SBF had detailed info on Alameda’s finances as recently as March, Forbes reveals

In contrast to Sam Bankman-Fried’s recent claim that he was unaware of Alameda’s position, Forbes recently release Communication with SBF in drafting the list of billionaires shows that he was familiar with Alameda’s finances.

his latest interview In an interview with The New York Times, the former CEO said Alameda made a risky investment in the FTX platform because it was too influential and he didn’t understand what the company was doing. He said it was because he didn’t.

“It is not the company I run. I didn’t,” SBF said in an interview.

Interestingly, in the midst of all this development, several billionaires came to Bankman-Fried’s defense.

Call me crazy, I think @sbf telling the truth.

— Bill Ackman (@BillAckman) November 30, 2022

Along with Bill Ackman, FTX investor and exchange spokesperson O’Leary has voiced his support for Bankman-Fried.

lost millions as an investor @FTX Sandblasted as a paid spokesperson for the company, but after listening to that interview, I @Bill Ackman Camp about kids! https://t.co/5lWzTT7JEv

— Kevin O’Leary aka Mr. Wonderful (@kevinolearytv) December 1, 2022

Forbes’ recent revelation about SBF is a different story

Bankman-Fried sent Forbes documents showing ownership of Alameda (90%) and FTX (about 50%) in January 2021, along with screenshots of wallets holding cryptocurrencies.

SBF says it was ‘deeply unaware’ of Alameda’s finances

Forbes says it sent details of Alameda’s stake in Augusthttps://t.co/SVR3XJuvc5 pic.twitter.com/PHek7Tx7qv

— Decibel (@tier10k) December 2, 2022

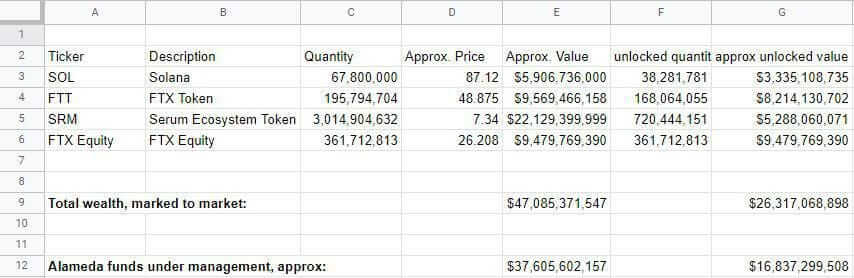

According to the revelation, he sent a Google Spreadsheet listing assets including FTX stocks, 67.8 million Solana tokens, 193.2 million FTT tokens, and 3 billion Serum tokens.

Subsequently, Forbes also found that the Google sheets were regularly modified when calculating the annual global billionaire list.

Alameda increased its share of FTT tokens to 195.8 million as the cryptocurrency price rose. As a result, “Alameda funds in operation, approx.” Row read $37,605,602,157.

“Another column listing only unlocked or tradable tokens pegs Alameda’s total funding at a more modest $14.7 billion. Updates like this arrive regularly – effectively , whenever Forbes asks,” said Forbes.

The Google Spreadsheet has since changed in September 2021 to include an updated tab called “Alameda Funds Under Management”. This tab increased to $37.6 billion, $16.8 billion when counting unlocked tokens only.

In March 2022, Bankman-Fried updated the spreadsheet again to add details about Alameda’s ownership. FTT’s token holdings have dwindled to 176 million tokens. Solana was reduced to his 53 million.

SBF again led Forbes net worth two months before FTX collapsed and provided the following table. Largest shareholder of FTX and FTX USA new tab in the spreadsheet also showed Alameda’s holdings, showing 53 million, 3 billion and 176 million shares in Solana, Serum and FTT respectively.

At the time, Bankman-Freed’s managed share of Alameda’s funds totaled $8.6 billion, or $6.4 billion counting unlocked tokens alone.

Some Twitter users have criticized FTX’s former CEO following recent revelations.

Helping Forbes create a picture of their net worth is a big red flag. Most billionaires want to keep their wealth as hidden as possible.

— Ben Davenport (@bendavenport) December 2, 2022

Forbes said.

“The level of detail Bankman-Fried has provided to Forbes over the years indicates that he had detailed knowledge of some of Alameda’s holdings, and at least some knowledge of the transactions that took place in 2021 in particular. I co-founded FTX in 2019.”