Saylor claps back at tax fraud allegations; USDT and USDC at war for market dominance

Some of the biggest news in the cryptoverse on Sept. 1 included Michael Saylor opposing a tax avoidance allegation, the US investigating Binance for post-2020 AML compliance, and Celsius giving creditors a $210 million Including asking for the dollar to be returned, and that OpenSea only supported NFTs after the PoS merger.

CryptoSlate Top Stories

Thaler respectfully disagrees with DC AG’s tax evasion allegations

Following a tax evasion lawsuit filed against Bitcoin maximalist Michael Thaler on August 31, he released a statement claiming that he does not owe taxes to the District of Columbia because he resides in Miami. Announced.

The lawsuit has previously claimed Sailor is a resident of a low-tax jurisdiction like Miami to avoid paying taxes in a district where she reportedly has “multiple yachts” and a luxury penthouse. He said he made the claim deliberately.

Thaler said in a statement:

“I respectfully disagree with the District of Columbia’s position + I look forward to a fair resolution in court.”

Ethereum POW Token Could Trade at $18, Paradigm Predicts

Paradigm analysts weighed the difference between the spot price of Ethereum and the future price and came to a prediction that the Ethereum POW token could trade at $18 after the merger.

Given that ETH holders currently have a neutral bias towards the futures market, the price of ETHPOW will be 1.5% of ETH’s current market capitalization, he added.

Unable to recover from Rari/FEI hack, Babylon Finance shuts down on Nov 15

Months after Babylon Finance was hit by an $80 million hack, the protocol announced it would cease operations on November 15th.

Exploit impact was exacerbated by deteriorating market conditions. As a result, the user has terminated his 75% of the assets locked in the protocol.

The announcement caused the BABL token to crash 92% after dropping from around $5 to $0.218. Congeeco data.

Creditors File New Lawsuit Seeking $22.5 Million Redemption Against Celsius

A new group of creditors has filed a lawsuit against Celsius seeking repayment of $22.5 million.

Creditors said their funds were held in custody accounts and were redeemable based on the agreed service period.

Creditors have asked the court to allow Celsius to return the seized assets.

Celsius wants to return $210 million worth of custody assets

Due to a growing number of claims from creditors, Celsius has filed a petition asking the court to allow eligible customers to withdraw up to $210 million from the platform.

The cryptocurrency lender has confirmed that the affected assets are the property of the client and not part of the bankruptcy estate.

OpenSea Exclusively Supports Ethereum PoS NFTs Following Merge

Shortly after the integration, OpenSea announced that it would only support NFTs on the proof-of-stake version of Ethereum. As a result, we will stop trading his ETHPoW NFTs on our platform.

research highlights

Fed Huffs and Puffs, Blows Your Home As Quantitative Tightening Begins

CryptoSlate’s recent macro analysis reveals that the Fed’s plan to issue $35 billion in mortgage-backed securities (MBS) to curb inflation could lead to a further collapse in the housing market. .

Individual investors can add MBS to their portfolio. This will help get money out of the economy and keep inflation down. With mortgage payments up 75% year-over-year, many people could fall behind on their payments, leading to a housing oversupply and financial losses for her MBS investors.

An oversupply of housing could trigger a new housing crisis and drag down financial markets, including cryptocurrencies.

However, with the expected currency devaluation in the event of a housing crisis, many may turn to “real assets” like crypto to preserve their wealth.

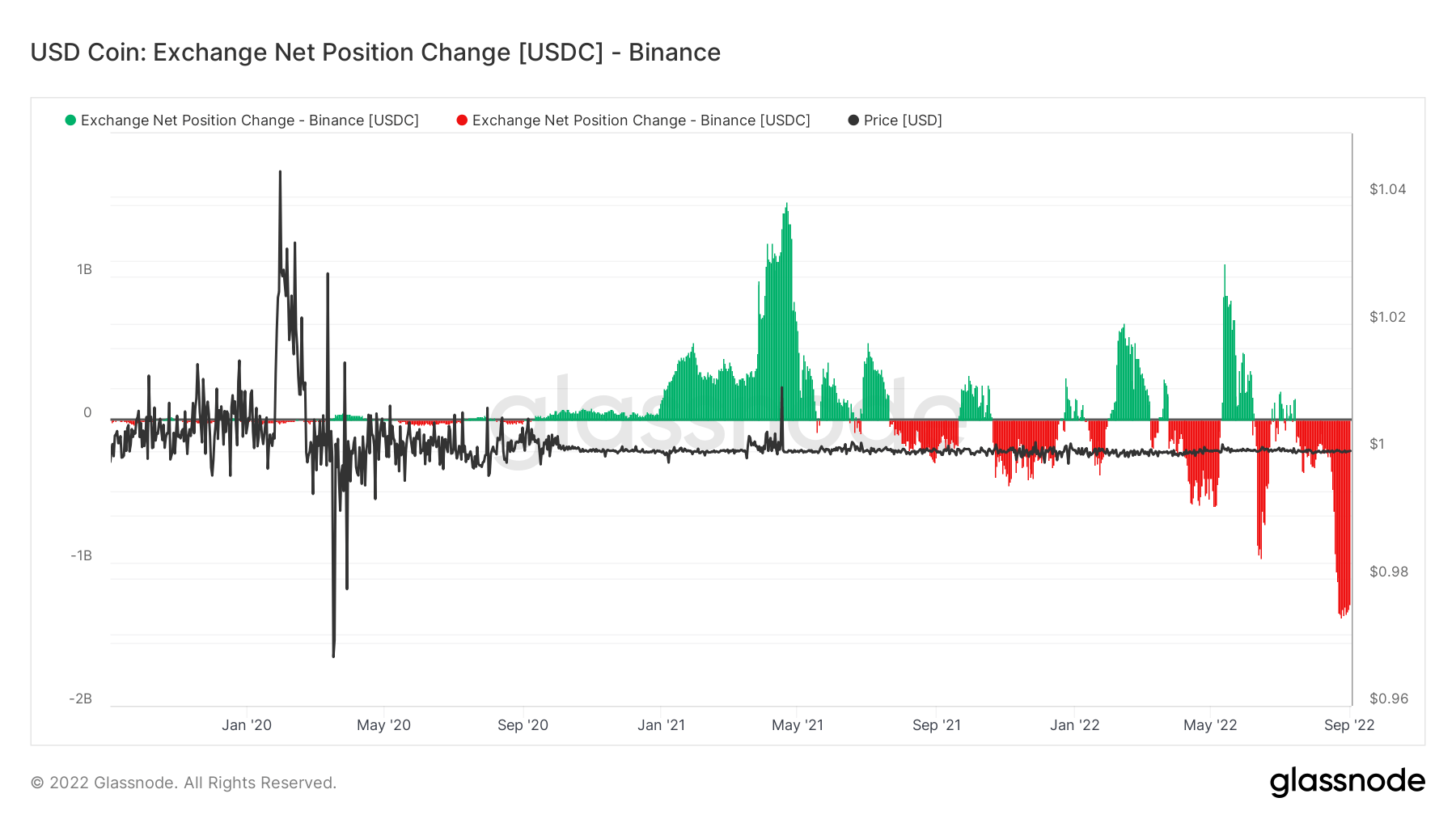

Binance USDC withdrawals surpass $1 billion per day this week

According to on-chain data analyzed by CryptoSlate, an average of $1 billion worth of USDC has exited Binance hot wallets this week, which is in line with market trends.

Further analysis of stablecoin withdrawals on other exchanges shows that stablecoin balances have generally declined significantly.

The stablecoin war heats up as USDC and USDT vie for market share

The leading stablecoins, USDT and USDC, which account for 12% of the total cryptocurrency market cap, have been battling for control over the past few weeks.

USDC reportedly grew by $4 billion during a period when USDT lost more than $16 billion in market cap. The heat of the market downturn in August forced the token to hit local lows.

However, two stablecoins are recovering from the fundamental story that contributed to their decline. They are witnessing a resurgence of dominance in the cryptocurrency market, which has increased by 40% over the past few weeks.

News around Cryptoverse

US Attorneys Investigate Binance’s AML Compliance

US prosecutors have been investigating Binance since 2020 for the measures it has taken to ensure anti-money laundering and sanctions compliance, according to Reuters.

Binance CEO Changpeng Zhao said in a tweet that the exchange has met all of the regulator’s 2020 demands.

Another story today about crypto companies getting inquiries from regulators. A request was made to voluntarily share certain information in 2020. It is important for the industry to build trust with regulators.

My chat messages are semi-public anyway. pic.twitter.com/h35Xd4tZhf

— CZ🔶 Binance (@cz_binance) September 1, 2022

Binance’s chief communications officer, Patrick Hillman, said the company’s compliance team is made up of former regulators and law enforcement agencies to ensure full compliance with all regulatory requirements. .

FASB Crypto Accounting Rules Skip NFTs and Some Stablecoins

The Financial Accounting Standards Board (FASB) does not include NFTs and some stablecoins in its cryptocurrency audits. wall street journal report,

Project scope includes assets that are non-unique, incompatible, intangible, and contain no contractual right to cash flow, goods, or services.

Binance Introduces Free ETH Trading

Users trading the ETH/BUSD pair will not have to pay any trading fees for the next month.

binance announced The move is to attract both newcomers and veterans interested in the Ethereum ecosystem in anticipation of upcoming merges.

Cardano is now live on Robinhood

In anticipation of Vasil hard fork mounts, Robinhood has announced that users can start transaction Cardano’s ADA token on the platform.

Despite the listing news, ADA prices remain stable. On the daily chart, ADA rose just 9% to $0.462 from his 24-hour low of $0.424.

LG launches cryptocurrency wallet on Hedera

LG Electronics reportedly During startup Release of cryptocurrency wallet “Wallypto” in Q3 2022. Wallypto he built in partnership with the Hedera blockchain.

crypto market

Bitcoin was up 0.2% on the day, trading at $20,085, while Ethereum was trading at $1,586, reflecting a 2% gain.