The central banks’ dilemma: inflation, stagflation, and the cryptocurrency response in today’s economy

quick take

- The economy is built on credit, so it needs both growth and expansion. Deflation and stagflation are therefore what central banks fear most. Take the UK as an example, but this can be attributed to many Western countries.

Three metrics that contribute to stagflation.

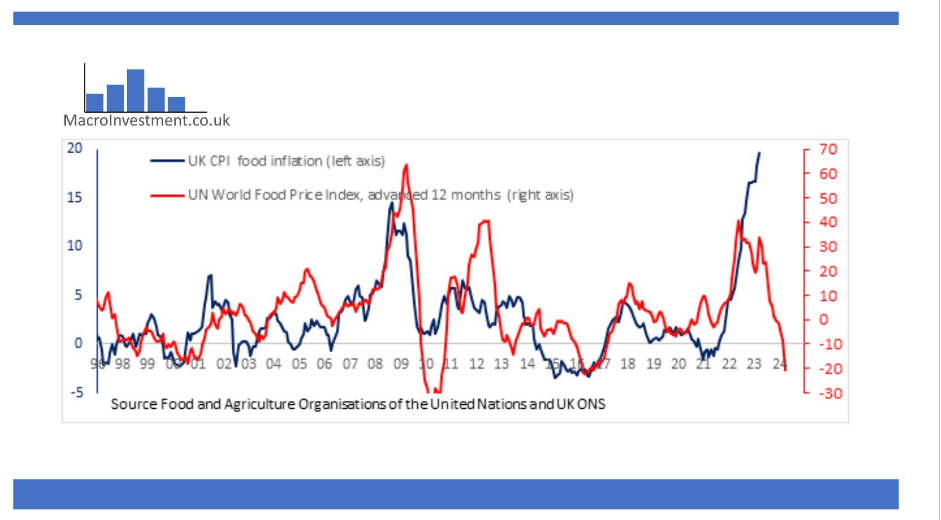

- Sustained high inflation: Inflation has been above the CPI target of 2% for more than a year, and entrenching inflation is the biggest concern for central banks. For example, in the UK, CPI inflation has been in double digits for almost a year, while core inflation has hit 6% for over a year.

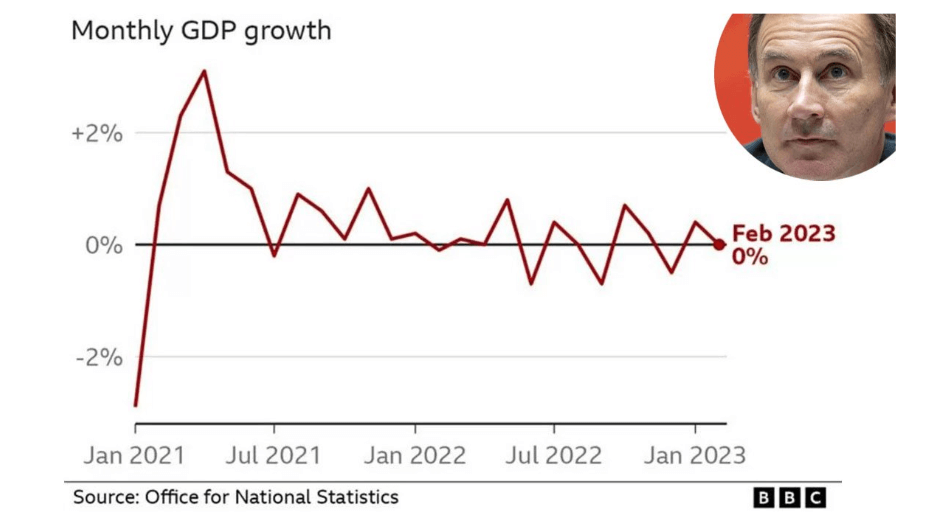

- Sluggish demand in the country’s economy: British Real GDP is still below Q4 2019.

- High unemployment: We’re still far from here, but the UK unemployment rate jumped from 3.7% to 3.8%. This puts further pressure on the labor market as interest rates continue to rise and remain high.

The last time we saw stagflation was in the 1970s, when consumer goods prices tended to rise and asset prices tended to contract. Central banks are wedged between a rock and a hard place.

crypto slate Previously, we covered asset price insights from the 1970s to the 2020s.

The Central Bank’s Dilemma: Inflation, Stagflation and Cryptocurrency Responses in Today’s Economy First Appeared on CryptoSlate.