Terra collapse sparked explosive growth in long-term Bitcoin supply

The collapse of Terra, with its $60 billion worth evaporated, has already faded as a defining moment in cryptocurrency history.

TerraForm Labs co-founder Do Kwon argues that the problem boils down to weaknesses in UST’s stablecoin protocol design. However, others have openly called the project a scam from the start.

The event triggered an outflow of capital, pushing prices across the board from where the market had yet to recover.

Nonetheless, on-chain indicators show an interesting shift in long-term Bitcoin holder dynamics due to the collapse.

Bitcoin supply held by long-term holders surges

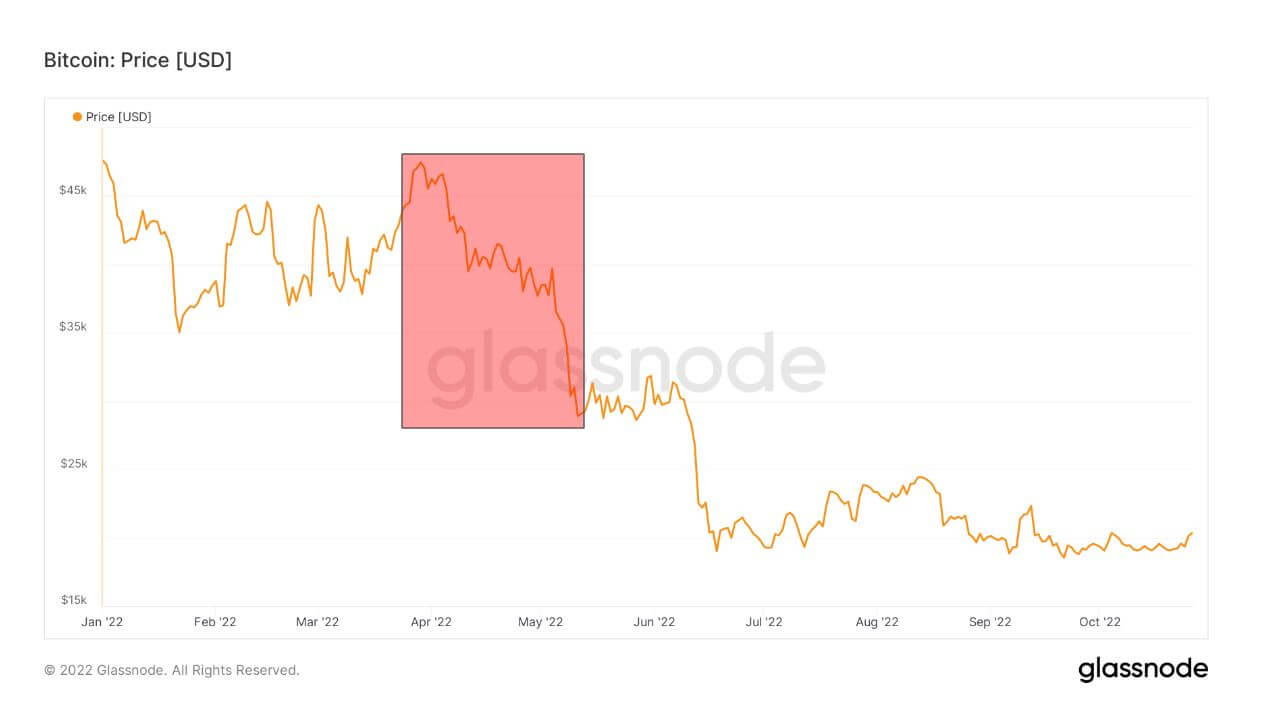

At the end of March, Bitcoin’s price was at $47,000, holding up well despite early warnings of a spike in inflation and further escalation of troubles in Eastern Europe.

Going into May, BTC started the month at $40,000. However, on May 7th, the UST began to lose its dollar peg price. By May 13th, the UST closed daily at $0.13 and he fell to $0.06 on the day.

As the crisis unfolded, a chain reaction took BTC down to $30,000 by May 11th. And by mid-June, the price had dropped 62% from the end of March, bringing him to $18,000.

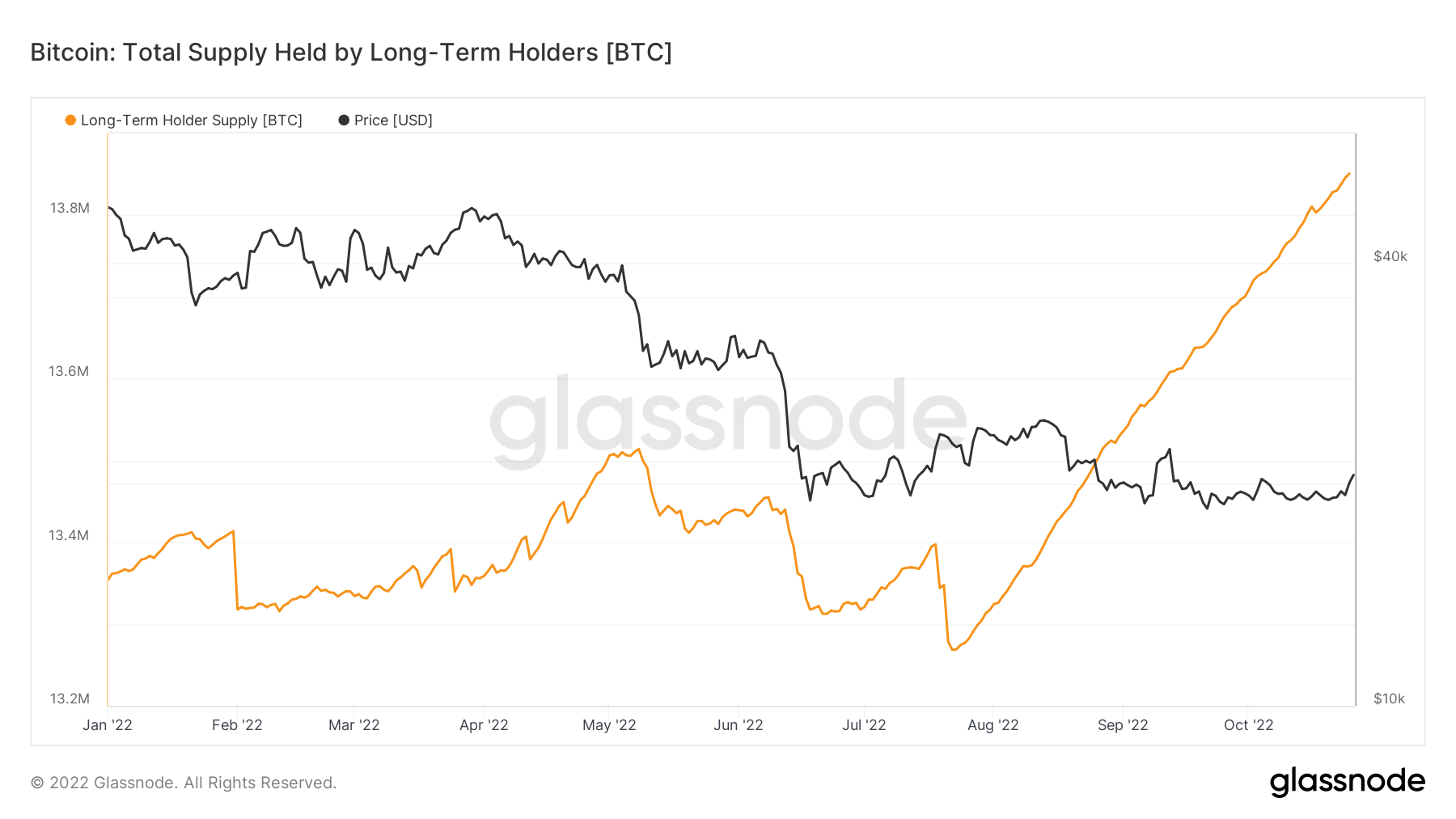

The chart below shows the total supply held by long-term holders (LTH). Glassnode defines LTH as an individual holding her position for more than six months. Rumors of UST unpegging spread, and in early May he highlights a gradual drop in LTH.

This trend bottomed out by late July, leading to continued LTH 45-degree takeoffs. A key reason for this pattern relates to early buying activity in April and he in May (6 months ago).

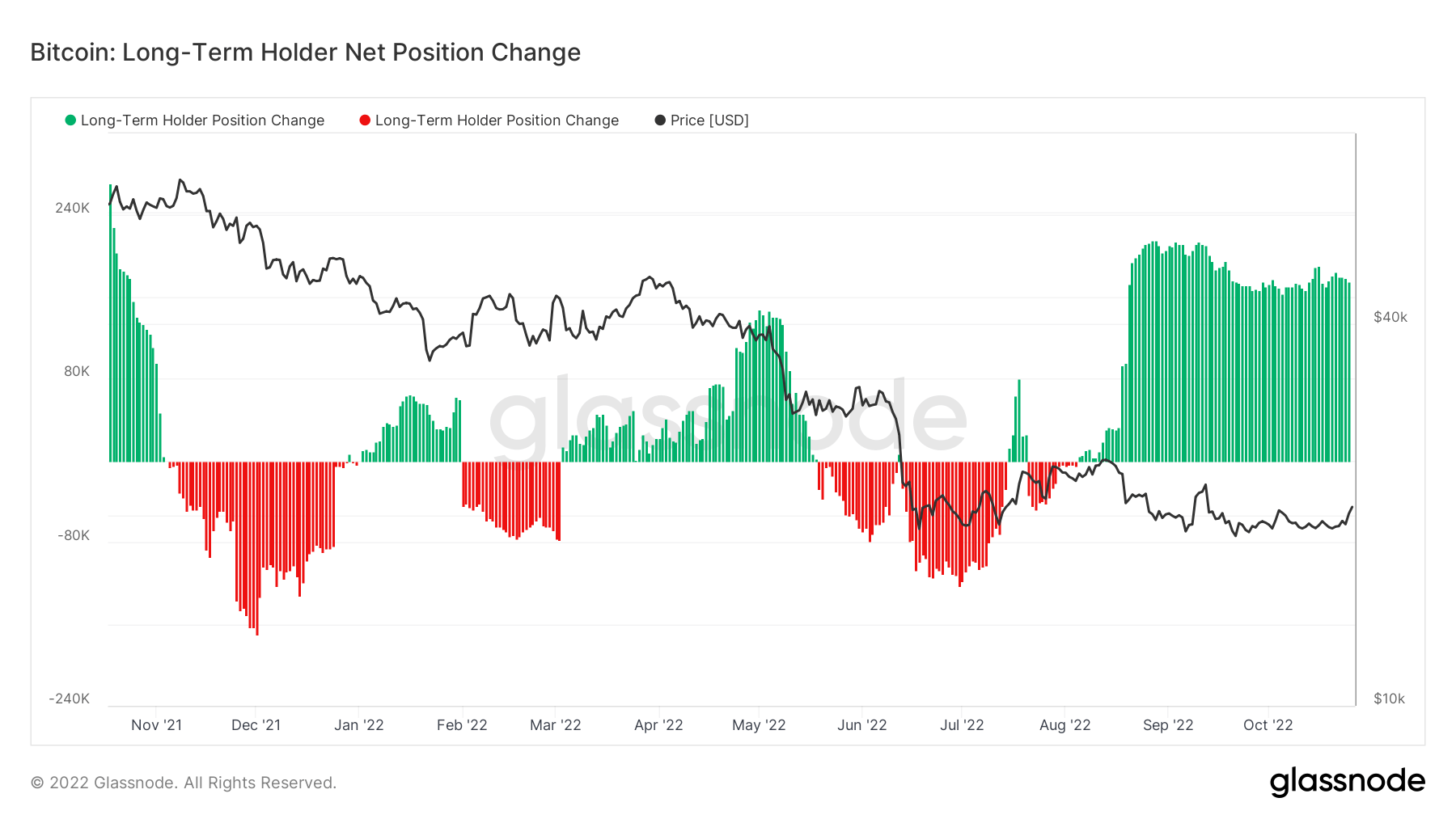

Change in LTHs Net Position

Bitcoin: Changes in the net position of long-term holders refer to the distribution of tokens by LTH. LTH is shown in green as a net accumulator and in red as a net distributor cashing out a position.

As macro conditions deteriorated later in the year, LTH started selling positions. However, since September, the trend has reversed, with LTH finding value at these prices and accumulating accordingly.

Short-term and long-term holders

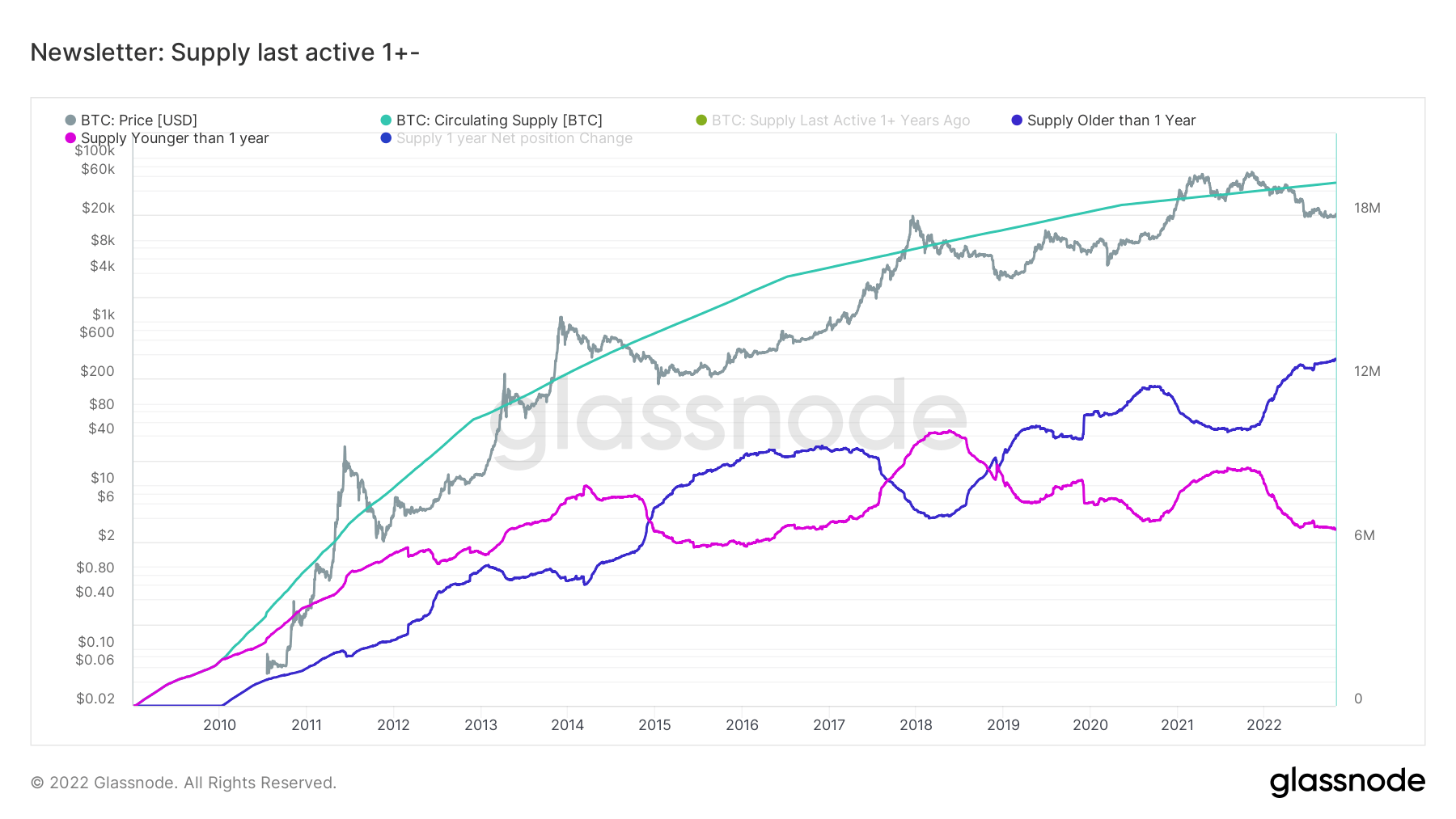

The chart below modifies the definition of LTH to hold more than one year. In other words, Short-Term Holders (STH) refer to his holdings of less than one year.

It was noted that the BTC price peak coincided with a leveling or a significant drop in STH supply. The exception to this was the period before the $900 price peak in December 2013. In these examples, we were unable to identify a pattern for STH.

Similarly, the supply of LTH increased along with the market lull as LTH accumulated tokens after that outlier period.

To date, LTH has skyrocketed while STH has declined rapidly. This produced a dramatically different pattern never seen before.