Two metrics show Bitcoin in uptrend, historically a good time for risk-on assets

The behavior of long-term Bitcoin (BTC) holders is considered one of the most decisive factors for evaluating BTC’s performance, market highs and market troughs. A long-term holder is defined as an address that has not moved her BTC holdings in the last 6 to 12 months.

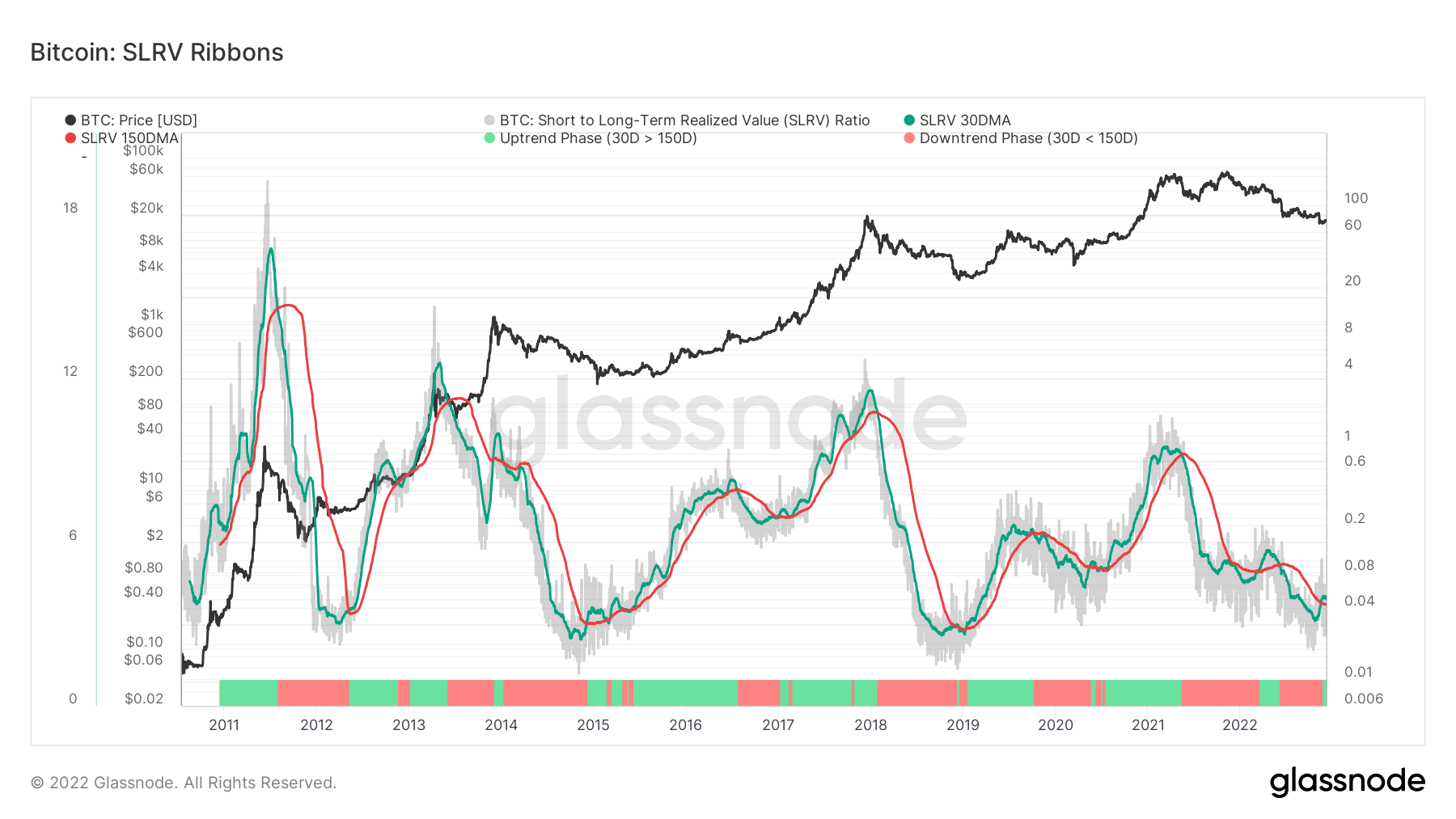

The Short-to-Long-Term Realized Value (SLRV) ratio shows the percentage of BTC in existence, the amount moved in the last 24 hours, divided by the last percentage moved in the last 6-12 months.

High values seen in the SLRV ratio indicator indicate that short-term BTC holders are becoming more active and engaged in the BTC network. This indicates that the top of the market is approaching, suggesting that the market hype is in full swing. A low SLRV ratio indicates no short-term holder activity and/or an increasing long-term holder base.

By applying the SLRV ribbon to the SLRV ratio, we can identify positive and negative trends in the market and historically identify transitions between risk-on and risk-off allocations to BTC. The SLRV ribbons in both chart images observe the 30-day and 150-day moving averages of the SLRV ratios.

According to the historical SLRV ratio chart below, the uptrend phase is generally below the 30-day and 150-day downtrend phase ratio values during the bear market. Shifts in power have been seen in 2012, 2015, and 2019, each marking a clear shift in market sentiment and fueling a range of bull markets.

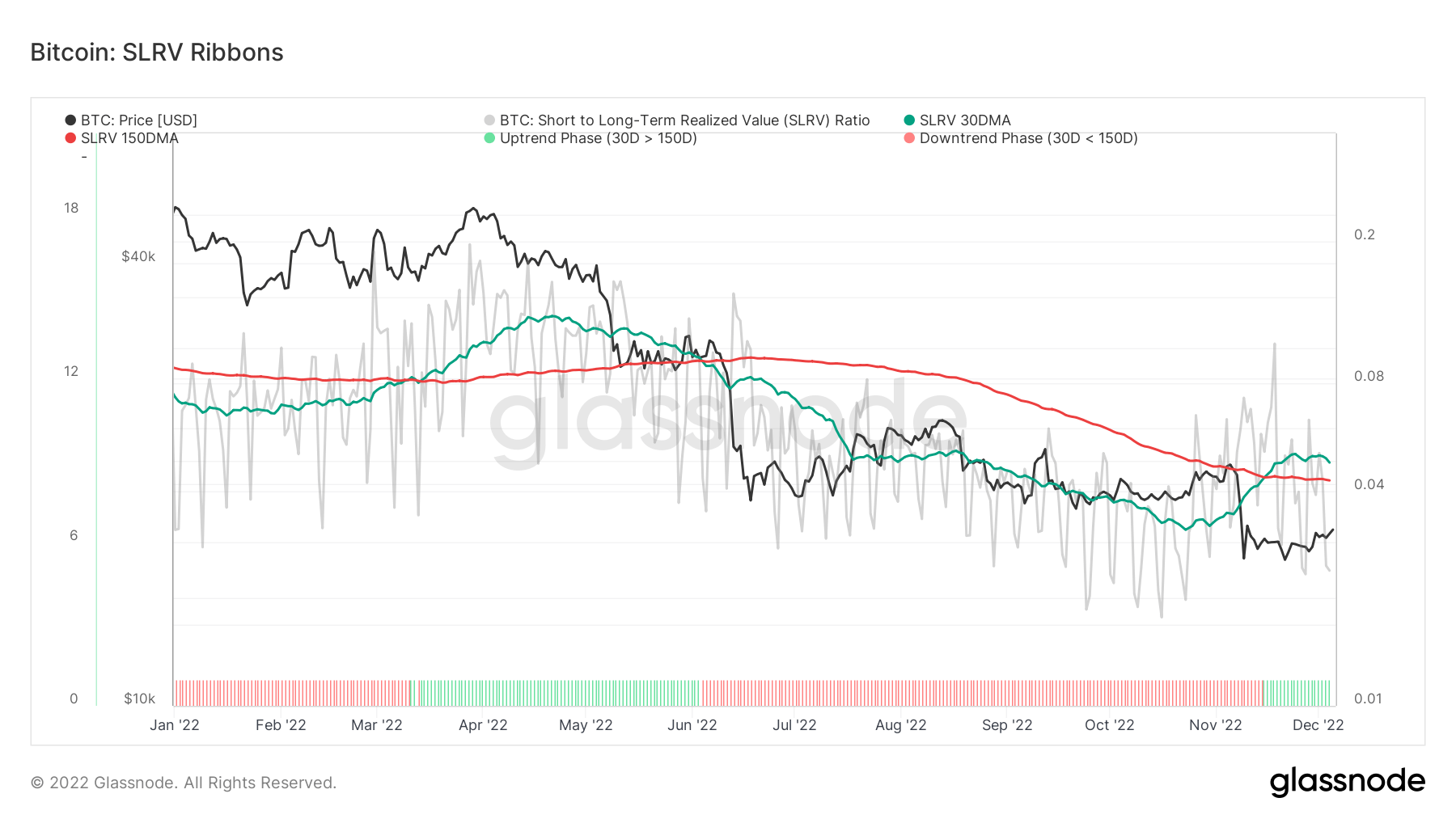

According to the SLRV ratio throughout the year, BTC last saw a move to an uptrend in March, but a downtrend continued in June. This downtrend caused the SLRV ratio to remain above 0.08 as he entered September, but slowly tapered off in mid-November.

As you can see in the chart above, the SLRV uptrend phase ribbon outperformed its counterpart in December. According to historical data, this uptrend is expected to continue — following the same pattern displayed in his BTC SLRV ratio ribbons in 2015 and 2019.

The uptrend to bullish sentiment was confirmed when BTC traded around $16,800 on Nov. 15, and only once before, around March, before the Luna collapse.

During the FTX crash, the SLRV ratio dropped to 0.019. Achieving such low SLRV ratios has historically been associated with long-term bottoming out phases of bear markets and the reversal of the trend towards bull markets.