SSD Market to Hit $67 Billion in 2028, 130% Growth From Today

Average selling prices for NAND memory and solid-state drives have fallen in recent quarters due to weak demand and oversupply. However, as more applications adopt SSDs, their selling price and sales are expected to increase. Five years from now, in 2028, SSD revenue will grow to $67 billion, according to estimates from . Yole group (via storage newsletter).

In the long term, the overall market size of SSDs is expected to grow from $29 billion and 352 million units in 2022 to $67 billion and 472 million units in 2028, with Yole says the compound annual growth rate to 2028 will be around 15%. Claim.

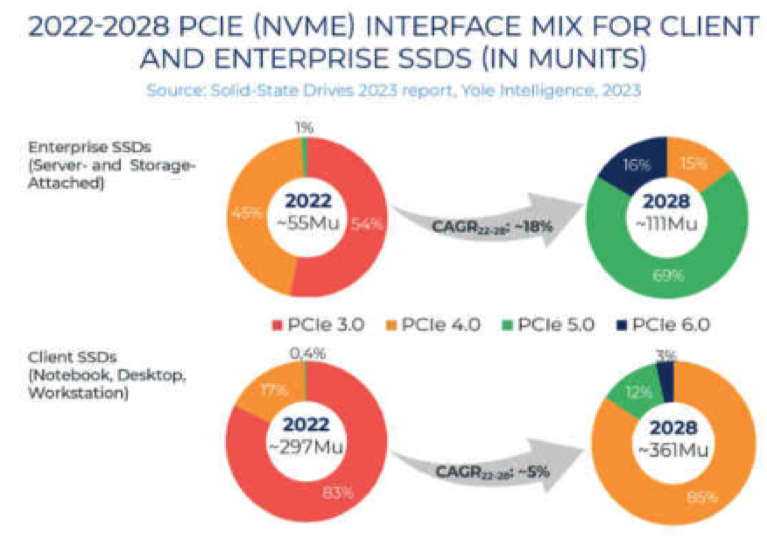

Of the 352 million SSDs sold in 2022 (including those included in the Best SSD list), about 55 million were enterprise drives and the remainder were client SSDs. Enterprise SSD shipments in 2022 were dominated by PCIe SSDs accounting for about 55% or 30 million units. This number is expected to increase to approximately 71% or 79 million units by 2028. The share of PCIe client SSDs is expected to rise from about 85% in 2021 to about 96% in 2028, representing 252 million units and 347 million units. , Each.

Enterprise drives will adopt the new PCIe interface sooner than their client brethren. Yole believes that 69% of enterprise-grade SSDs will use the PCIe 5.0 bus in 2028, while only 12% of client drives will use this interface in that year. As for PCIe 6.0 SSDs, they are expected to hold 16% of the data center drive market in 2028, but only 3% of the client SSD market.

SSD sales fell 14% year over year, from $34 billion in 2021 to $29 billion in 2022. In terms of units, this equates to about 352 million units, down from over 400 million units in 2021. However, Yole Group considers this sharp decline to be his one-off event. On the other hand, the company has not attempted to provide a more or less accurate dollar or unit sales forecast for 2023 due to continued depletion of inventories and continued economic weakness.

Not all SSD suppliers can monetize market growth equally. According to Yole, while client SSD products will see weak demand in the next few years, the growth of enterprise SSDs is expected to be driven by “the need for low-latency storage for advanced workloads” in the data center space. The market research firm doesn’t disclose the workloads it represents, but low-latency solid-state storage applications are essential for trendy applications like generative AI.

Yole Group states that there are two types of SSD suppliers. NAND Integrated Device Manufacturers (IDMs) that manufacture their own memory, develop their own NAND controllers, and manufacture their own drives, and 3rd party SSD manufacturers that buy flash memory (in the form of NAND wafers or chips) From IDM, drives are built using third-party controllers, while both types of SSD manufacturers tend to purchase controllers from companies such as Silicon Motion, Phison, and Marvell for cloud data centers. Large operators often develop their own storage devices, but still purchase memory and controllers from third parties.

Leading IDMs such as Samsung, Kioxia, Western Digital, Micron, SK Hynix, and Solidigm accounted for 82% share of the overall SSD market in 2022. In contrast, third-party SSD makers such as Kingston, Seagate and Adata controlled only 18% of him.