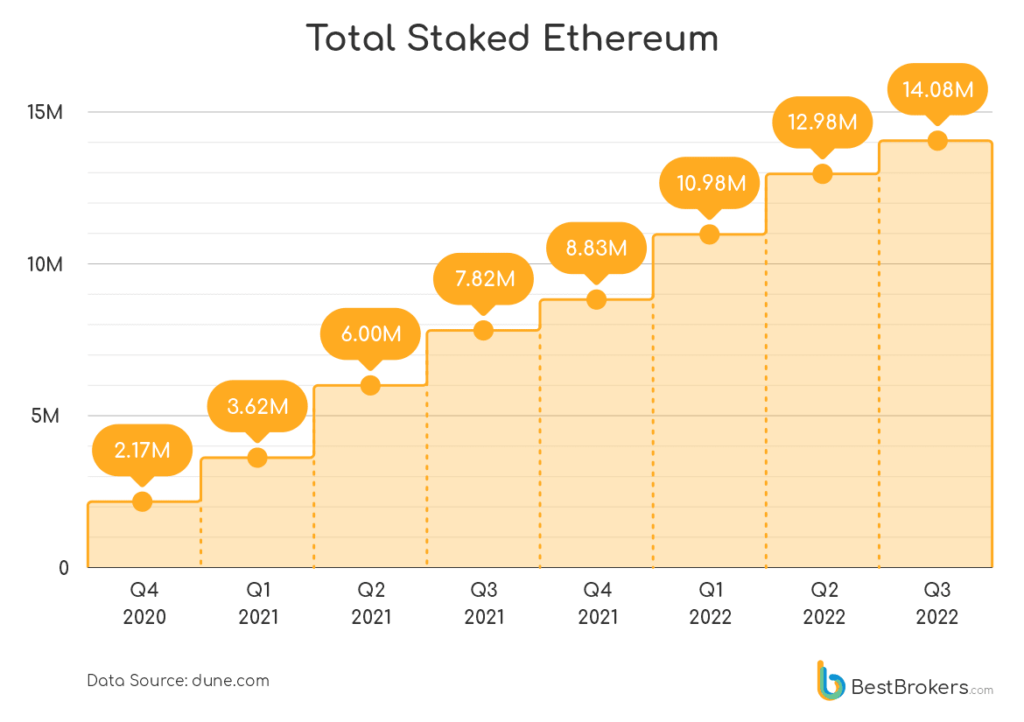

Total staked Ethereum surpasses 14 million in Q3 amid 64% decline in price

According to a report from trading platform Bestbrokers, the amount of Ethereum staked has risen to just over $19 billion at around 14 million ETH since the beginning of the year.

Ethereum’s price has fallen about 64% over the same period, while other assets such as gold and stocks have also fallen about 10-20%.

Alan Goldberg, Market Analyst at BestBrokers, commented:

“Today, Ethereum has a total stake of about 14.44 million ($19.5 billion). In the third quarter of 2022 alone, total ETH staked exceeded 1.096 million, which means that traders can invest in traditional markets. It indicates that it considers it to be a reliable alternative to

The Merge has finally completed a proof-of-stake upgrade for the Ethereum network. So it should come as no surprise that this had a net positive effect on the amount of ETH staked. Miners can no longer mine Ethereum using the Proof of Work consensus method. Staking Ethereum is therefore a primary way to contribute to the security of the network.

The current APR for Ethereum staking is around 4-5%, but it will not be possible to unstake until the Shanghai update is complete. Platforms such as Lido allow an investor to exchange his sETH token for his ETH. This is known as liquid staking. However, the original he Ethereum remains in the protocol, only changing hands so that sETH token holders can redeem it.

However, in reference to Ethereum staked directly into the network, Goldberg also said:

“Depositing for a year without accessing the funds is a risky move, especially when the funds are cryptocurrencies. But traders keep betting. The bets are on, and the amount is increasing every day, proving that many traders are comfortable with Ethereum.”

The chart above shows a steady increase in staked Ethereum since Q4 2020.

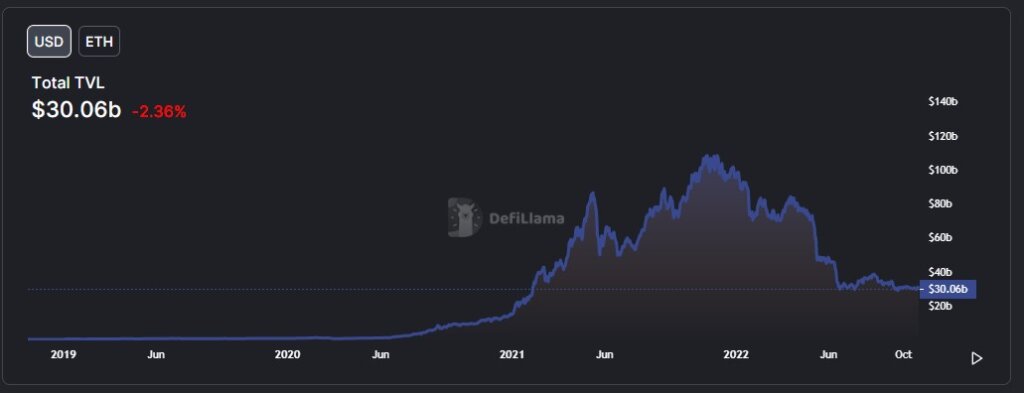

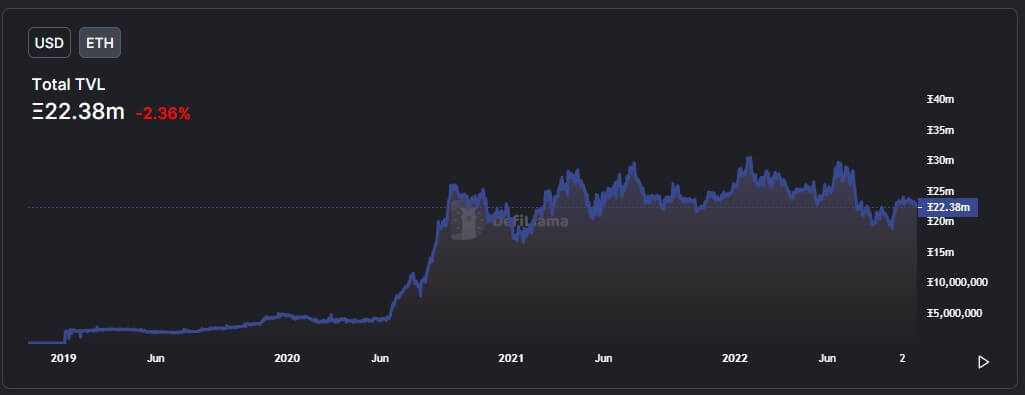

The chart below shows the total amount of Ethereum staked across all DeFi protocols in both ETH and USD. TVL reached about $105 billion in November 2021, while ETH-denominated TVL neared an all-time high in June 2022.

Taking into account all DeFi including liquid staking, Ethereum’s total stake was 22.38 ETH, down 26% from its all-time high in November 2021. It is essential when looking at the USD denominated TVL of a crypto asset. To always understand the price of the underlying asset.

In June 2022, the USD value of Ethereum TVL fell, but the amount of ETH staked increased. This discrepancy is related to the drop in the price of his ETH during that time. Ethereum dropped 43% to close at $1,099 after he opened at $1,942 in June.