Taking a deep dive on how the Bitcoin fundamentals look on-chain as the dust settles from the FTX fallout

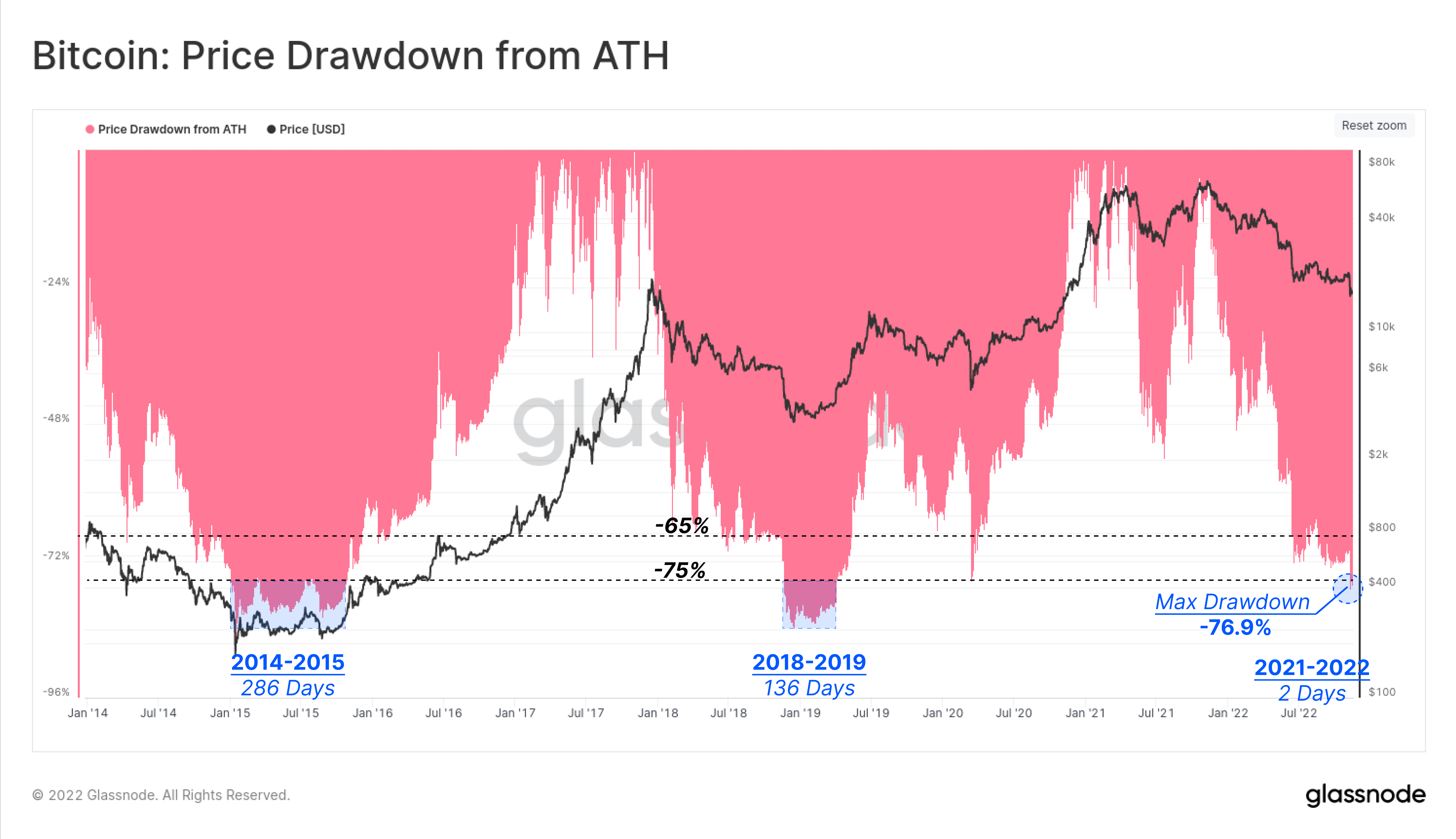

Price drawdown from ATH compared to previous bear market

Bitcoin is currently down 75% from its all-time high (ATH), with a maximum drawdown of 76.9% from the November 9 FTX drop. However, this is nothing new in Bitcoin history. During the 2014-2015 bear market, Bitcoin dropped more than 85% from his ATH and lasted about 286 days in maximum surrender.

A similar event occurred during the 2018-19 bear market, which saw an 84% drawdown over 136 days. His 76% drawdown started in mid-November, so based on history, this could continue into his Q1 2023.

2022, a bear market different from 2014 and 2018

The current 2022 bear market is different from the 2014 and 2018 bear markets for a number of reasons, mainly due to Bitcoin becoming the mainstream currency.

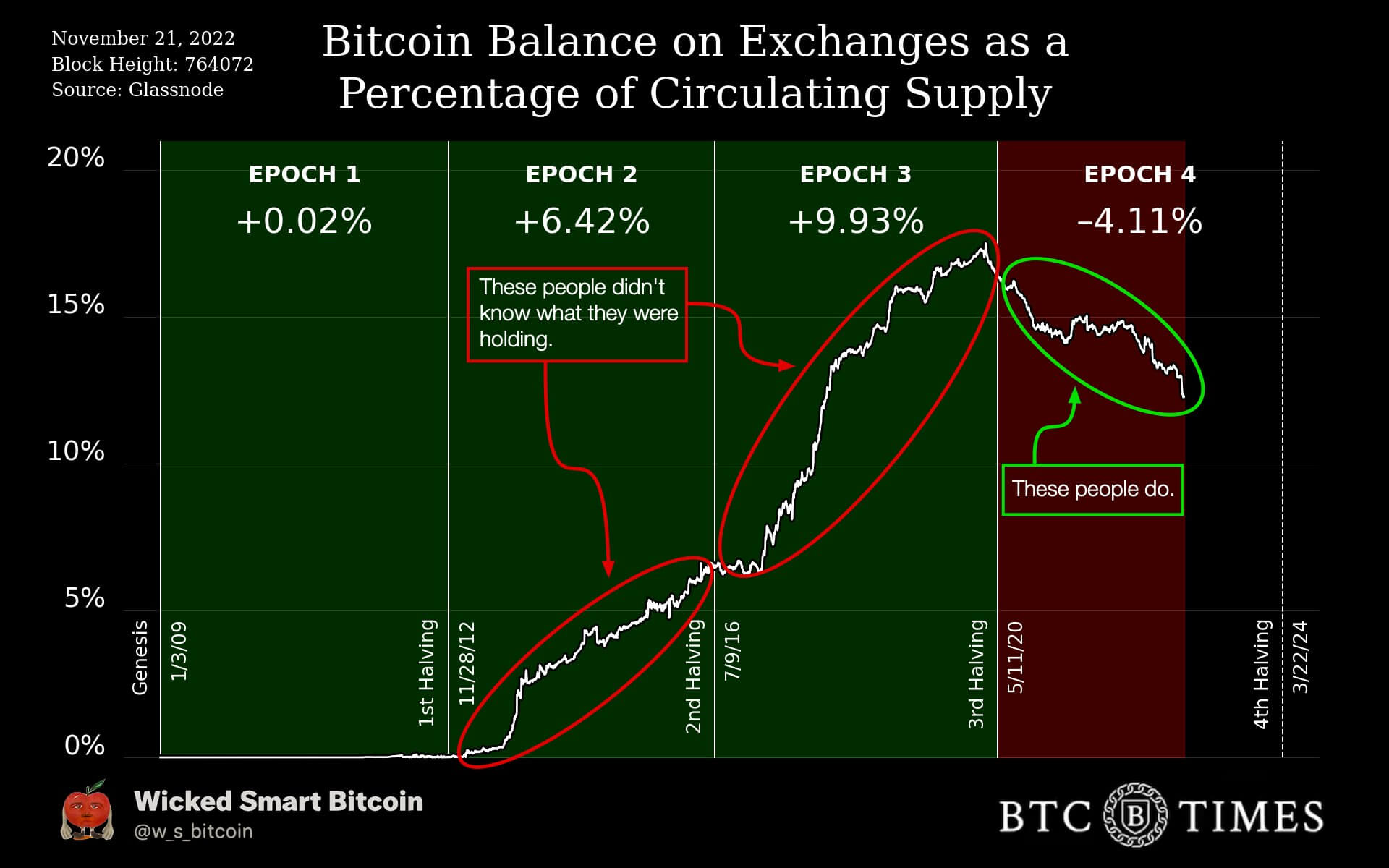

Epoch 2 – second half-life (2012-2016)

Bitcoin surged above $1,000 during the 2013 bull market, and in 2017, the price hit $20,000, and the coin quickly flooded exchanges.

In the second halving, or Epoch 2, when Bitcoin hit a $1,000 high, about 6.5% of Bitcoin returned to centralized exchanges. From the beginning to the end of Epoch 2, hundreds of Bitcoins ended up in over 1000 Bitcoins on exchanges.

Epoch 3 – 3rd half-life

The third epoch started in mid-2016 and saw around 1 million bitcoins on exchanges. At the end of the third halving, just before Covid 2020, the exchange held over 3 million of his Bitcoins. This pushed the price of Bitcoin up to $20,000 at the end of 2017, while the low was $3,000.

Epoch 4 – 4th half-life

Since COVID and the start of the fourth halving, exchanges have seen bitcoin supply drop by more than 4%, with around 12% of supply remaining on exchanges. Over 135,000 Bitcoins have been withdrawn from exchanges in the last 30 days. This is minus his 1% of the Bitcoin supply. This is the first time the coin has been removed in a bear market. So far, Bitcoin has gone from his $69,000 peak to his $15,500 low.

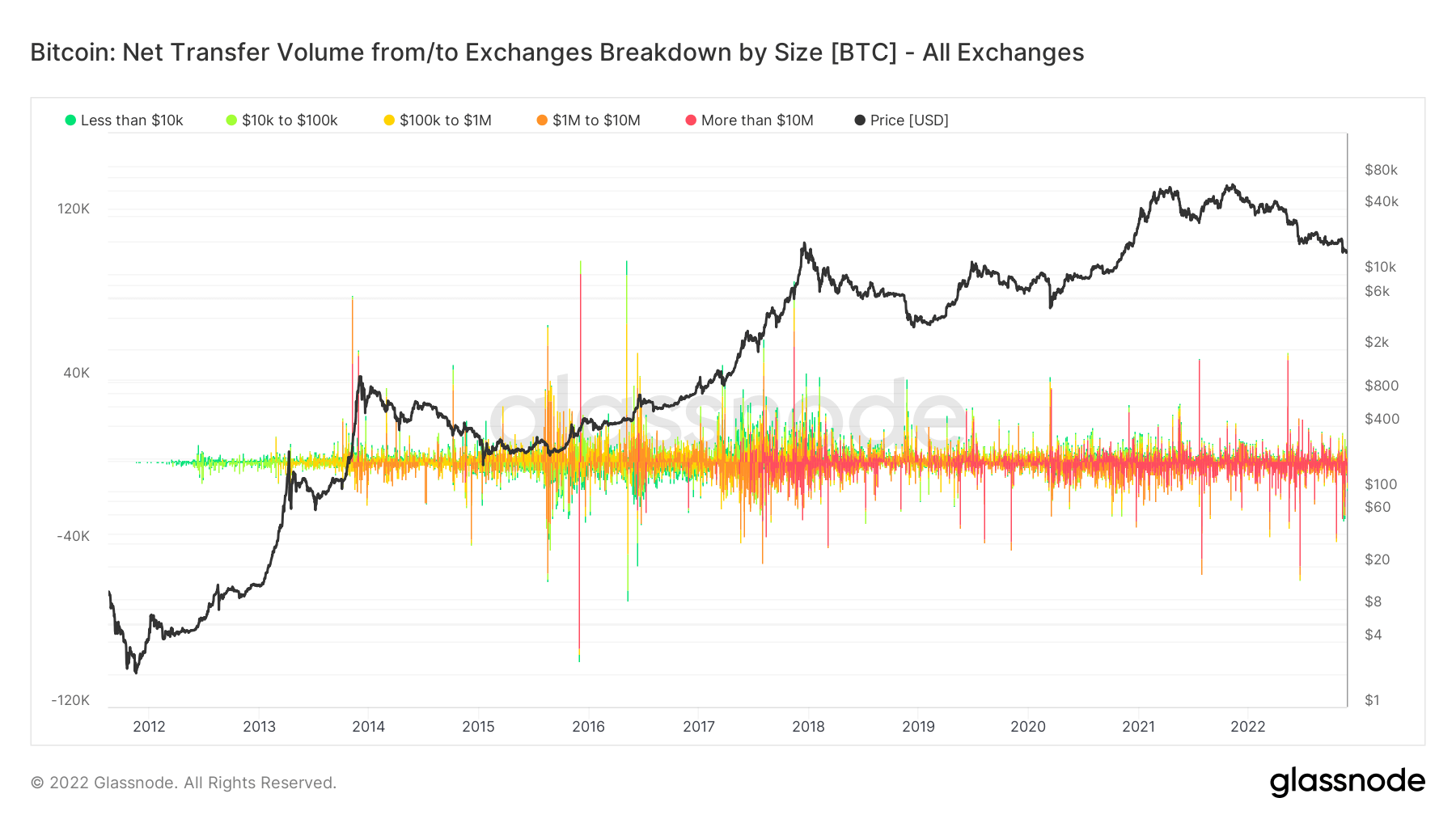

Not this time. Retailers are withdrawing coins.

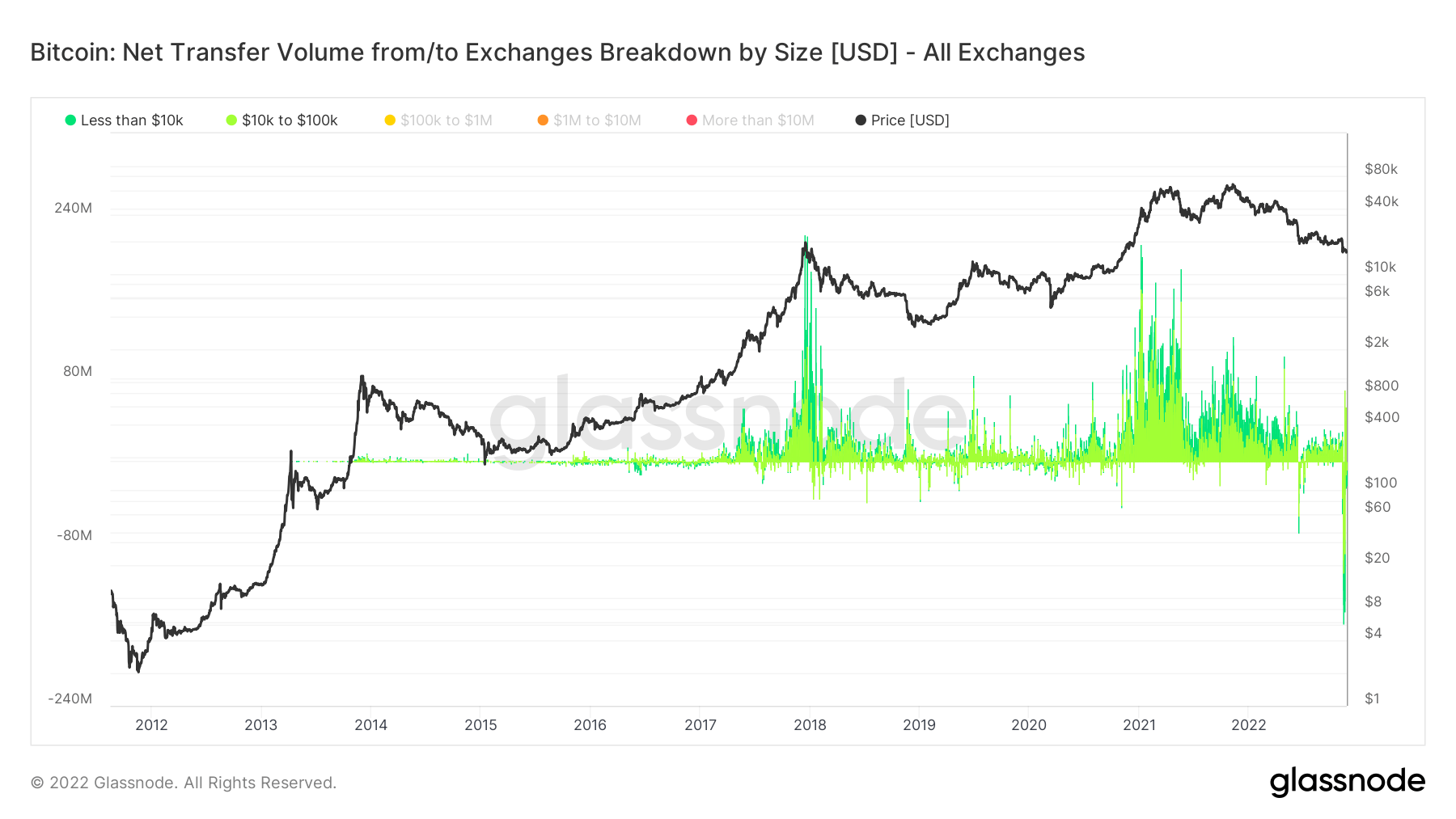

Dig deeper into which cohorts are withdrawing Bitcoin from exchanges.

As we have seen since the birth of Bitcoin, a surge in transactions from green to yellow indicates smaller transactions. As time went on, until around 2017, a storm of red his transactions began to occur, indicating institutional adoption into the space.

However, when filtered to show retail deals under $100,000, it’s clear that they had FOMO during the peak bull markets of 2017 and 2021, peaking above $200 million. Meanwhile, in the past 30 days, the network has seen its highest ever number of retail withdrawals, surpassing $180 million. Retailers may have learned a great lesson from the impact of FTX and the meaning of “not your key, not your coin.”

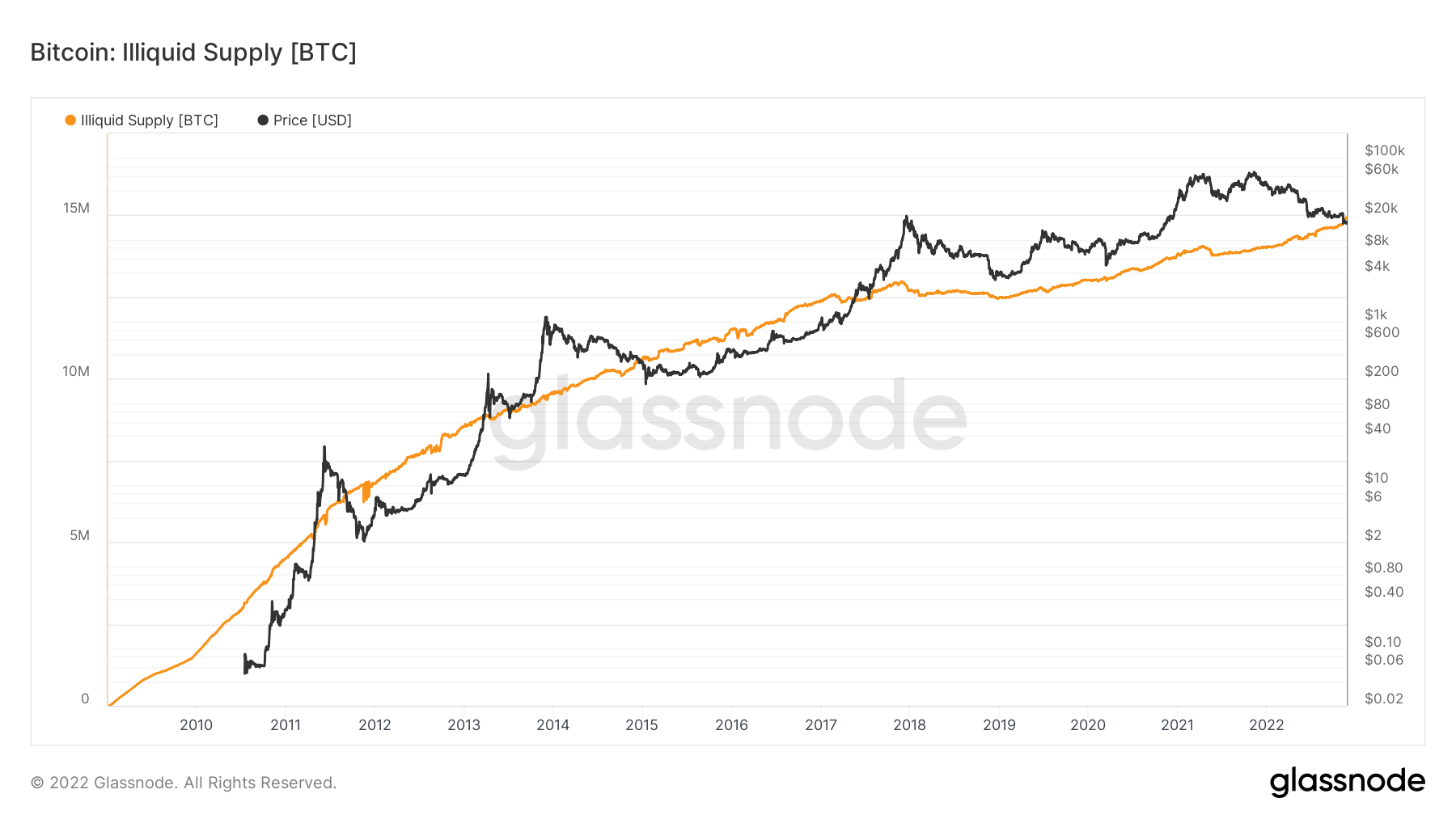

With the collapse of FTX and other centralized entities within the crypto space, self-custody became a hot topic and the number of self-custody coins increased exponentially in 2022 (14 million to 15 million). His 19.2 million coins currently in circulation make him 78% of self-custody coins.

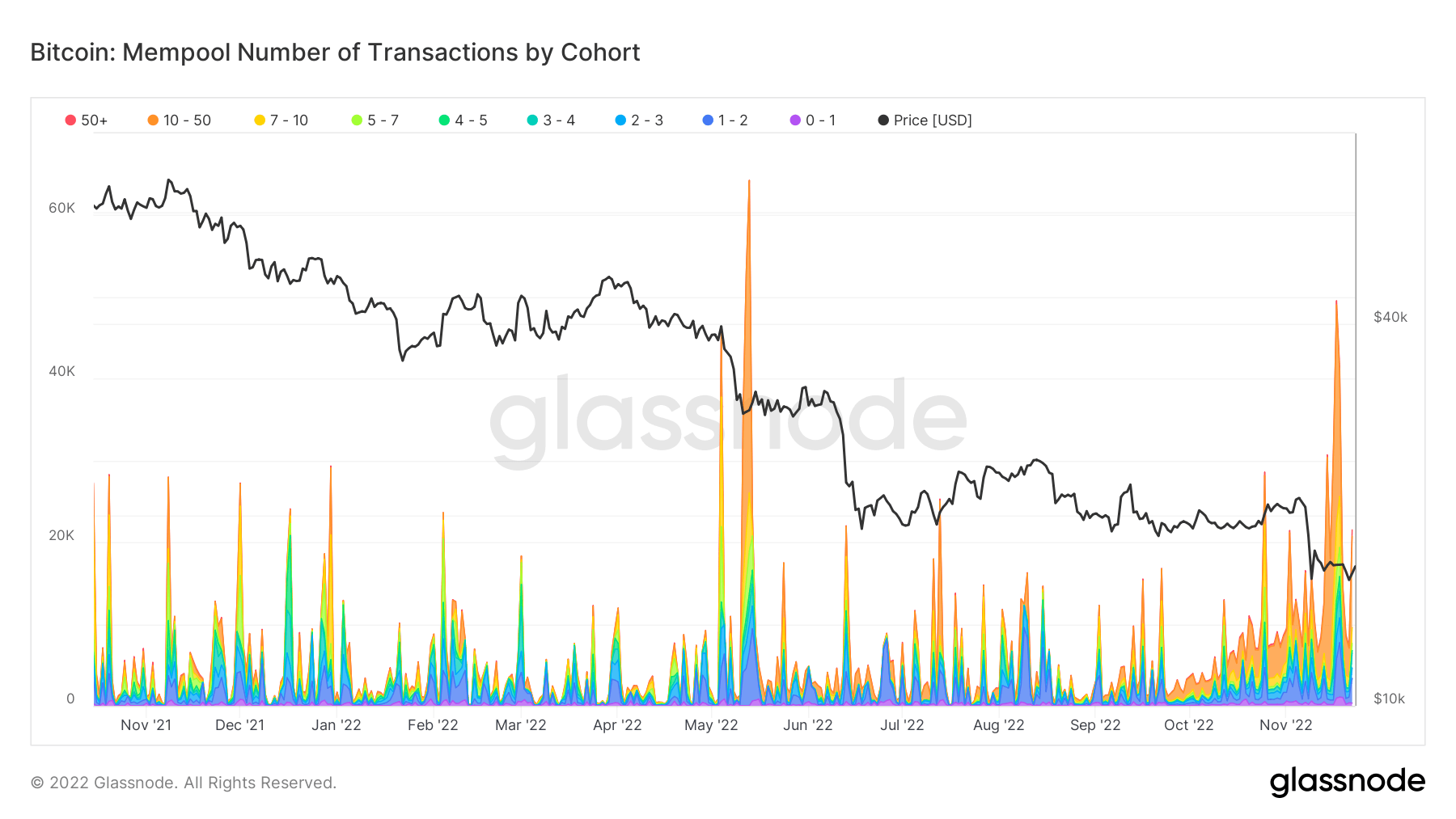

Mempool is full, people are not waiting for proof of reserves

Due to the high number of coins exiting the exchange, mempool saw a significant increase in transactions. Especially he is noticeable in June and he in November. There is a clear correlation between surrender from FTX and Luna’s Fallout.

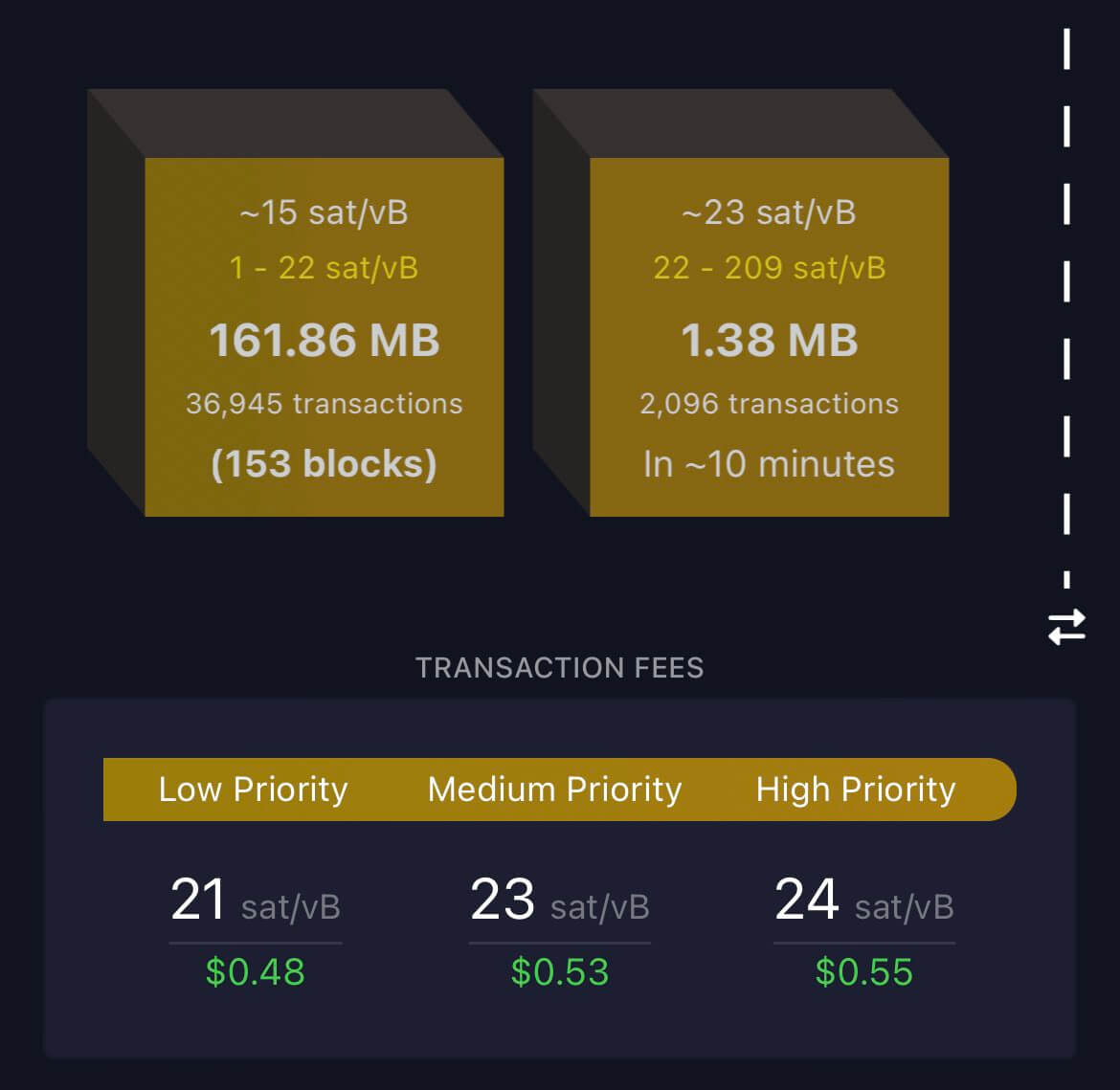

What happened last week shows that a huge amount of network volume and traffic was accumulating on-chain. When the mempool is backlogged, nodes will prioritize nodes with higher fees when volume is high.

On November 14th, 154 blocks were waiting in the mempool. This is his biggest backlog since May 2021, and such massive deals are rarely seen outside of a bull market.

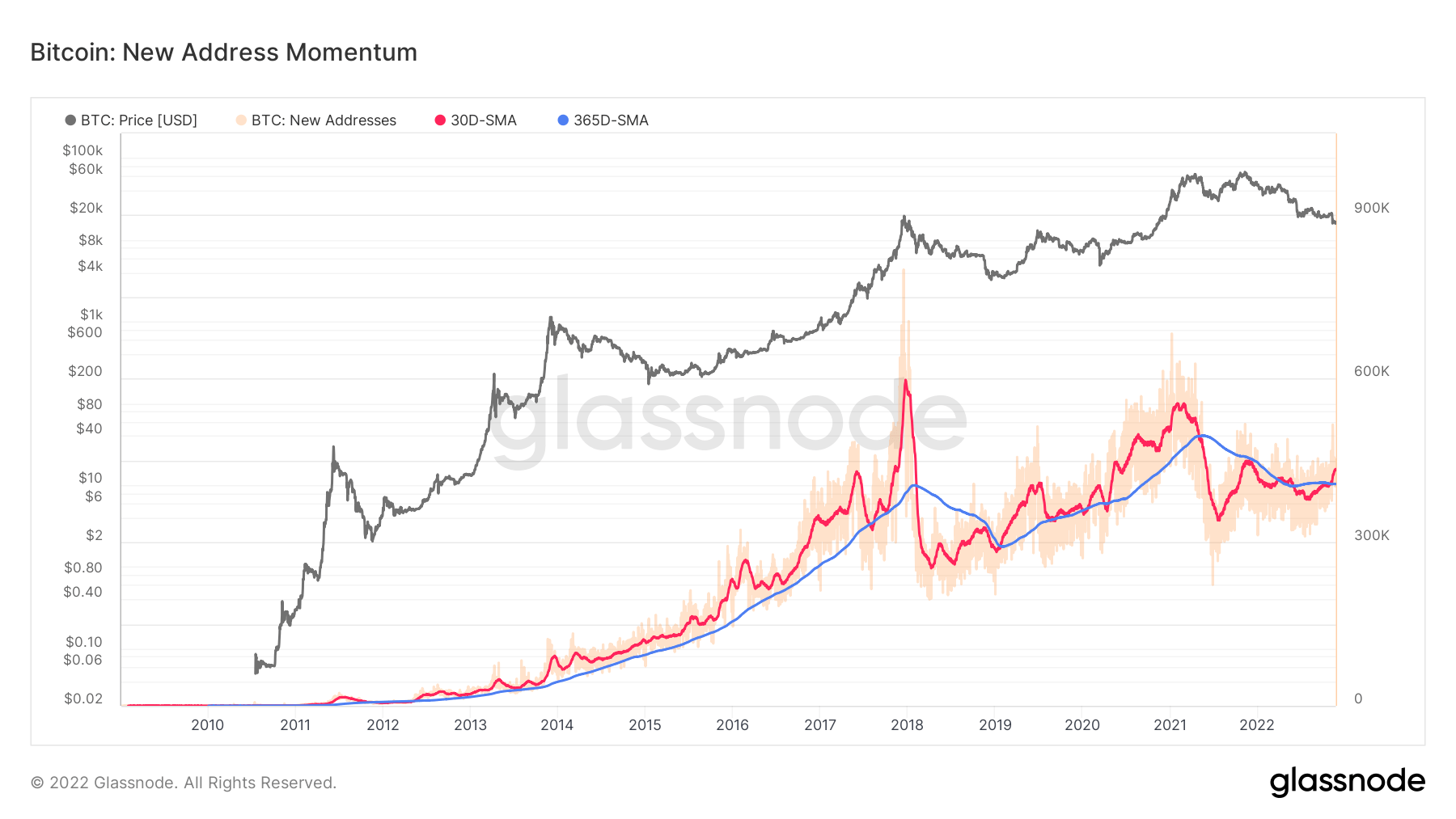

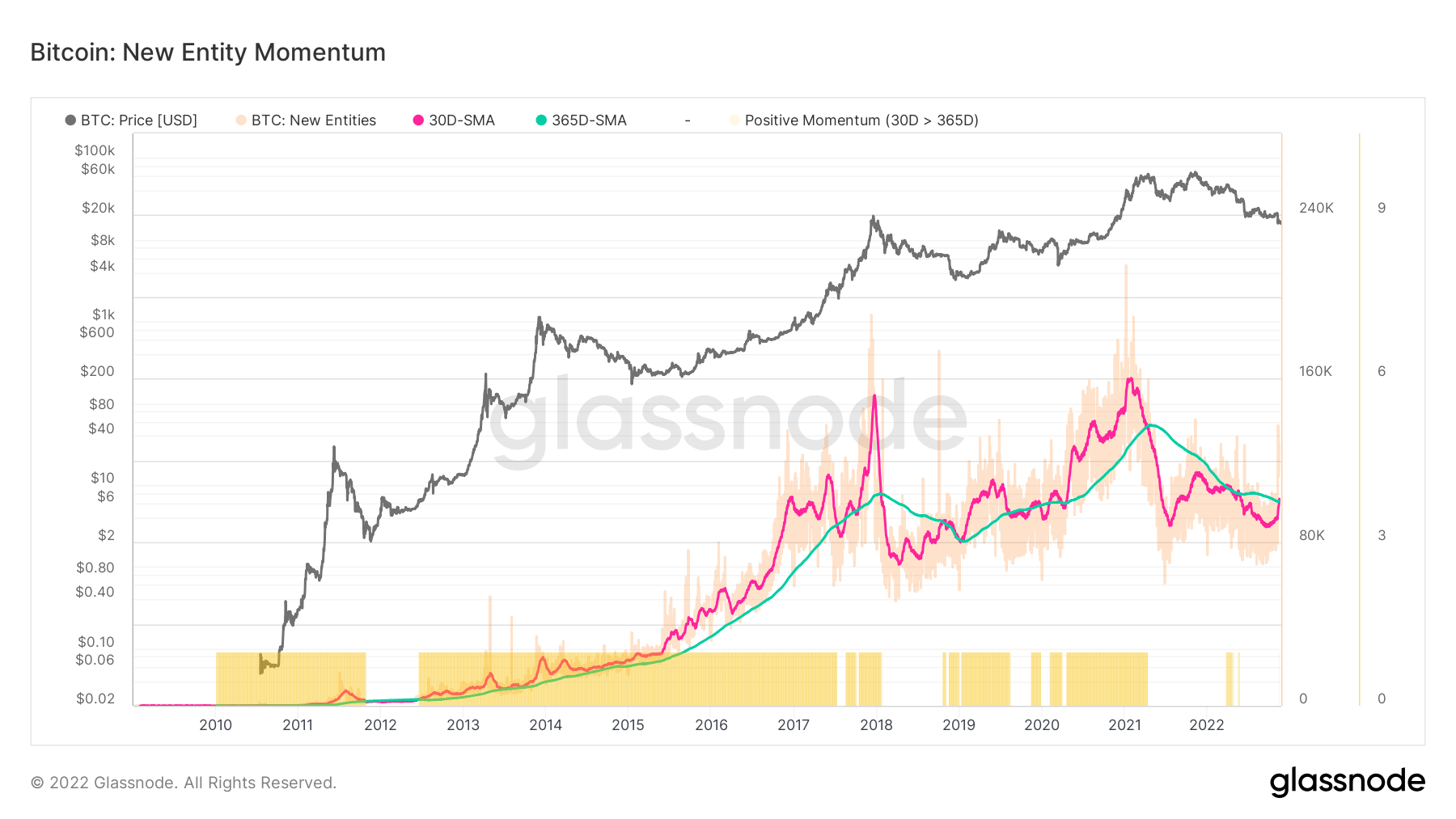

New Entities Coming to the Ecosystem

Healthy network adoption is often characterized by an increase in daily active users, an increase in transaction throughput, an increase in demand for block space, and vice versa. The number of new entities on the chain utilizes the entity reconciliation method to more accurately measure the magnitude, trend and momentum of activity across the network.

Digging deeper into the on-chain data shows that most of the non-zero addresses were created in the last month. His 30-day Simple Moving Average (SMA) for new addresses is above his 365-day SMA and has been flat for most of 2022.

The growth in the number of new addresses has shifted to higher entity momentum. All new non-zero balance addresses were required to obtain their balance in the last month, significantly increasing the number of new entities on the network.

The last time both new entities and new addresses exceeded 365DMA was during the 2020-2021 bull market.

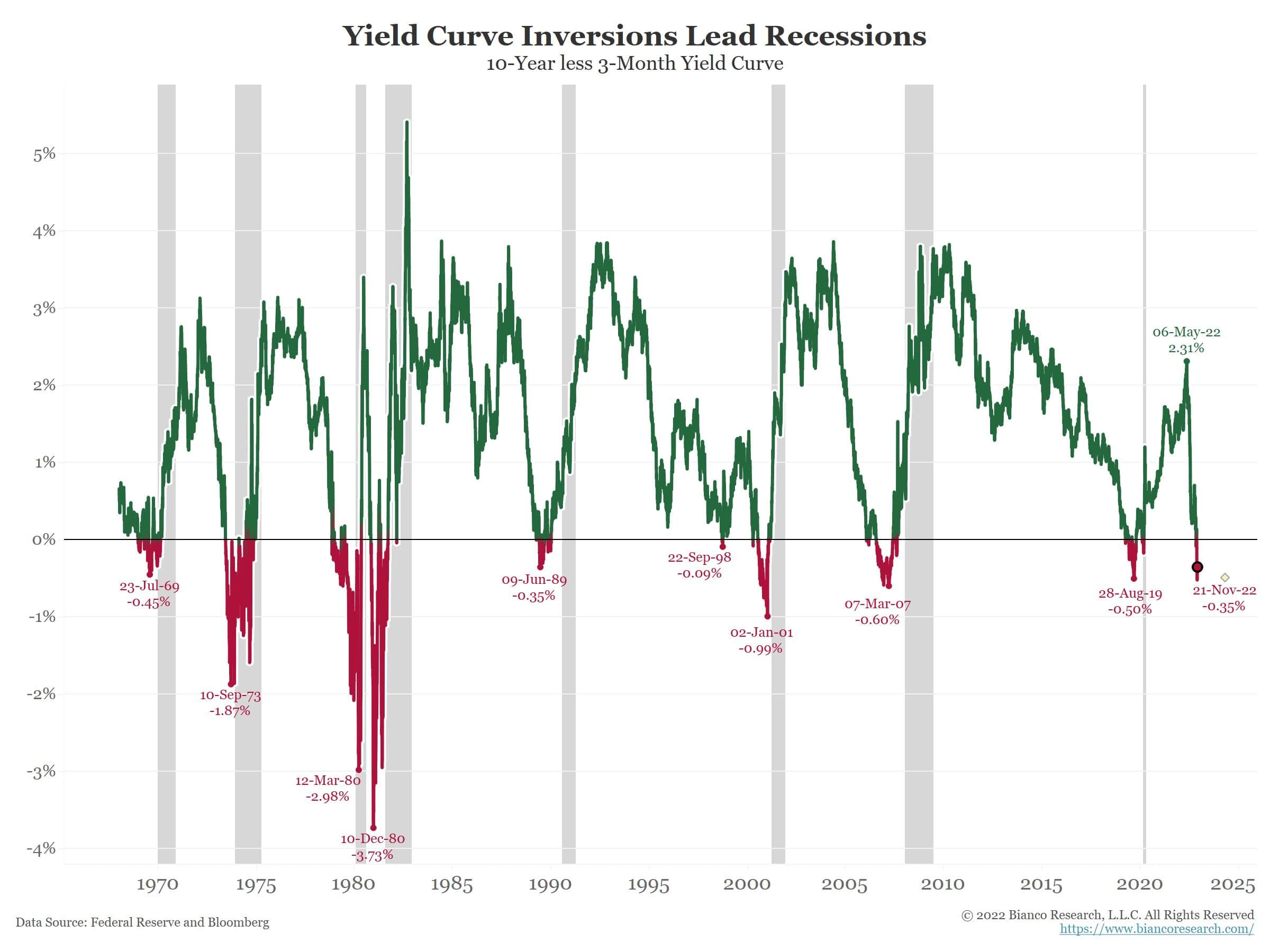

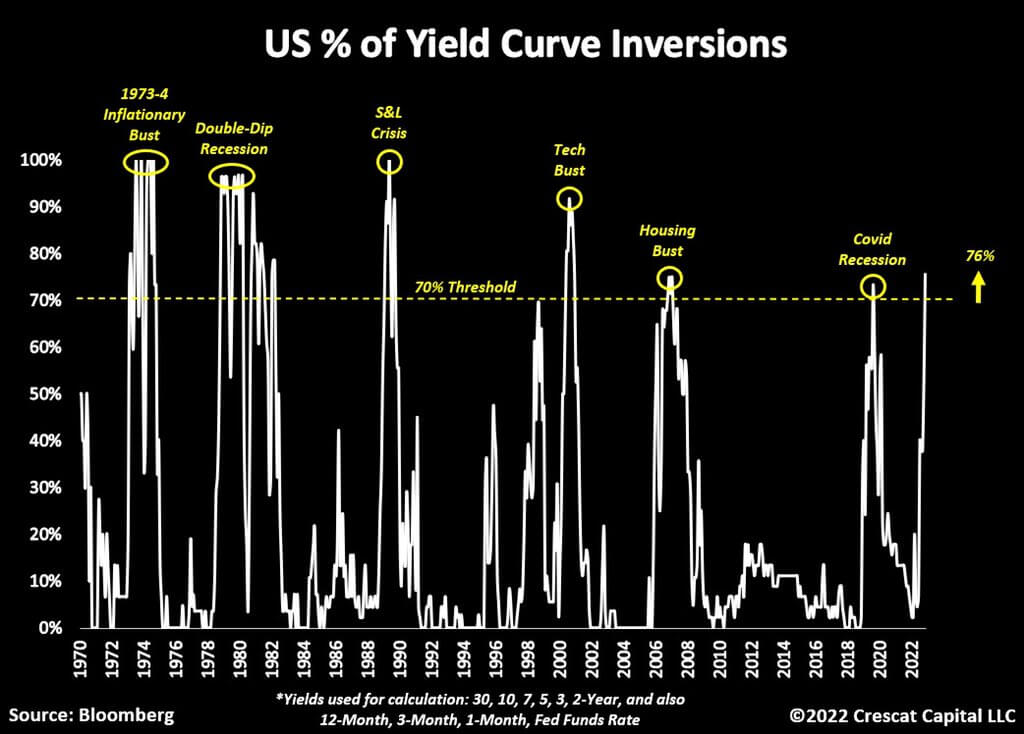

Historic U.S. Yield Curve Inversion

An inverted yield curve is when short-term rates are higher than long-term rates and the market indicates rates are too tight for the Fed.

What causes the curve to invert? Short-term rates rise because the market believes the Fed will continue to raise rates, while long-term rates rise because the economy at some point believes it will lower inflation. below short-term interest rates.

Various inverted yield curves are seen to identify recessions. The most notable are 10 years minus 2 years and 10 years minus 3 months.

More than 75% of the entire US financial curve is now inverted. Above 70%, there has been a recession in the last 50 years.

Economists believe that 10-year to 3-month yield spreads are the most accurate at identifying recessions, as most research has been done. The curve has reversed for almost two weeks, indicating a ‘permanent reversal’.

If the 3-month/10-year yield curve inverts for 10 days in a row, the recession forecast over the past 50+ years is 8-8. Average lead time is 311 days or about 10 months. – Jim Bianco (Bianco Research)