Short-term Bitcoin holders fell to its lowest level at 15% of the supply

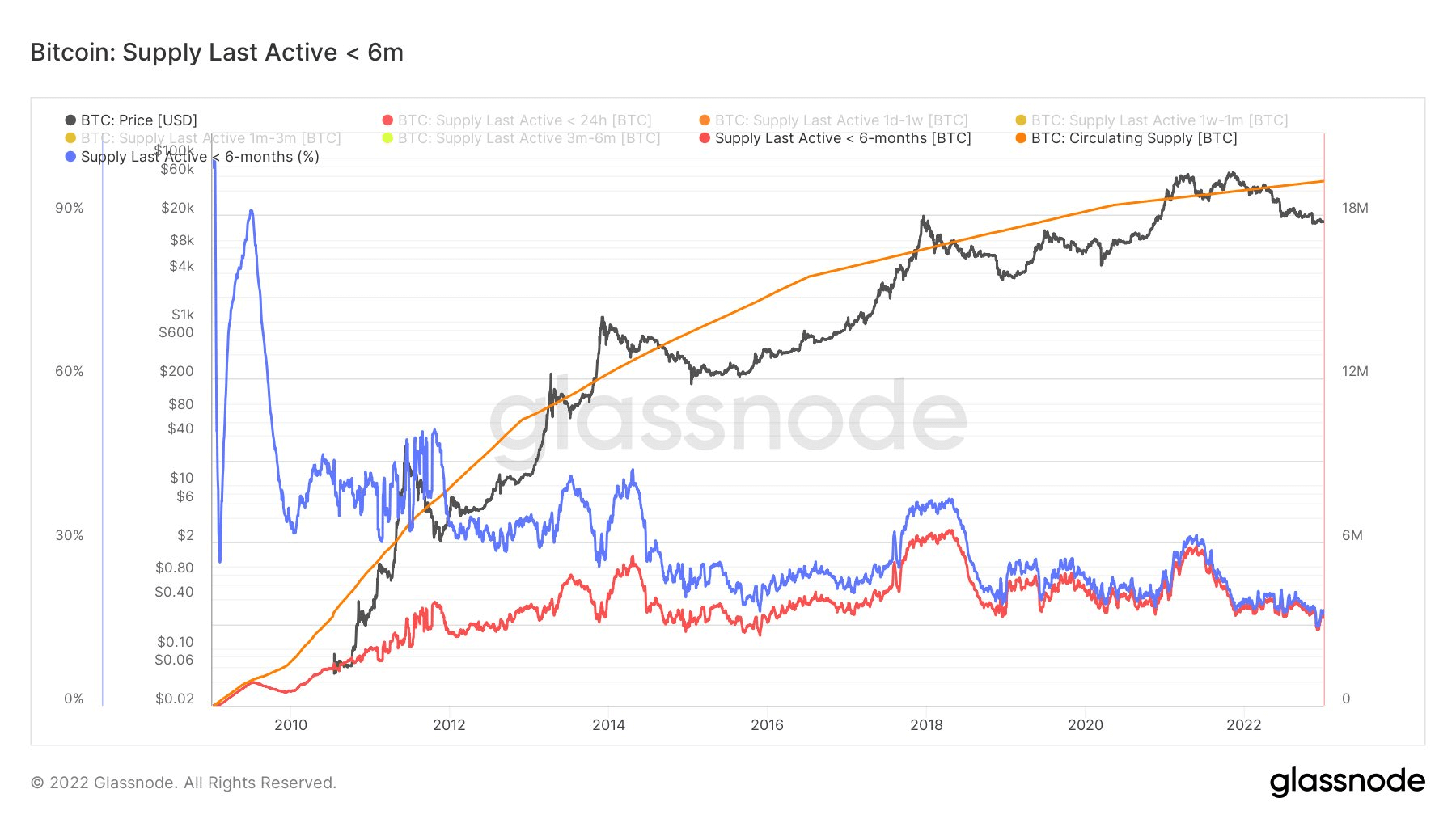

The Supply Last Active metric looks at the amount of inactive bitcoin over a specific period of time. Analysts speculate that less activity means more BTC is held, reducing selling pressure and acting as a tailwind for bullish price action.

of crypto slate An analysis of Glassnode’s data showed that the percentage of supply held for less than six months had fallen to its lowest level.

Bitcoin Supply Last Active Drops To New Lows

With the arrival of 2023, expectations are high that Bitcoin will reverse the negative price action that characterized the previous year.

The bitcoiner cohort with a holding period of 6 months or less currently stands at around 3 million BTC, representing 15% of the total circulating supply, the lowest percentage ever.

The last time Supply Last Active was at its lowest was during the bear market trough in Q4 2015, when the indicator hit 17%. From that point on he took two years and the Bitcoin price went from $200 to $20,000.

Analyzing historical data, we found that young coins typically increase in volume on two key events:

- The market becomes bullish as long-term investors spend and invest in the strength of the market.

- A surrender sale event where widespread panic puts coins of all ages back into liquid circulation.