SEC takes aim at influencers for securities fraud; SBF allegedly made political donations in others’ name

Dec. 134 Cryptoverse Biggest News Includes CryptoSlate Analysis Suggesting Bitcoin Bottom May Not Have Hit Yet and SEC Chairman Gary Gensler Claims He Knew About FTX Scam Rep. Tom Emmer included.

CryptoSlate Top Stories

US officials claim SBF donated to politicians using someone else’s name

An indictment filed by the Southern District of New York (SDNY) alleges that arrested FTX founder Sam Bankman-Fried made political contributions in someone else’s name.

Sam Bankman-Fried (SBF) was arrested by Bahamian authorities on December 12 and will face trial in the United States for crimes including money laundering and wire fraud.

according to Filed by SDNY Attorney Damian WilliamSBF is suspected of making donations to politicians using someone else’s name, which is against the rules. U.S. campaign finance regulations.

The FTX founder and his unnamed accomplice are said to have donated over $25,000 to US politicians.

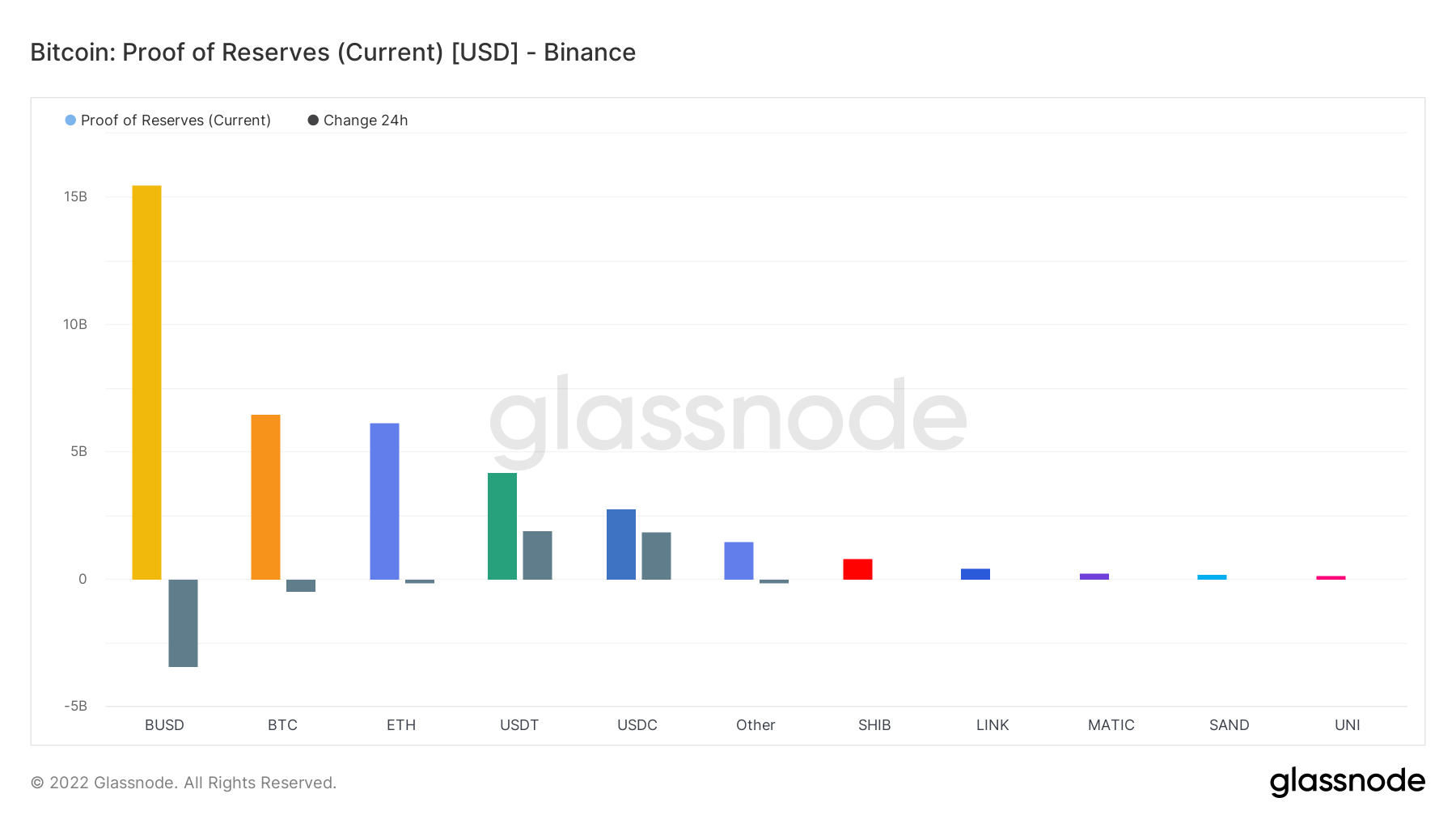

Binance Proof of Reserves Falls $3.5 Billion in 24 Hours

Over the past 24 hours, Binance USD (BUSD) and Bitcoin (BTC) Proof of Reserves (PoR) have fallen by $3.45 billion and $472.86 million respectively – according to Glassnode data analyzed by CryptoSlate.

within that same period. The Binance PoR brought in about $1.86 billion in both USD Coin (USDC) and Tether (USDT). Ethereum (ETH) margin reduction was also observed.

Total USD PoR on Binance is currently below $40 billion, which can be seen in the Glassnode chart below. This marks a steep year-to-date decline and a drop of about $13.2 billion in his PoR holdings since September.

SEC Indicts Eight in $100 Million Social Media Securities Fraud

The U.S. Securities and Exchange Commission (SEC) has indicted eight people in a $100 million securities fraud scheme involving major social media platforms, Twitter and Discord.

Seven of the defendants reportedly promoted themselves as successful traders on social media platforms and encouraged their followers to buy stocks of their choice by posting targeted and updated information about their positions. Recommended. However, as stock prices and trading volumes increased, the defendants allegedly sold the shares without disclosing their intentions, resulting in an illicit profit of approximately $100 million.

Elizabeth Warren working on bipartisan bill to tackle crypto money laundering

US Democratic Senator Elizabeth Warren joins forces with Republican Senator Roger Marshall to introduce new legislation to close loopholes in the financial system that allow digital assets to be used for money laundering We are working on a bipartisan bill.

In an exclusive statement to CNN, Warren said:

“I have been sounding the alarm in the Senate about the dangers of these digital asset loopholes and working bipartisanly to pass common-sense cryptography to better protect U.S. national security. I’m here.”

The bill, called the Digital Asset Anti-Money Laundering Act, seeks to bring the digital asset ecosystem into compliance with existing systems of anti-money laundering in the global financial system.

Congressman Tom Emer Alleges SEC Chairman Gensler Knew About FTX Scam

US Congressman Tom Emer Claims SEC Chairman Gary Gensler Knew FTX Was A Scam, But Had Meetings With Disgraceful Founder Sam Bankman-Fried Did.

In a tweet, Emmer shared the following section of the SEC filing.

“Bankman-Fried diverted FTX customer funds to Alameda since FTX’s inception and continued to do so until FTX’s collapse in November 2022.”

In scrutinizing the SEC filing, Congressman Tom Emer said Alleged SEC Chairman Gary Gensler has known FTX to be fraudulent from the beginning.

“Gary Gensler knows FTX has been rigged from the start.

research highlights

Study: On-Chain Bitcoin Metrics Show We May Not Have Bottomed Out

CryptoSlate’s analysis of on-chain Glassnode metrics showed mixed results for Bitcoin’s bottoming out.

A previous study, released on Sept. 27, looked at the Profit Supply Rate (PSP), Market Value to Realized Value (MVRV), and Profit and Loss Supply Rate (SPL) indicators. All of this indicated that a bottom was forming at that point.

Revisiting these same metrics, we find that PSP and MVRV are still bottoming out, but SPL is no longer bottoming out.

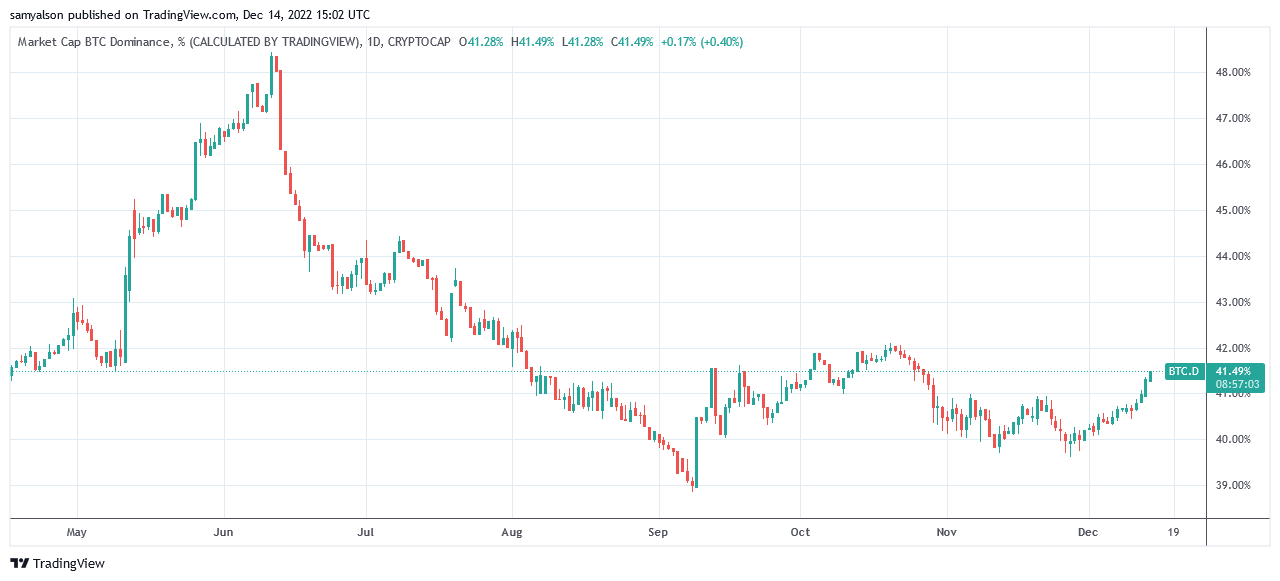

Bitcoin Surpasses Layer 1 SOL, ETH, DOT, BNB, ATOM in December

According to data analyzed by CryptoSlate, Bitcoin surpassed native tokens in the Solana, Ethereum, Polkadot, Binance and Cosmos ecosystems in December.

Bitcoin Dominance (BTC.D) is also trending higher this month. The chart below shows that BTC.D started at 39.9% in December and has been steadily rising. The current reading is 41.5%, a seven-week high.

crypto market

Over the past 24 hours, Bitcoin (BTC) rose 1.18% to trade at $17,937.45 while Ethereum (ETH) fell 0.05% to trade at $1,316.68.

Biggest Gainers (24 hours)

- DigiByte (DGB): +23.94%

- Mobile Coin (MOB): +20.72%

- Toncoin (TON): +11.49%

Biggest Loser (24h)

- Magic (magic): -12.09%

- Siacoin (SC): -10.92%

- Tribe (Tribe): -6.38%