Russia’s Ukraine invasion led to Bitcoin’s highest sell-off in the past 2 years

The past two years have been very eventful for the crypto space. The industry has witnessed astronomical adoption of cryptocurrencies, with Bitcoin (BTC) trading above his all-time high of $69,000.

However, despite this impressive growth, the industry has witnessed some adverse events that have shaken investor confidence.

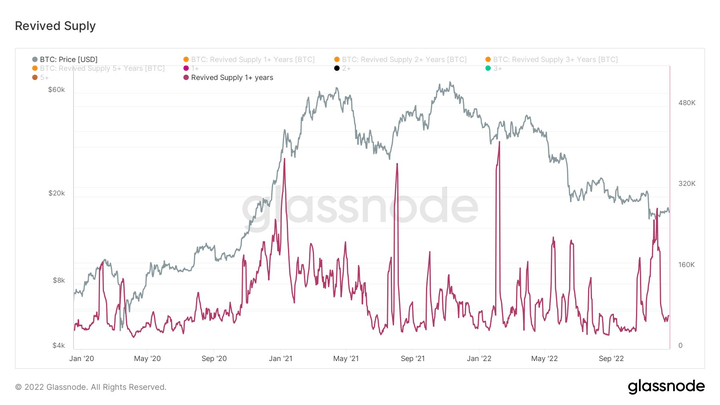

Using Glassnode’s revived supply data, CryptoSlate can measure events that have led to significant sales of major digital assets among long-term holders.

Revived Supply is the total amount of coins that have returned to circulation after being untouched for at least a year. That is, the total remittance of coins that have been dormant for over a year.

Long-term holders are classified as Bitcoin holders who have held their coins for at least 6 months.

Main sales event

Looking at events over the past two years, long-term holders have sold significantly on four different occasions in seven days. The four events are:

- China Bans Bitcoin Mining In 2021

- The beginning of the 2021 Bull Run

- 2022 Russian invasion of Ukraine

- FTX collapses in 2022

According to the chart above, the biggest sell-off occurred after Russia invaded Ukraine. During this period, the long-term holder sold his 410,000 BTC.

Other large selling events occurred during the 2021 bull market when long-term holders sold 375,000 BTC and 367,000 BTC when China banned Bitcoin mining.

The fourth highest selling event since the COVID pandemic came after FTX collapsed in November. BTC’s resurgent supply for the week was 280,000 coins, according to the chart, while Chainalysis reports that realized losses reached $9 billion, the fourth highest in 2022.

The fear that sold the holder

In addition to selling at the start of the 2021 bull market when investors turned a profit, BTC’s resurgent supply generally peaked at moments when investors felt fear. This was when real-world events caused panic during holdings and forced bitcoin to offload.

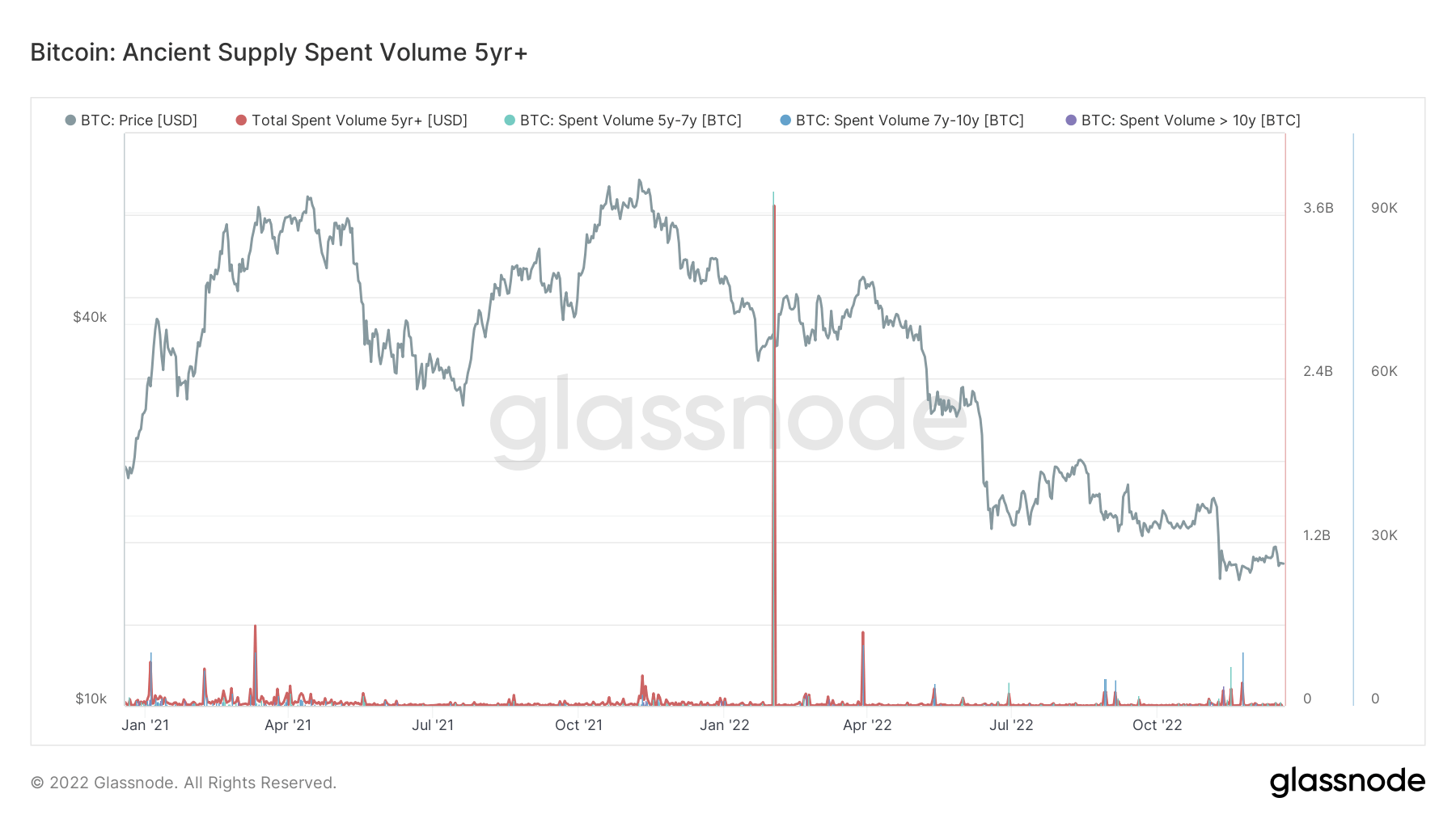

Fears peak when bitcoin that has been dormant for over five years is sold. These coins are considered ancient coins and their owners must be seriously terrified to lose faith and sell them.

Russia’s invasion of Ukraine seems to have had such an impact on investors. Other events triggered selling, including the first bull market, his second bull market on November 21, and the Luna collapse in May 2022.

In conclusion, long-term holders who sold in 2021 did so for profit, while those who sold in 2022 did so out of fear.