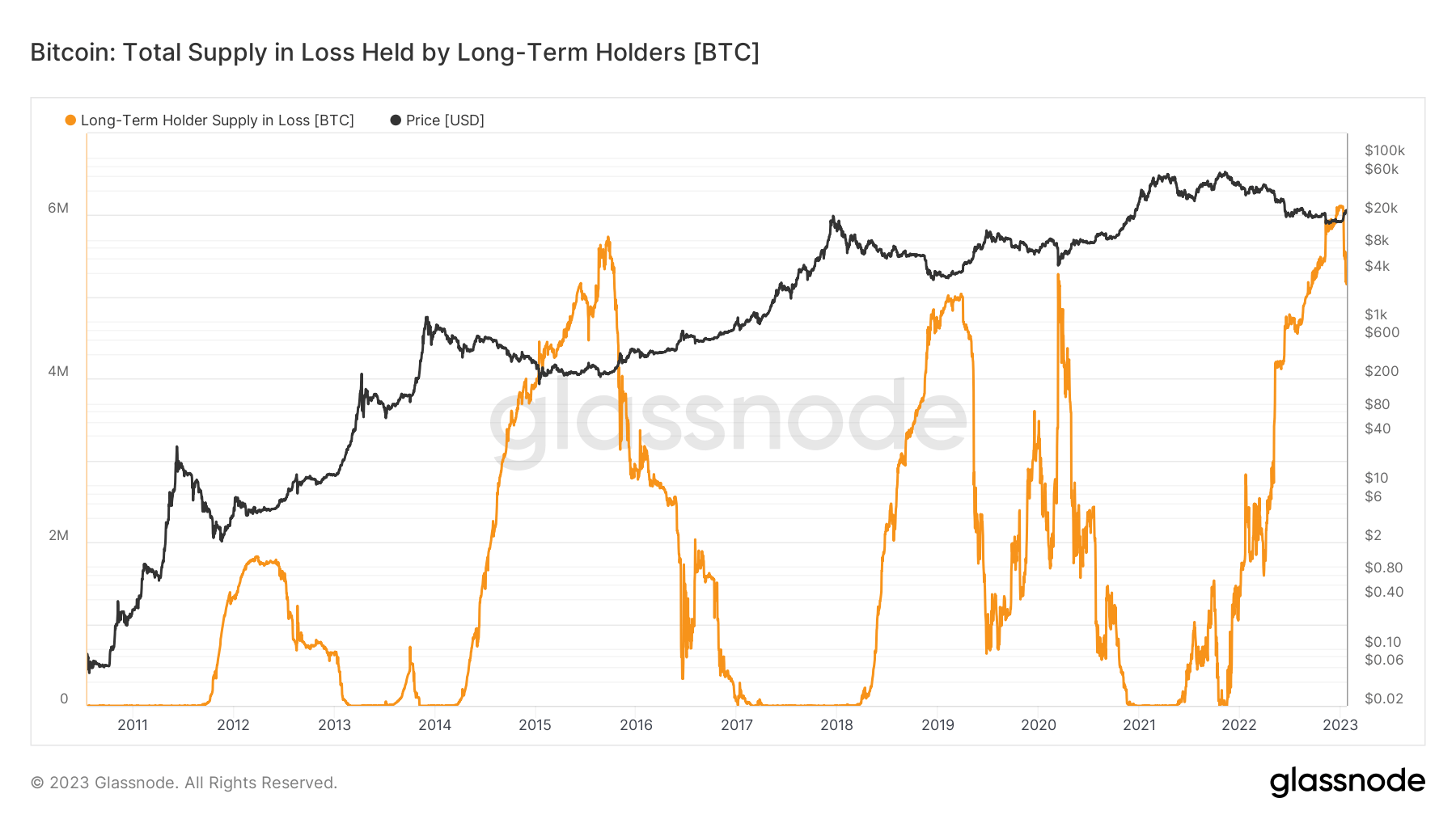

Average withdrawal price becomes even more important when analyzed with long-term holders.

Long-term holders, defined as those who hold BTC for more than 155 days, are less likely to spend their coins. The realized price at which they bought BTC has historically served as a solid resistance indicator. However, the average withdrawal price for long-term holders may be a better indicator of resistance as it represents the average value of coins transferred from exchanges to wallets.

At the end of 2022, the market reached a record high total supply of losses held by long-term holders. And while that number has fallen from 6 million BTC to 5 million BTC since the beginning of the year, it still shows that a significant portion of the supply is suffering losses.

This indicates that long-term holders may remain stuck at 5 million BTC until the realization price is reached, creating a solid resistance that could prevent Bitcoin from falling below its 2022 low. .