Stablecoin wars heat up as USDC and USDT battle for market share

Since the Terra Luna crisis earlier this year, there have been significant changes in the stablecoin ecosystem.

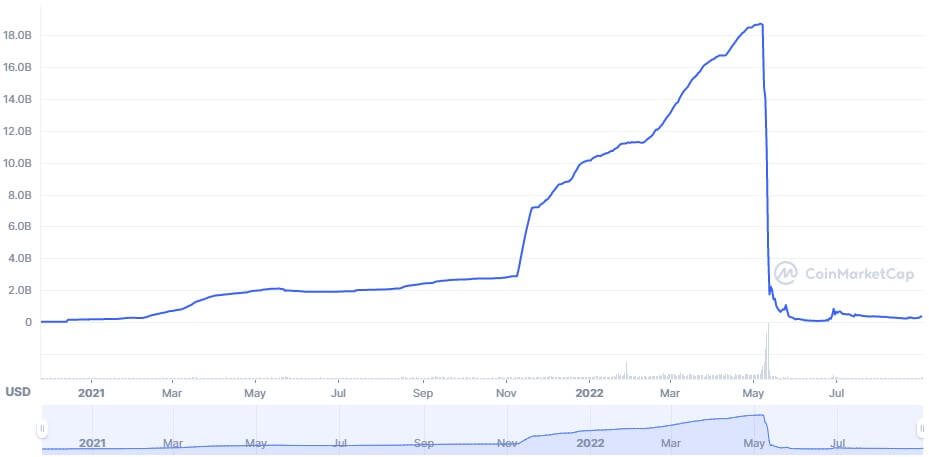

At the time of the crash, TerraUSD (UST) had a market cap of just over $18 billion, which was washed away almost overnight.

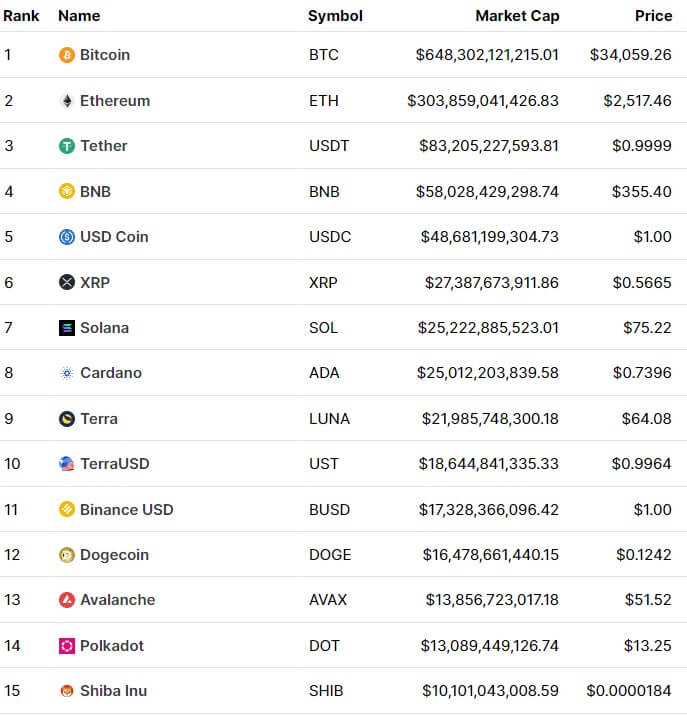

Terra’s UST quickly gained market share between November 2021 and May 2022 before losing its peg. At the time of Terra’s crash, UST was the third largest stablecoin by market cap behind Tether (USDT) and Circle’s USD Coin (USDC).

USDT was the clear frontrunner with almost double the market cap of USDC. At this point, the total market capitalization of the stablecoin industry was over $170 billion.

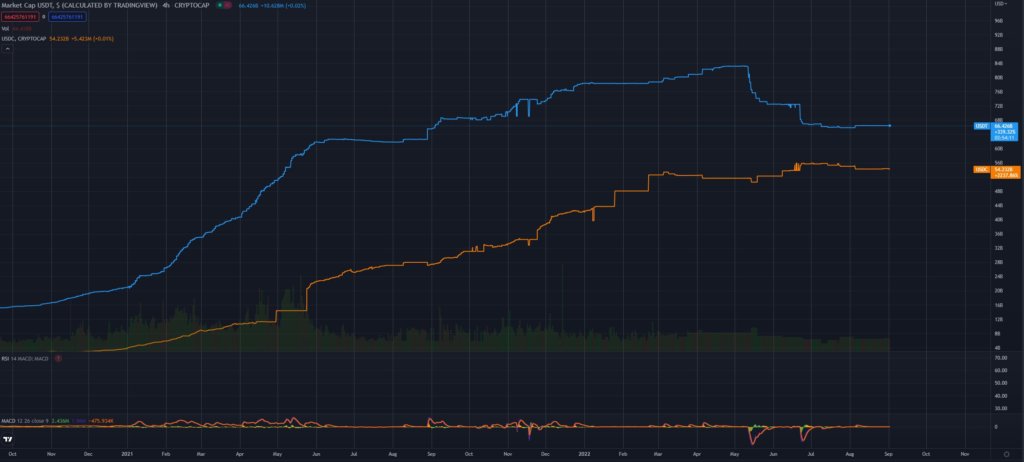

Today, the stablecoin market is worth a combined $153 billion, with the two most prominent players still being USDT and USDC. However, as you can see in the chart below, the gap between premier tokens has closed considerably. This chart shows the dominance of each token in the overall crypto market. USDC and USDT together account for about 12% of the cryptocurrency market capitalization.

Tether has lost more than $16 billion in market cap since May, while USDC has increased by $4 billion. In terms of market dominance, both he peaked in June and hit a low in early August.

However, in the past few weeks, both tokens have started to regain dominance across the crypto market, while their market caps have remained stable. Their total dominance rose by 40% as the market weakened with steady issuance from major stablecoins.

Numerous stories have influenced the circulating supply of both tokens during this time. Tether continues to battle bankruptcies, improper audits, and misleading treasury claims. At the same time, the Circle has had to contend with criticism of its decision to “blacklist” all addresses associated with Tornado Cash.

On Wednesday, Circle announced a partnership with Bybit.According to the press release, it will help accelerate Bybit’s growth as a gateway for retail and institutional USDC payment products.

Derivative contracts such as options and futures are primarily settled in USDT, so the move to enable $USDC-settled options is an aggressive move by Circle to further close the gap with Tether.

Circle co-founder and CEO Jeremy Allaire said:

Stablecoins have also been rapidly leaving exchanges in recent weeks, a rare occurrence during a bull market but a common occurrence in crypto winters.

Will USDC topple USDT, or can Binance USD (BUSD) come from behind and challenge both? BUSD’s current market cap is $19 billion, but growing faster than the top two doing.